This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1094-C

for the current year.

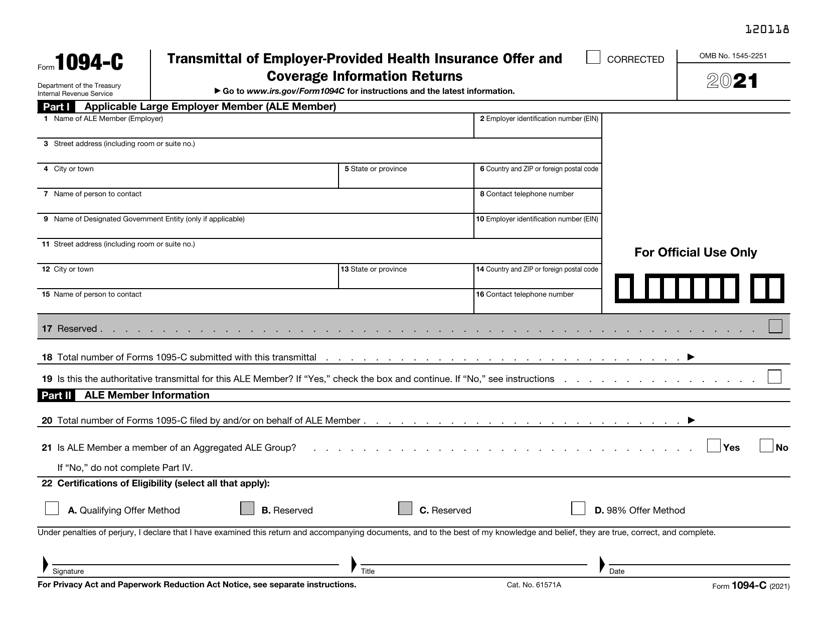

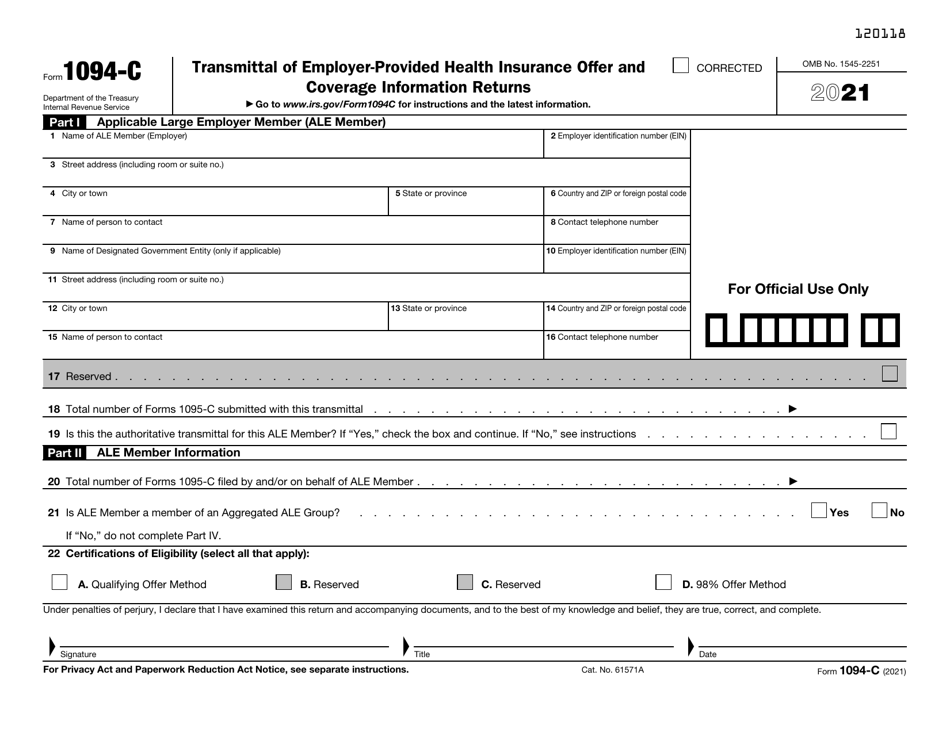

IRS Form 1094-C Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

What Is IRS Form 1094-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1094-C?

A: IRS Form 1094-C is a transmittal form that employers use to submit their Employer-Provided Health Insurance Offer and Coverage Information Returns to the IRS.

Q: What is the purpose of IRS Form 1094-C?

A: The purpose of IRS Form 1094-C is to provide the IRS with information about the health insurance coverage offered by an employer.

Q: Who needs to file IRS Form 1094-C?

A: Employers who are required to offer health insurance coverage to their employees under the Affordable Care Act (ACA) are generally required to file IRS Form 1094-C.

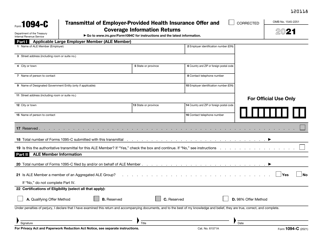

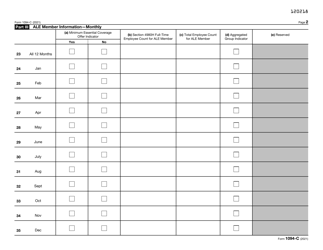

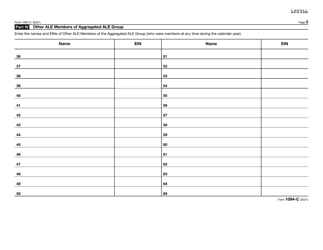

Q: What information is required on IRS Form 1094-C?

A: IRS Form 1094-C requires employers to provide information about their business, the total number of full-time employees, and details about the health insurance coverage offered.

Q: When is the deadline for filing IRS Form 1094-C?

A: The deadline for filing IRS Form 1094-C is typically February 28th if filing by paper or March 31st if filing electronically.

Form Details:

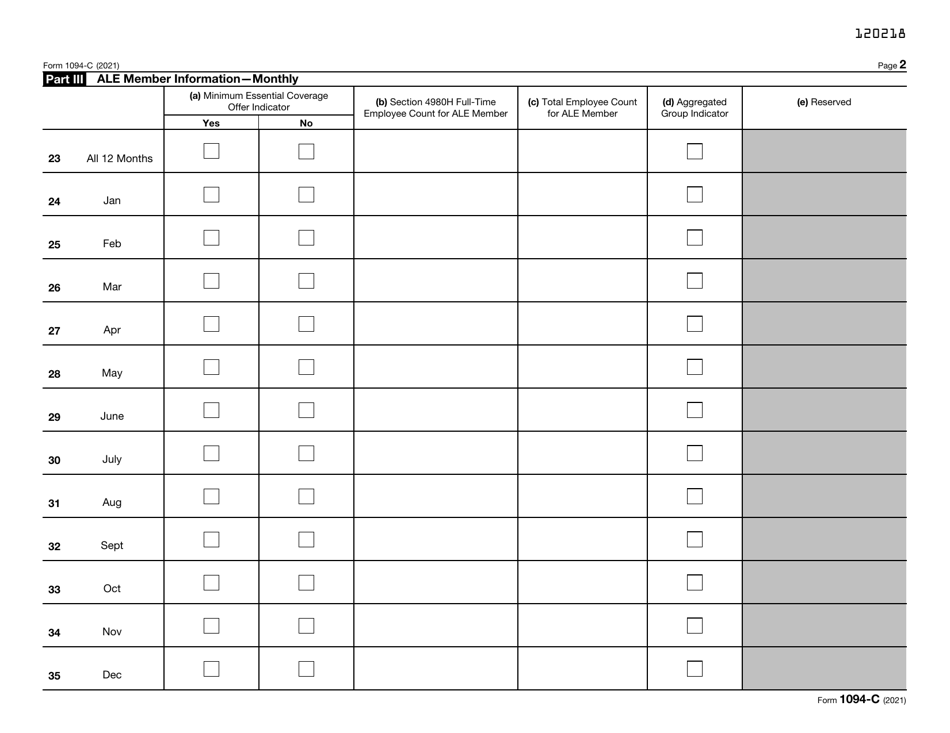

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1094-C through the link below or browse more documents in our library of IRS Forms.