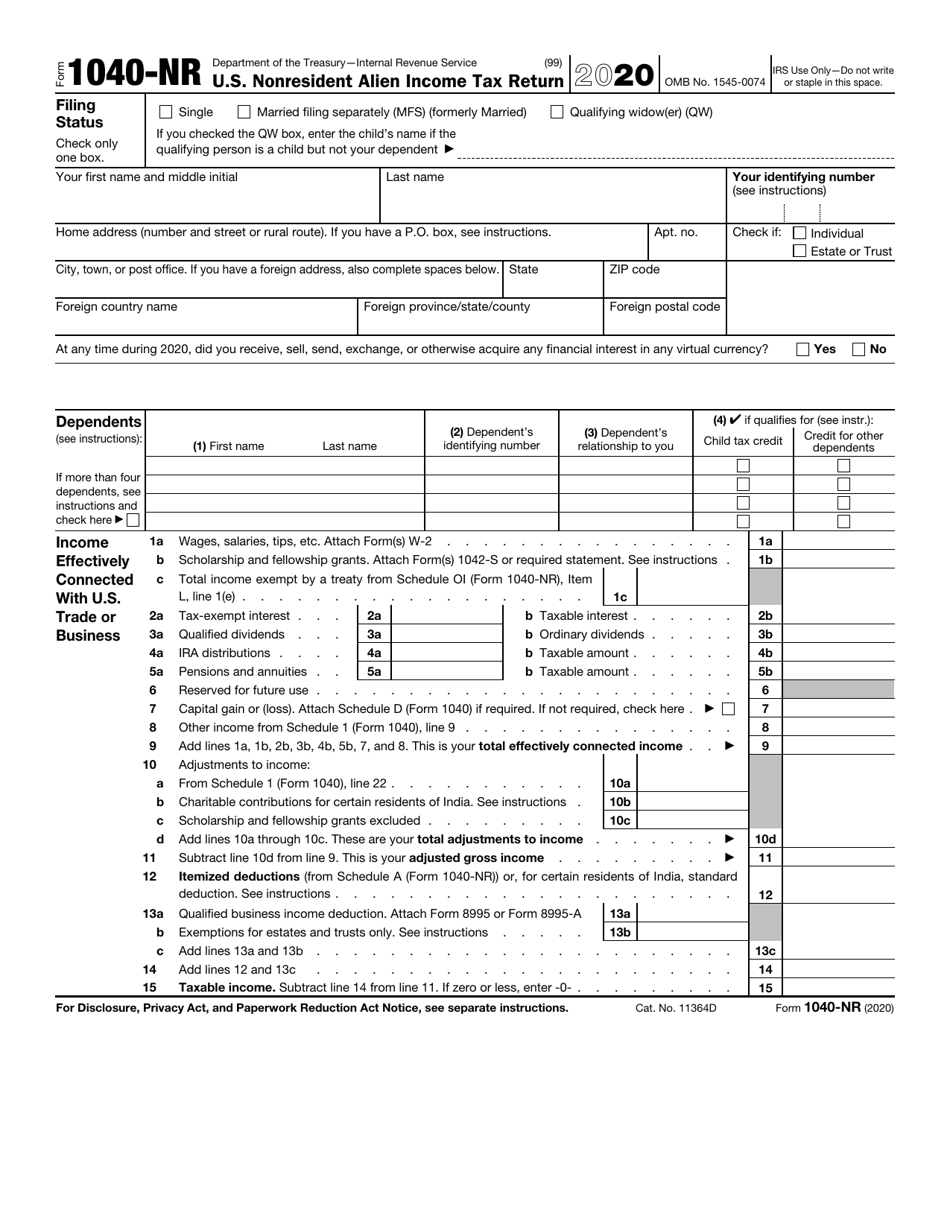

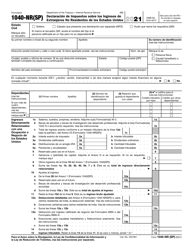

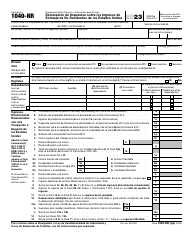

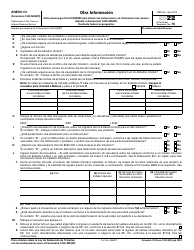

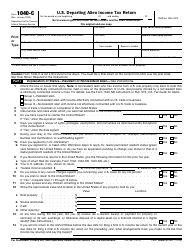

This version of the form is not currently in use and is provided for reference only. Download this version of

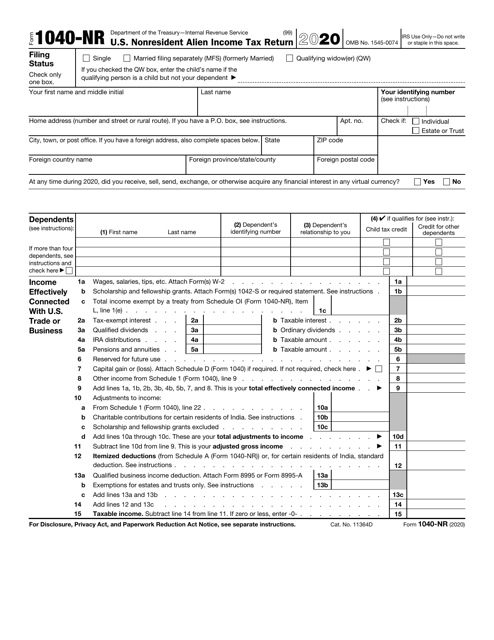

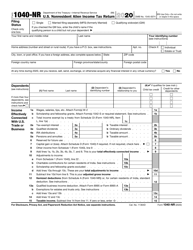

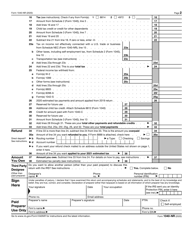

IRS Form 1040-NR

for the current year.

IRS Form 1040-NR U.S. Nonresident Alien Income Tax Return

What Is IRS Form 1040-NR?

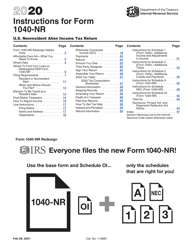

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-NR?

A: IRS Form 1040-NR is the U.S. Nonresident Alien Income Tax Return.

Q: Who needs to file IRS Form 1040-NR?

A: Nonresident aliens who have income from U.S. sources need to file IRS Form 1040-NR.

Q: What is considered U.S. source income?

A: U.S. source income includes wages, salaries, tips, and profits from business conducted in the U.S.

Q: Can I use IRS Form 1040 instead of 1040-NR?

A: No, nonresident aliens cannot use IRS Form 1040. They must use Form 1040-NR.

Q: Do I need to have a Social Security Number to file IRS Form 1040-NR?

A: No, nonresident aliens can use an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number.

Q: What is the deadline for filing IRS Form 1040-NR?

A: The deadline for filing IRS Form 1040-NR is typically April 15th, but it can vary.

Q: Are there any deductions or credits available for nonresident aliens on IRS Form 1040-NR?

A: Yes, nonresident aliens may be eligible for certain deductions and credits, such as the standard deduction and the child tax credit.

Q: Can I e-file IRS Form 1040-NR?

A: Yes, nonresident aliens can e-file IRS Form 1040-NR.

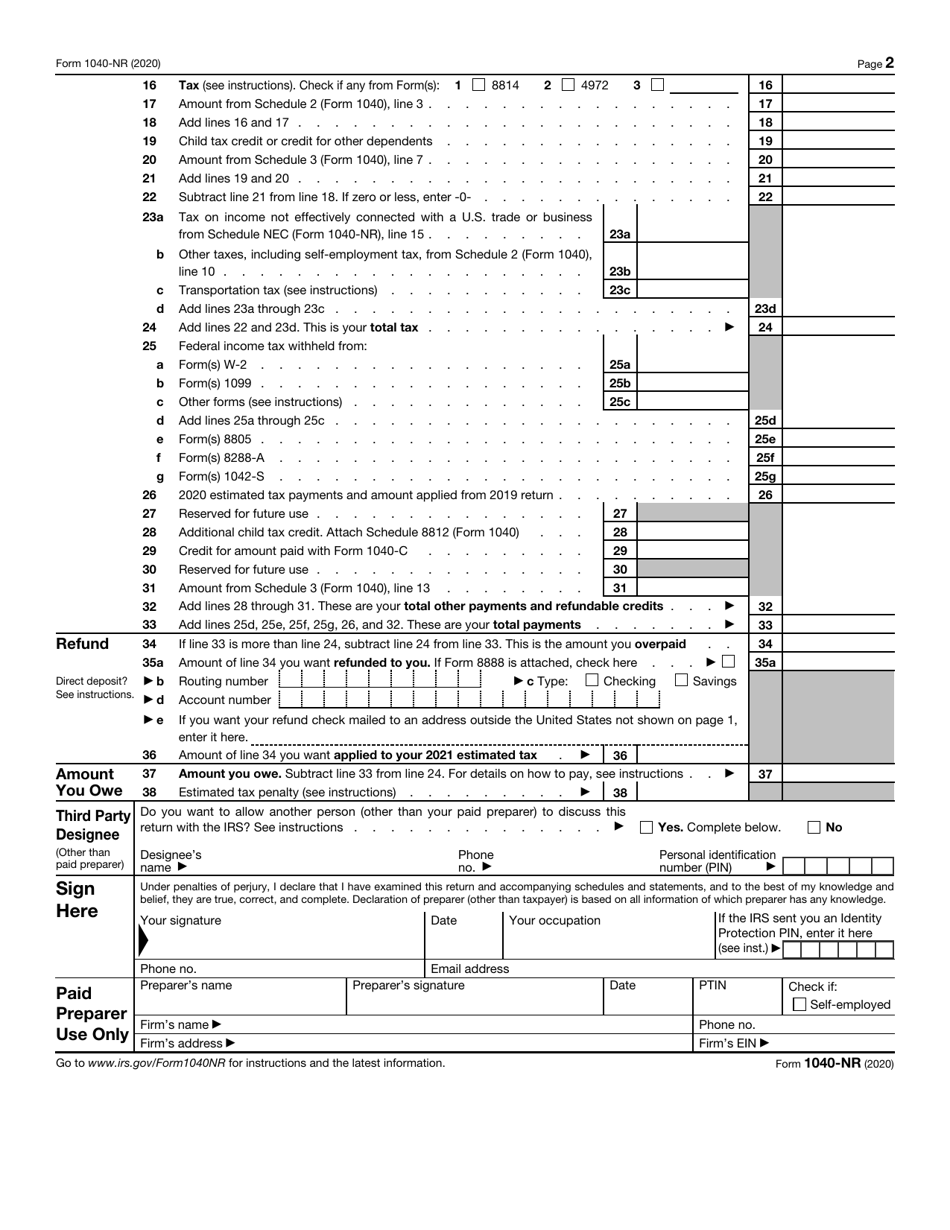

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-NR through the link below or browse more documents in our library of IRS Forms.