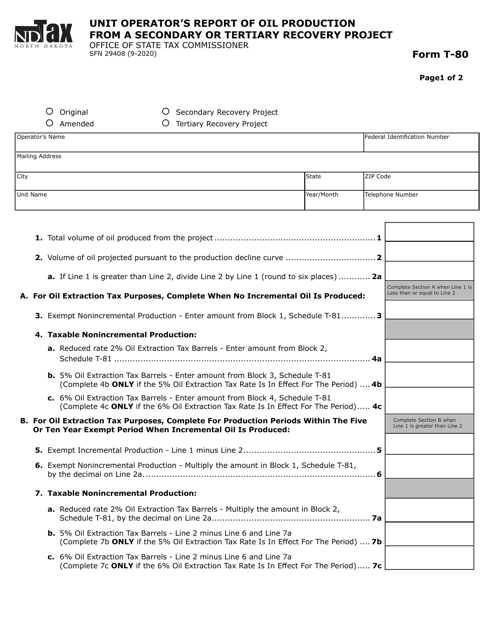

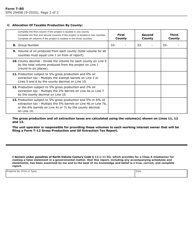

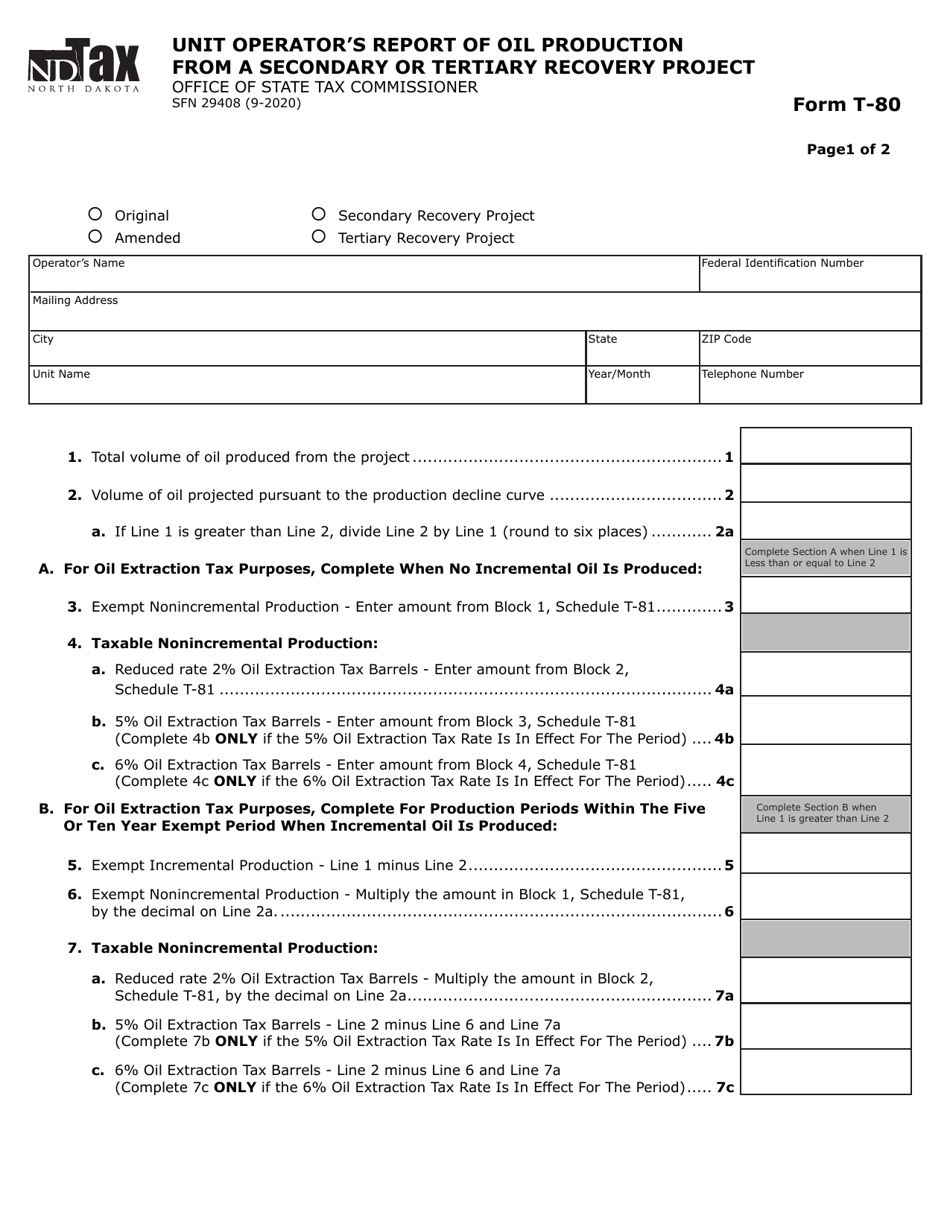

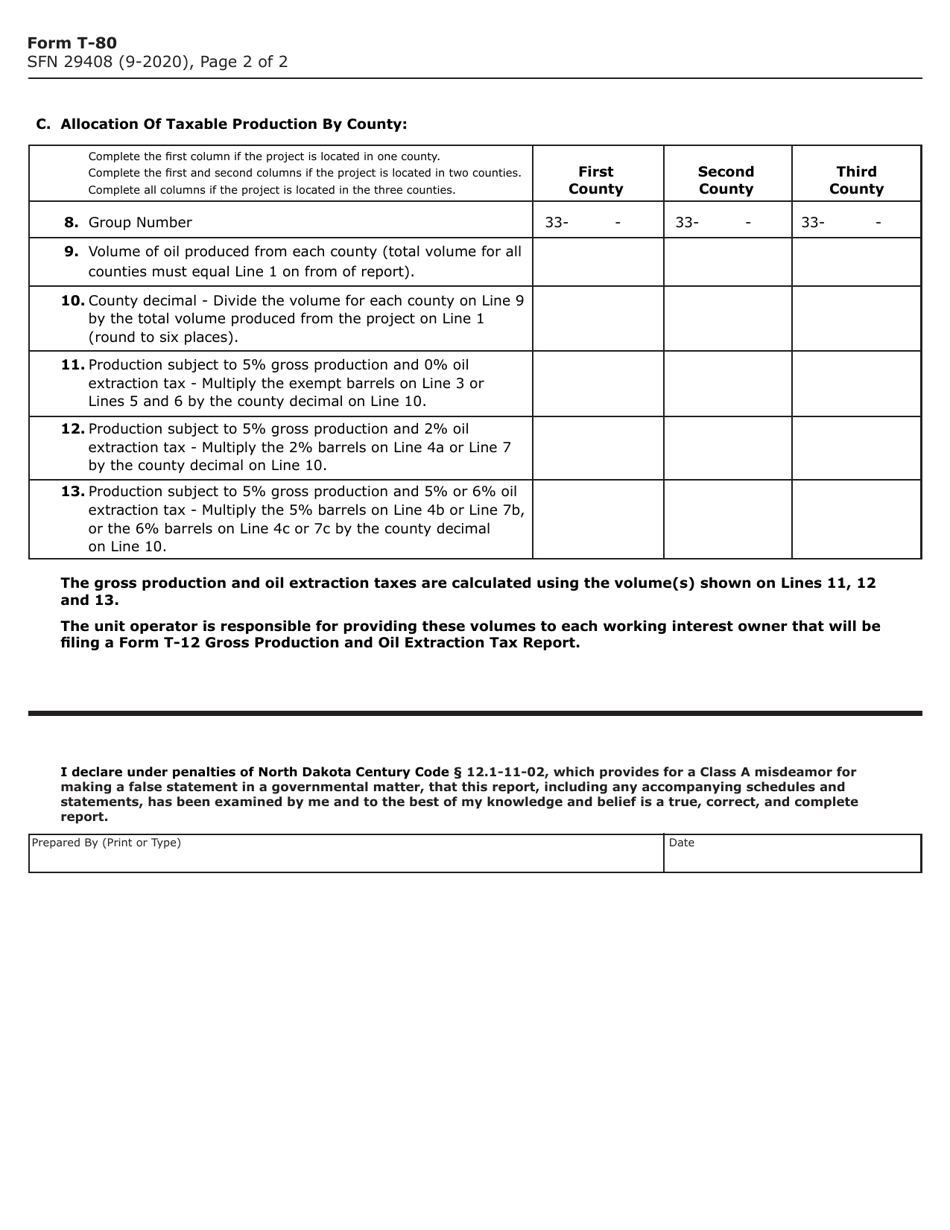

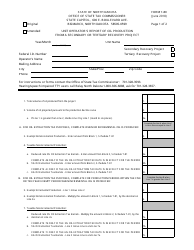

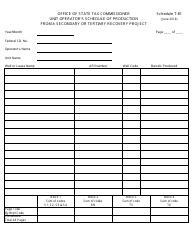

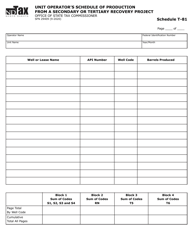

Form T-80 (SFN29408) Unit Operator's Report of Oil Production From a Secondary or Tertiary Recovery Project - North Dakota

What Is Form T-80 (SFN29408)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form T-80?

A: Form T-80 is a document used to report oil production from a secondary or tertiary recovery project in North Dakota.

Q: Who is required to fill out Form T-80?

A: The unit operator of the oil production project is responsible for filling out Form T-80.

Q: What is a secondary or tertiary recovery project?

A: A secondary or tertiary recovery project is a method used to extract oil from a reservoir after the primary extraction methods have been exhausted.

Q: What information is required on Form T-80?

A: Form T-80 requires information such as the well name, well number, production month, oil production volume, and method of recovery.

Q: When is Form T-80 due?

A: Form T-80 is typically due within 45 days after the end of the production month.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-80 (SFN29408) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.