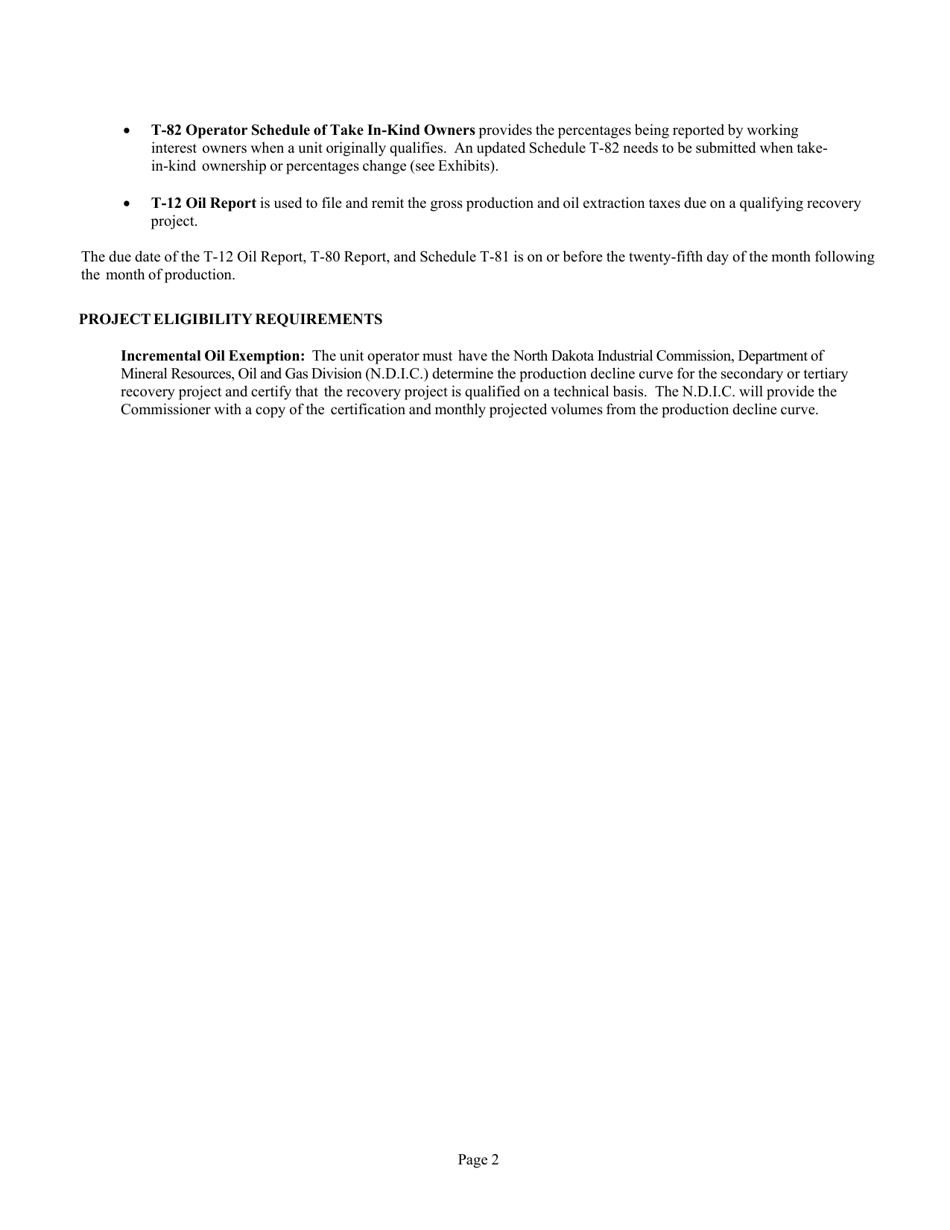

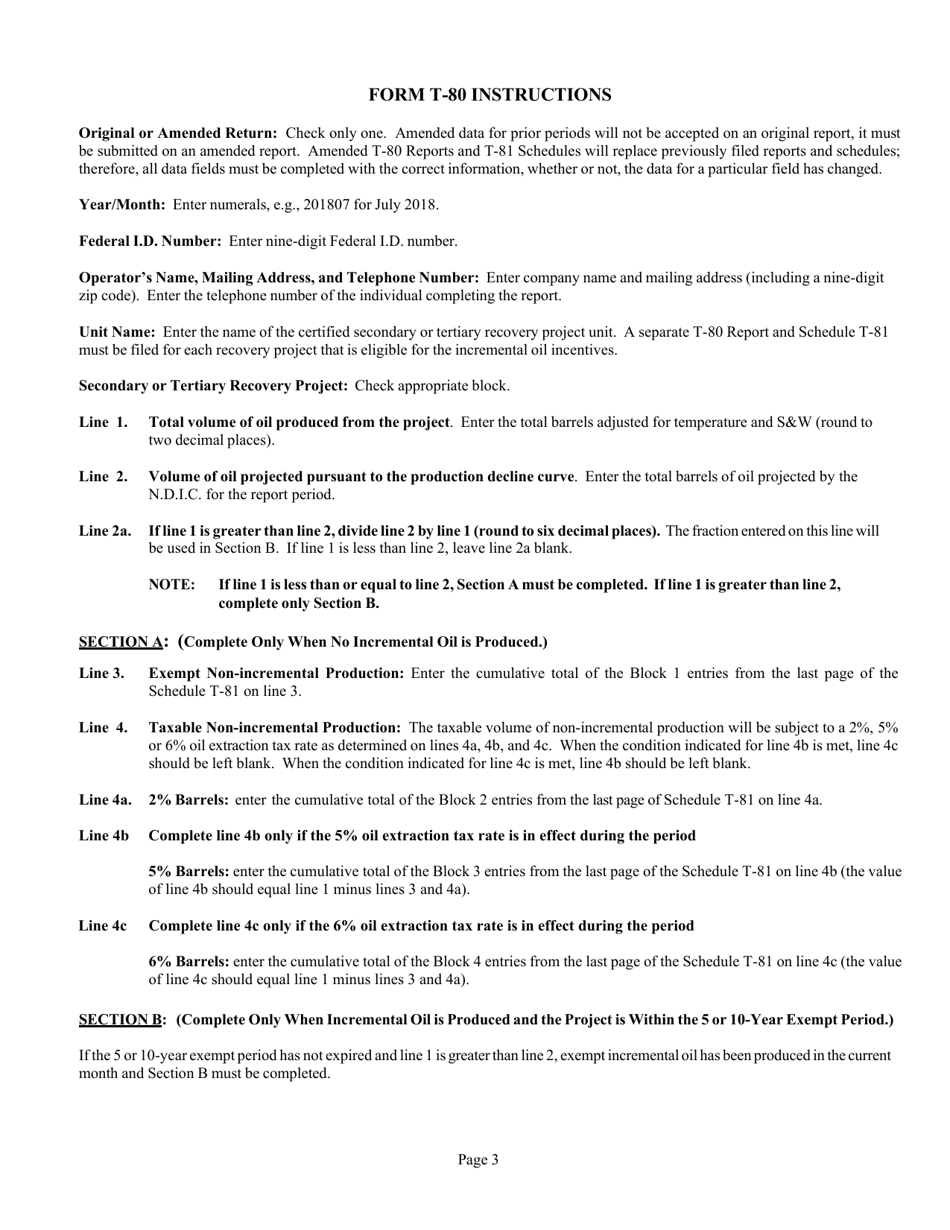

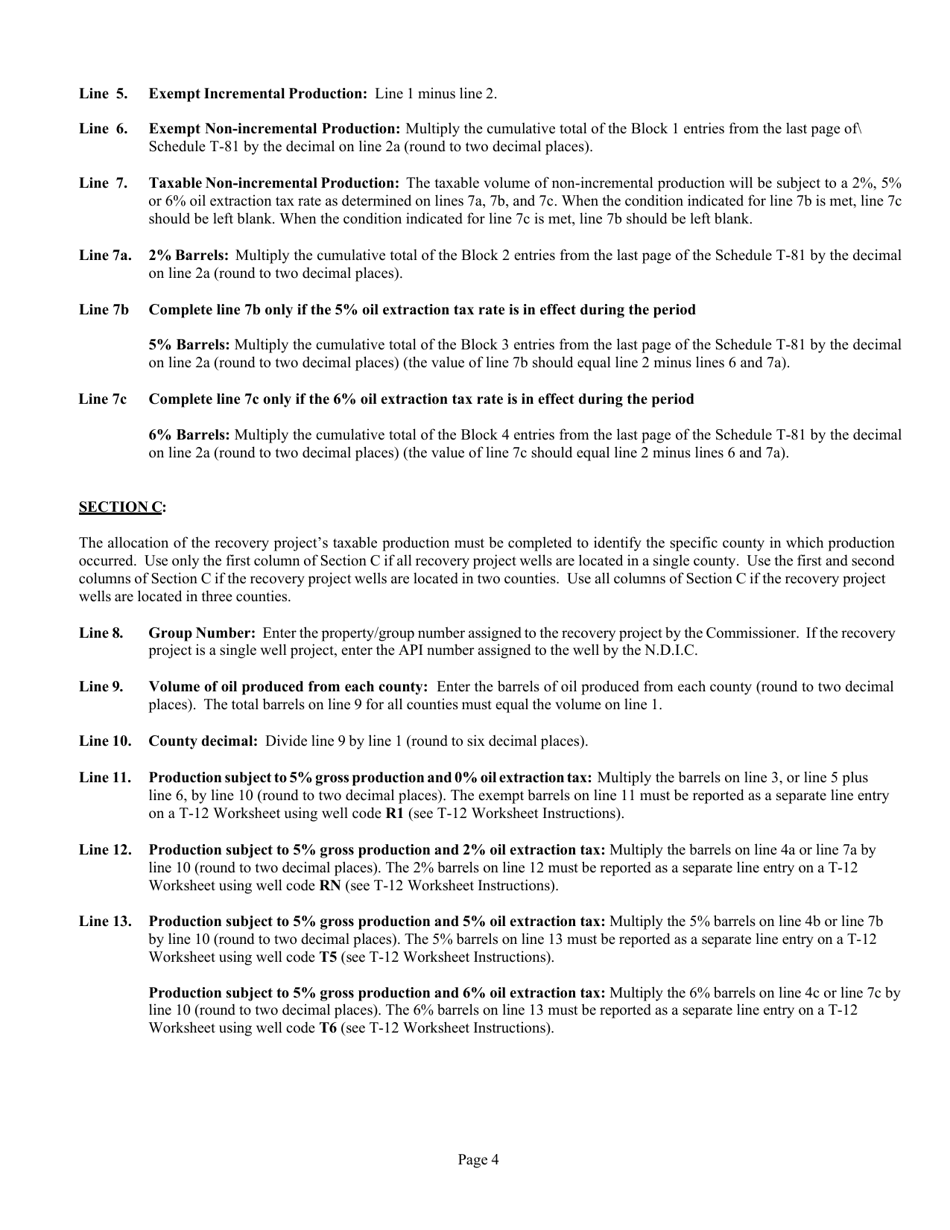

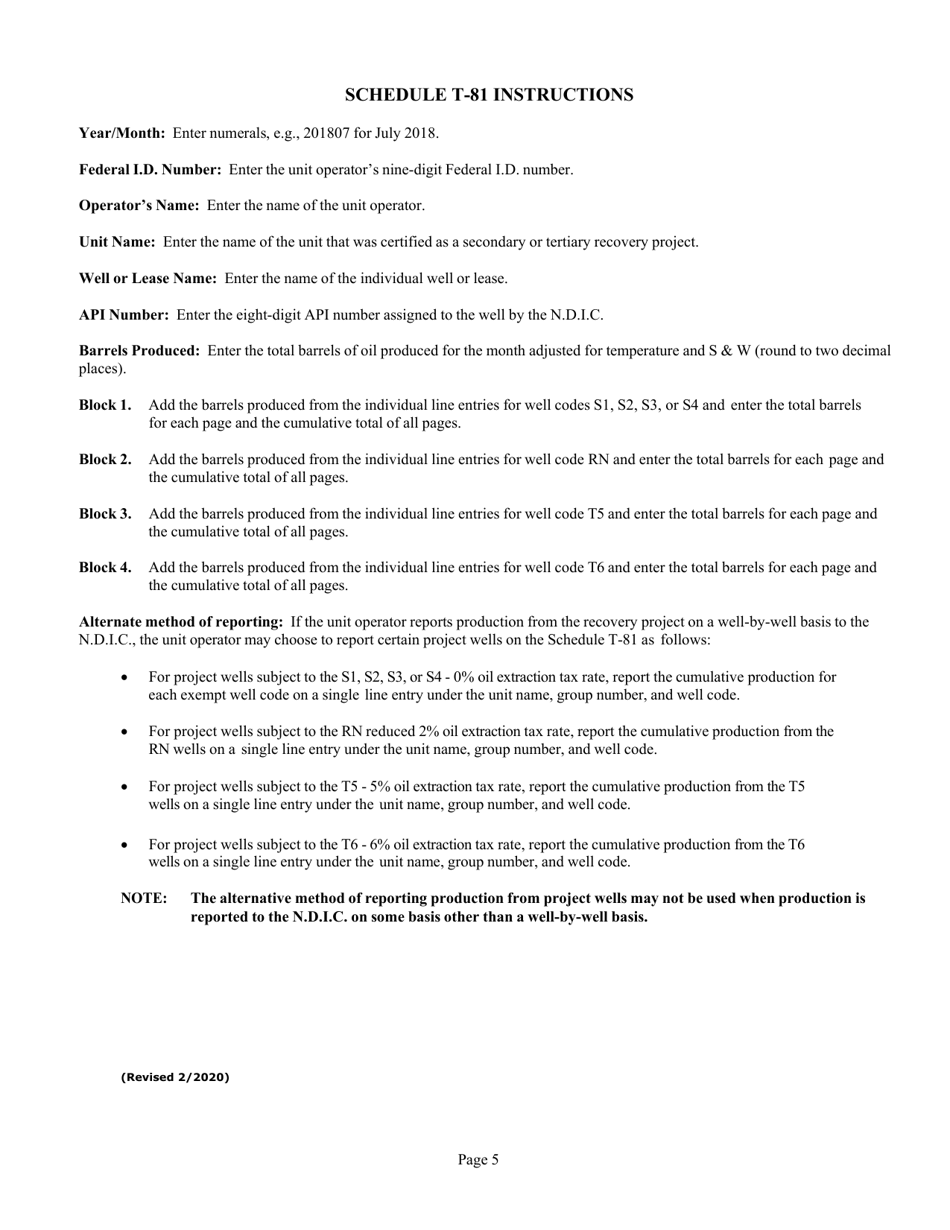

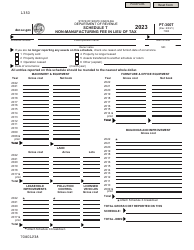

Instructions for Form T-80 Schedule T-81 - North Dakota

This document contains official instructions for Form T-80 Schedule T-81, - a form released and collected by the North Dakota Office of State Tax Commissioner.

FAQ

Q: What is Form T-80 Schedule T-81?

A: Form T-80 Schedule T-81 is a tax form used in North Dakota.

Q: What is the purpose of Form T-80 Schedule T-81?

A: The purpose of Form T-80 Schedule T-81 is to report your income and deductions for North Dakota state tax purposes.

Q: Who needs to file Form T-80 Schedule T-81?

A: Individuals who are residents of North Dakota and have income from sources within the state need to file Form T-80 Schedule T-81.

Q: When is the deadline to file Form T-80 Schedule T-81?

A: The deadline to file Form T-80 Schedule T-81 is the same as the deadline for your North Dakota state tax return, which is usually April 15th.

Q: Do I need to include any supporting documents with Form T-80 Schedule T-81?

A: You may need to include supporting documents such as W-2 forms, 1099 forms, and receipts for deductions with Form T-80 Schedule T-81.

Q: What happens if I don't file Form T-80 Schedule T-81?

A: If you are required to file Form T-80 Schedule T-81 and you fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Is Form T-80 Schedule T-81 only for state taxes?

A: Yes, Form T-80 Schedule T-81 is specifically for reporting income and deductions for North Dakota state tax purposes.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Dakota Office of State Tax Commissioner.