This version of the form is not currently in use and is provided for reference only. Download this version of

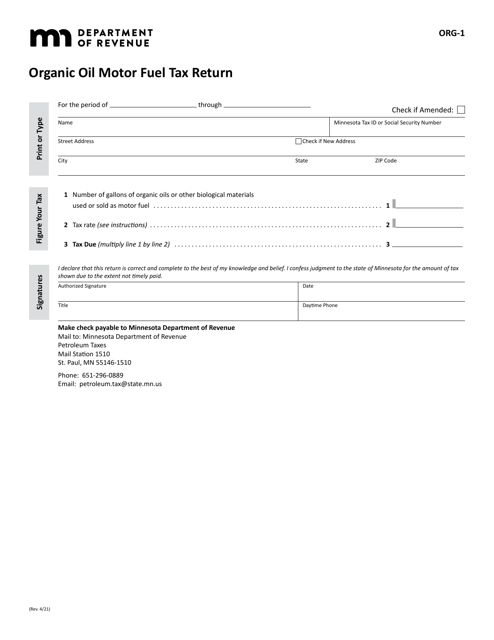

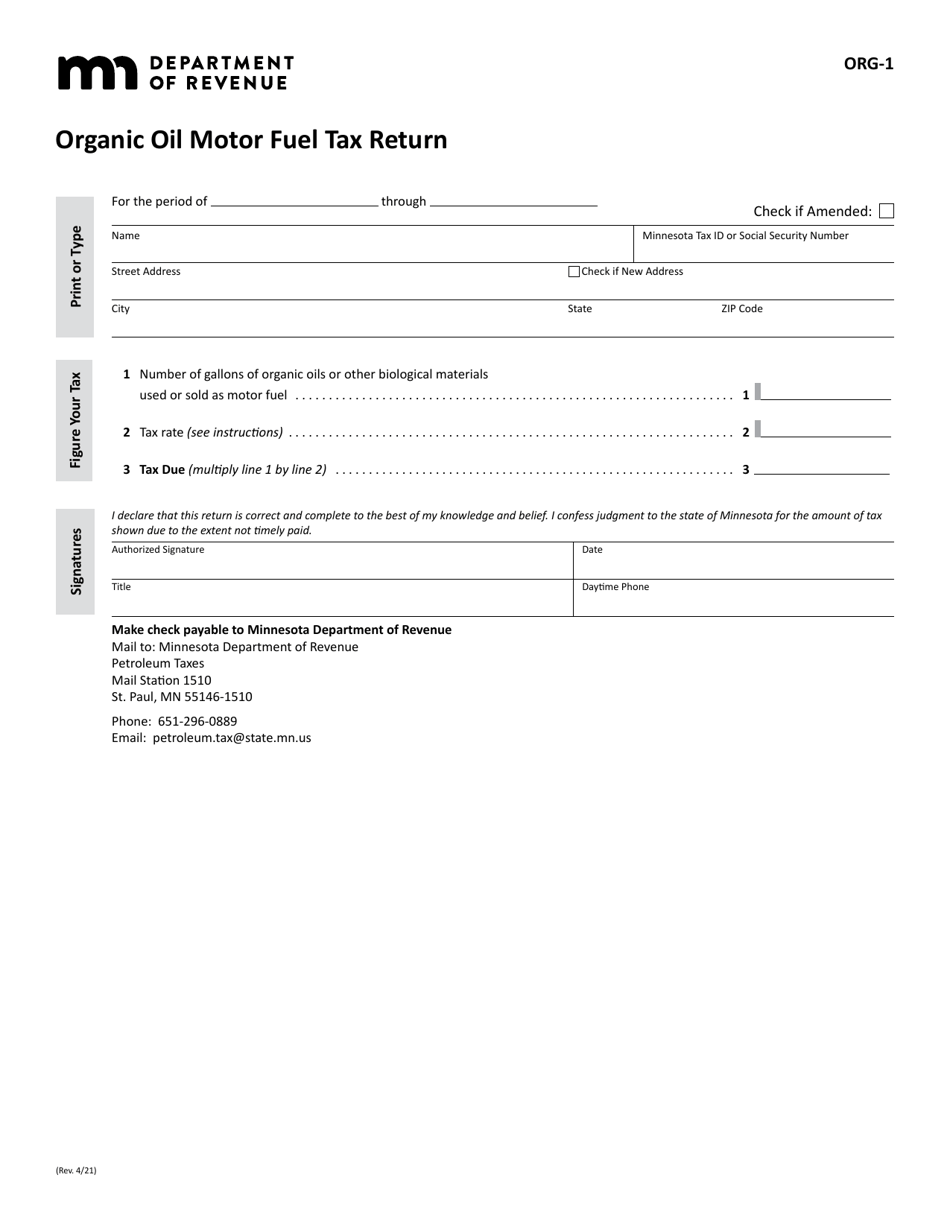

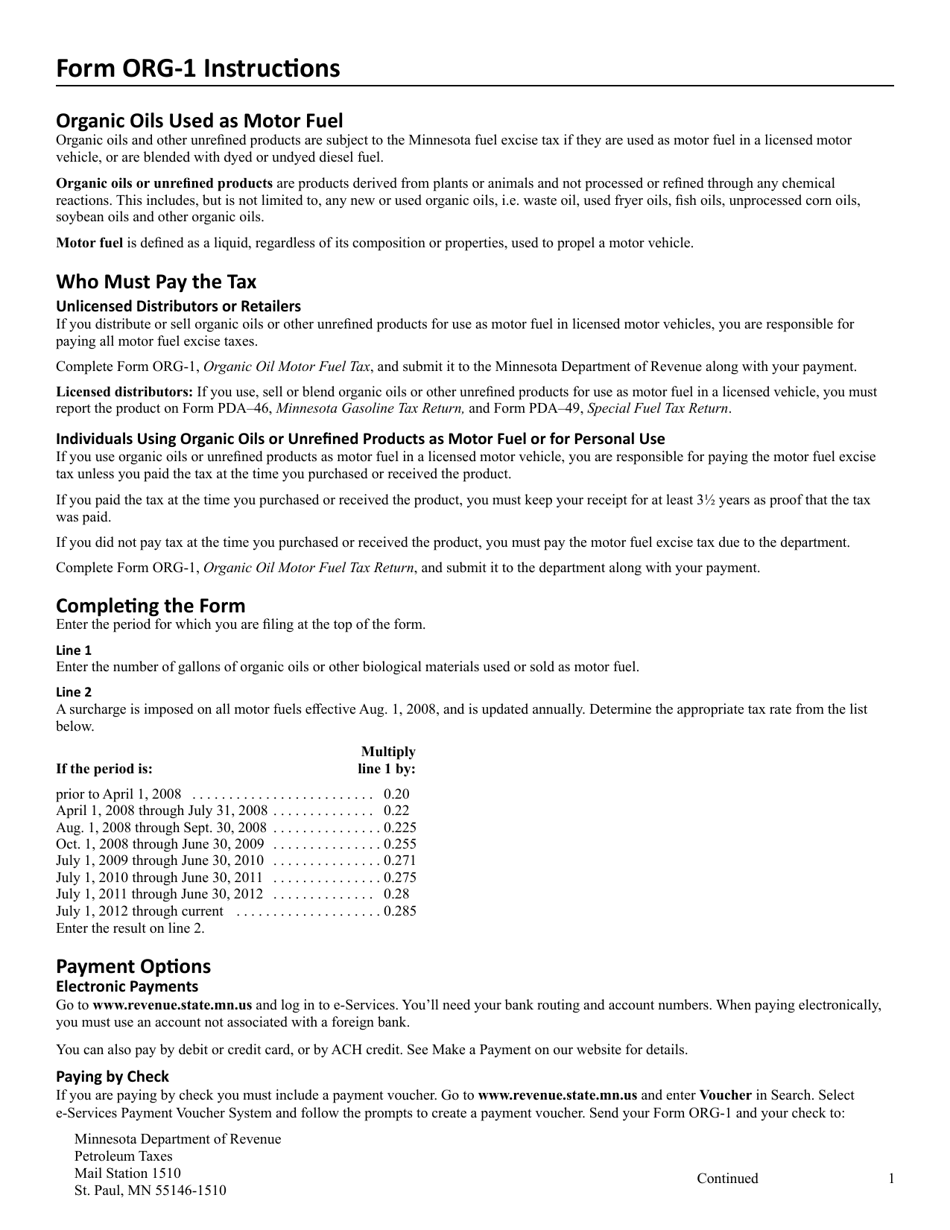

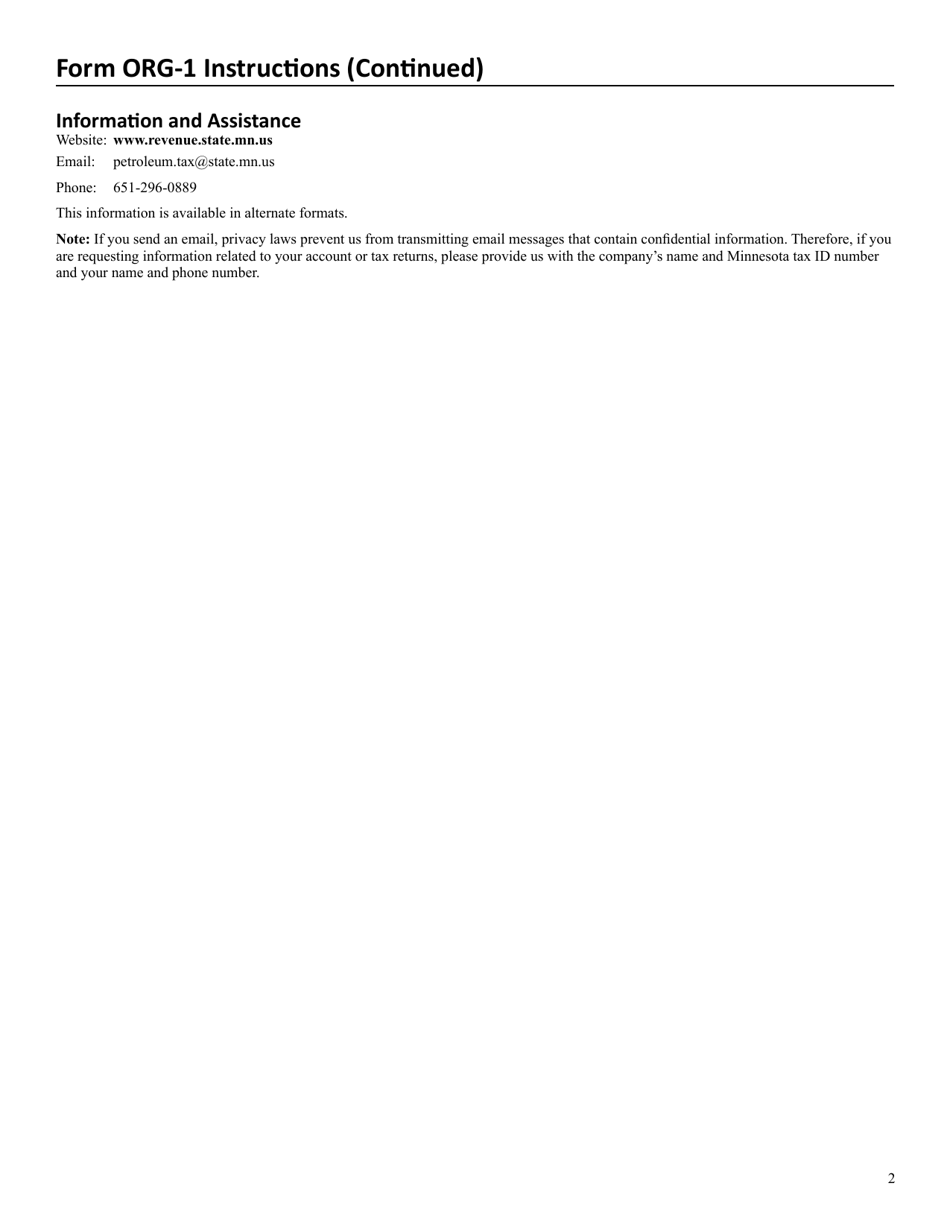

Form ORG-1

for the current year.

Form ORG-1 Organic Oil Motor Fuel Tax Return - Minnesota

What Is Form ORG-1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ORG-1 form?

A: The ORG-1 form is the Organic Oil Motor Fuel Tax Return.

Q: What is the purpose of the ORG-1 form?

A: The purpose of the ORG-1 form is to report and pay taxes on organic oil motor fuel in Minnesota.

Q: Who needs to file the ORG-1 form?

A: Any business or individual who sells or uses organic oil motor fuel in Minnesota needs to file the ORG-1 form.

Q: When is the ORG-1 form due?

A: The ORG-1 form is due on a monthly basis, and the due date is the last day of the following month.

Q: Are there any penalties for late filing of the ORG-1 form?

A: Yes, there are penalties for late filing of the ORG-1 form. The penalty rate is 10% of the tax due, with a minimum penalty of $10.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ORG-1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.