This version of the form is not currently in use and is provided for reference only. Download this version of

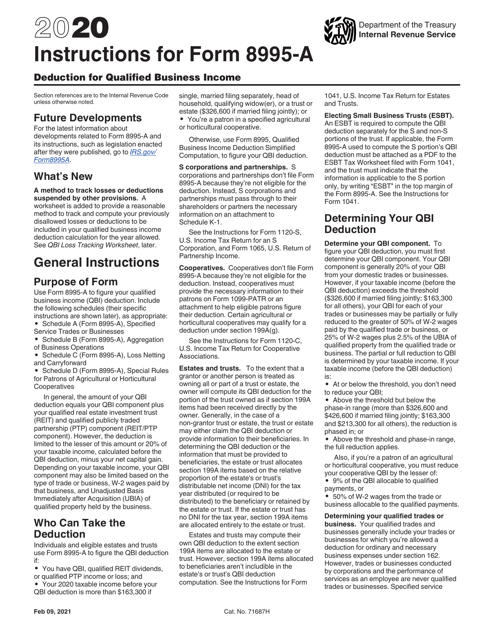

Instructions for IRS Form 8995-A

for the current year.

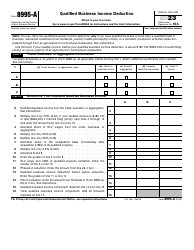

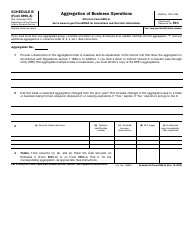

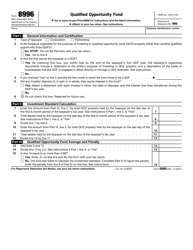

Instructions for IRS Form 8995-A Qualified Business Income Deduction

This document contains official instructions for IRS Form 8995-A , Qualified Business Income Deduction - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8995-A is available for download through this link.

FAQ

Q: What is IRS Form 8995-A?

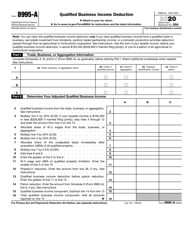

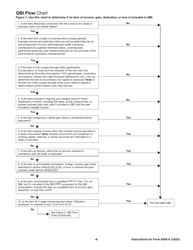

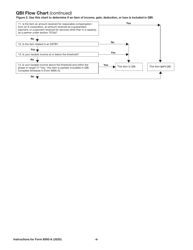

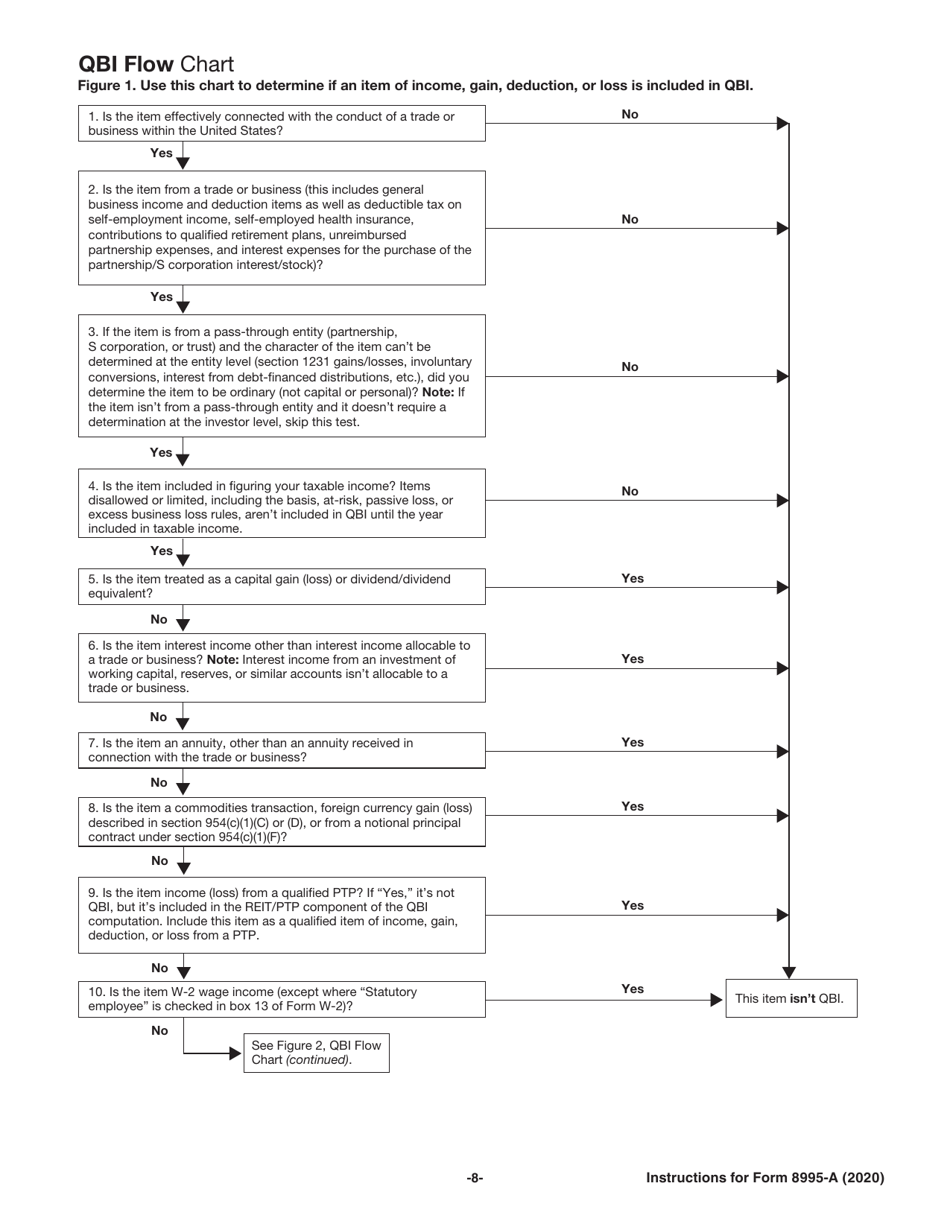

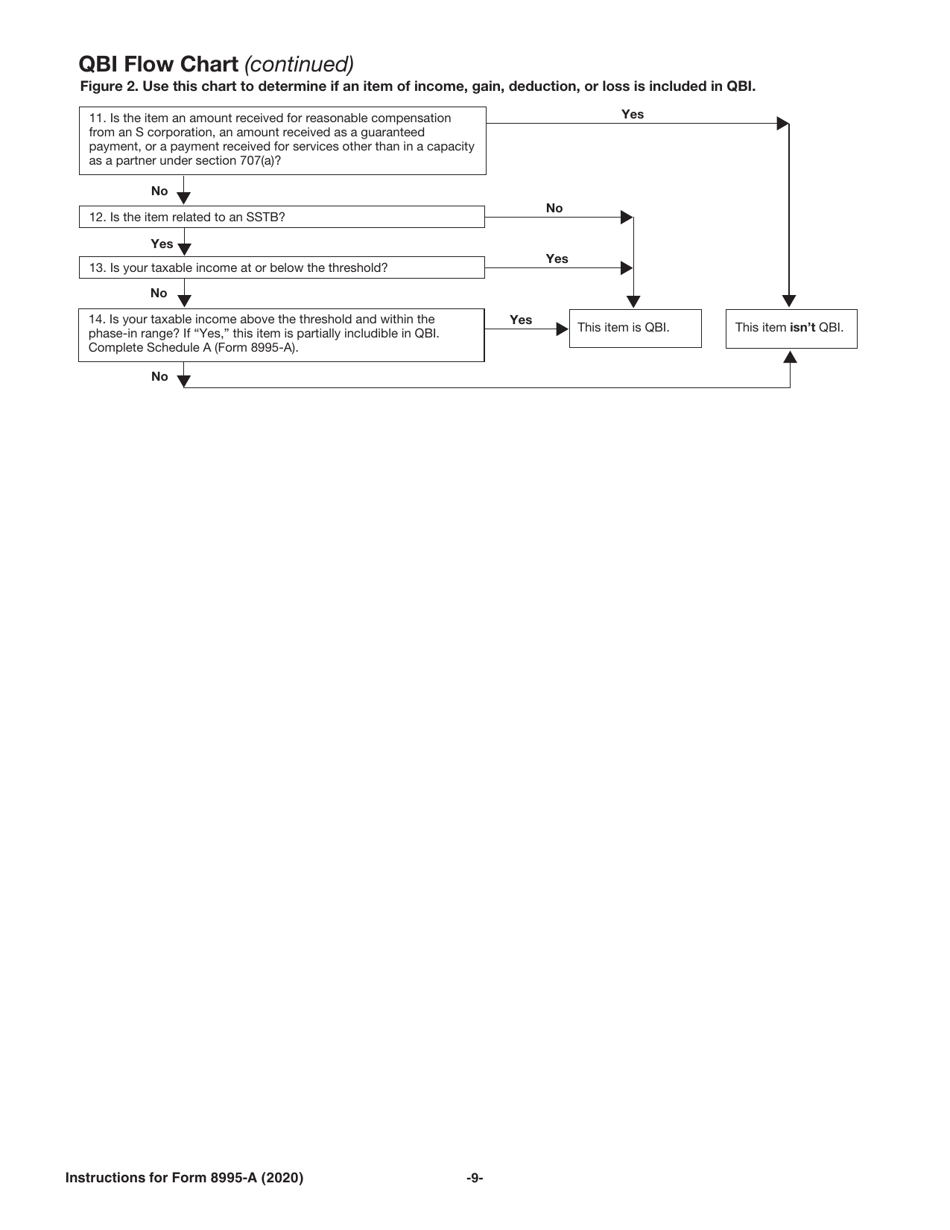

A: IRS Form 8995-A is a tax form used to calculate the Qualified Business Income Deduction.

Q: Who is eligible to use Form 8995-A?

A: Taxpayers with qualified business income from a specified trade or business are eligible to use Form 8995-A.

Q: What is the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction is a tax deduction that allows eligible taxpayers to deduct up to 20% of their qualified business income.

Q: What information is required on Form 8995-A?

A: Form 8995-A requires information about the taxpayer's qualified business income, relevant deductions, and overall taxable income.

Q: When is the deadline to file Form 8995-A?

A: Form 8995-A is generally filed with the taxpayer's annual tax return, which is due on April 15th of each year.

Q: Can I e-file Form 8995-A?

A: Yes, Form 8995-A can be e-filed along with the taxpayer's annual tax return.

Q: Is the Qualified Business Income Deduction subject to any limitations?

A: Yes, the Qualified Business Income Deduction may be subject to various limitations depending on the taxpayer's income and type of business.

Q: What are the benefits of the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction can lower a taxpayer's overall taxable income and potentially reduce their tax liability.

Q: Do I need any additional documentation to support my Qualified Business Income Deduction?

A: Taxpayers should keep records and documentation of their business income and expenses to support their deduction, but they do not need to submit these records with Form 8995-A.

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.