Excise Tax Reporting Templates

Are you a business or individual that needs to report and file excise taxes? Look no further - we have the solution for you. Our Excise Tax Reporting services are designed to make the process of reporting and filing excise taxes quick, simple, and hassle-free.

Excise taxes are often imposed on certain goods or activities, such as alcohol, tobacco, gasoline, and more. These taxes are collected by the government to help fund various programs and initiatives. However, keeping track of all the necessary forms and filing requirements can be overwhelming and time-consuming.

That's where our Excise Tax Reporting services come in. We provide a comprehensive solution for businesses and individuals to stay compliant with excise tax regulations. Our experienced team is well-versed in the intricacies of excise tax reporting and can help ensure accurate and timely filing.

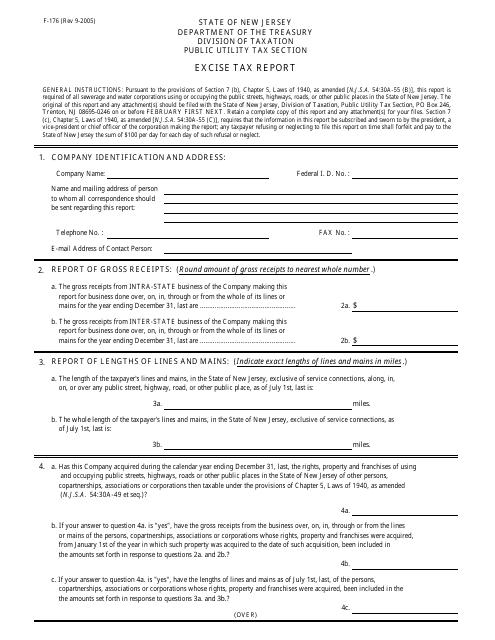

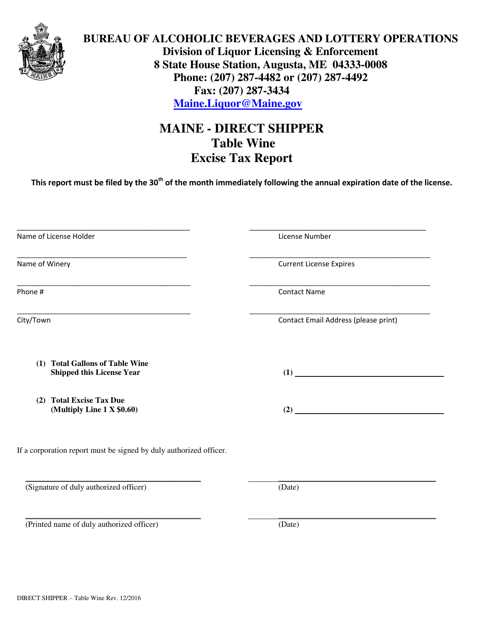

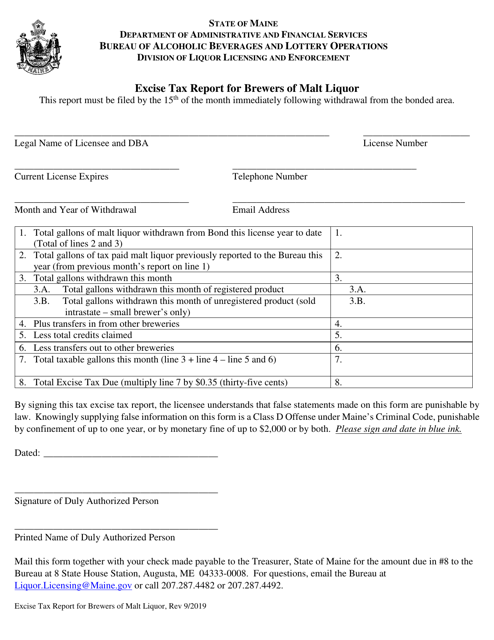

Whether you're a brewery, winery, distributor of beverages, or any other business that deals with excise taxable products, we can assist you. Our services cover a wide range of excise tax forms, including the Form F-176 Excise Tax Report in New Jersey, the Direct ShipperTable Wine Excise Tax Report in Maine, and many more.

With our Excise Tax Reporting services, you can avoid the stress and confusion that comes with filing these complex forms on your own. Our experts will guide you through the process, ensuring that you take advantage of any available exemptions and deductions, maximizing your tax savings.

Don't let excise tax reporting become a burden for your business. Let us handle the paperwork, so you can focus on what you do best - running and growing your business. Contact us today to learn more about our Excise Tax Reporting services and how we can help you stay compliant while minimizing your tax liability.

Documents:

7

This form is used for reporting excise tax in the state of New Jersey.

This document is a report used by direct shippers of table wine in Maine to report and pay excise taxes.

This form is used for brewers of malt liquor in Maine to report their excise tax. It allows brewers to provide the necessary information and calculate the amount of tax owed on their malt liquor production.

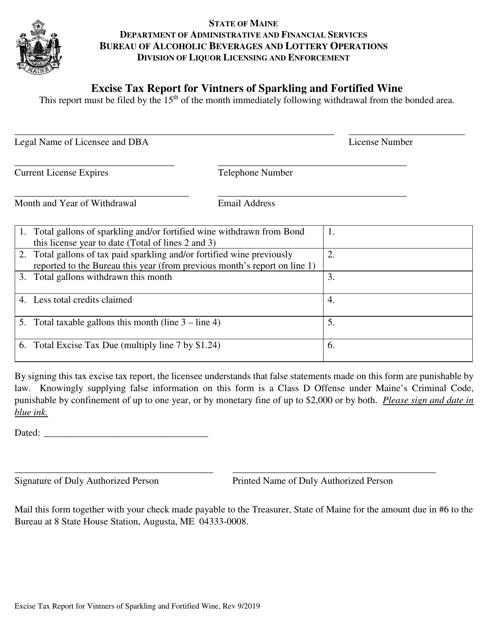

This document is used for reporting excise taxes for vintners in Maine who produce sparkling and fortified wine.

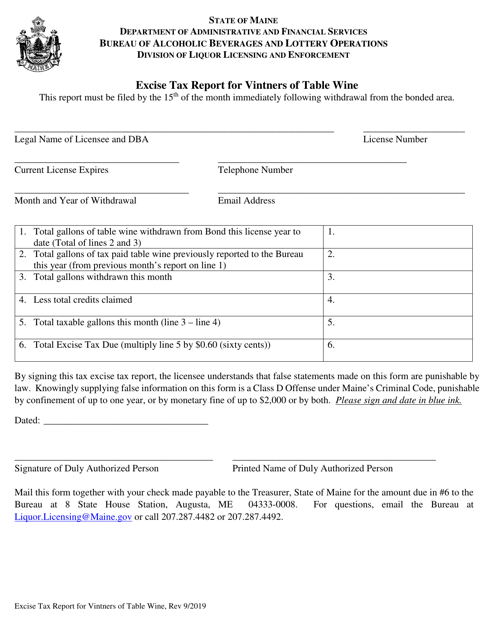

This type of document is used by vintners of table wine in Maine to report excise taxes.

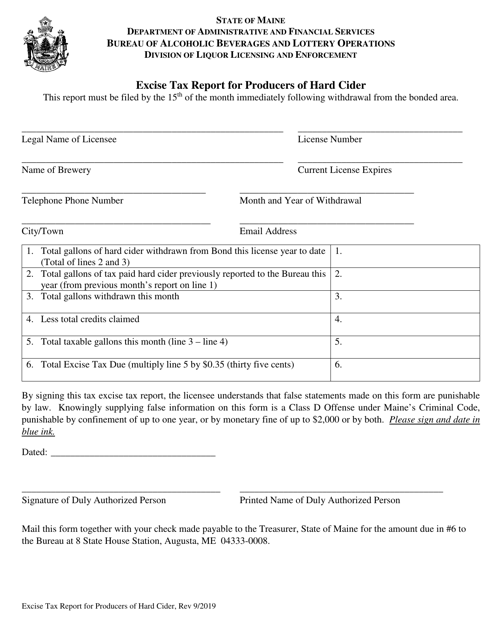

This form is used for reporting excise taxes by producers of hard cider in the state of Maine.

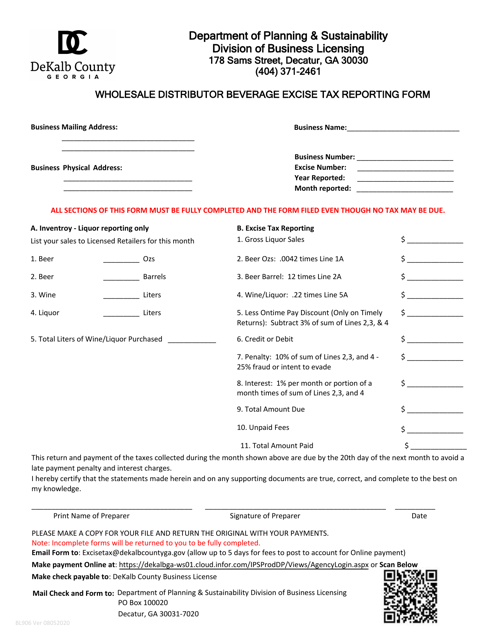

This form is used for reporting and paying wholesale distributor beverage excise taxes in DeKalb County, Georgia.