This version of the form is not currently in use and is provided for reference only. Download this version of

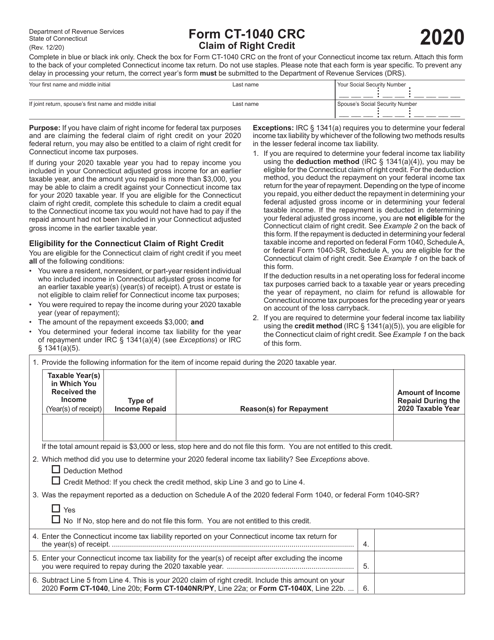

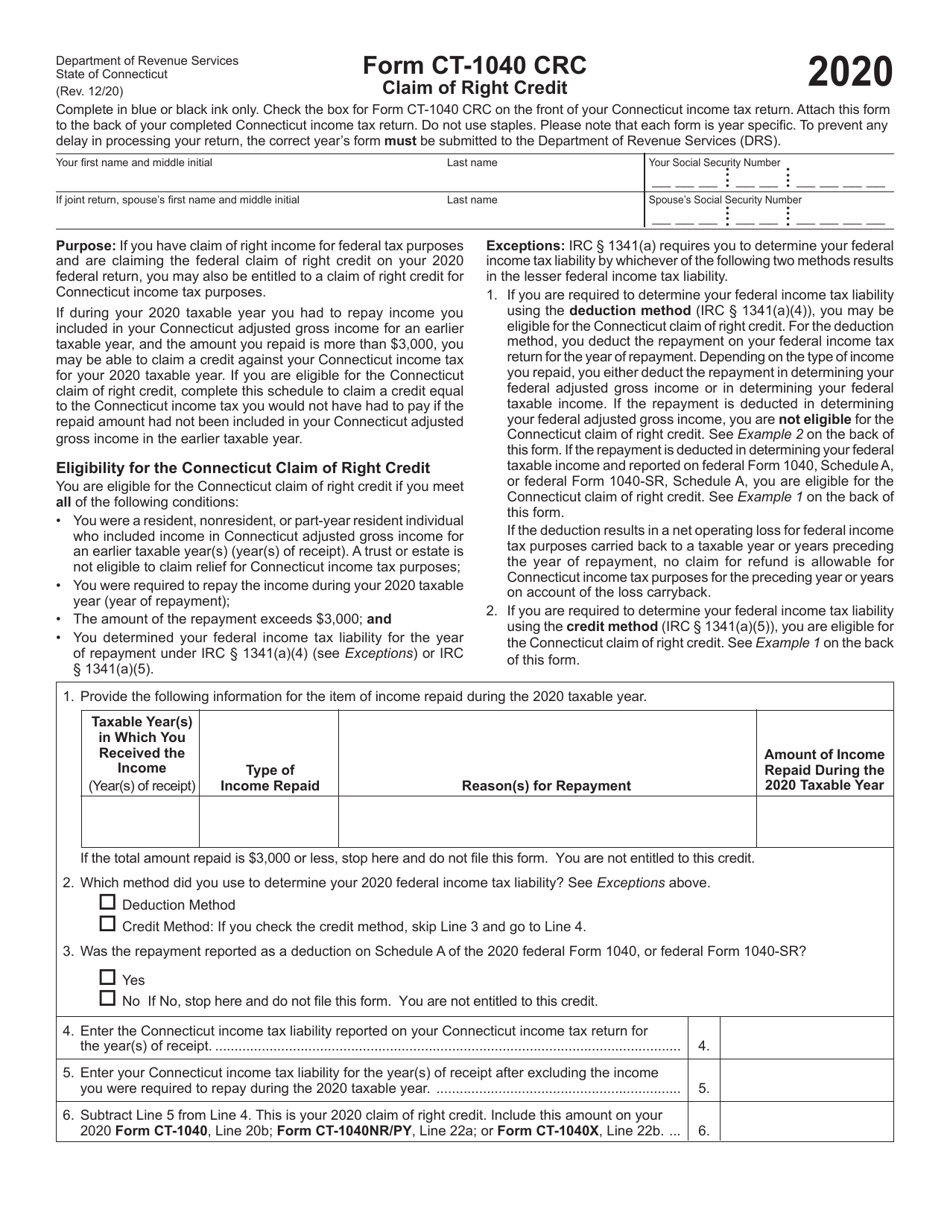

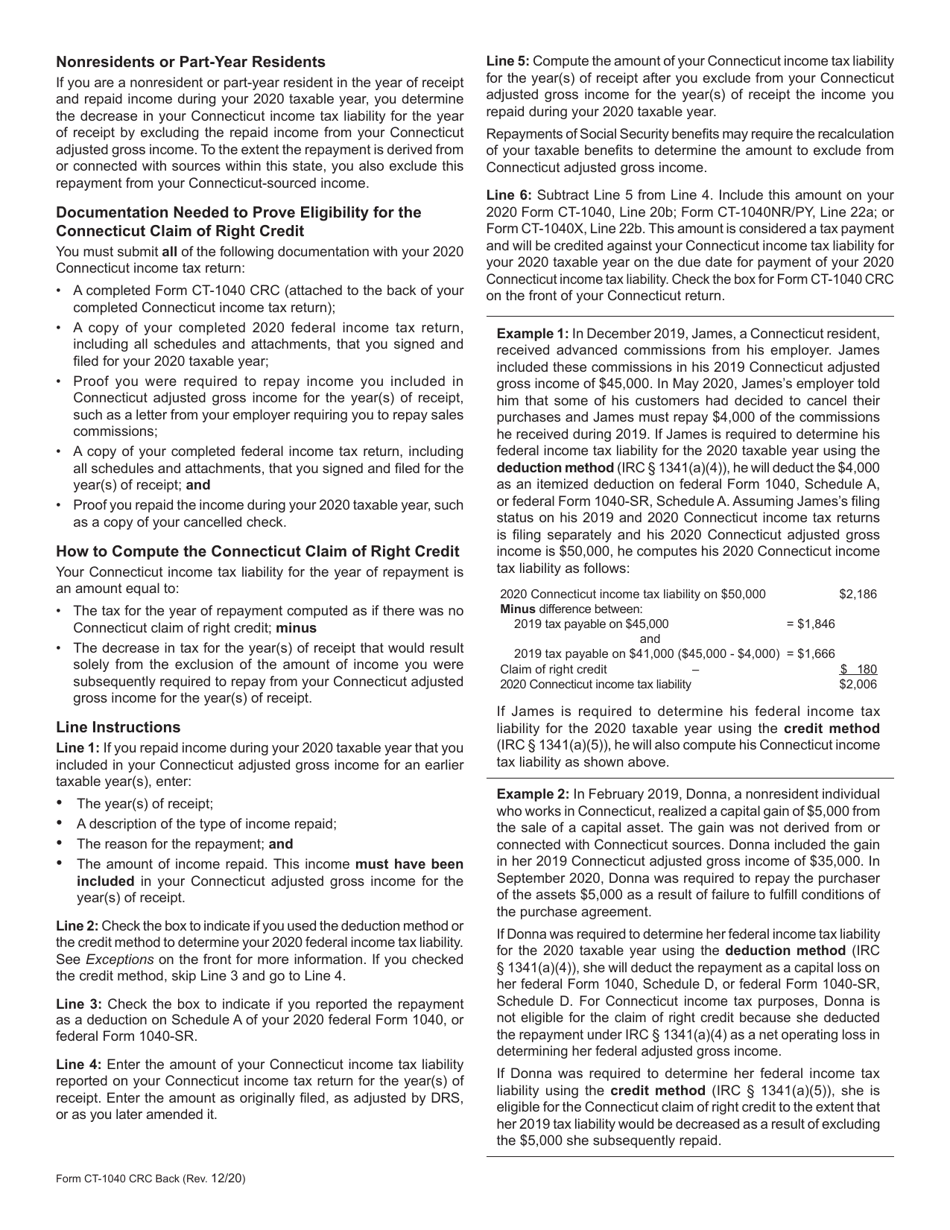

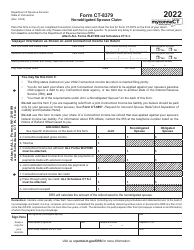

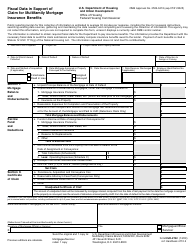

Form CT-1040 CRC

for the current year.

Form CT-1040 CRC Claim of Right Credit - Connecticut

What Is Form CT-1040 CRC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040 CRC?

A: Form CT-1040 CRC is a tax form used in Connecticut to claim the Claim of Right Credit.

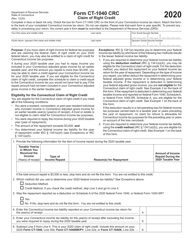

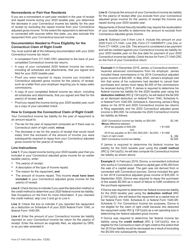

Q: What is the Claim of Right Credit?

A: The Claim of Right Credit is a tax credit available to Connecticut residents who received income in a previous tax year that was later returned due to a claim of right under federal law.

Q: Who can claim the Claim of Right Credit?

A: Connecticut residents who received income in a previous tax year that was later returned due to a claim of right under federal law can claim the Claim of Right Credit.

Q: How do I file Form CT-1040 CRC?

A: To file Form CT-1040 CRC, you need to complete the form and attach it to your Connecticut state income tax return (Form CT-1040).

Q: Is there a deadline to file Form CT-1040 CRC?

A: Yes, the deadline to file Form CT-1040 CRC is the same as the deadline for filing your Connecticut state income tax return, which is usually April 15th.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040 CRC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.