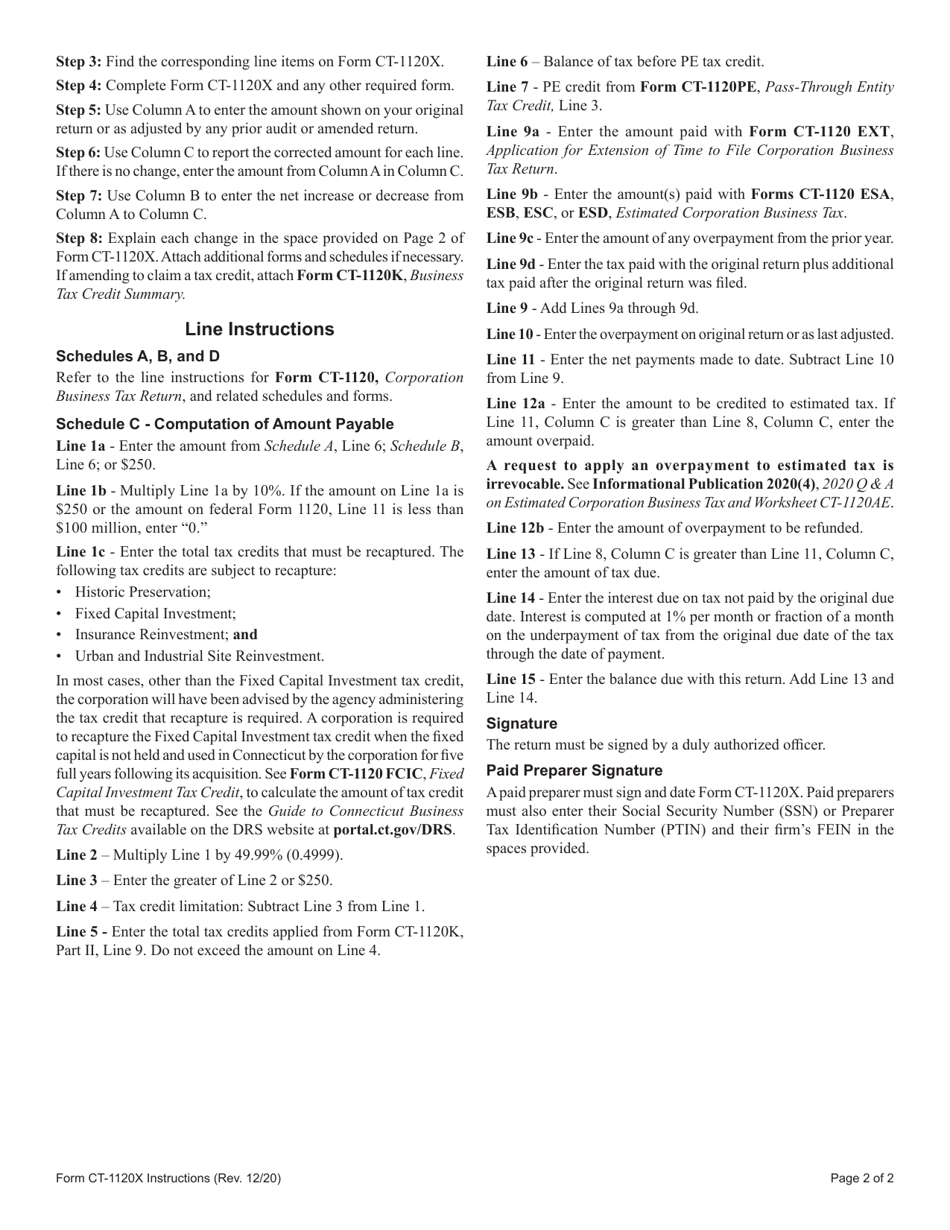

Instructions for Form CT-1120X Amended Corporation Business Tax Return - Connecticut

This document contains official instructions for Form CT-1120X , Amended Corporation Business Tax Return - a form released and collected by the Connecticut Department of Revenue Services. An up-to-date fillable Form CT-1120X is available for download through this link.

FAQ

Q: What is Form CT-1120X?

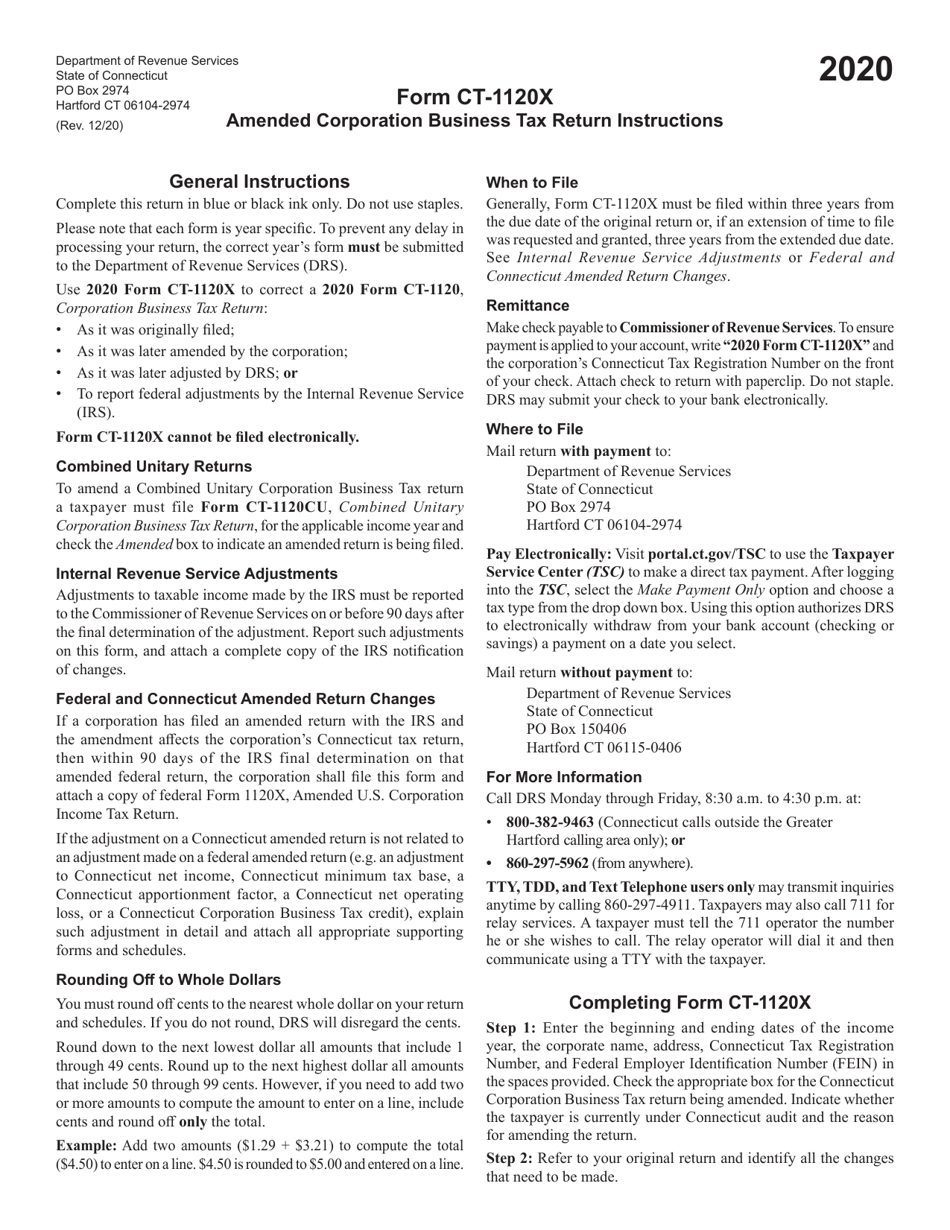

A: Form CT-1120X is the Amended CorporationBusiness Tax Return for corporations in Connecticut.

Q: Who needs to file Form CT-1120X?

A: Corporations in Connecticut who need to make amendments to their previously filed Corporation Business Tax Return.

Q: Why would a corporation need to file Form CT-1120X?

A: A corporation may need to file Form CT-1120X if they made mistakes or need to modify information on their previously filed Corporation Business Tax Return.

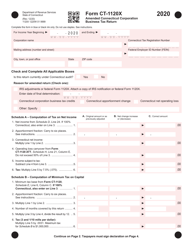

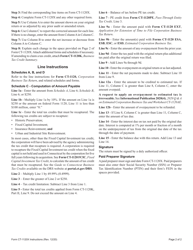

Q: What information is required on Form CT-1120X?

A: Form CT-1120X requires information such as the corporation's name, tax identification number, changes to income, deductions, credits, and any other necessary information.

Q: When is the deadline to file Form CT-1120X?

A: The deadline to file Form CT-1120X is generally within three years from the original due date of the Corporation Business Tax Return.

Q: Are there any penalties for filing Form CT-1120X late?

A: Yes, there may be penalties for filing Form CT-1120X late. It is important to file the amended return as soon as possible to avoid penalties and interest.

Q: Can I e-file Form CT-1120X?

A: No, Form CT-1120X cannot be e-filed. It must be submitted by mail to the Connecticut Department of Revenue Services.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Connecticut Department of Revenue Services.