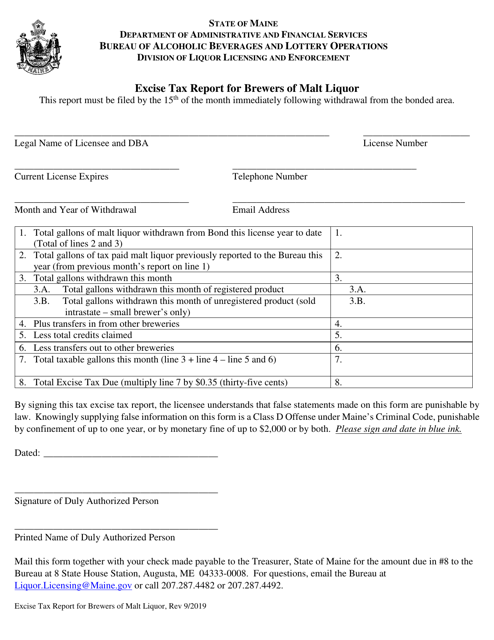

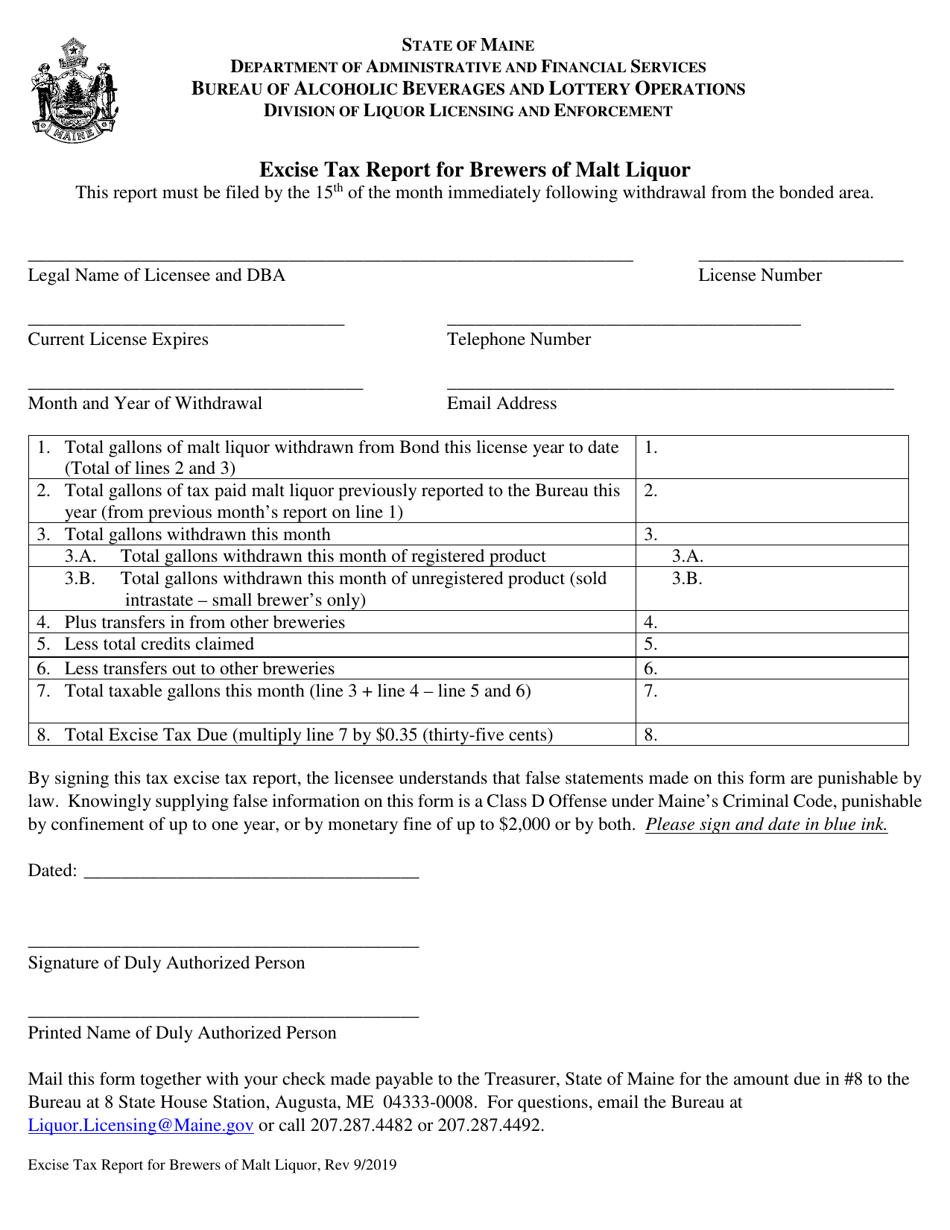

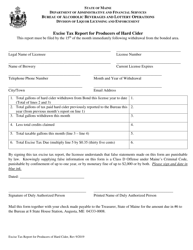

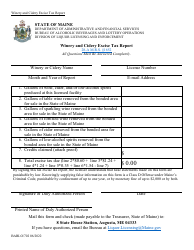

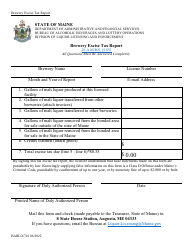

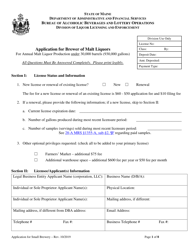

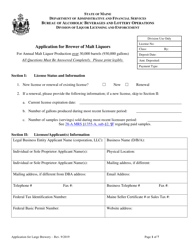

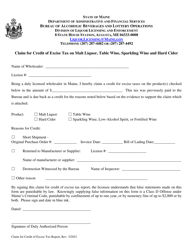

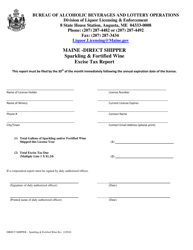

Excise Tax Report for Brewers of Malt Liquor - Maine

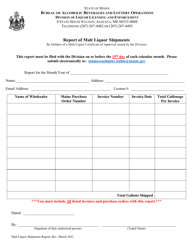

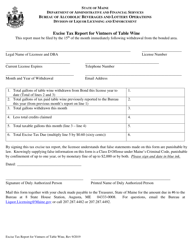

Excise Tax Report for Brewers of Malt Liquor is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

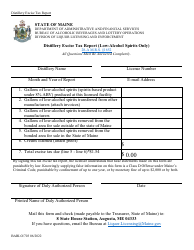

Q: What is the excise tax on brewers of malt liquor in Maine?

A: The excise tax on brewers of malt liquor in Maine varies depending on the alcohol content and the volume of production.

Q: How is the excise tax calculated for brewers of malt liquor in Maine?

A: The excise tax for brewers of malt liquor in Maine is calculated based on the alcohol content and the number of barrels produced.

Q: Are there different tax rates for different alcohol content levels?

A: Yes, the excise tax rates vary depending on the alcohol content of the malt liquor.

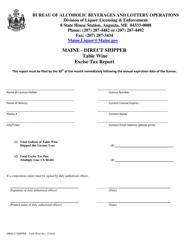

Q: How often are brewers required to file excise tax reports in Maine?

A: Brewers in Maine are required to file excise tax reports on a monthly basis.

Q: Are there any exemptions or deductions available for brewers of malt liquor in Maine?

A: Maine offers certain exemptions and deductions for brewers of malt liquor, but the specific details can vary.

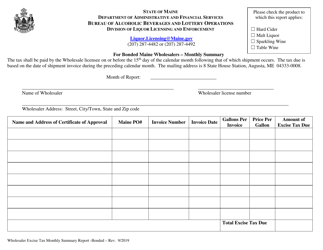

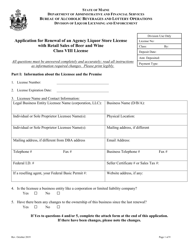

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.