This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CG-114

for the current year.

Instructions for Form CG-114 Claim for Redemption / Refund of Cigarette Tax Stamps and Prepaid Sales Tax - New York

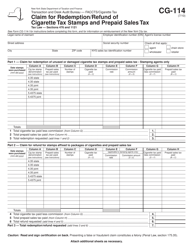

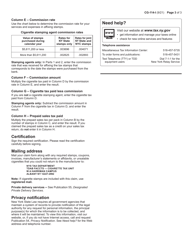

This document contains official instructions for Form CG-114 , Claim for Redemption/Refund of Cigarette Tax Stamps and Prepaid Sales Tax - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CG-114 is available for download through this link.

FAQ

Q: What is Form CG-114?

A: Form CG-114 is a document used to claim redemption or refund of cigarette tax stamps and prepaid sales tax in New York.

Q: Who can use Form CG-114?

A: Individuals or businesses that have overpaid cigarette tax or prepaid sales tax can use Form CG-114 to claim a redemption or refund.

Q: What is the purpose of Form CG-114?

A: The purpose of Form CG-114 is to request a redemption or refund of cigarette tax stamps and prepaid sales tax that have been overpaid.

Q: What information do I need to complete Form CG-114?

A: You will need to provide your name, address, social security number or federal employer identification number, and information about the overpayment.

Q: Is there a deadline for filing Form CG-114?

A: Yes, you must file Form CG-114 within three years from the date of overpayment in order to be eligible for a redemption or refund.

Q: How long does it take to process Form CG-114?

A: The processing time for Form CG-114 varies, but it typically takes several weeks to receive a redemption or refund.

Q: What supporting documents do I need to include with Form CG-114?

A: You may need to include copies of cigarette tax stamp invoices, prepaid sales tax receipts, or other relevant documentation to support your claim.

Q: Can I appeal if my claim on Form CG-114 is denied?

A: Yes, if your claim is denied, you have the right to appeal the decision by following the instructions provided by the New York Department of Taxation and Finance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.