This version of the form is not currently in use and is provided for reference only. Download this version of

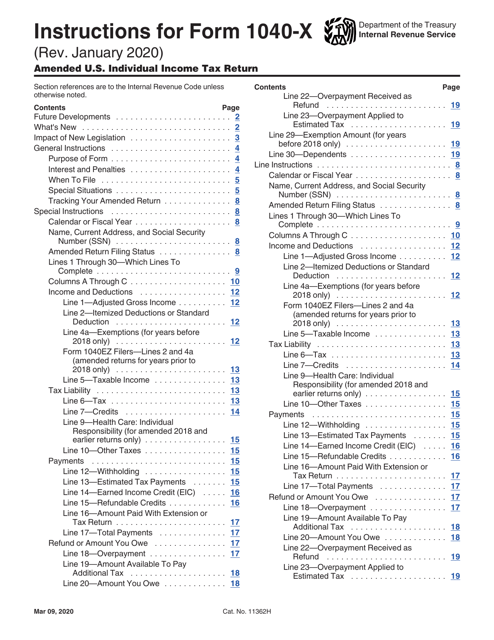

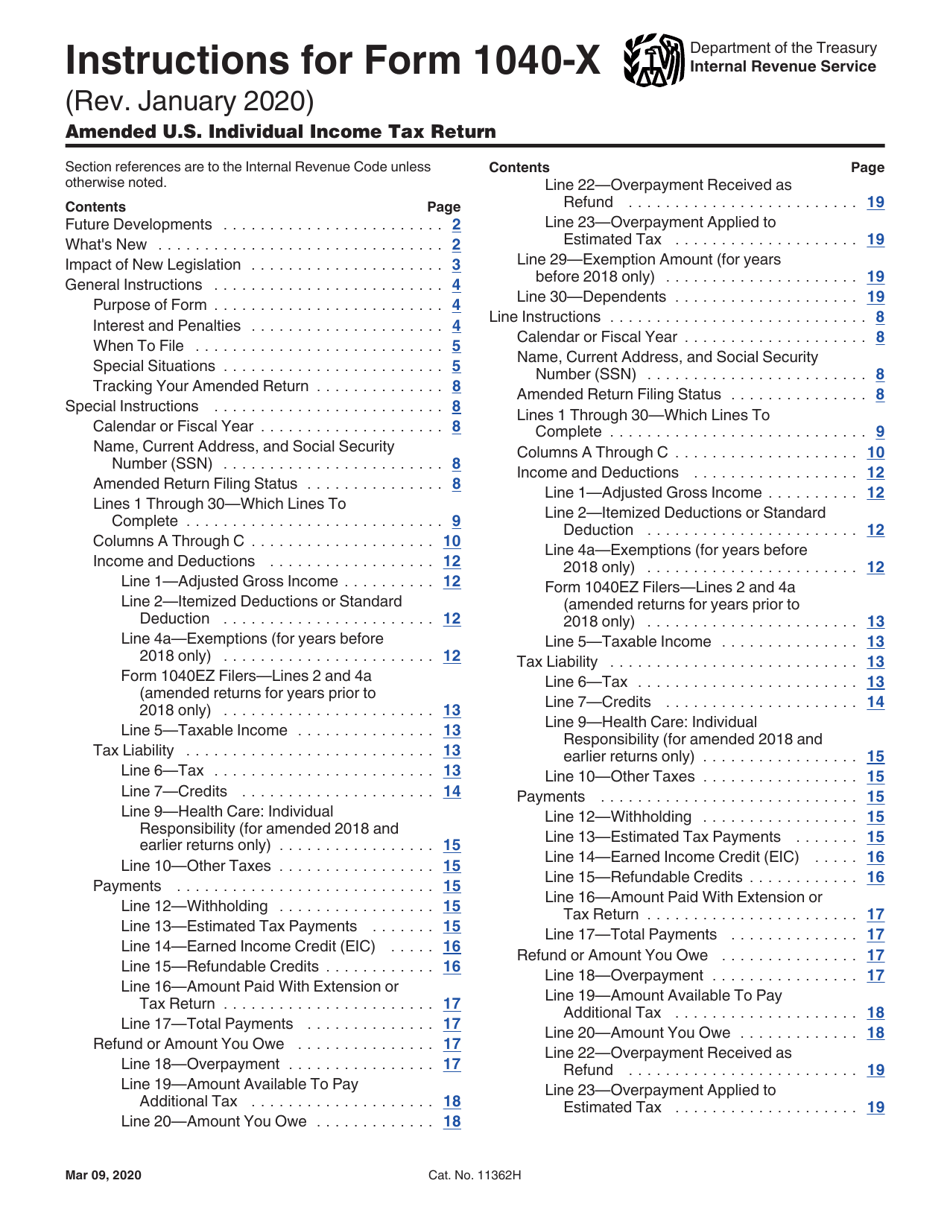

Instructions for IRS Form 1040-X

for the current year.

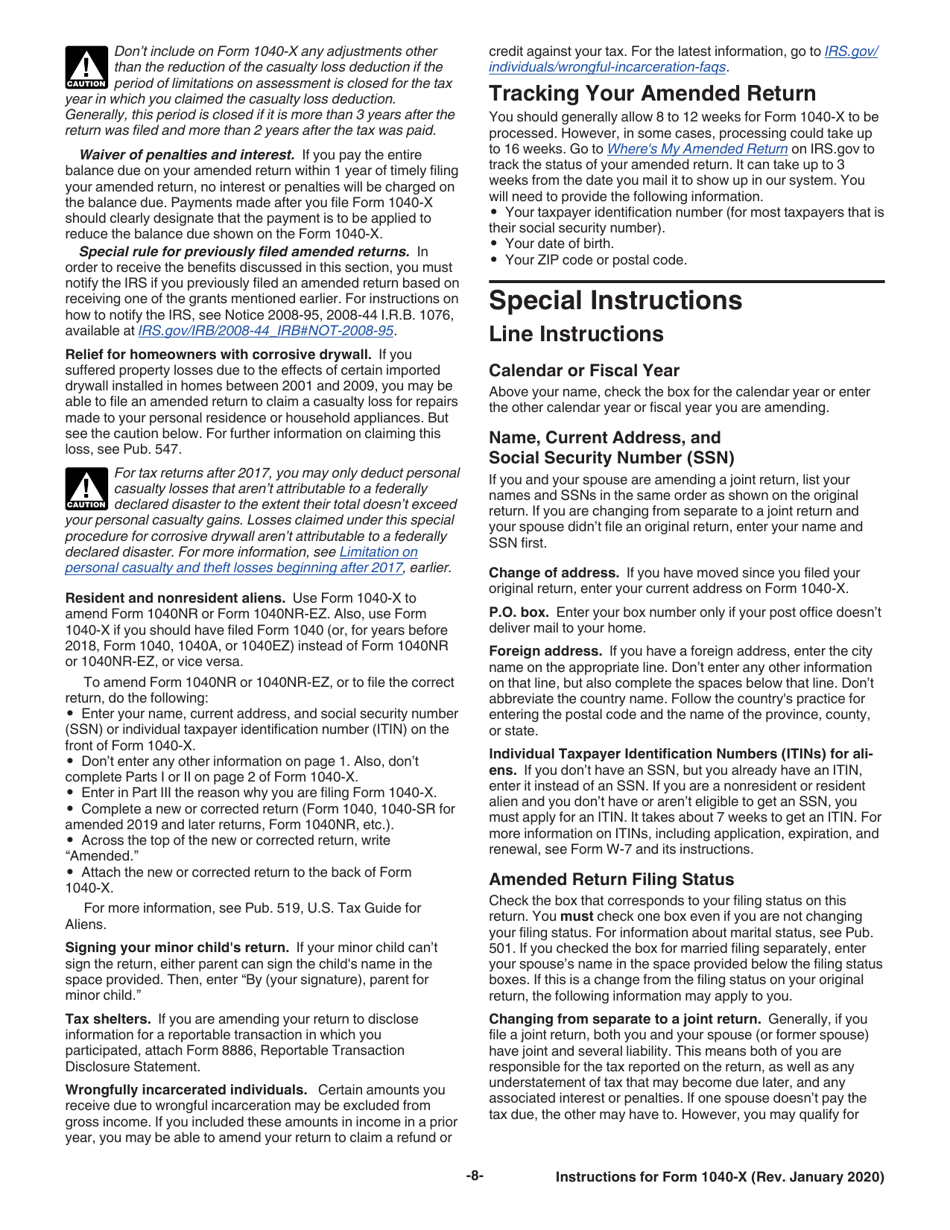

Instructions for IRS Form 1040-X Amended U.S. Individual Income Tax Return

This document contains official instructions for IRS Form 1040-X , Amended U.S. Individual Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-X is available for download through this link.

FAQ

Q: What is IRS Form 1040-X?

A: IRS Form 1040-X is the form used to amend a previously filed U.S. Individual Income Tax Return.

Q: Why would I need to file Form 1040-X?

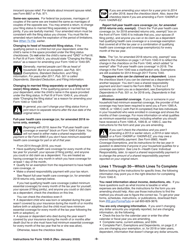

A: You would need to file Form 1040-X if you need to make changes or corrections to your previously filed tax return.

Q: When should I file Form 1040-X?

A: You should file Form 1040-X as soon as you discover an error or omission on your original tax return.

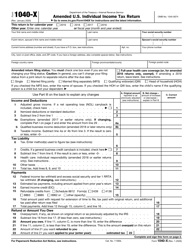

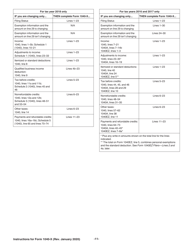

Q: How do I fill out Form 1040-X?

A: You will need to provide your name, social security number, original tax return information, the changes you are making, and the reason for the changes.

Q: How long does it take to process Form 1040-X?

A: It can take several weeks or months to process Form 1040-X, depending on the complexity of your changes and the IRS workload.

Q: Can I e-file Form 1040-X?

A: No, you cannot currently e-file Form 1040-X. It must be mailed to the IRS.

Instruction Details:

- This 21-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.