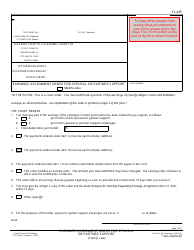

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form FL-195

for the current year.

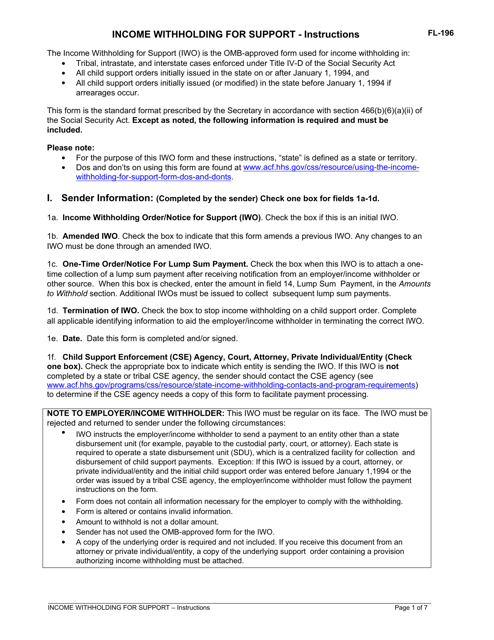

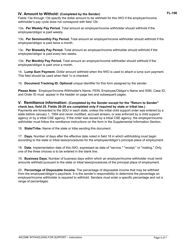

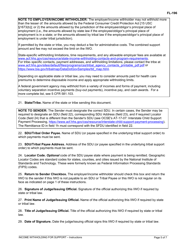

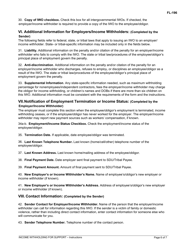

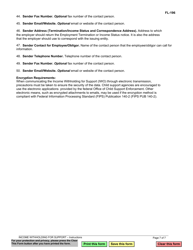

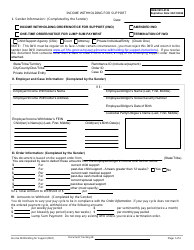

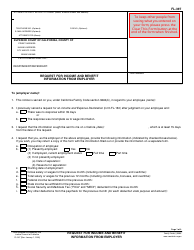

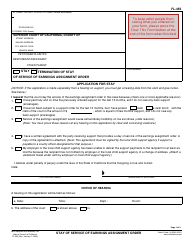

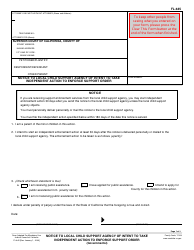

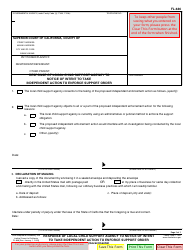

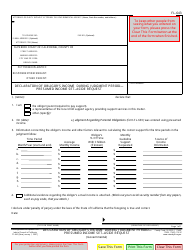

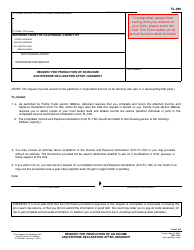

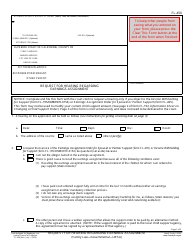

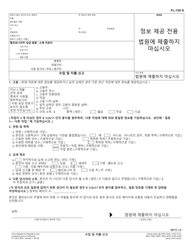

Instructions for Form FL-195 Income Withholding for Support - California

This document contains official instructions for Form FL-195 , Income Withholding for Support - a form released and collected by the California Judicial Branch. An up-to-date fillable Form FL-195 is available for download through this link.

FAQ

Q: What is Form FL-195?

A: Form FL-195 is the Income Withholding for Support form in California.

Q: What is the purpose of Form FL-195?

A: The purpose of Form FL-195 is to establish income withholding for support payments in a California divorce or paternity case.

Q: Who needs to use Form FL-195?

A: Form FL-195 is used by parents or legal guardians who want to request income withholding for support payments in California.

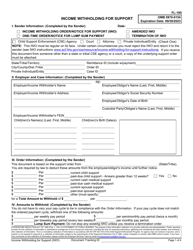

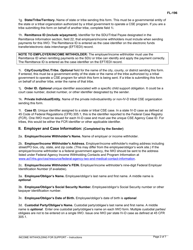

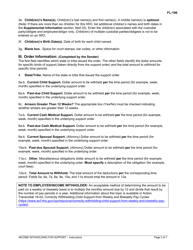

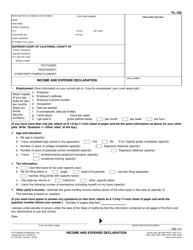

Q: What information is required on Form FL-195?

A: Form FL-195 requires the contact information of both parents, details of the support order, and information about the employer, among other details.

Q: How do I fill out Form FL-195?

A: You need to provide all the required information on the form, including your contact details, details of the support order, and employer information.

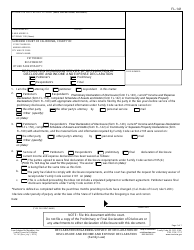

Q: What should I do with the completed Form FL-195?

A: You should file the completed Form FL-195 with the court and serve a copy on the employer of the parent who will be making the support payments.

Q: What happens after I file Form FL-195?

A: Once Form FL-195 is filed and served, the employer will be required to withhold income from the paying parent's paycheck and send it to the appropriate agency for distribution.

Q: Is there a fee to file Form FL-195?

A: There may be a filing fee associated with Form FL-195. Contact the local court for information on the fee amount.

Q: Can I modify or cancel income withholding established through Form FL-195?

A: Yes, you can request a modification or cancellation of income withholding by filing a new form with the court and serving a copy on the employer.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Judicial Branch.