This version of the form is not currently in use and is provided for reference only. Download this version of

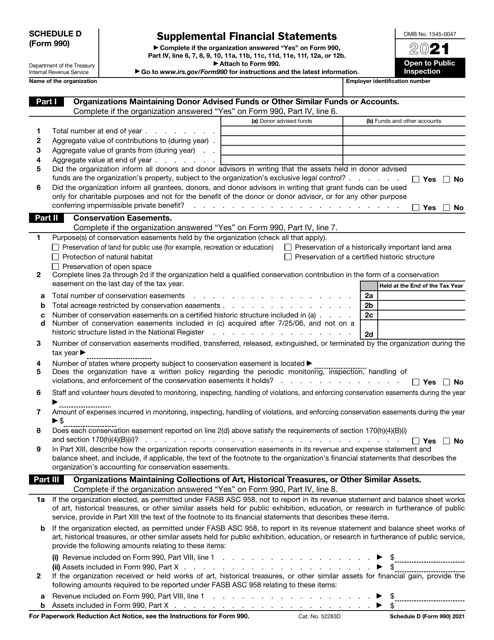

IRS Form 990 Schedule D

for the current year.

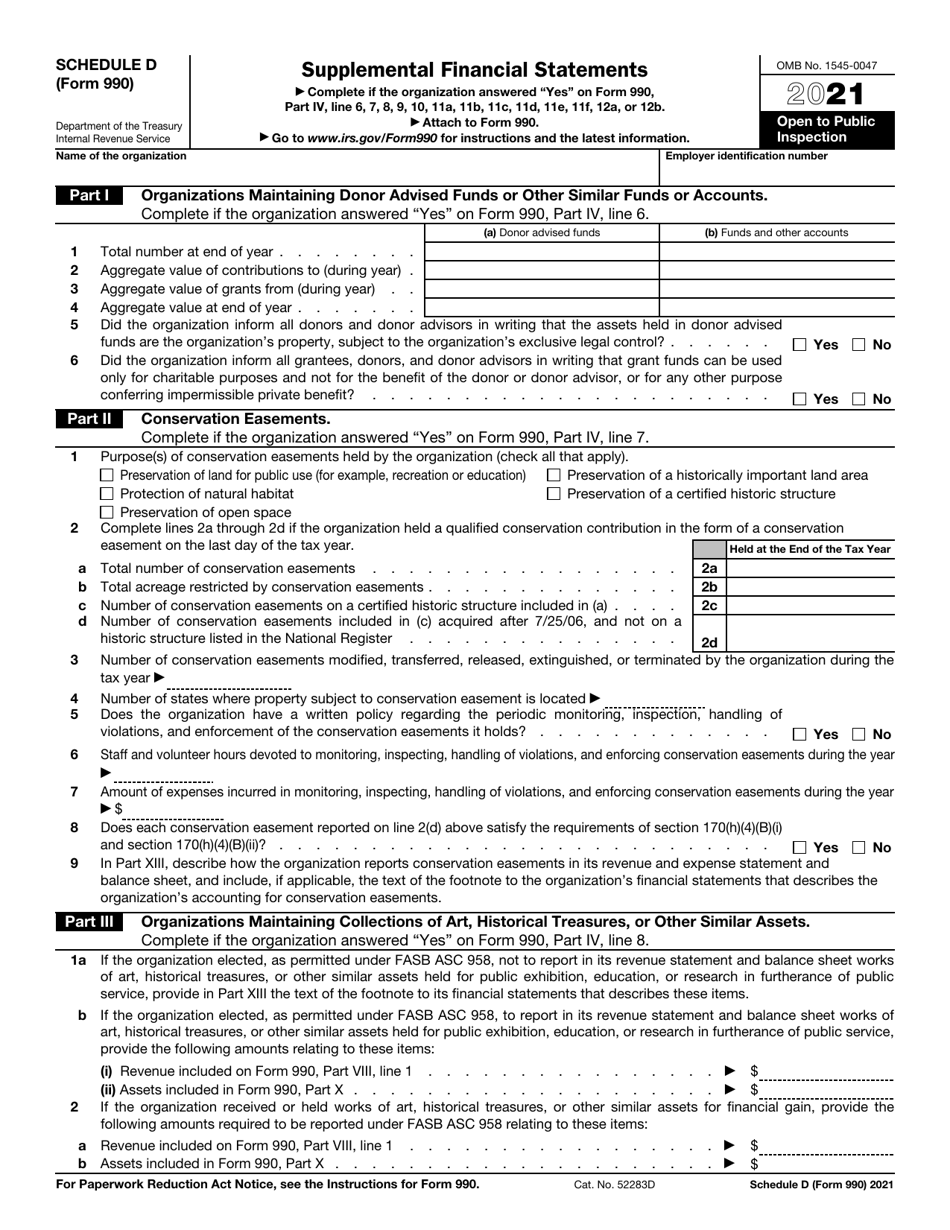

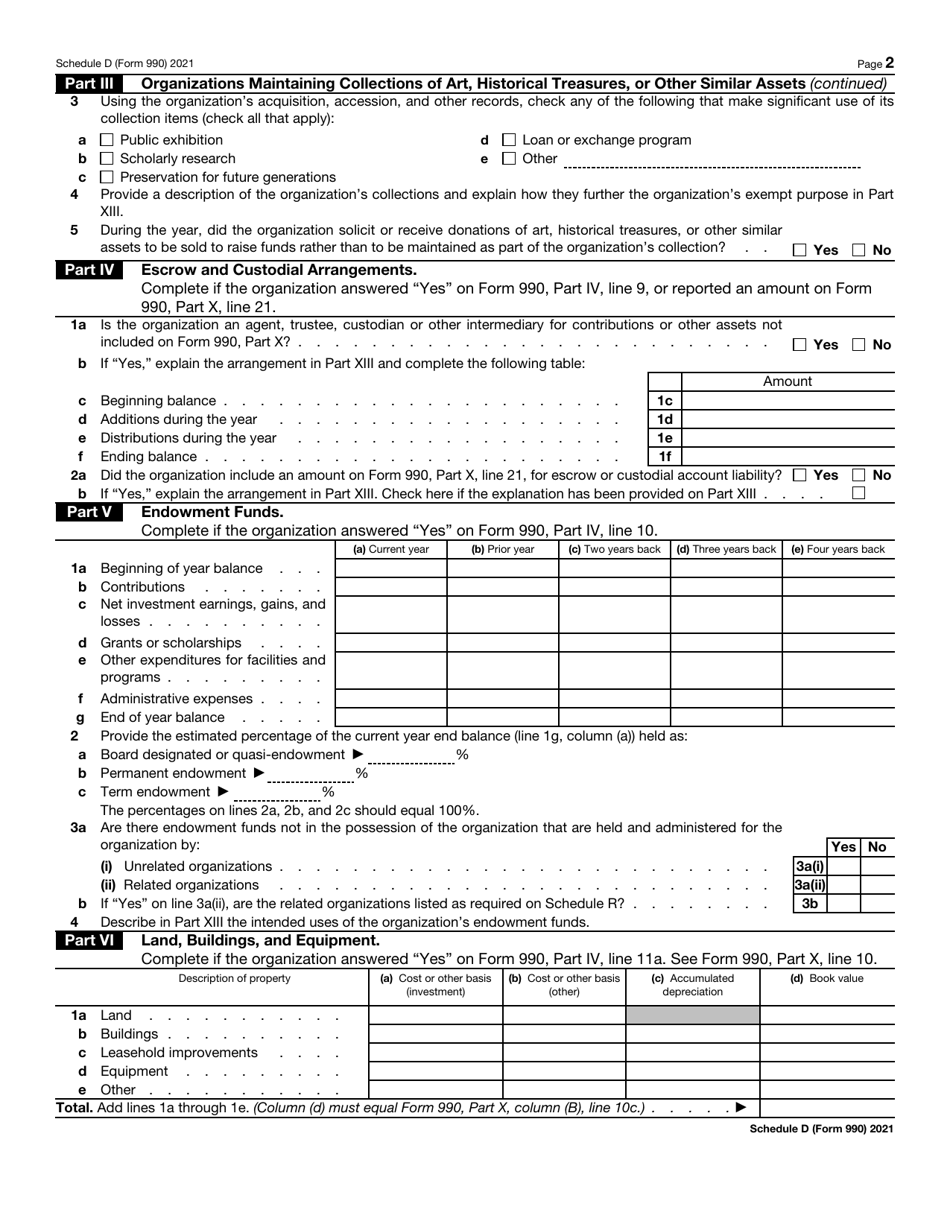

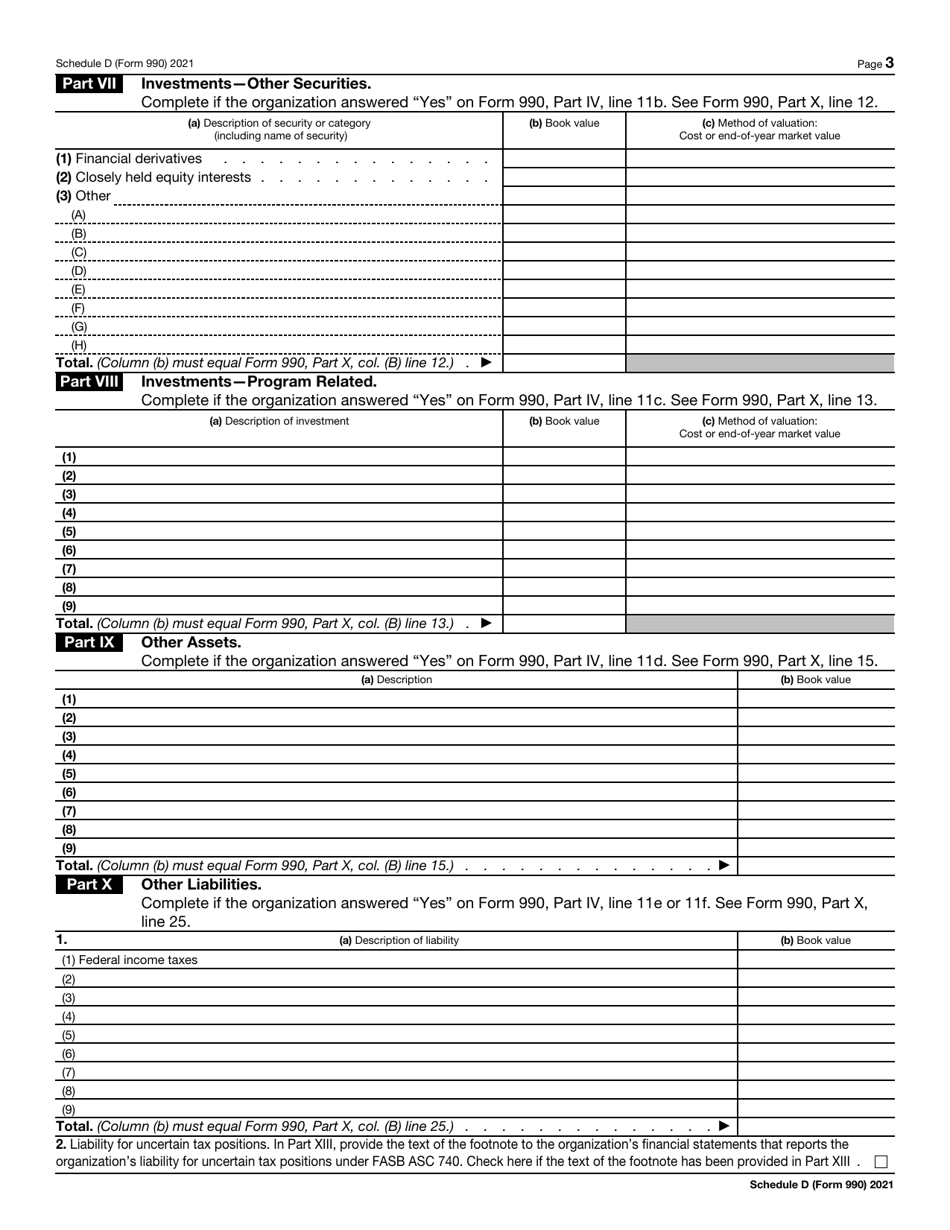

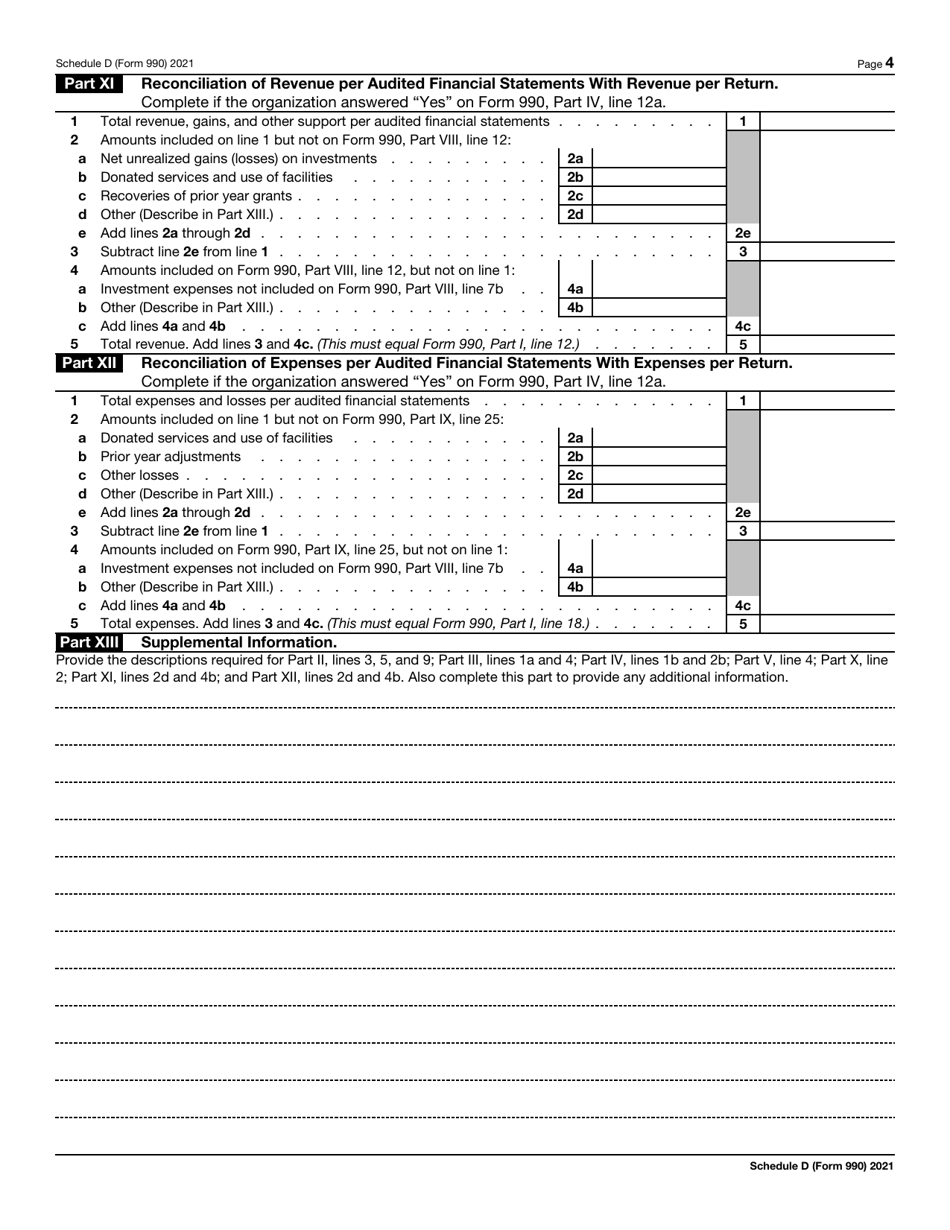

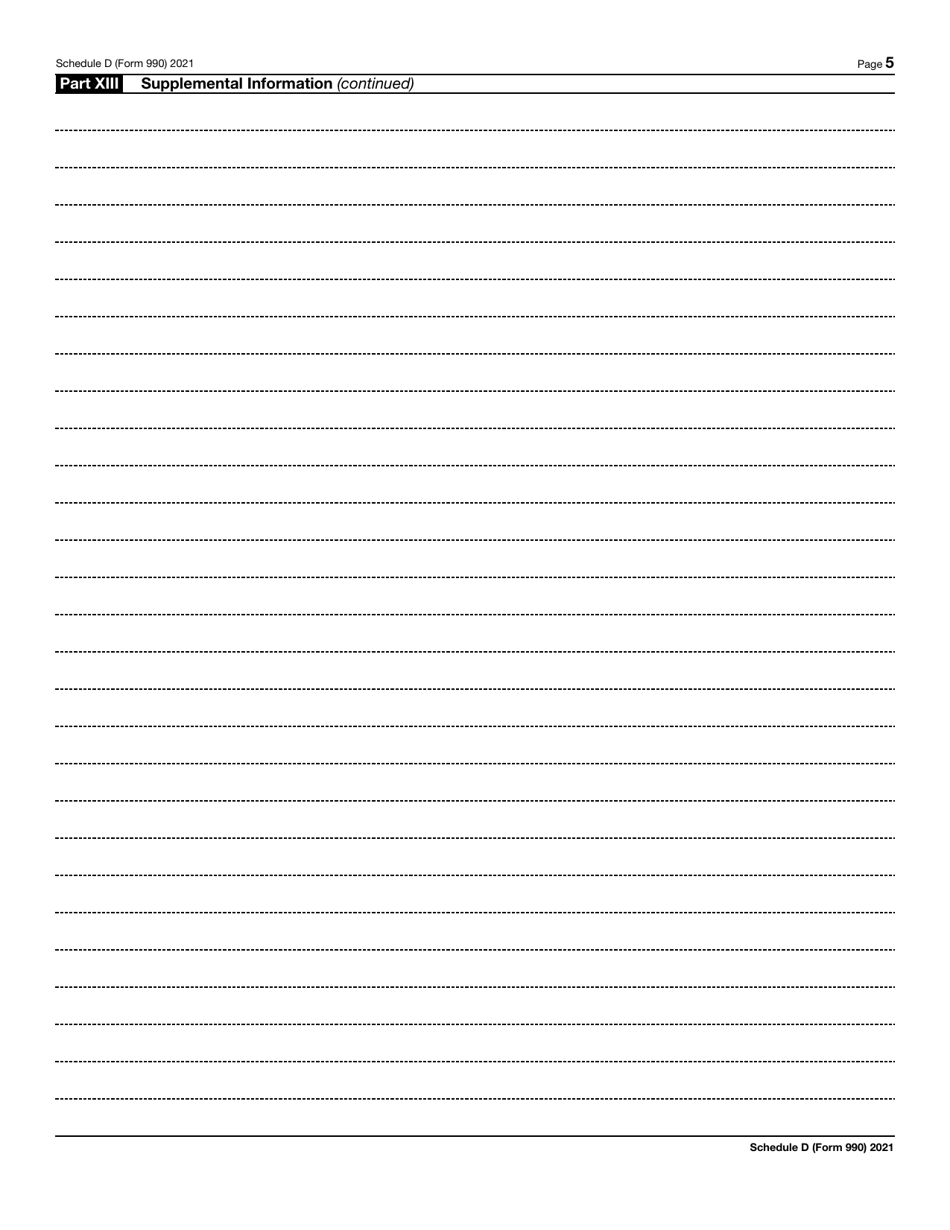

IRS Form 990 Schedule D Supplemental Financial Statements

What Is IRS Form 990 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule D?

A: IRS Form 990 Schedule D is a supplemental form that provides detailed financial information about an organization's investments, grants, and other financial transactions.

Q: Who needs to file IRS Form 990 Schedule D?

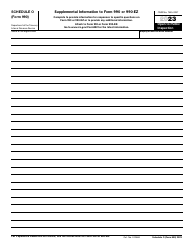

A: Nonprofit organizations that file IRS Form 990 or Form 990-EZ must file Schedule D if they have certain types of financial transactions to report.

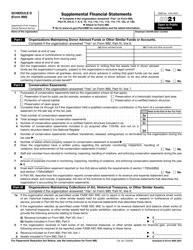

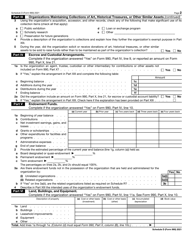

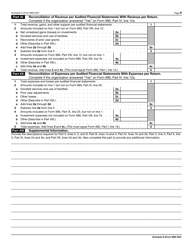

Q: What types of financial transactions are reported on IRS Form 990 Schedule D?

A: IRS Form 990 Schedule D is used to report various types of financial transactions, such as investments in stocks, bonds, and real estate, grants given to other organizations, and income from fundraising events.

Q: When is the deadline to file IRS Form 990 Schedule D?

A: The deadline to file IRS Form 990 Schedule D is the same as the deadline for filing the main Form 990 or Form 990-EZ, which is usually the 15th day of the 5th month after the end of the organization's fiscal year.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule D through the link below or browse more documents in our library of IRS Forms.