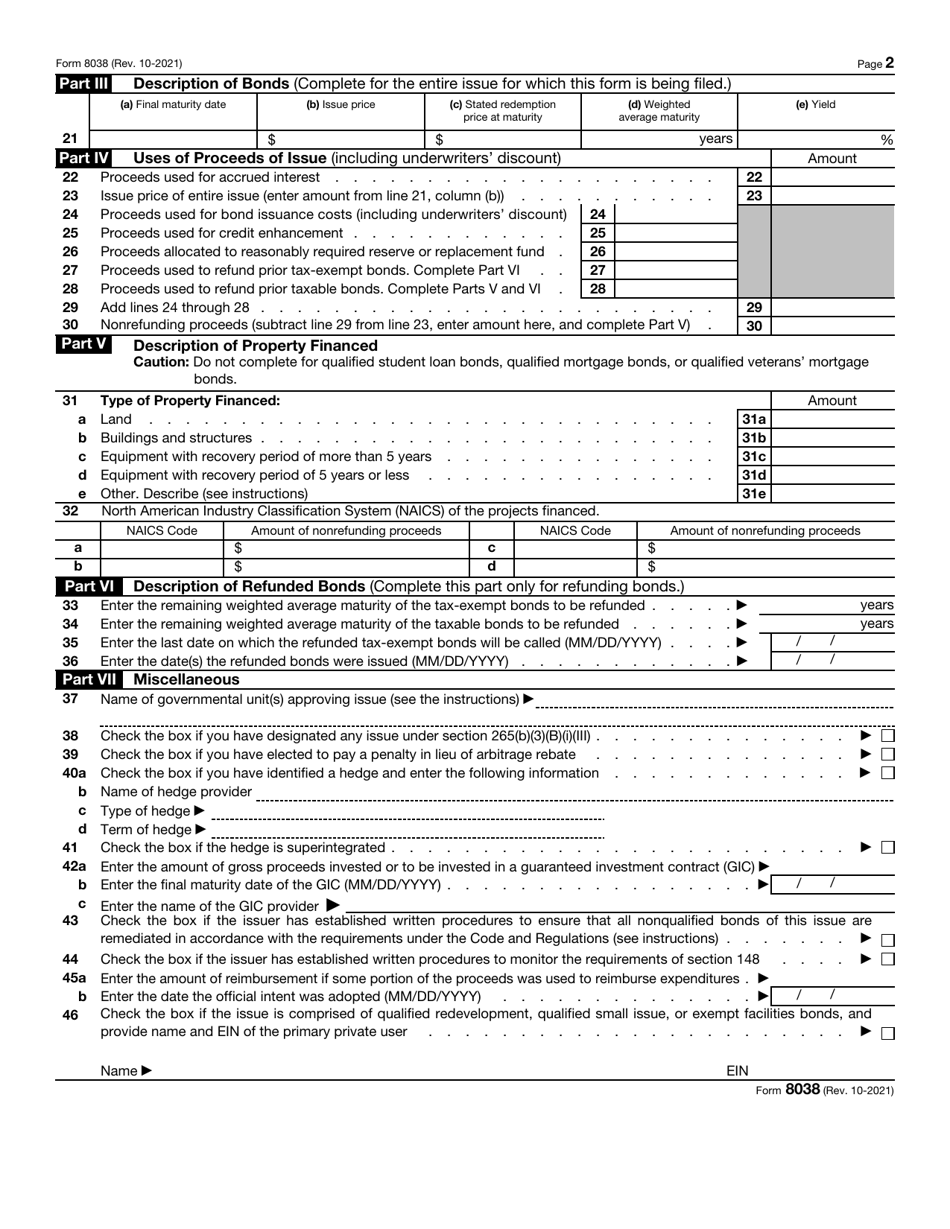

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8038

for the current year.

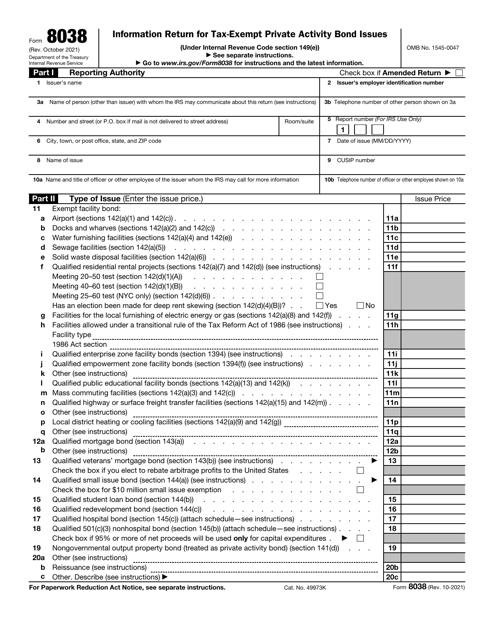

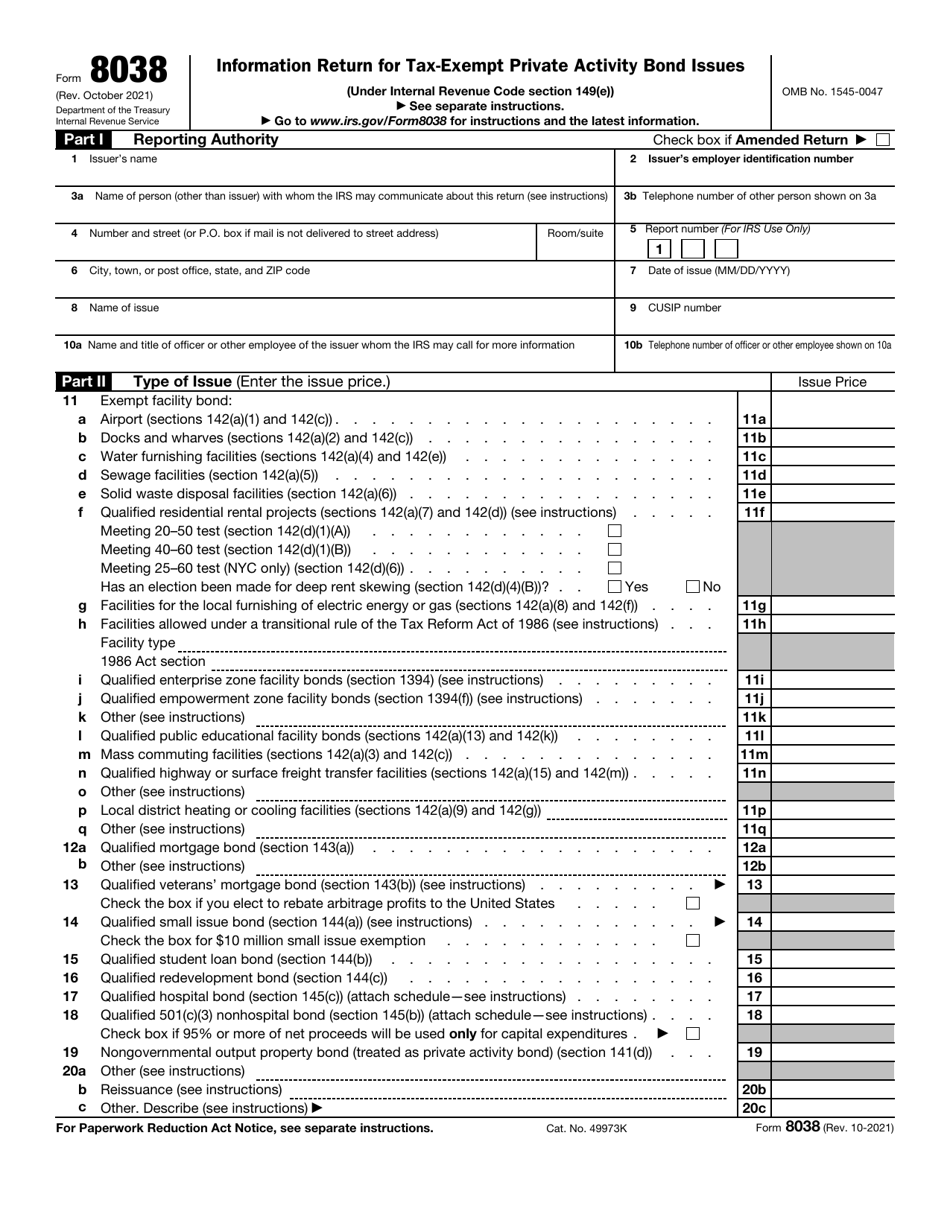

IRS Form 8038 Information Return for Tax-Exempt Private Activity Bond Issues

What Is IRS Form 8038?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038?

A: IRS Form 8038 is an information return for tax-exempt private activity bond issues.

Q: Who needs to file IRS Form 8038?

A: Issuers of tax-exempt private activity bonds need to file IRS Form 8038.

Q: What does the IRS Form 8038 provide information on?

A: IRS Form 8038 provides information on tax-exempt private activity bond issues.

Q: When is the deadline to file IRS Form 8038?

A: The deadline to file IRS Form 8038 varies depending on the type of bond issue.

Q: Is there a fee for filing IRS Form 8038?

A: Yes, there is a fee for filing IRS Form 8038.

Q: Can I file IRS Form 8038 electronically?

A: Yes, you can file IRS Form 8038 electronically.

Q: What happens if I don't file IRS Form 8038?

A: If you don't file IRS Form 8038, you may be subject to penalties and interest.

Q: Are there any exceptions to filing IRS Form 8038?

A: There may be exceptions to filing IRS Form 8038 for certain types of bond issues.

Q: Do I need to attach any supporting documents with IRS Form 8038?

A: Yes, you may need to attach supporting documents depending on the bond issue.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038 through the link below or browse more documents in our library of IRS Forms.