This version of the form is not currently in use and is provided for reference only. Download this version of

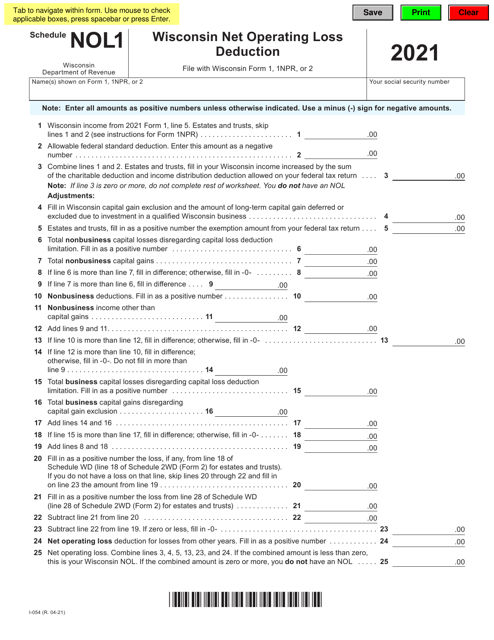

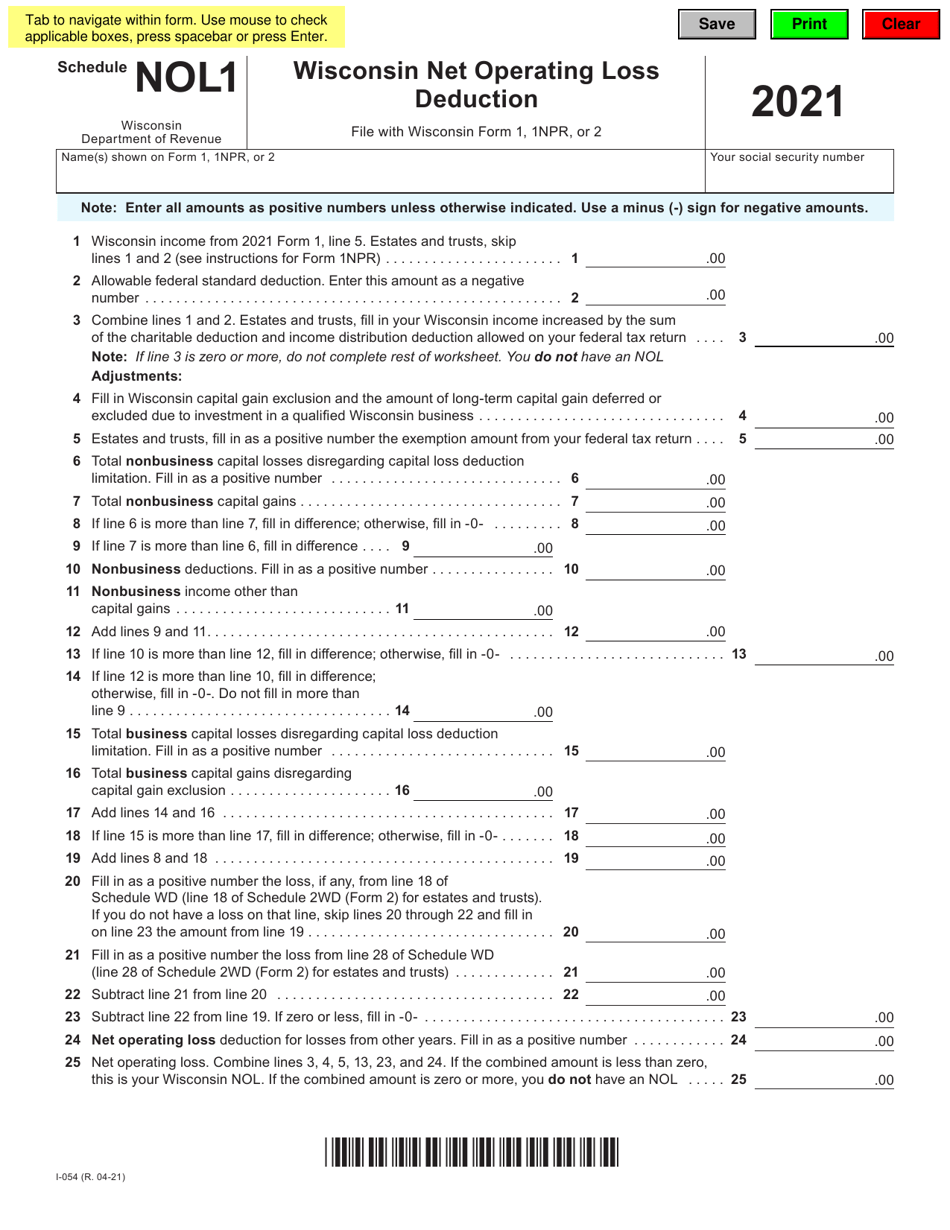

Form I-054 Schedule NOL1

for the current year.

Form I-054 Schedule NOL1 Wisconsin Net Operating Loss Deduction - Wisconsin

What Is Form I-054 Schedule NOL1?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-054?

A: Form I-054 is a form used to claim the Wisconsin Net Operating Loss Deduction.

Q: What is the purpose of Schedule NOL1?

A: The purpose of Schedule NOL1 is to calculate and report the Net Operating Loss Deduction for Wisconsin.

Q: What is the Wisconsin Net Operating Loss Deduction?

A: The Wisconsin Net Operating Loss Deduction is a deduction that allows businesses to offset their current year's income with any net operating losses from previous years.

Q: Who is eligible to claim the Wisconsin Net Operating Loss Deduction?

A: Businesses that have experienced a net operating loss in a previous year are eligible to claim the Wisconsin Net Operating Loss Deduction.

Q: How do I fill out Schedule NOL1?

A: To fill out Schedule NOL1, you will need to provide the necessary information regarding your net operating loss from previous years and calculate the deductions accordingly.

Q: When is the deadline to file Schedule NOL1?

A: The deadline to file Schedule NOL1 is the same as the deadline for filing your Wisconsin income tax return, which is typically April 15th.

Q: Are there any additional requirements for claiming the Wisconsin Net Operating Loss Deduction?

A: Yes, there may be additional requirements and restrictions for claiming the Wisconsin Net Operating Loss Deduction. It is recommended to review the instructions provided with Form I-054 Schedule NOL1 or consult a tax professional for guidance.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-054 Schedule NOL1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.