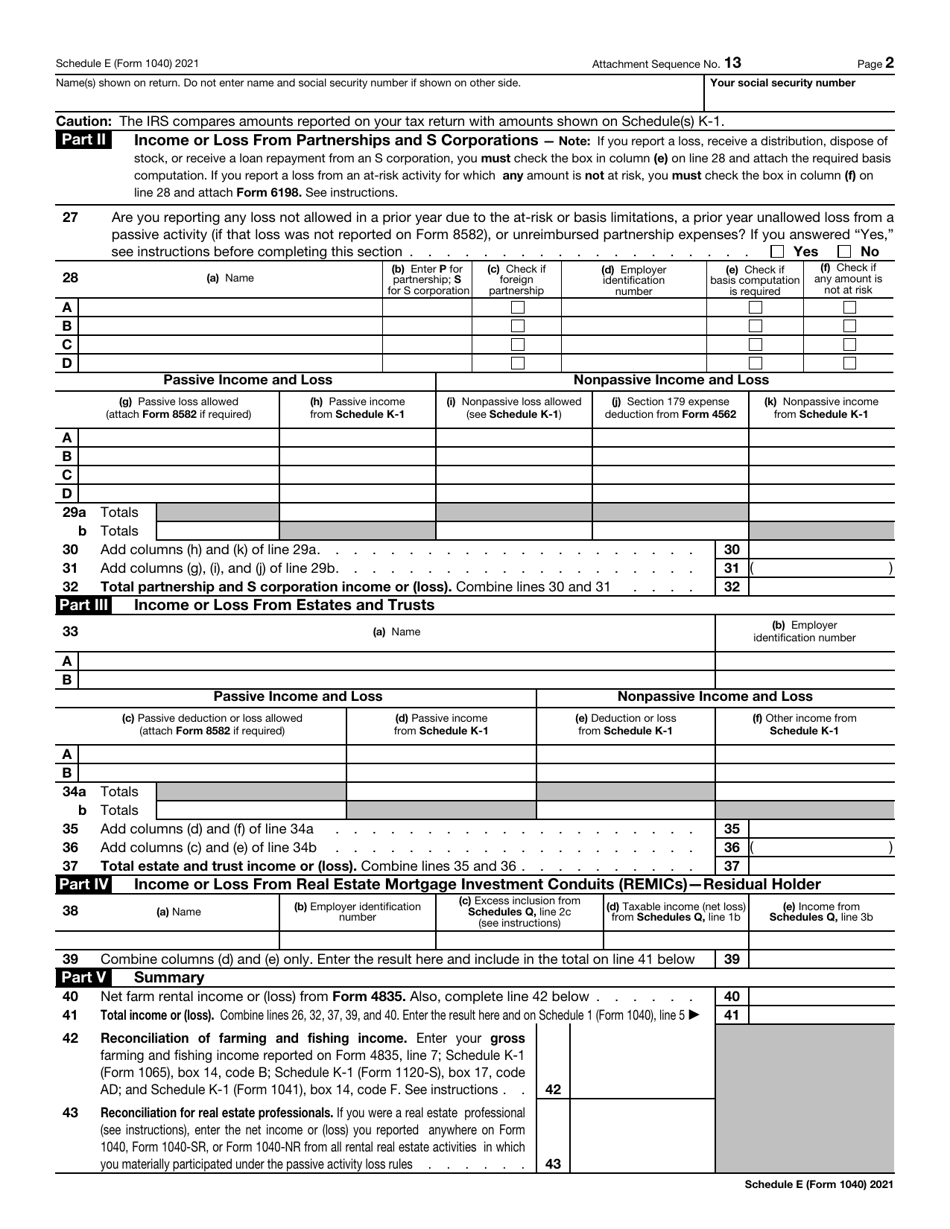

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule E

for the current year.

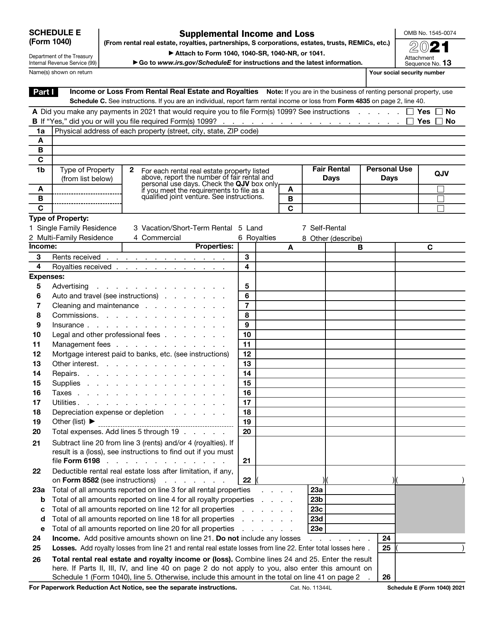

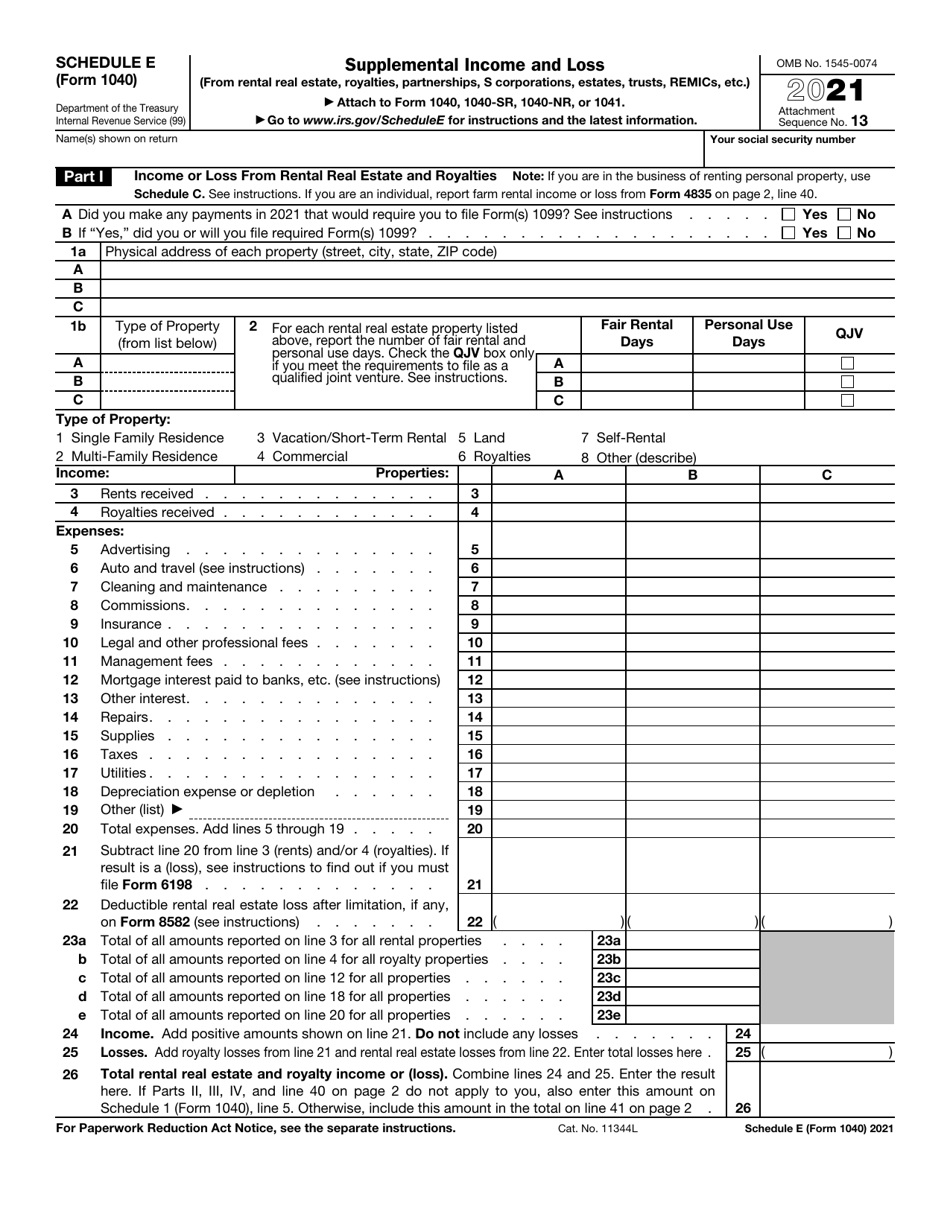

IRS Form 1040 Schedule E Supplemental Income and Loss

What Is IRS Form 1040 Schedule E?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule E?

A: IRS Form 1040 Schedule E is a tax form used to report supplemental income and loss.

Q: What is supplemental income?

A: Supplemental income refers to income you receive from sources other than your regular job, such as rental income, royalties, or businesses.

Q: What is a loss on Schedule E?

A: A loss on Schedule E refers to expenses that exceed your rental or business income. It can be used to reduce your overall tax liability.

Q: Do I need to file Schedule E?

A: You need to file Schedule E if you have rental income, royalties, partnerships, S corporations, estates, or trusts.

Q: Can I claim rental property expenses on Schedule E?

A: Yes, you can claim expenses related to your rental property, such as mortgage interest, property taxes, repairs, and maintenance on Schedule E.

Q: What is the purpose of Schedule E?

A: The purpose of Schedule E is to calculate and report your supplemental income or loss, which is then used to determine your overall tax liability.

Q: What supporting documents do I need for Schedule E?

A: You may need supporting documents such as rental agreements, receipts, and records of expenses to accurately complete Schedule E.

Q: Can I e-file Schedule E?

A: Yes, you can e-file Schedule E along with your federal income tax return using IRS-approved tax software or through a tax professional.

Q: When is the deadline to file Schedule E?

A: The deadline to file Schedule E is typically the same as the deadline to file your federal income tax return, which is usually April 15th.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule E through the link below or browse more documents in our library of IRS Forms.