This version of the form is not currently in use and is provided for reference only. Download this version of

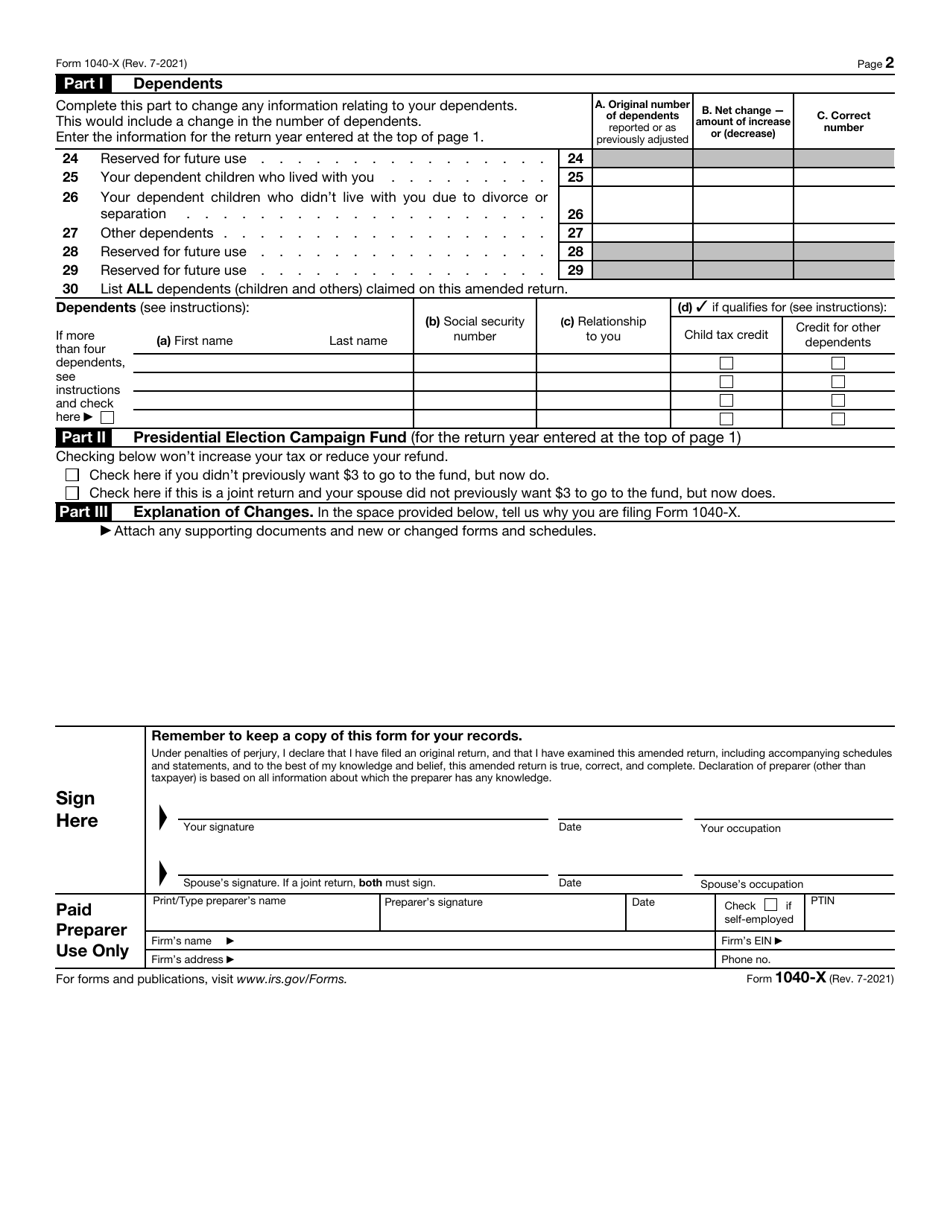

IRS Form 1040-X

for the current year.

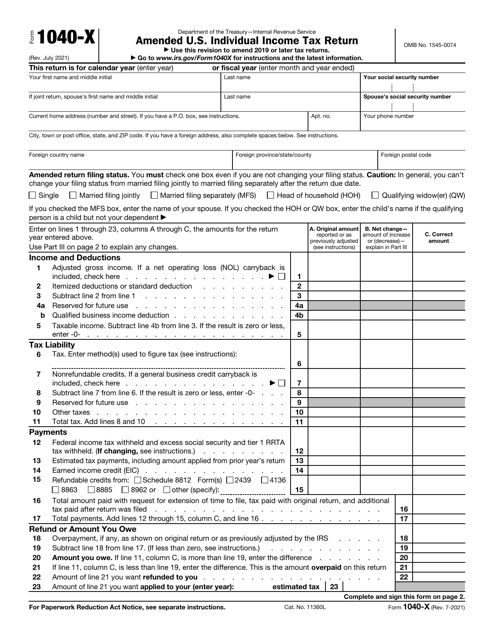

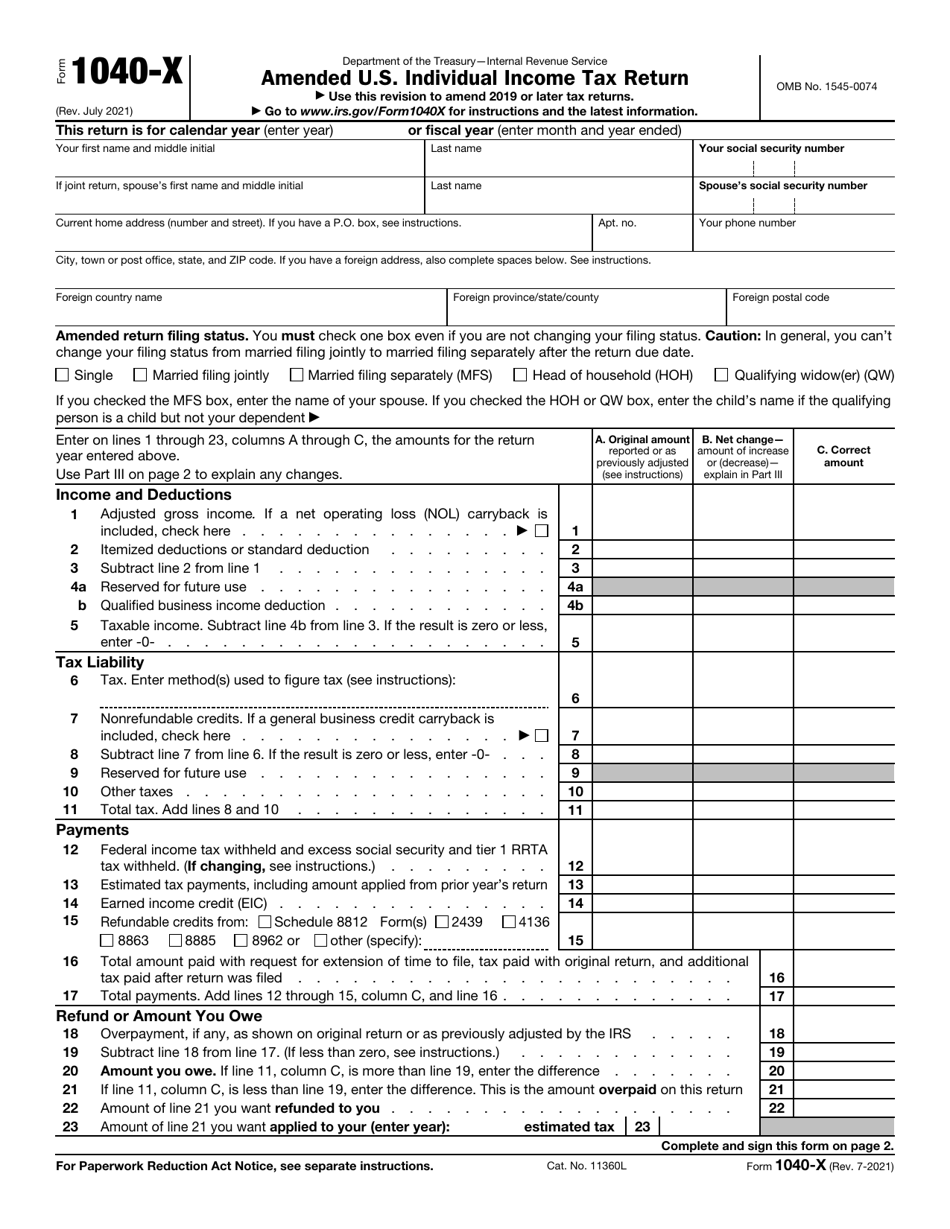

IRS Form 1040-X Amended U.S. Individual Income Tax Return

What Is IRS Form 1040-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1040-X?

A: Form 1040-X is the form used to amend your U.S. Individual Income Tax Return.

Q: When should I use Form 1040-X?

A: You should use Form 1040-X if you need to correct errors or make changes to your original tax return.

Q: What information should I provide on Form 1040-X?

A: On Form 1040-X, you should provide the corrected or additional information that needs to be changed on your original tax return.

Q: How do I file Form 1040-X?

A: You can file Form 1040-X by mail. Make sure to include any supporting documentation.

Q: Is there a deadline for filing Form 1040-X?

A: Yes, there is a deadline for filing Form 1040-X. Generally, you have up to three years from the date you filed your original tax return or within two years from the date you paid the tax, whichever is later.

Q: What happens after I file Form 1040-X?

A: After you file Form 1040-X, the IRS will review your amended return and notify you of any changes or adjustments made.

Q: Can I e-file Form 1040-X?

A: No, you cannot e-file Form 1040-X. It must be filed by mail.

Form Details:

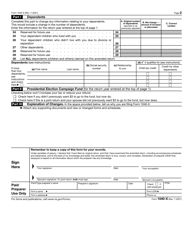

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-X through the link below or browse more documents in our library of IRS Forms.