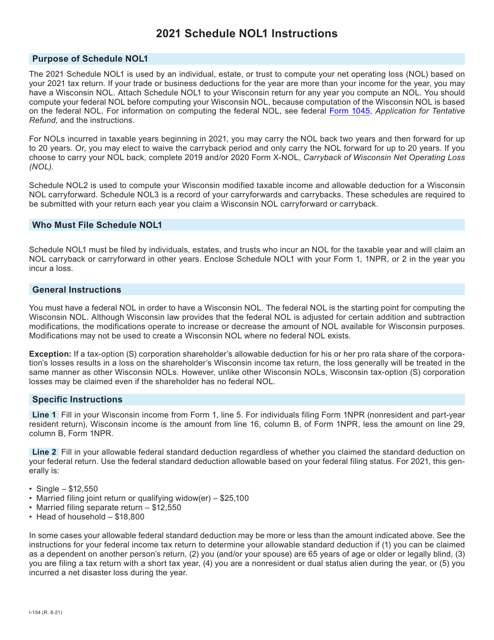

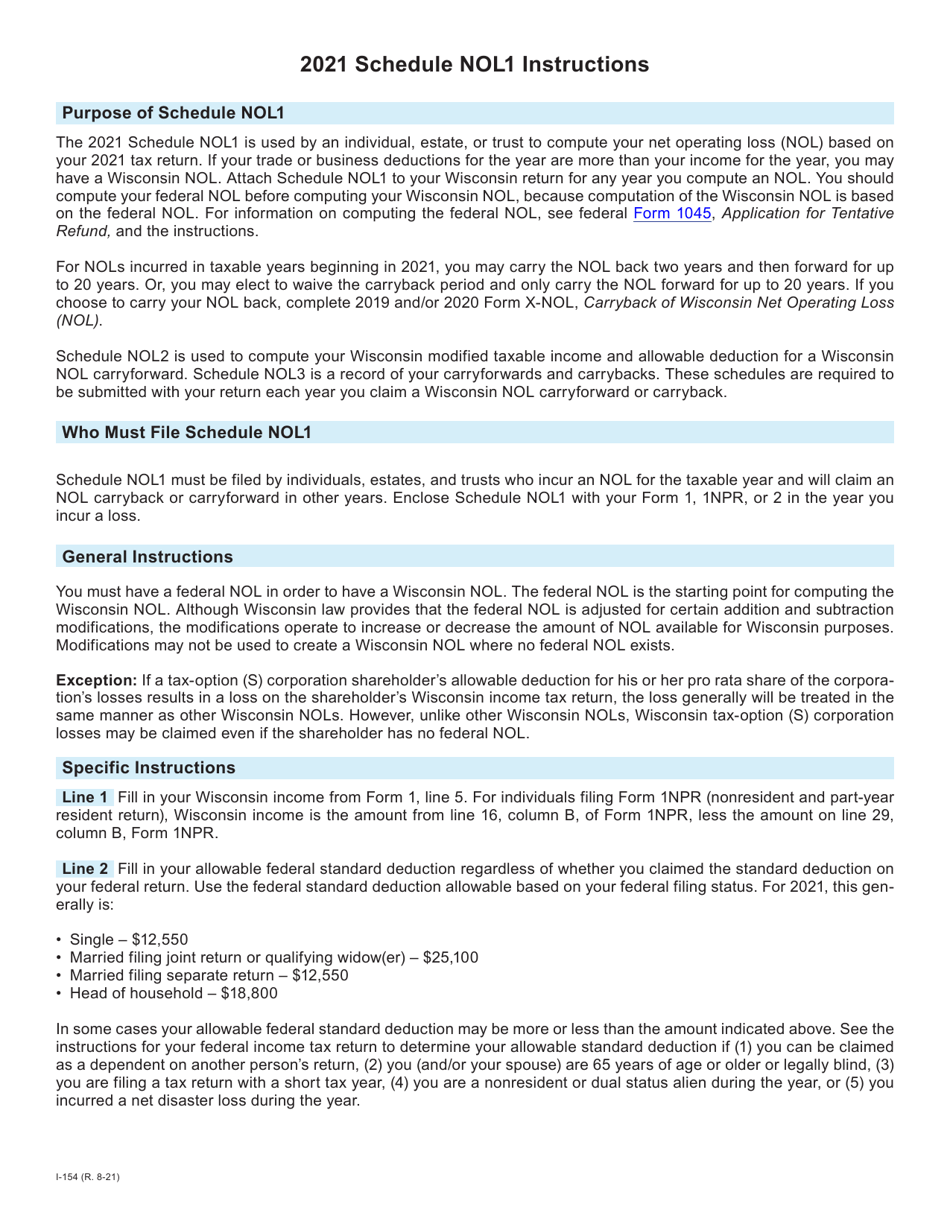

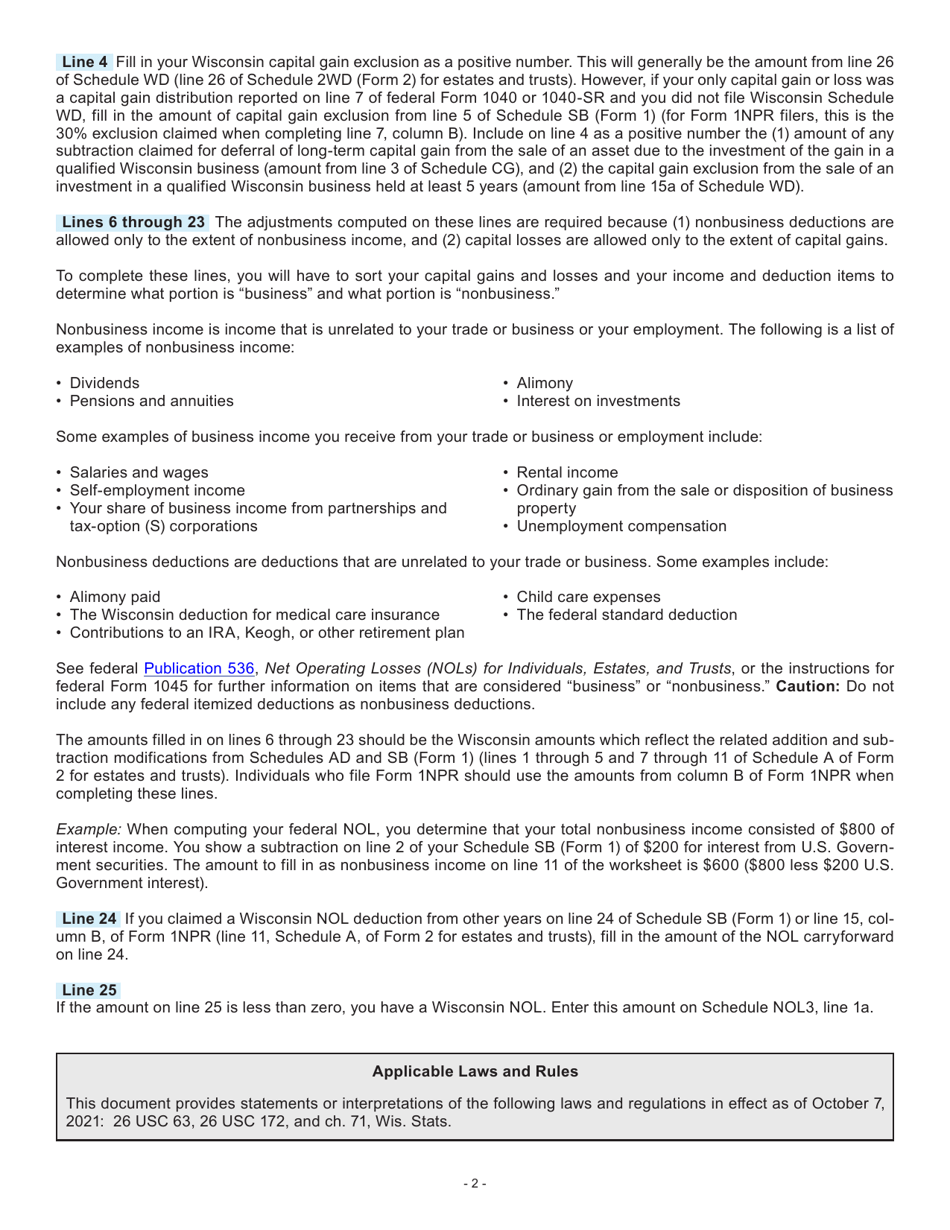

Instructions for Form I-054 Schedule NOL1 Wisconsin Net Operating Loss Deduction - Wisconsin

This document contains official instructions for Form I-054 Schedule NOL1, Wisconsin Net Operating Loss Deduction - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-054 Schedule NOL1 is available for download through this link.

FAQ

Q: What is Form I-054 Schedule NOL1?

A: Form I-054 Schedule NOL1 is a tax form used in Wisconsin to claim the net operating loss deduction.

Q: What is the Wisconsin Net Operating Loss Deduction?

A: The Wisconsin Net Operating Loss Deduction is a deduction that allows businesses to offset current year profits with previous year's losses.

Q: Who needs to file Form I-054 Schedule NOL1?

A: Businesses in Wisconsin that have experienced a net operating loss and want to claim the deduction need to file Form I-054 Schedule NOL1.

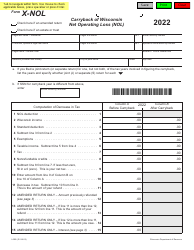

Q: How do I file Form I-054 Schedule NOL1?

A: Form I-054 Schedule NOL1 can be filed electronically or by mail. The instructions on the form provide details on how to submit it.

Q: What information do I need to complete Form I-054 Schedule NOL1?

A: To complete Form I-054 Schedule NOL1, you will need information about your net operating loss and income from the previous years.

Q: When is the deadline to file Form I-054 Schedule NOL1?

A: The deadline for filing Form I-054 Schedule NOL1 in Wisconsin is the same as the deadline for filing your state tax return, which is usually April 15th.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.