This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule D

for the current year.

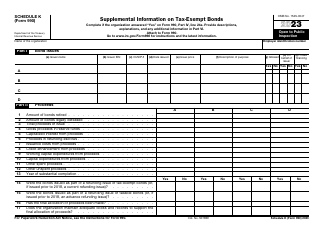

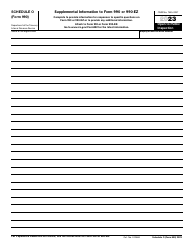

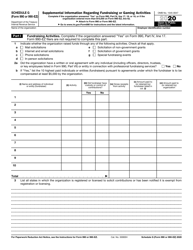

Instructions for IRS Form 990 Schedule D Supplemental Financial Statements

This document contains official instructions for IRS Form 990 Schedule D, Supplemental Financial Statements - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule D?

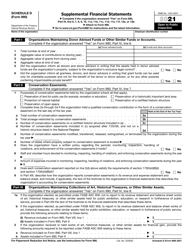

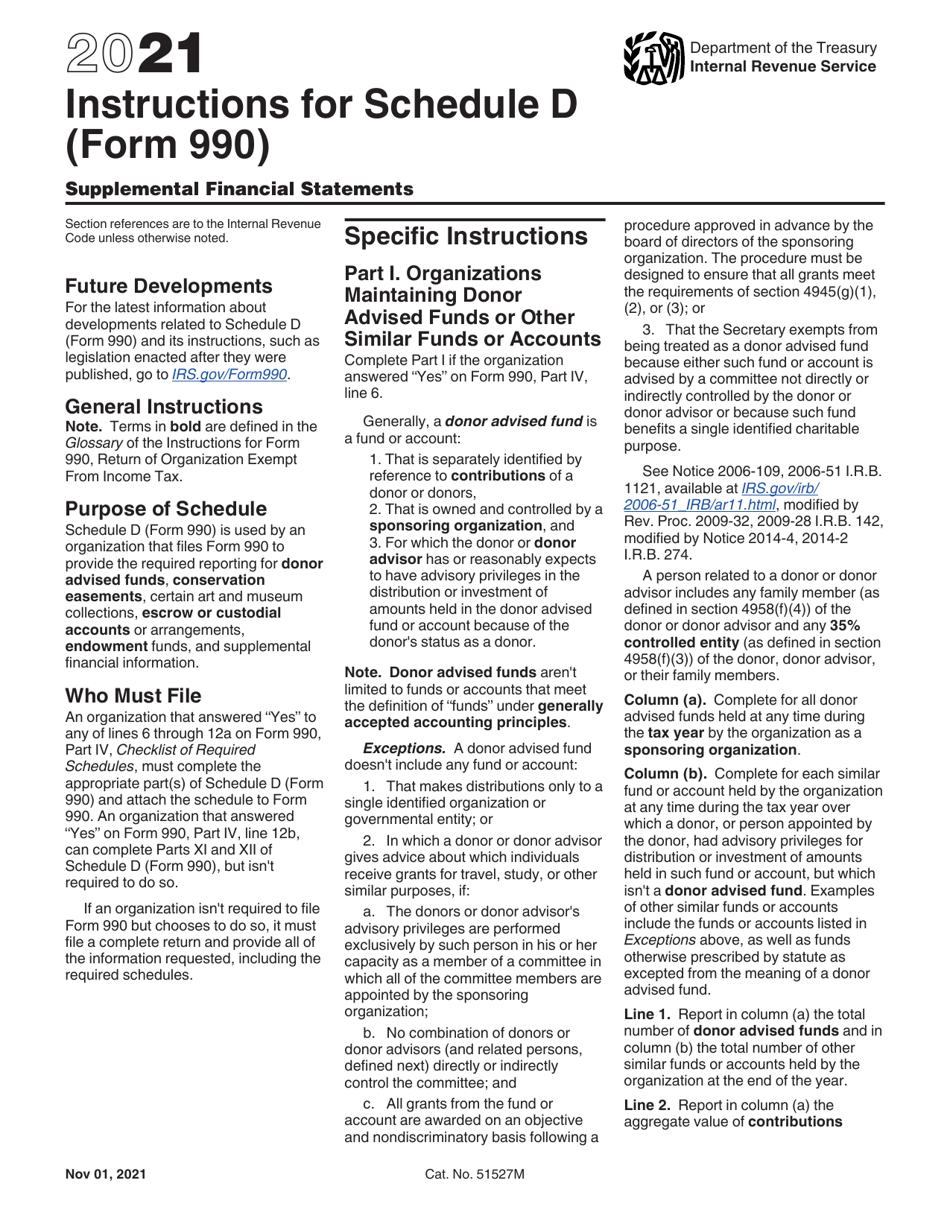

A: IRS Form 990 Schedule D is a supplemental form that provides additional financial information for organizations filing Form 990.

Q: Who needs to file IRS Form 990 Schedule D?

A: Organizations that file Form 990, such as certain nonprofits and charities, may need to complete Schedule D if they have certain types of assets or financial transactions.

Q: What information is provided in IRS Form 990 Schedule D?

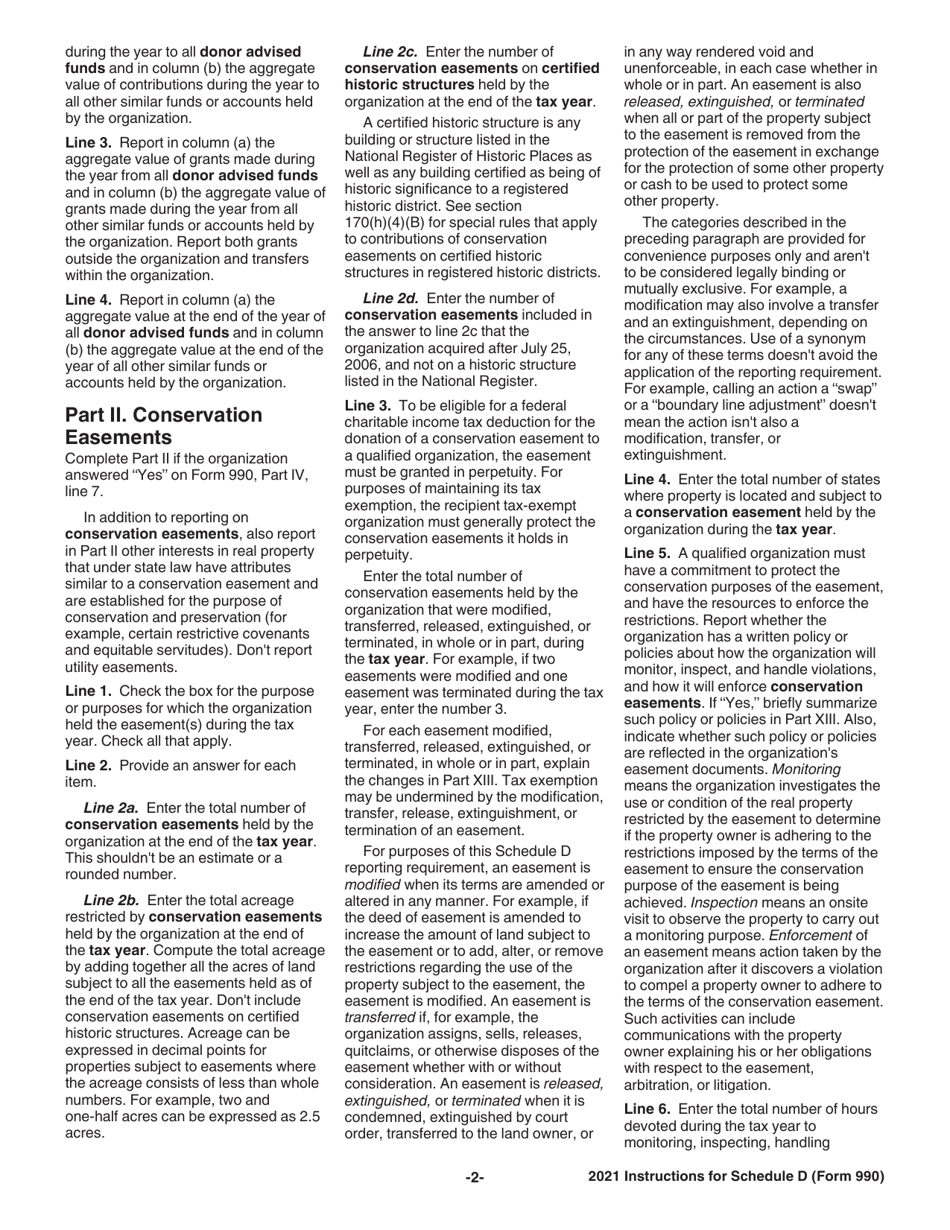

A: Schedule D provides detailed information about the organization's assets, such as investments, endowments, and capital assets. It also asks for information about financial transactions and relationships with related organizations.

Q: When is the deadline to file IRS Form 990 Schedule D?

A: The deadline to file Form 990 Schedule D is the same as the deadline for filing Form 990 for the organization, which is typically the 15th day of the fifth month after the end of the organization's fiscal year.

Q: What happens if I don't file IRS Form 990 Schedule D?

A: Failing to file IRS Form 990 Schedule D when required can result in penalties and potential loss of tax-exempt status for the organization.

Q: Are there any exceptions or special rules for IRS Form 990 Schedule D?

A: There may be exceptions and special rules for certain types of organizations or specific circumstances. It's important to review the instructions for Form 990 Schedule D or consult a tax professional to ensure compliance.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.