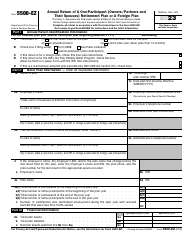

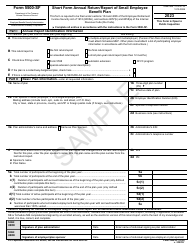

This version of the form is not currently in use and is provided for reference only. Download this version of

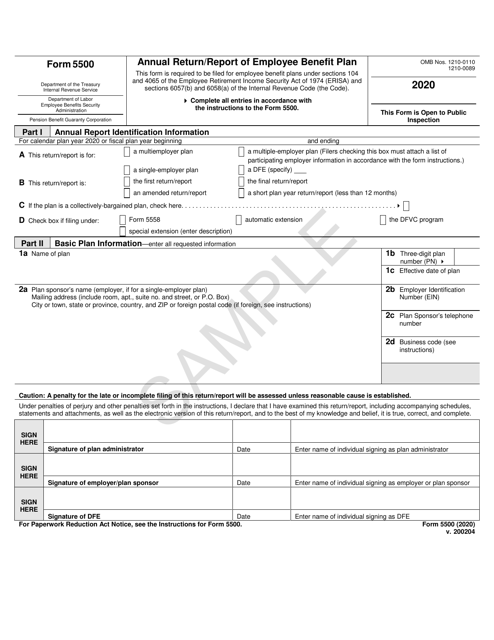

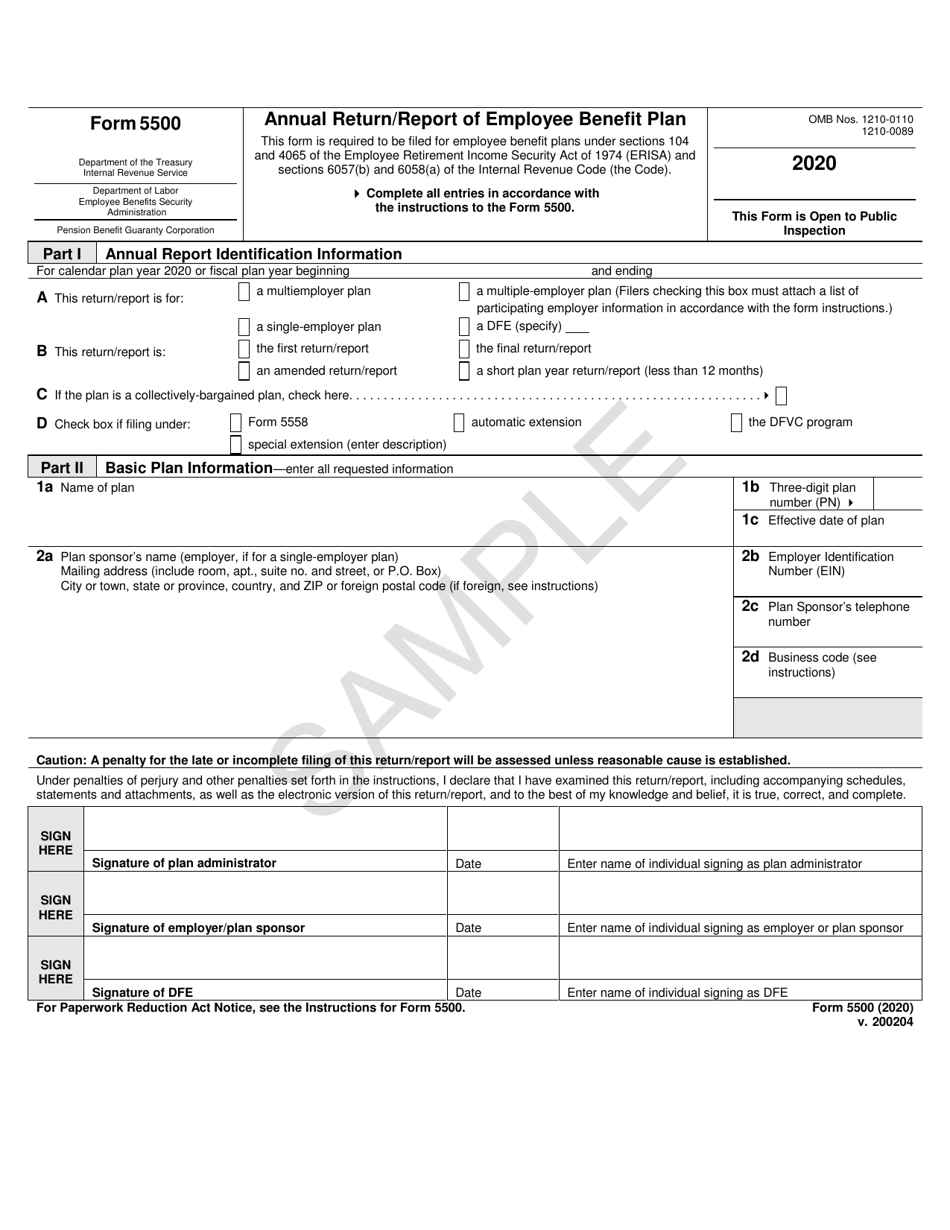

Form 5500

for the current year.

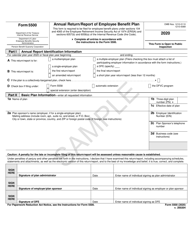

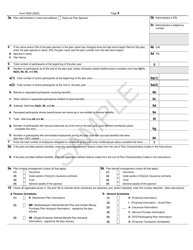

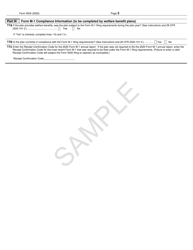

Form 5500 Annual Return / Report of Employee Benefit Plan - Sample

What Is Form 5500?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500?

A: Form 5500 is an annual return/report filed by employee benefit plans to provide information about the plan's financial condition and operations.

Q: Who is required to file Form 5500?

A: Employee benefit plans that meet certain criteria, such as having more than 100 participants, are generally required to file Form 5500.

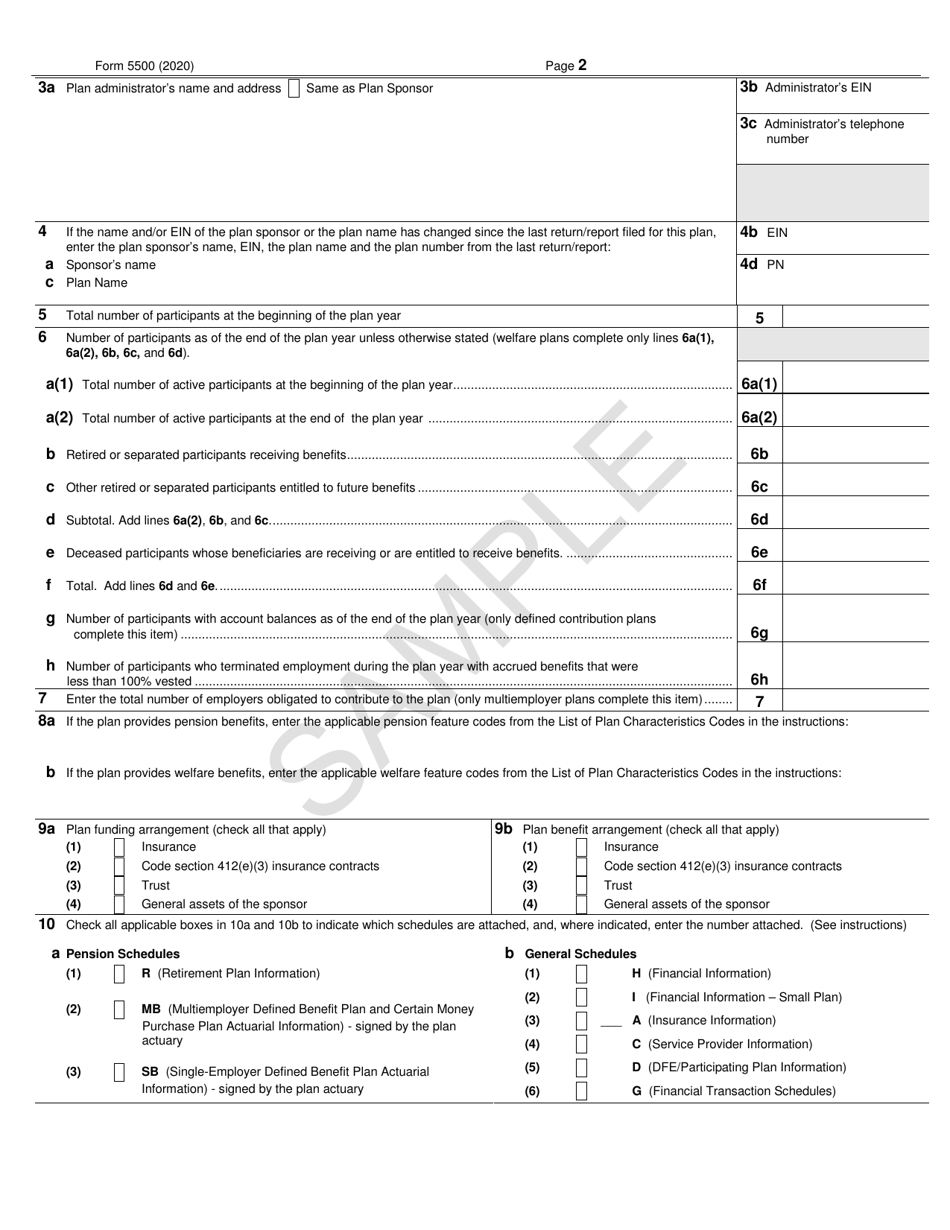

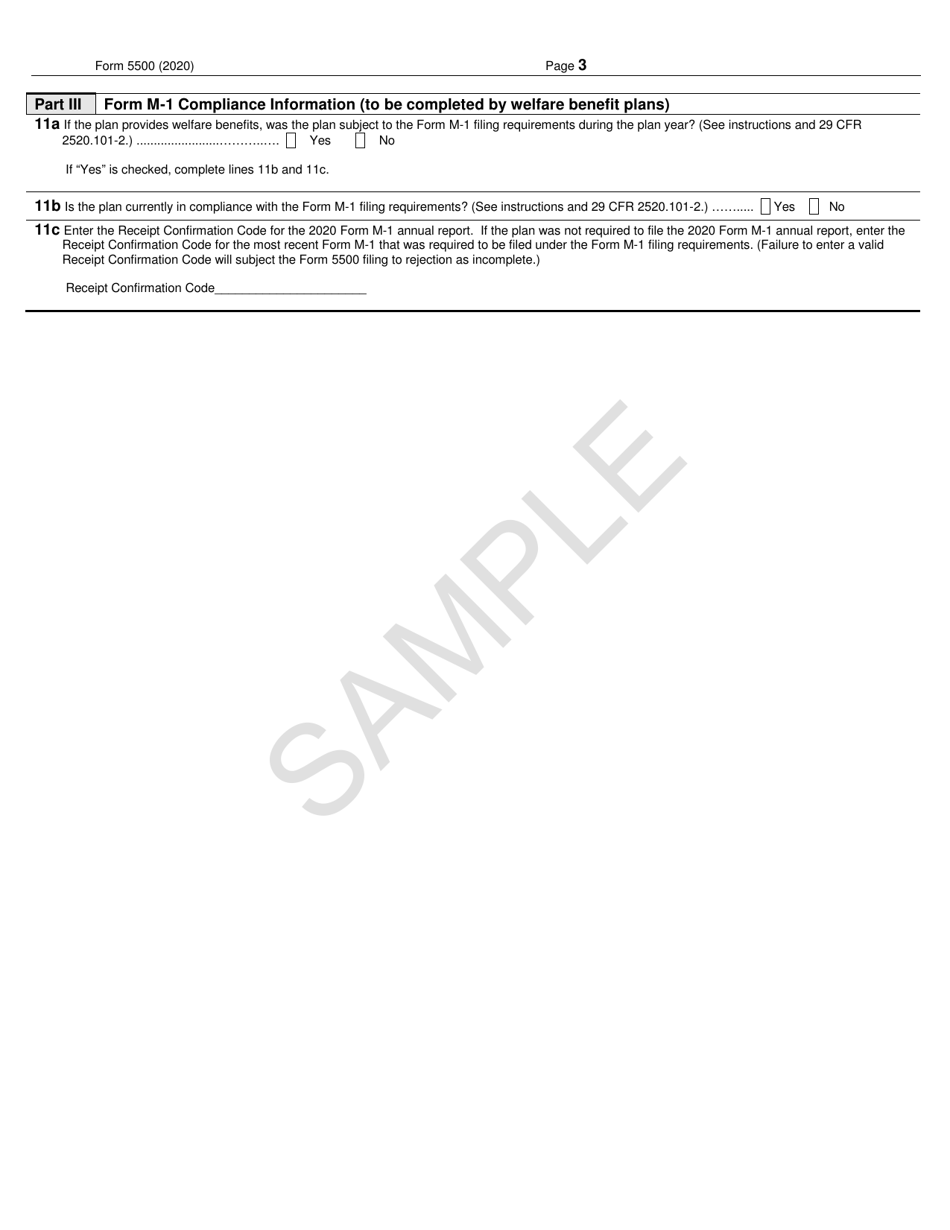

Q: What information does Form 5500 require?

A: Form 5500 requires information about the plan sponsor, plan administrator, plan characteristics, financial information, and other details about the employee benefit plan.

Q: When is Form 5500 due?

A: The deadline to file Form 5500 varies depending on the type of plan, but for calendar year plans, it is generally due on July 31st of the year following the plan year.

Q: Can Form 5500 be filed electronically?

A: Yes, Form 5500 can be filed electronically through the Department of Labor's EFAST2 system.

Q: What are the penalties for not filing Form 5500?

A: The penalties for not filing Form 5500 can range from $2,233 per day for late filings to $1,100 per day for failures to file.

Q: Is there an extension available for filing Form 5500?

A: Yes, extensions of up to 2.5 months can be requested by filing Form 5558 with the IRS before the original due date of Form 5500.

Q: What is the purpose of Form 5500?

A: The purpose of Form 5500 is to provide the government and participants with information about the financial condition and operation of employee benefit plans, and to ensure compliance with applicable laws and regulations.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.