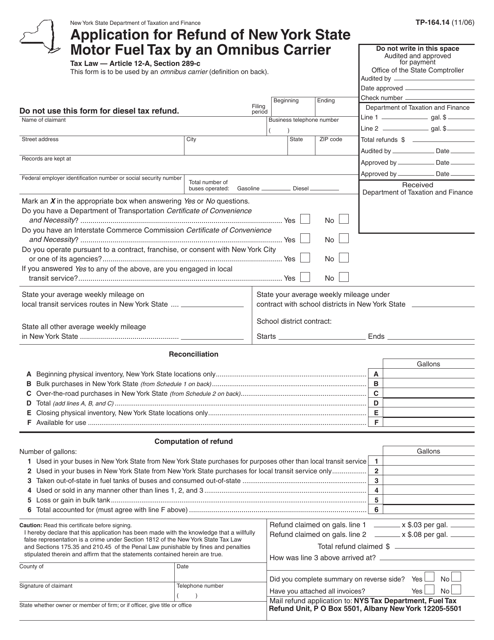

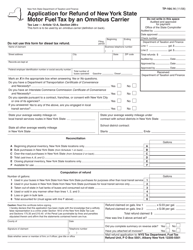

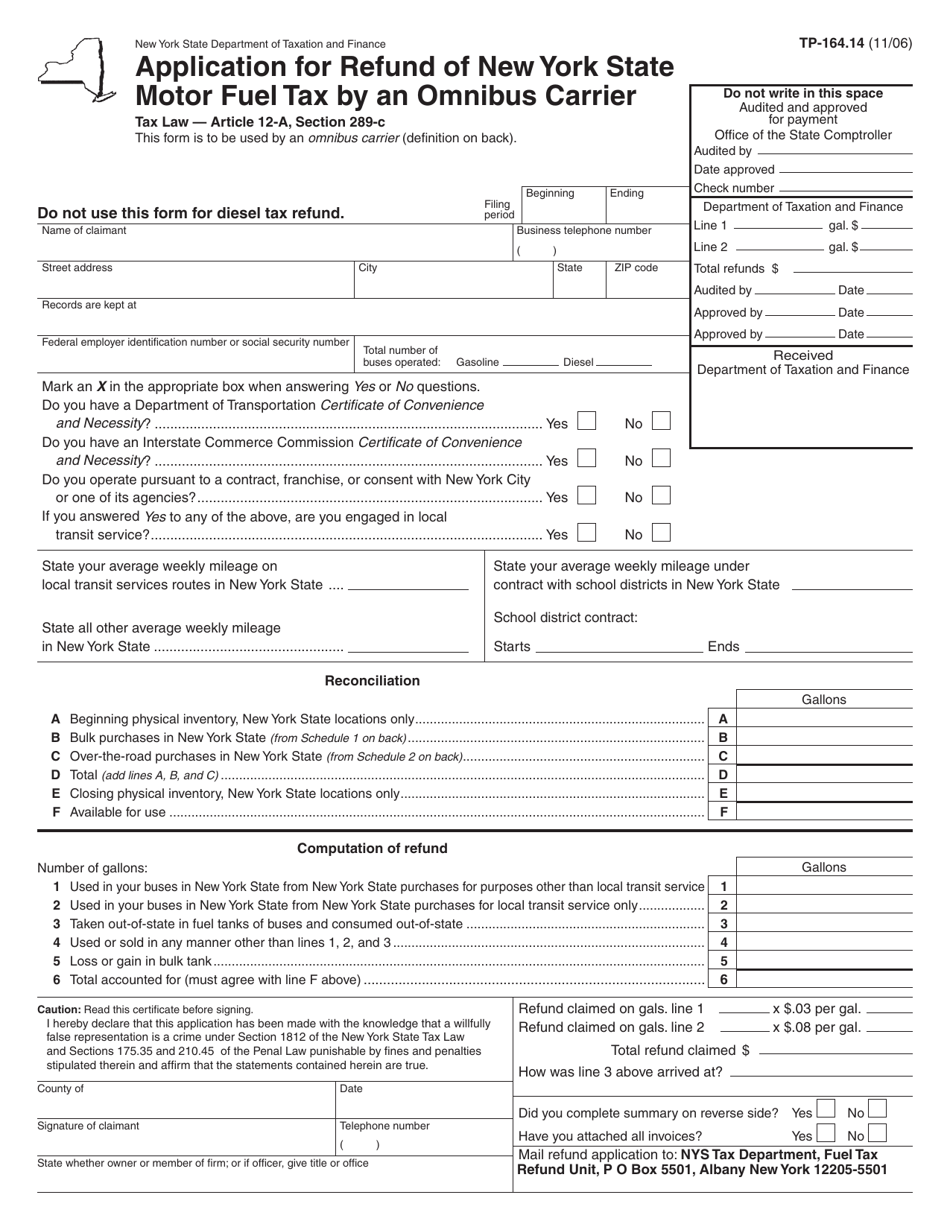

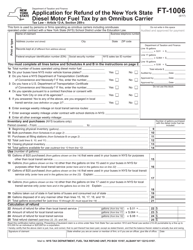

Form TP-164.14 Application for Refund of New York State Motor Fuel Tax by an Omnibus Carrier - New York

What Is Form TP-164.14?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-164.14?

A: Form TP-164.14 is the Application for Refund of New York State Motor Fuel Tax by an Omnibus Carrier.

Q: Who can use Form TP-164.14?

A: Omnibus carriers in New York State can use Form TP-164.14 to apply for a refund of motor fuel tax.

Q: What is the purpose of Form TP-164.14?

A: The purpose of Form TP-164.14 is to request a refund of motor fuel tax paid by an omnibus carrier in New York State.

Q: Are there any eligibility criteria for using Form TP-164.14?

A: Yes, to be eligible, you must be an omnibus carrier registered with the New York State Department of Taxation and Finance.

Q: When should I submit Form TP-164.14?

A: You should submit Form TP-164.14 within three years from the date of purchase of the motor fuel for which you are seeking a refund.

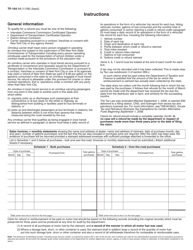

Q: What supporting documents are required with Form TP-164.14?

A: You must attach copies of fuel receipts and invoices, as well as supporting documentation showing that the motor fuel was used in an eligible manner.

Q: How long does it take to process a refund request submitted on Form TP-164.14?

A: The processing time for a refund request submitted on Form TP-164.14 can vary, but generally it takes several weeks to process.

Q: Can I file Form TP-164.14 electronically?

A: No, at this time, electronic filing is not available for Form TP-164.14. You must submit a paper form by mail.

Form Details:

- Released on November 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-164.14 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.