This version of the form is not currently in use and is provided for reference only. Download this version of

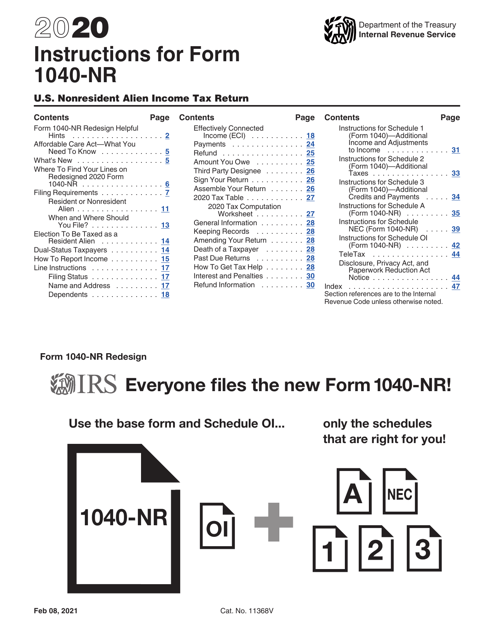

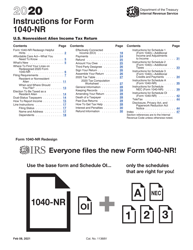

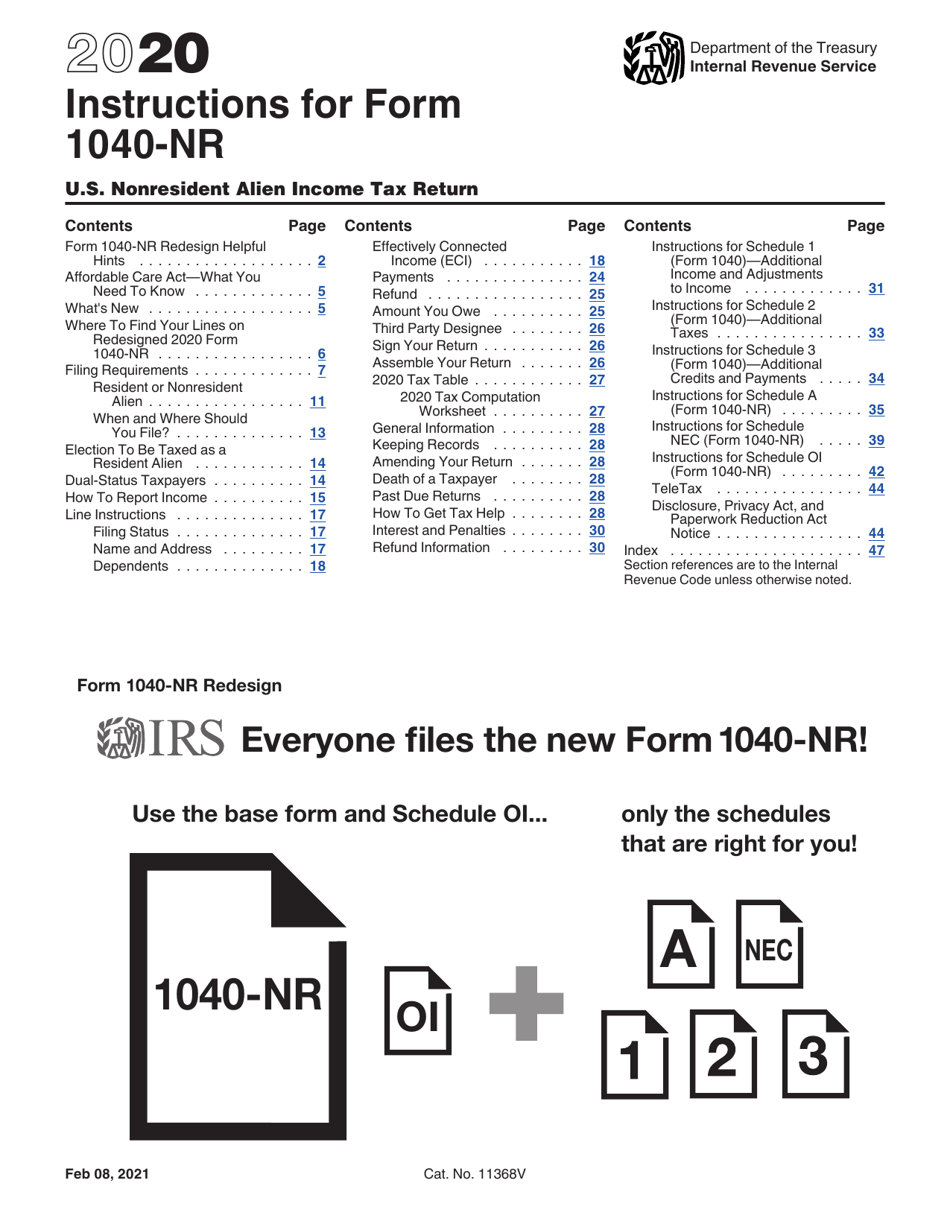

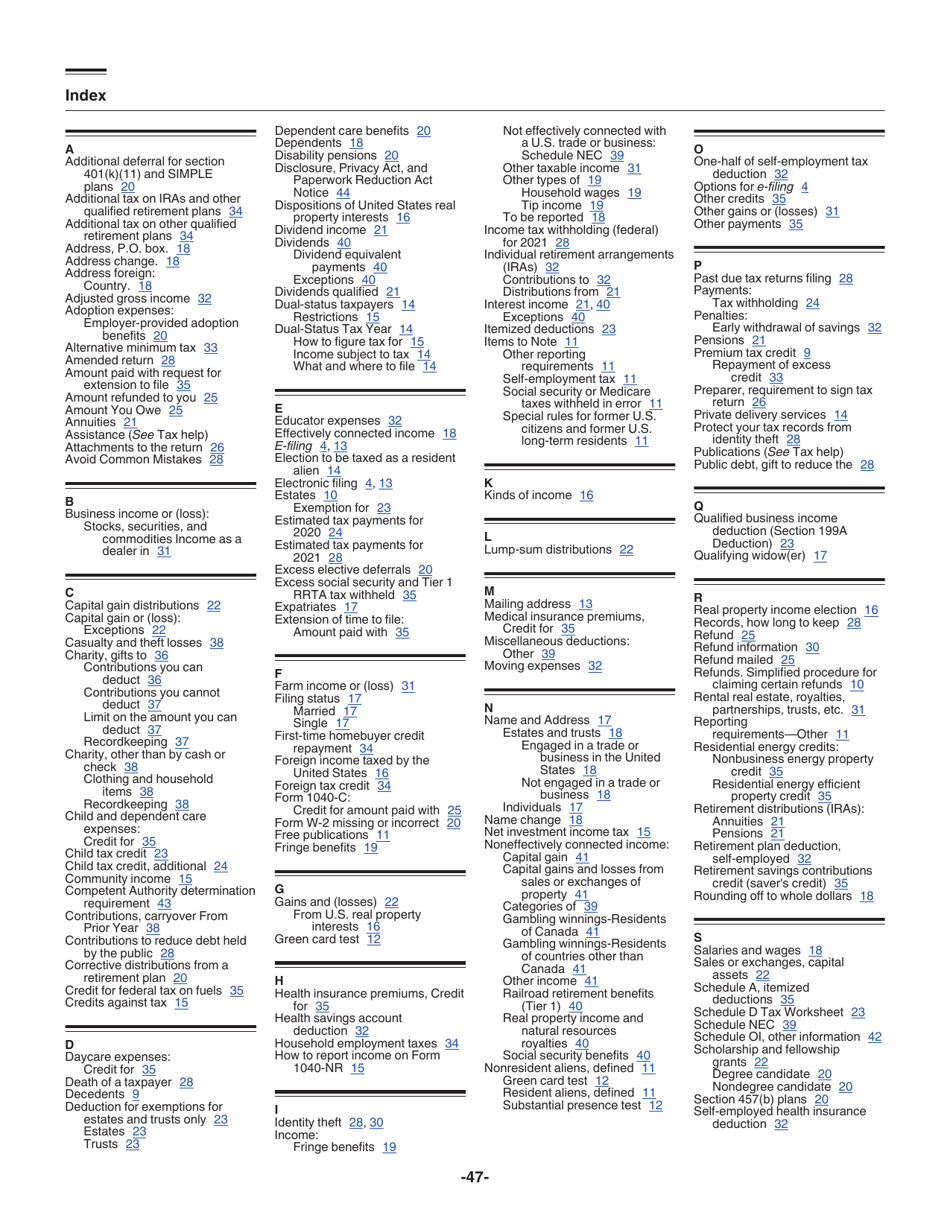

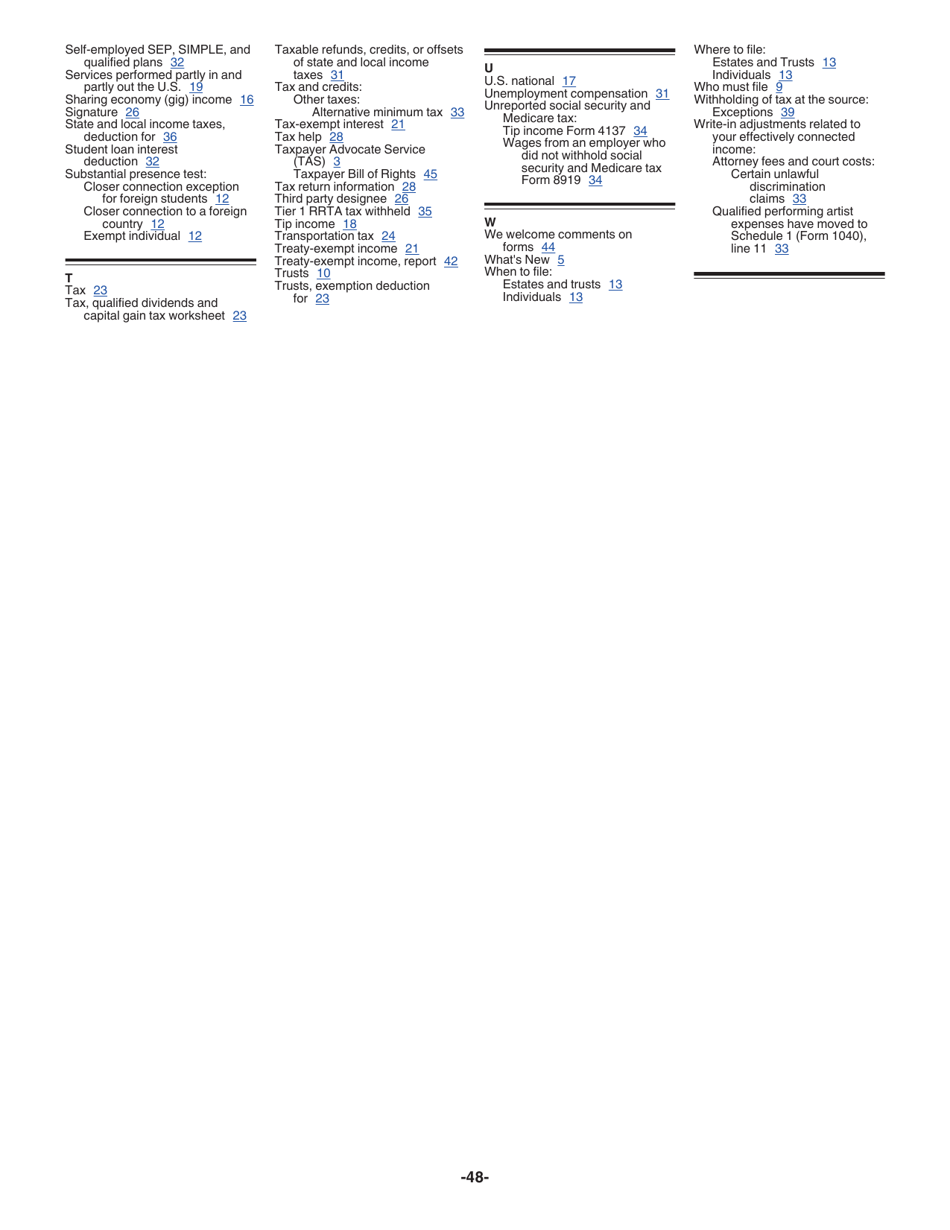

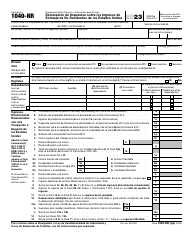

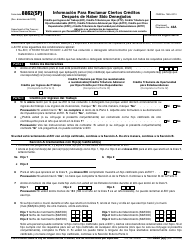

Instructions for IRS Form 1040-NR

for the current year.

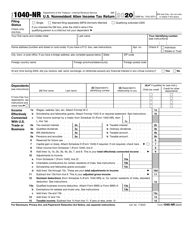

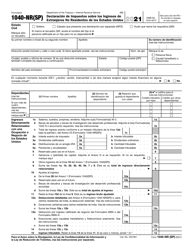

Instructions for IRS Form 1040-NR U.S. Nonresident Alien Income Tax Return

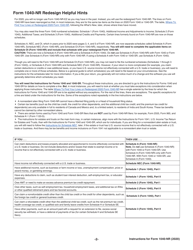

This document contains official instructions for IRS Form 1040-NR , U.S. Nonresident Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-NR is available for download through this link.

FAQ

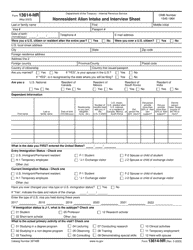

Q: What is IRS Form 1040-NR?

A: IRS Form 1040-NR is the U.S. Nonresident Alien Income Tax Return.

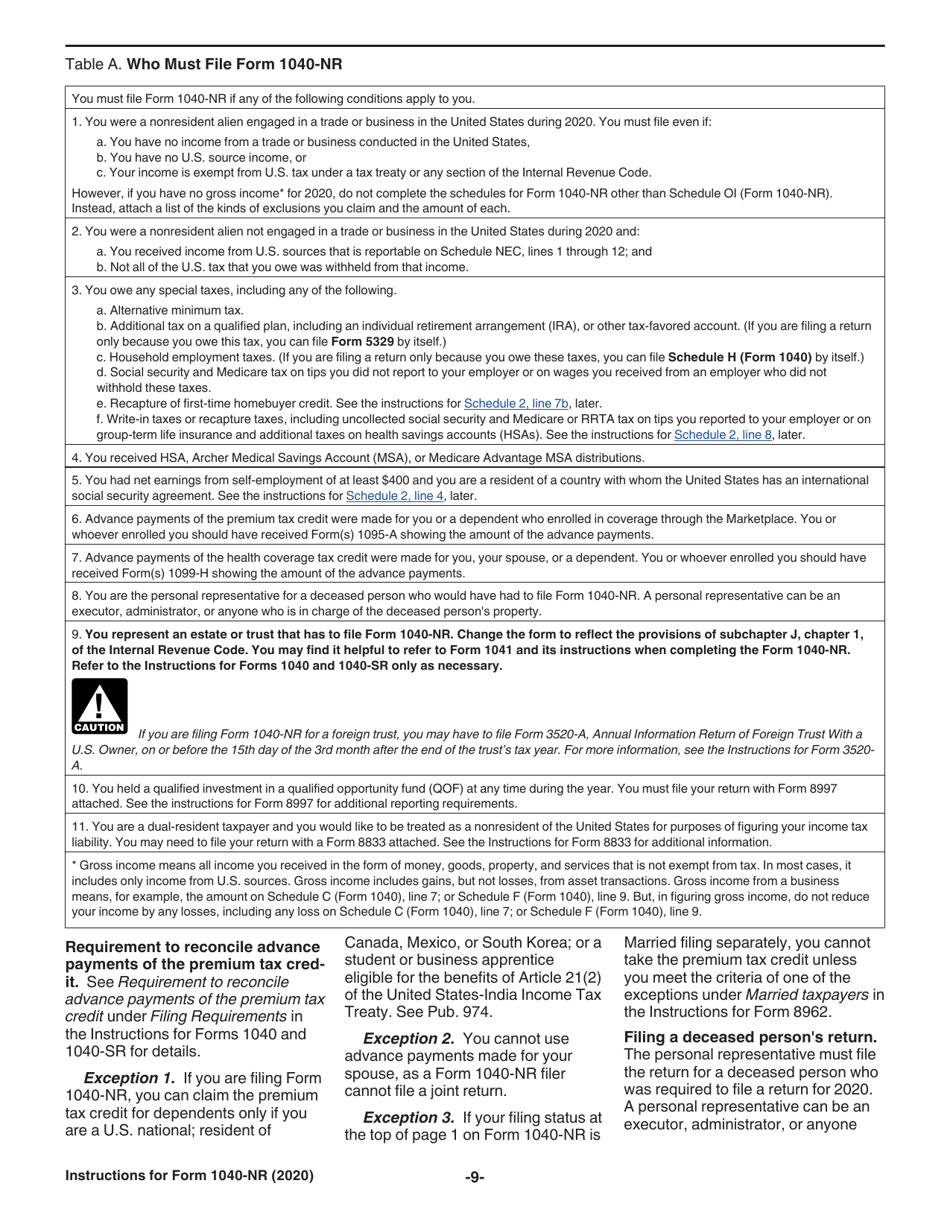

Q: Who needs to file IRS Form 1040-NR?

A: Nonresident aliens who have income from U.S. sources need to file IRS Form 1040-NR.

Q: What is the purpose of IRS Form 1040-NR?

A: The purpose of IRS Form 1040-NR is to report and pay taxes on income earned by nonresident aliens from U.S. sources.

Q: When is the deadline for filing IRS Form 1040-NR?

A: The deadline for filing IRS Form 1040-NR is generally April 15th.

Q: Are there any exceptions to the April 15th deadline?

A: Yes, there are certain exceptions for nonresident aliens, such as if they are a student or a scholar.

Q: What should I do if I can't file IRS Form 1040-NR by the deadline?

A: If you can't file IRS Form 1040-NR by the deadline, you may be able to request an extension using Form 4868.

Q: Are there any penalties for not filing IRS Form 1040-NR?

A: Yes, there may be penalties for not filing IRS Form 1040-NR, including interest and late fees.

Q: Can I file IRS Form 1040 instead of Form 1040-NR?

A: No, nonresident aliens cannot file IRS Form 1040. They must file IRS Form 1040-NR.

Q: Do I need a Social Security Number to file IRS Form 1040-NR?

A: No, nonresident aliens who do not have a Social Security Number can apply for an Individual Taxpayer Identification Number (ITIN) to file IRS Form 1040-NR.

Instruction Details:

- This 48-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.