This version of the form is not currently in use and is provided for reference only. Download this version of

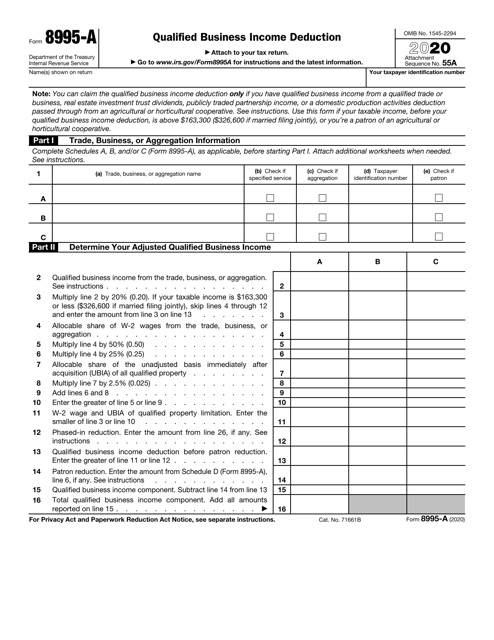

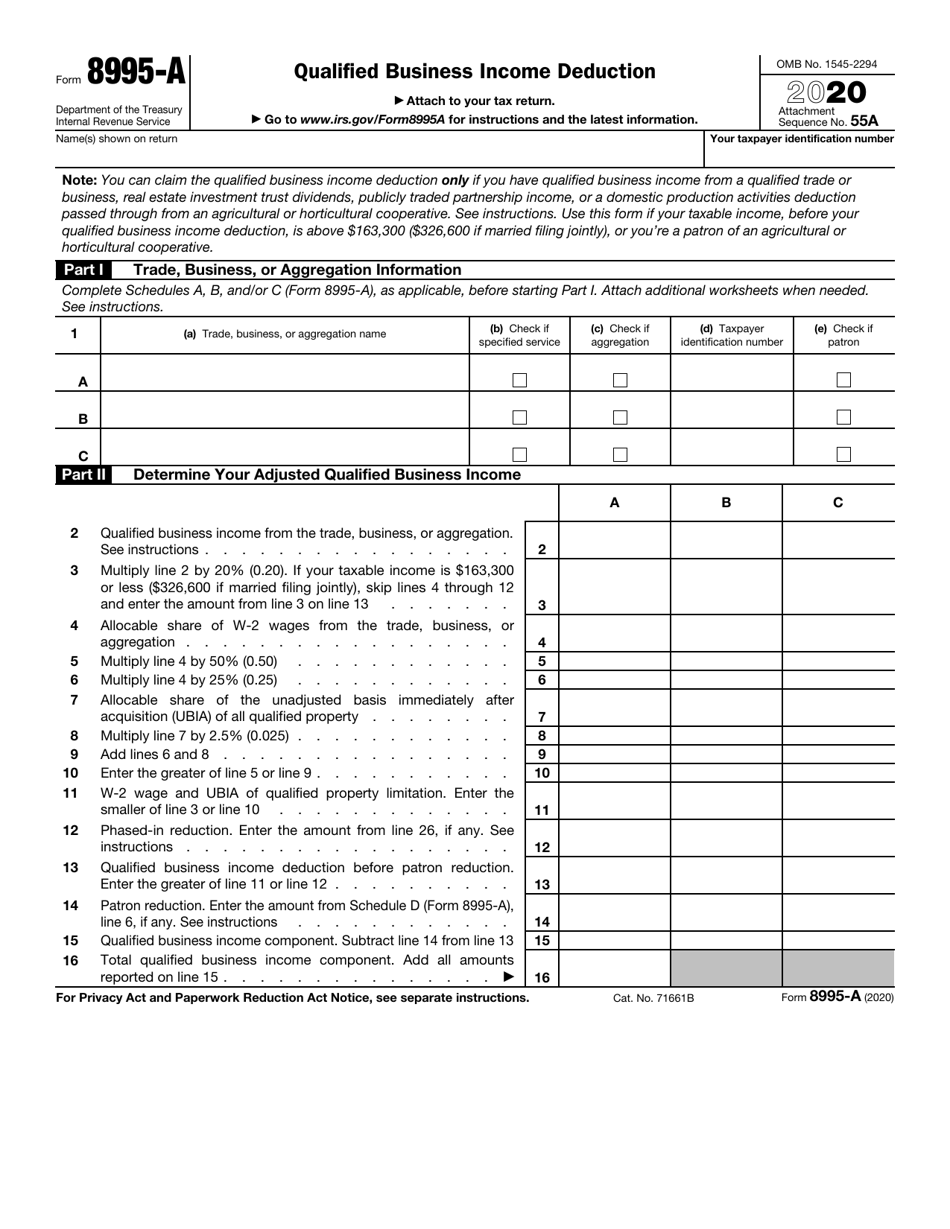

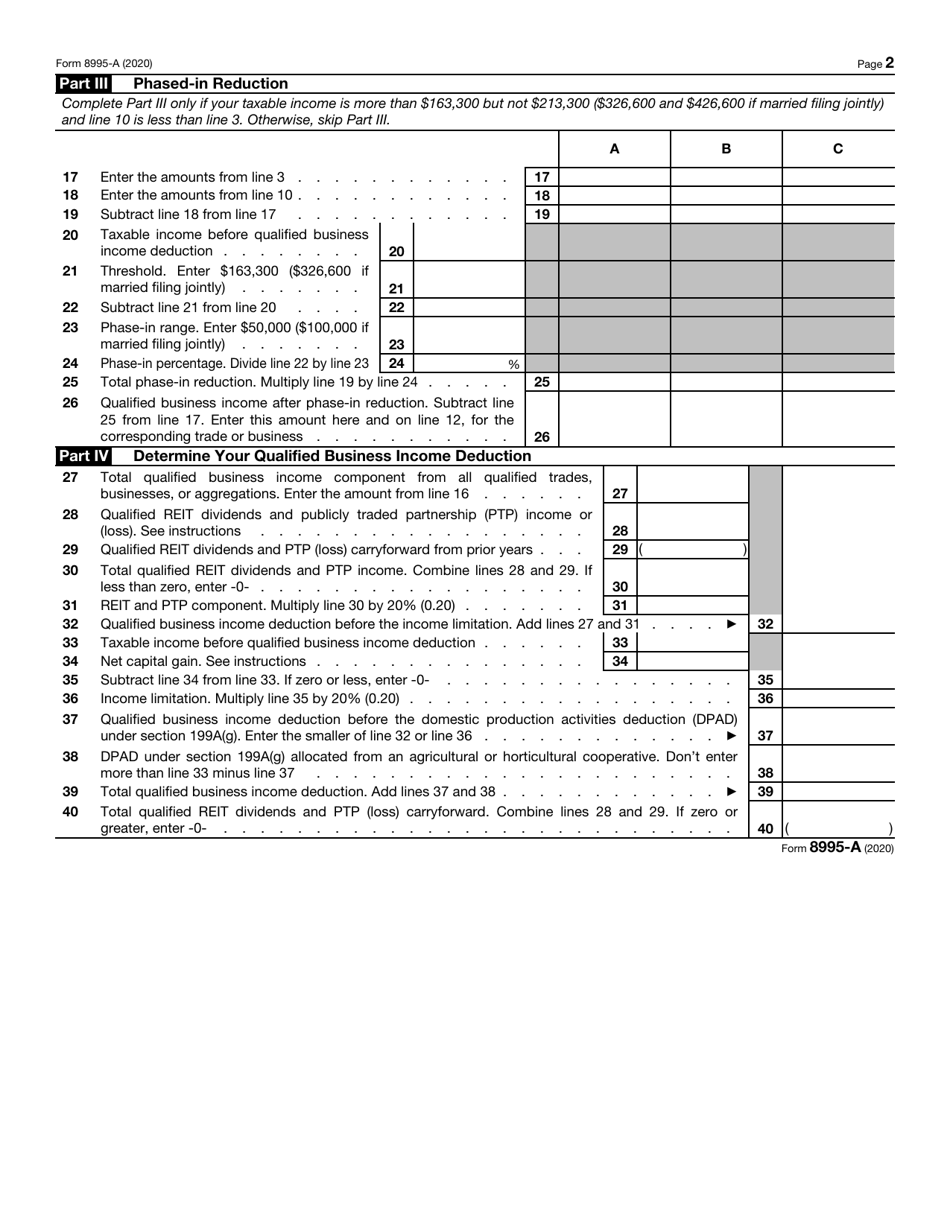

IRS Form 8995-A

for the current year.

IRS Form 8995-A Qualified Business Income Deduction

What Is IRS Form 8995-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a form used to calculate the Qualified Business Income Deduction.

Q: Who can use IRS Form 8995-A?

A: Individuals, estates, and trusts with qualified business income can use IRS Form 8995-A.

Q: What is the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction is a tax deduction for eligible businesses and entities.

Q: What information is required on IRS Form 8995-A?

A: Information such as the taxpayer's name, business information, and income details are required on IRS Form 8995-A.

Q: When is IRS Form 8995-A due?

A: IRS Form 8995-A is typically due on the same date as the taxpayer's annual tax return.

Q: Are there any limitations or restrictions for claiming the Qualified Business Income Deduction?

A: Yes, there are certain limitations and restrictions that apply to claiming the Qualified Business Income Deduction. It is recommended to consult a tax professional or refer to the IRS guidelines for specific details.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A through the link below or browse more documents in our library of IRS Forms.