This version of the form is not currently in use and is provided for reference only. Download this version of

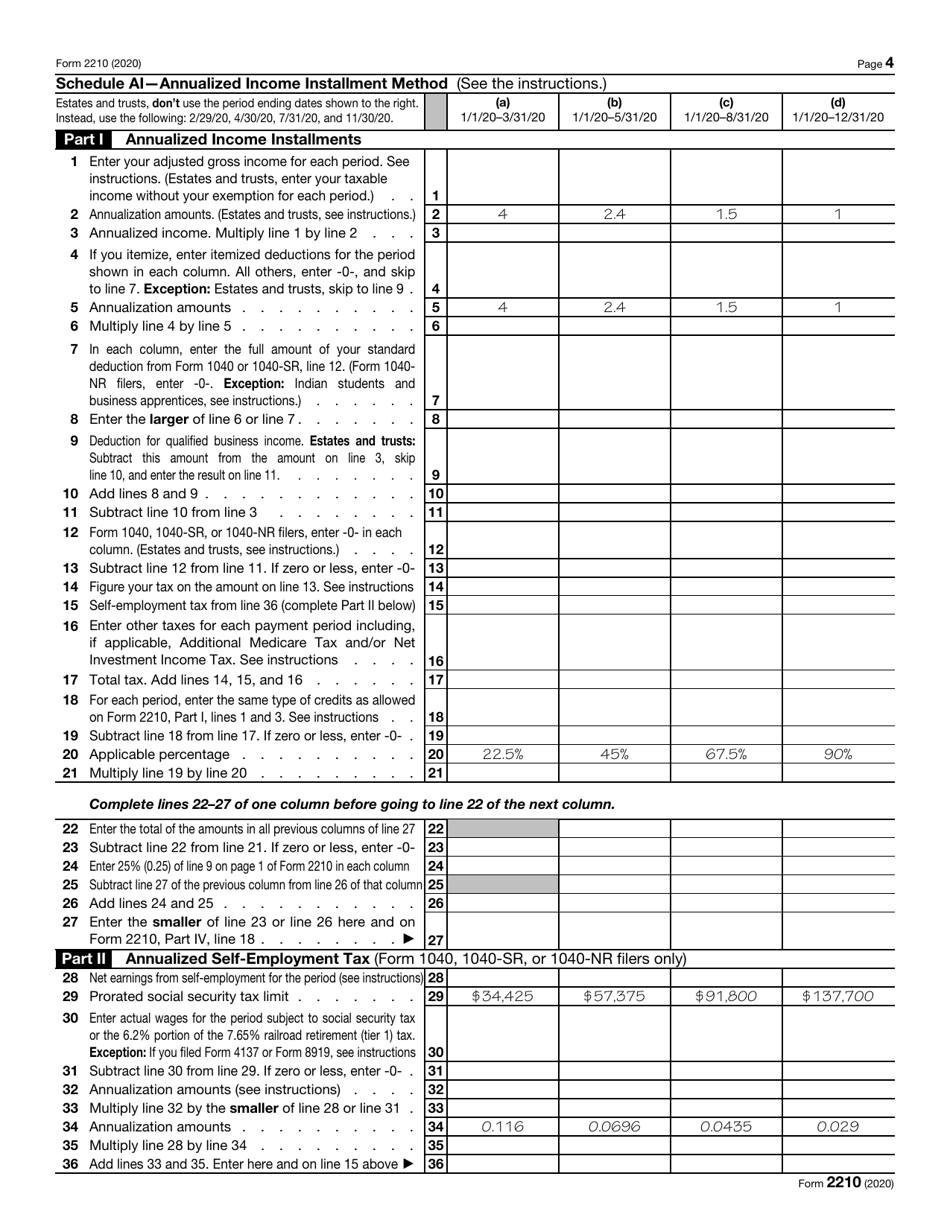

IRS Form 2210

for the current year.

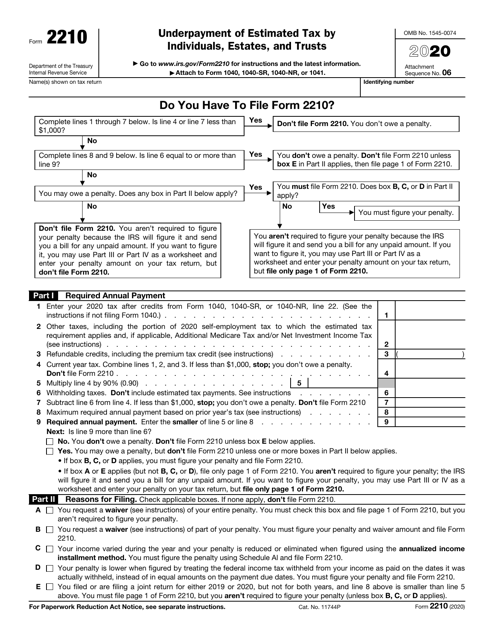

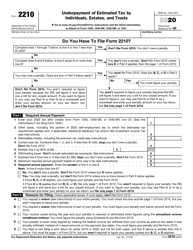

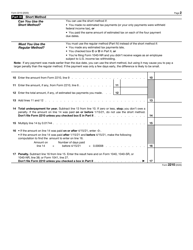

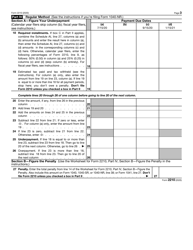

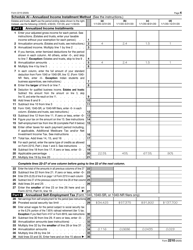

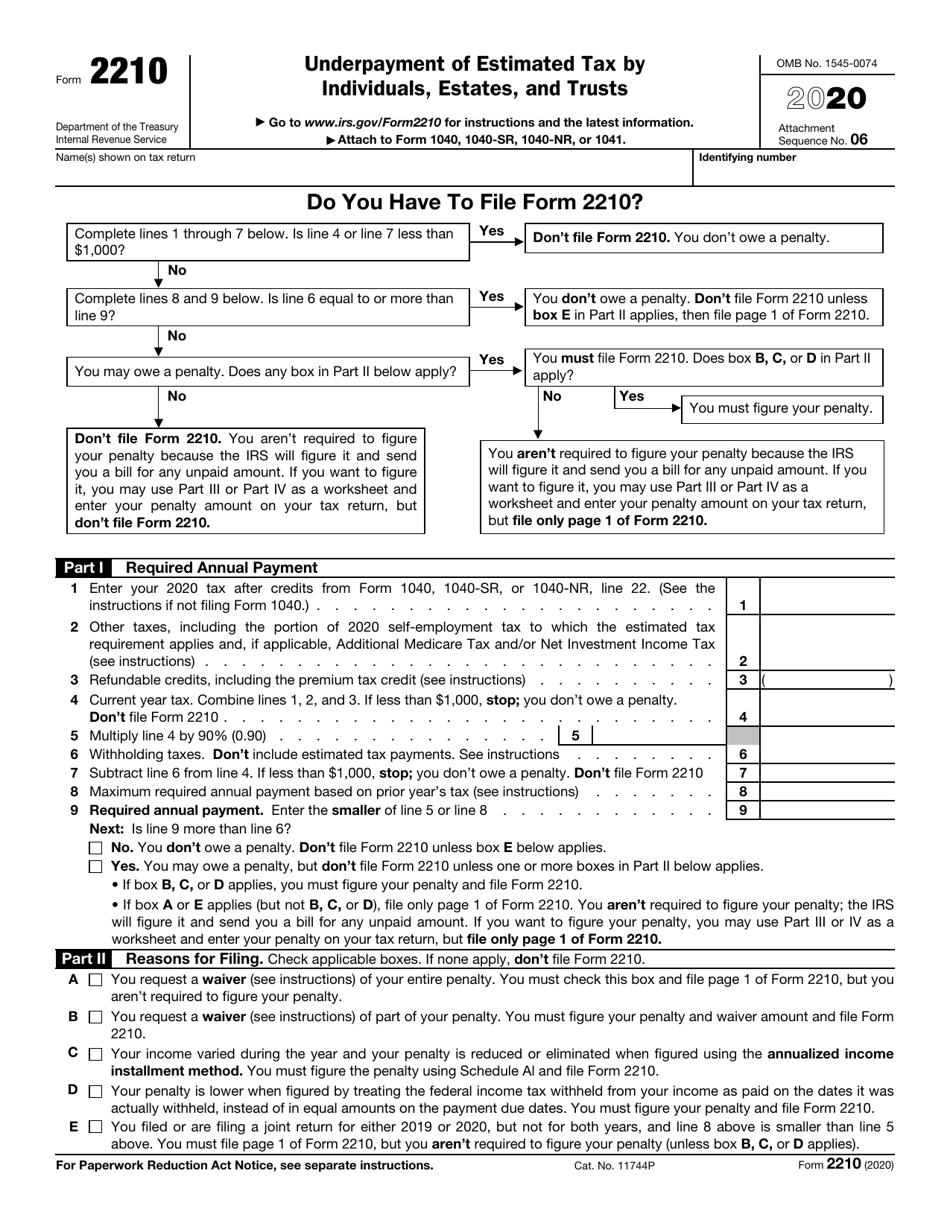

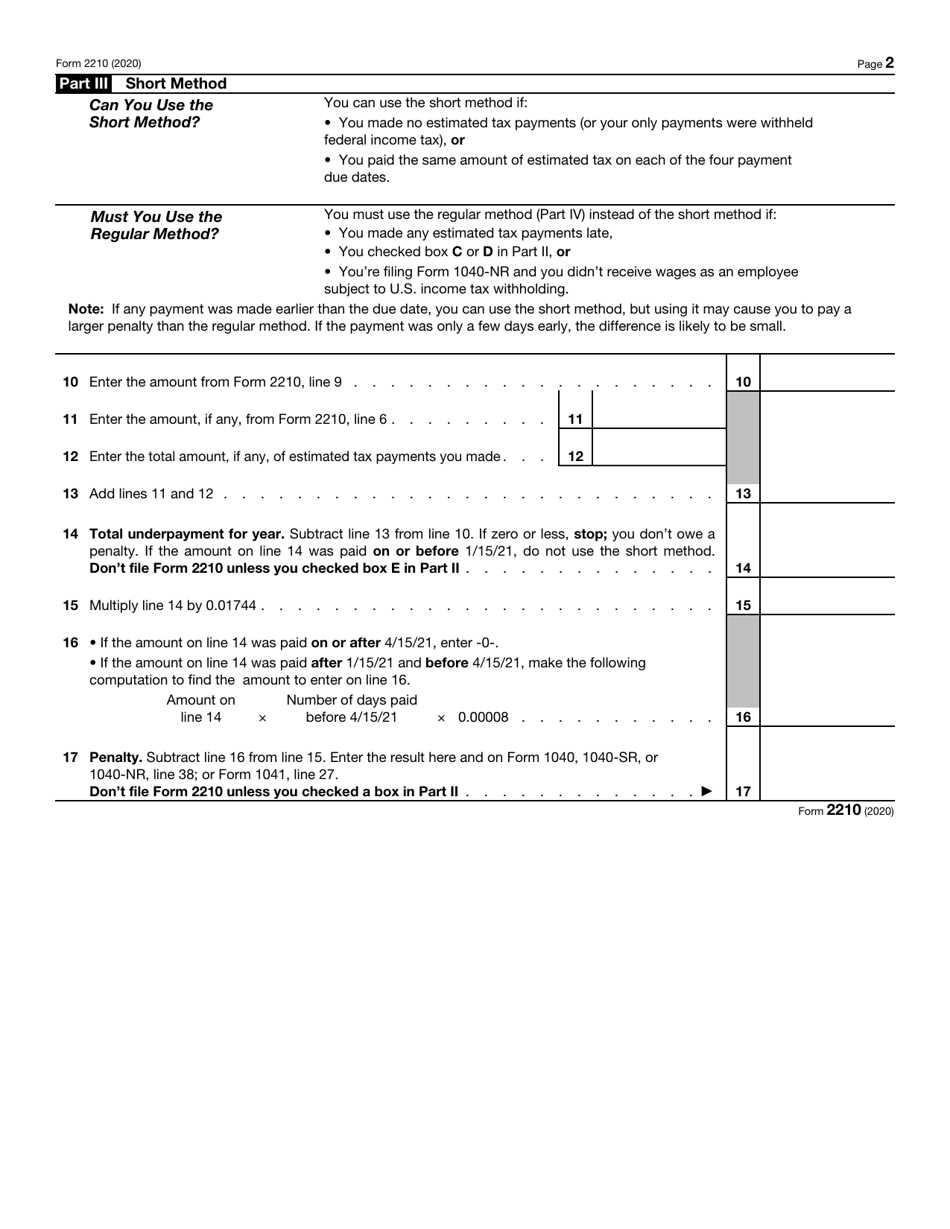

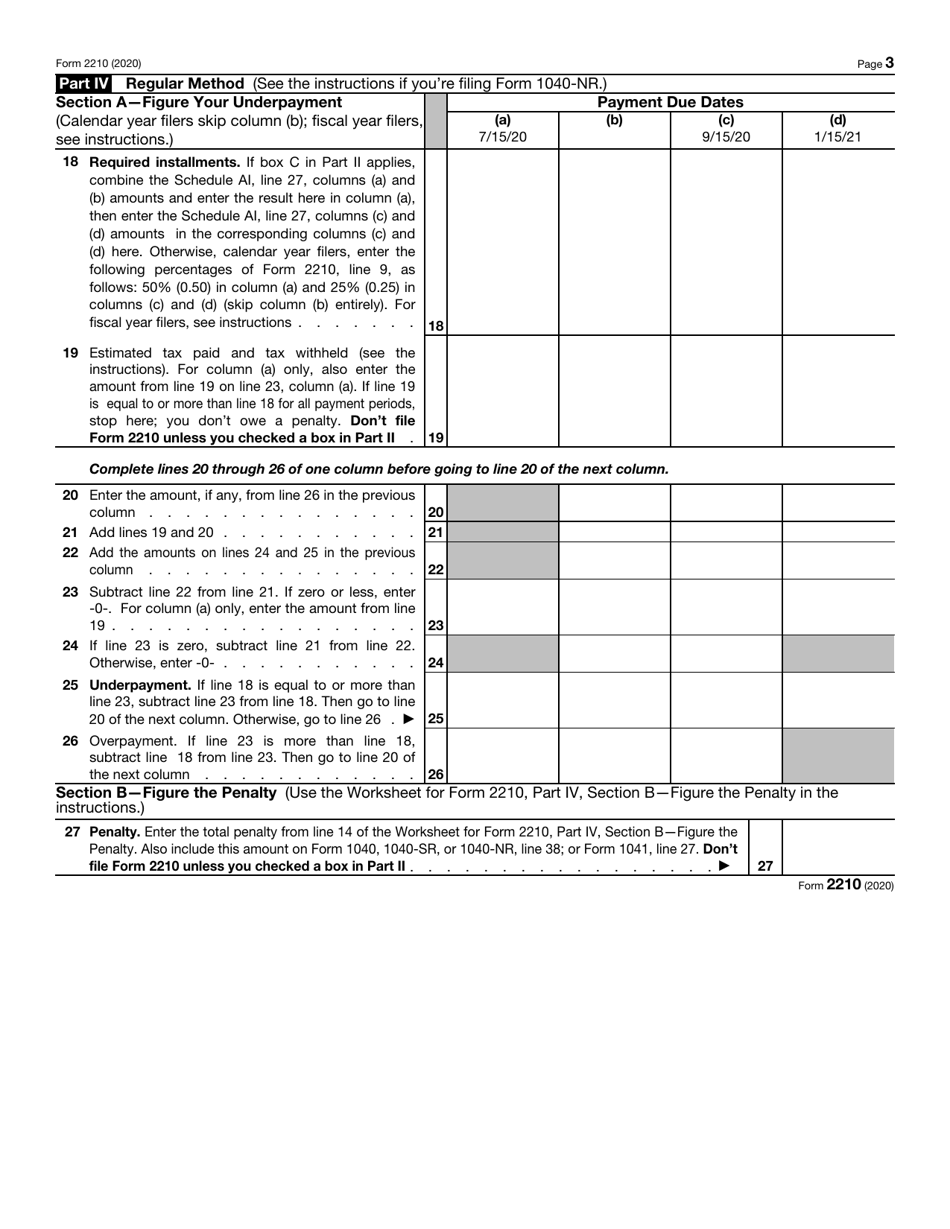

IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts

What Is IRS Form 2210?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 2210?

A: IRS Form 2210 is used to calculate the penalty for underpayment of estimated tax by individuals, estates, and trusts.

Q: Who needs to file IRS Form 2210?

A: Individuals, estates, and trusts who have made insufficient estimated tax payments may need to file IRS Form 2210.

Q: What is the purpose of IRS Form 2210?

A: The purpose of IRS Form 2210 is to calculate and pay the penalty for underpayment of estimated tax.

Q: How do I fill out IRS Form 2210?

A: You will need to provide information about your estimated tax payments, income, and deductions to fill out IRS Form 2210.

Q: When is IRS Form 2210 due?

A: IRS Form 2210 is typically due on the same day as your individual income tax return, which is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: What happens if I don't file IRS Form 2210?

A: If you do not file IRS Form 2210 when required, you may face penalties and interest on the underpayment of estimated tax.

Q: Can I file IRS Form 2210 electronically?

A: Yes, you can file IRS Form 2210 electronically using tax preparation software or through a professional tax preparer.

Q: Are there any exceptions to the penalty for underpayment of estimated tax?

A: Yes, there are exceptions and special rules that may apply to certain individuals, estates, and trusts. It is recommended to consult the instructions for IRS Form 2210 or a tax professional for more details.

Q: Can I amend IRS Form 2210?

A: Yes, if you made a mistake on your original IRS Form 2210, you can file an amended form to correct the error.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2210 through the link below or browse more documents in our library of IRS Forms.