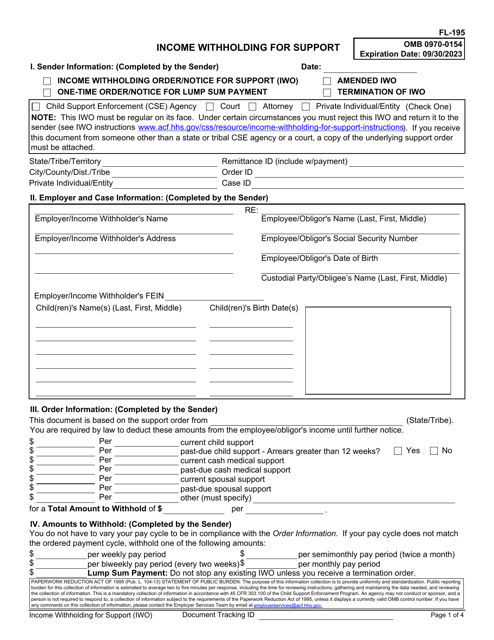

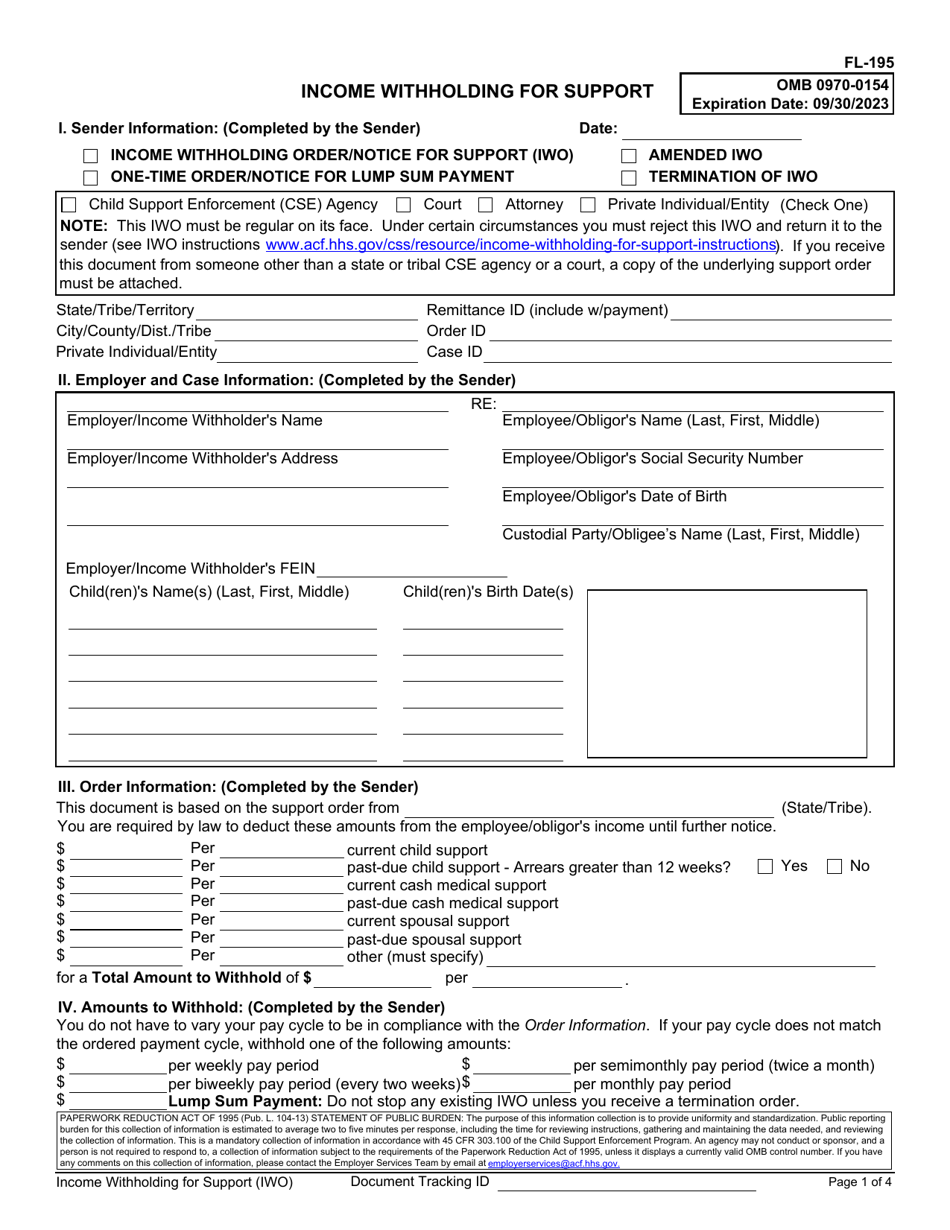

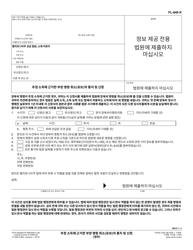

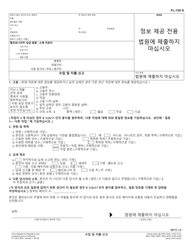

Form FL-195 Income Withholding for Support - California

What Is Form FL-195?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FL-195?

A: Form FL-195 is the Income Withholding for Support form used in California.

Q: What is the purpose of Form FL-195?

A: The purpose of Form FL-195 is to request income withholding for support, also known as wage garnishment, in California.

Q: Who should use Form FL-195?

A: Form FL-195 should be used by individuals seeking to initiate income withholding for support in California.

Q: What information is required on Form FL-195?

A: Form FL-195 requires basic information about the parties involved, such as names, addresses, and social security numbers, as well as details about the child support order.

Q: Is it mandatory to use Form FL-195 for income withholding in California?

A: Yes, using Form FL-195 is mandatory to initiate income withholding for support in California.

Q: What should I do after completing Form FL-195?

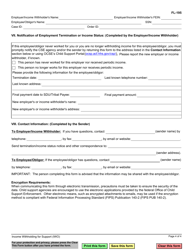

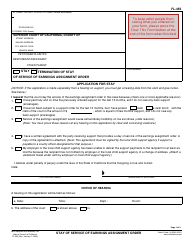

A: After completing Form FL-195, you should make copies of the form, file the original with the court, and serve a copy to the other party.

Q: Are there any fees associated with filing Form FL-195?

A: There may be filing fees associated with filing Form FL-195. The amount varies by county.

Q: What happens after Form FL-195 is filed?

A: After Form FL-195 is filed, the court will review the form and, if approved, send it to the employer for income withholding.

Form Details:

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FL-195 by clicking the link below or browse more documents and templates provided by the California Judicial Branch.

How to Fill Out Form FL-195?

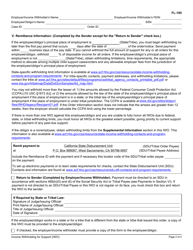

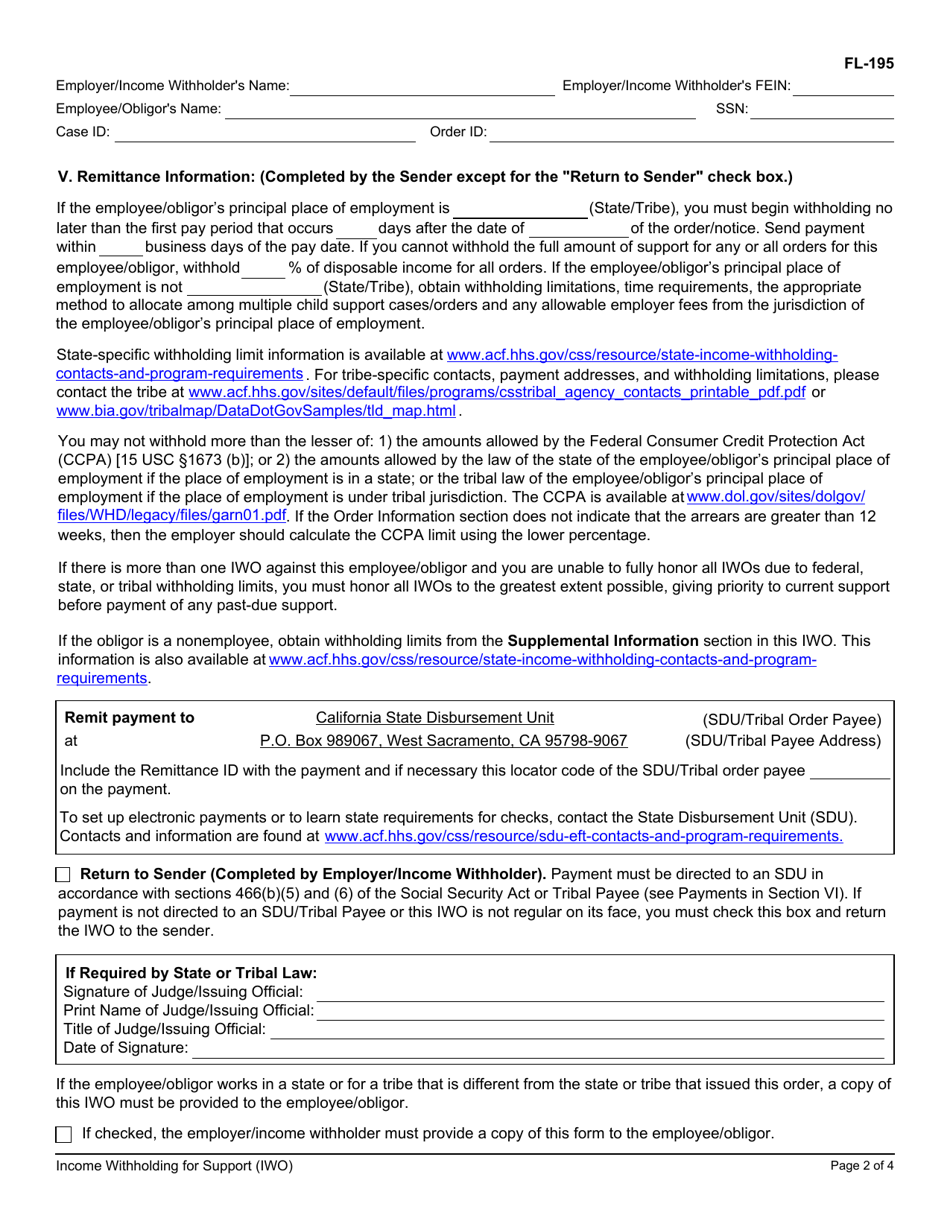

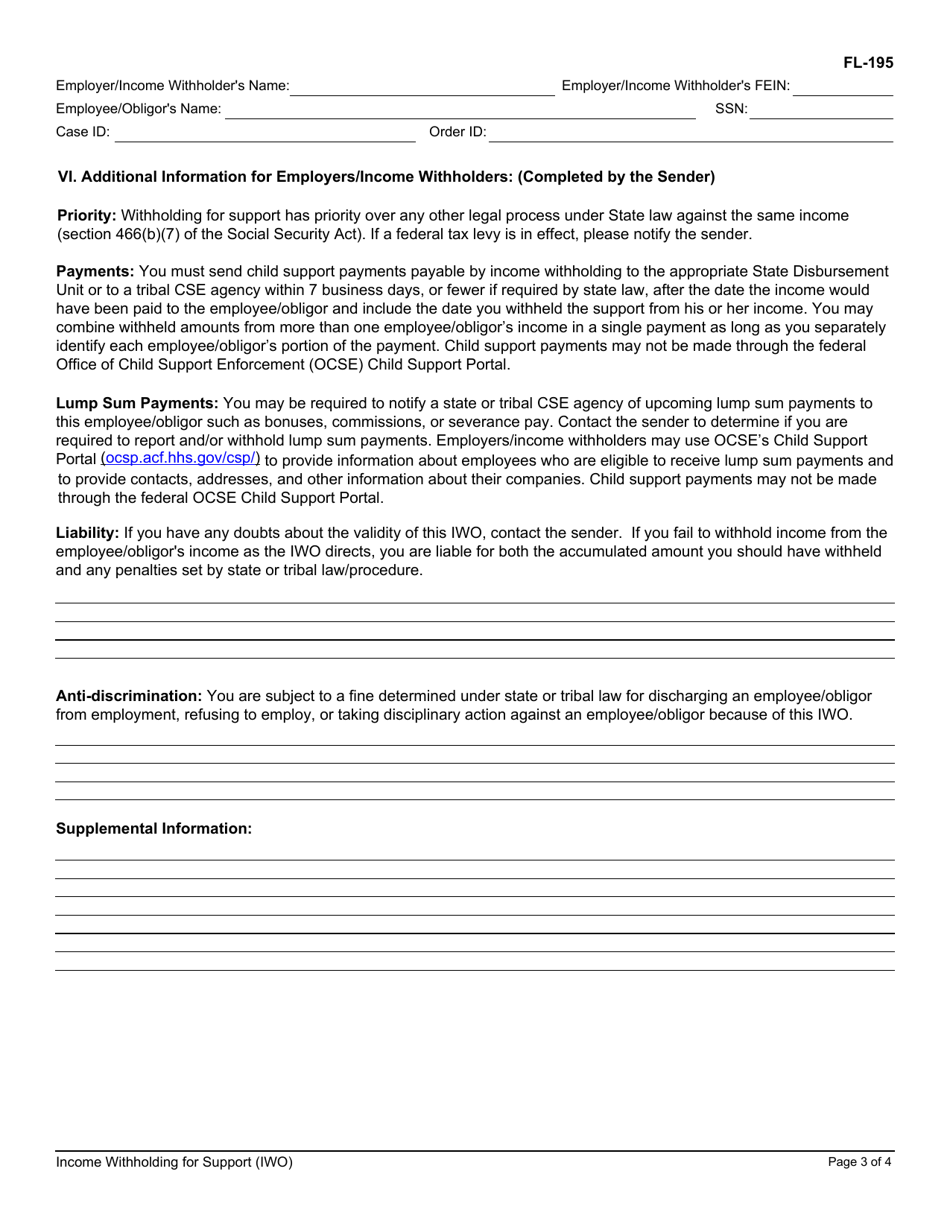

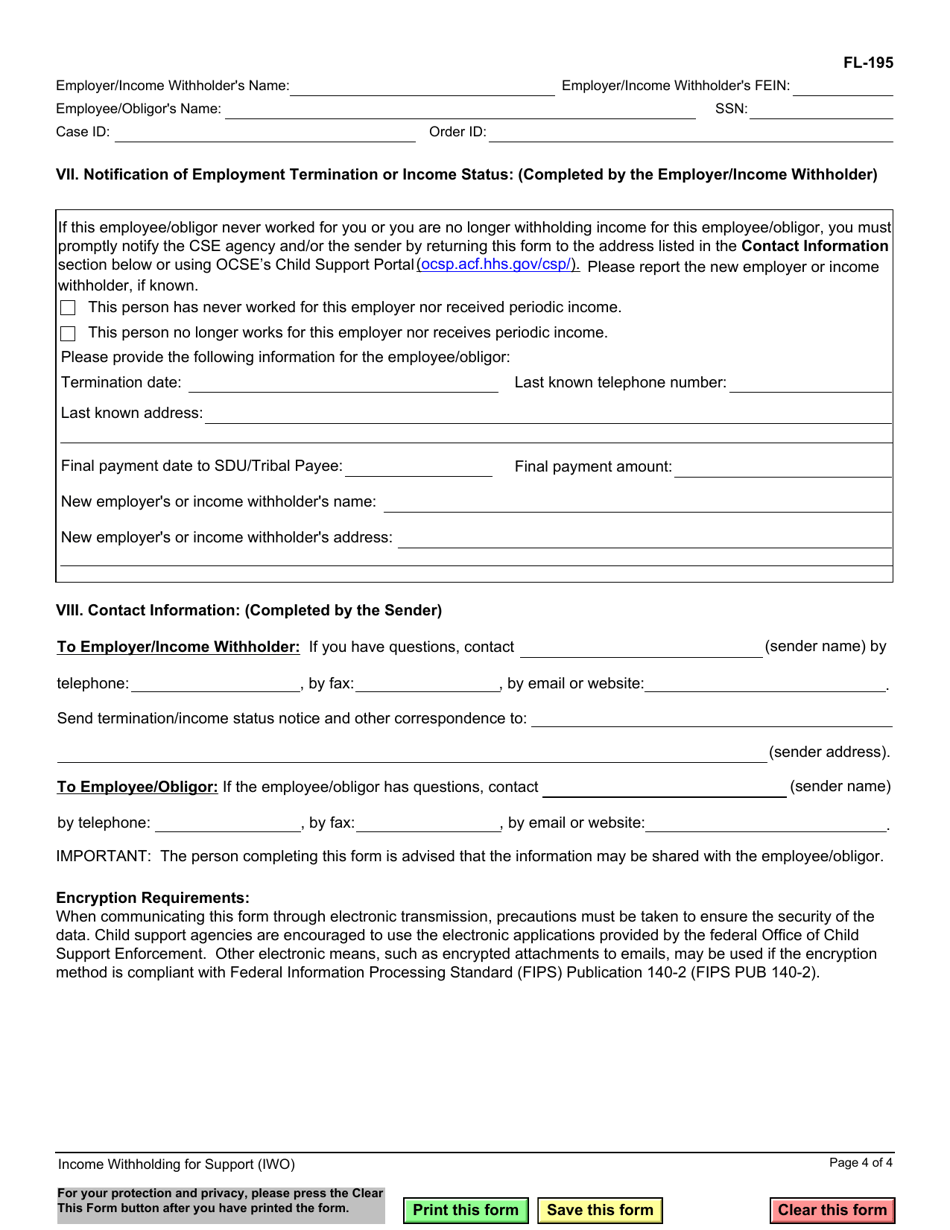

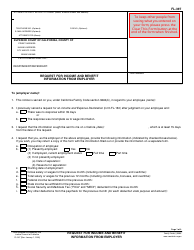

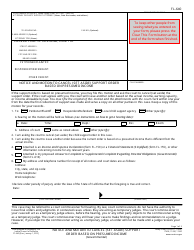

Gather and prepare to write down all the information that will be needed such as your and employee/obligor's personal information including full names, physical addresses, Social Security Numbers, dates of birth, telephone and fax numbers; Also provide detailed employer information, the organization to whom the IWO will be sent to.

Detailed step-by-step instructions on how tofill out Form FL-195 available for download through this link. Use black ink when filling out the form.

-

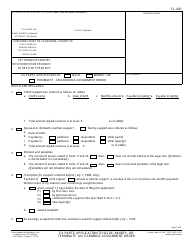

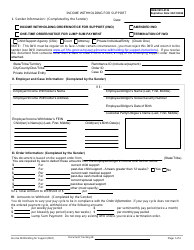

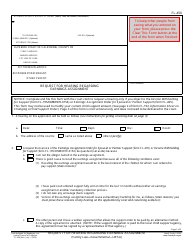

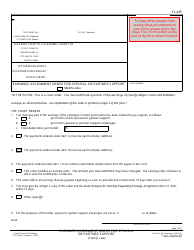

At the very top of the form select which type of IWO you are filing- an initial IWO, an amended IWO (if this form amends a previous IWO), One-Time Order for Lump Sum Payment, or the Termination of IWO (Check this box to stop income withholding on a child support order).

-

Check the appropriate box to indicate who is sending the IWO: Child Support Enforcement (CSE) Agency, court, attorney, a private individual.

-

Select your state and city, provide order ID (a unique identifier, usually it is a court case number), name the private individual/entity, or CSE organization sending this form.

-

Enter the following information as requested:

- Employer's name and mailing address, including street/PO box, city, state, and ZIP code;

- Employer FEIN (a nine-digit Federal Employer Identification Number, if available);

- Employee name and Social Security Number, date of birth;

- Custodial Party Name (this is your name, the person who's filling out the form);

- Child/children's name(s) and birthdate(s). Only provide information for children related to this case.

-

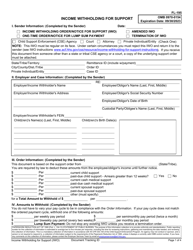

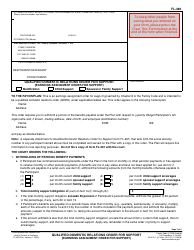

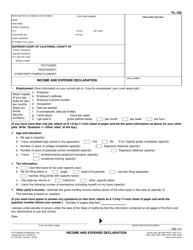

In the "Order Information Section," dollar amounts for specific types of support are listed.

-

"Amounts to Withhold and Per-Pay-Period" depends on the employee's payment schedule. The "Effective Date" of this IWO must be specified.

-

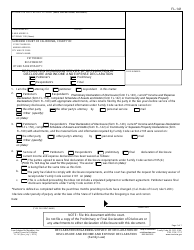

Please check and specify any additional requirements in your state or territory to properly complete this form and provide additional contact information for inquiries. Make sure to fill out all the information required to avoid delays.

-

To save time, money, and resources, an official electronic form can be used (e-IWO).