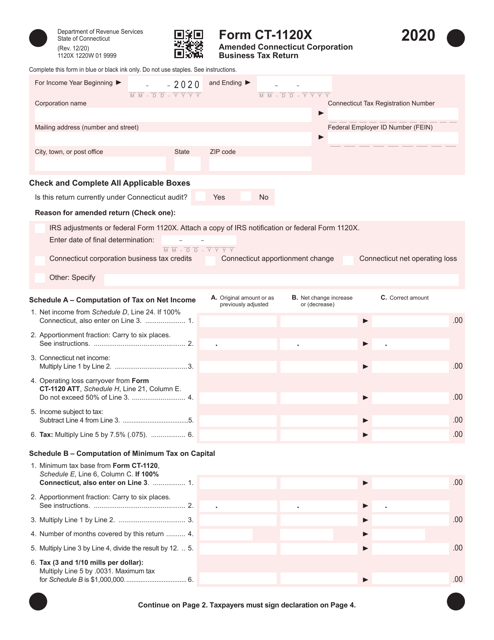

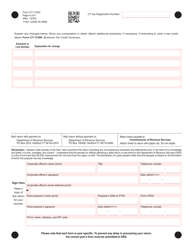

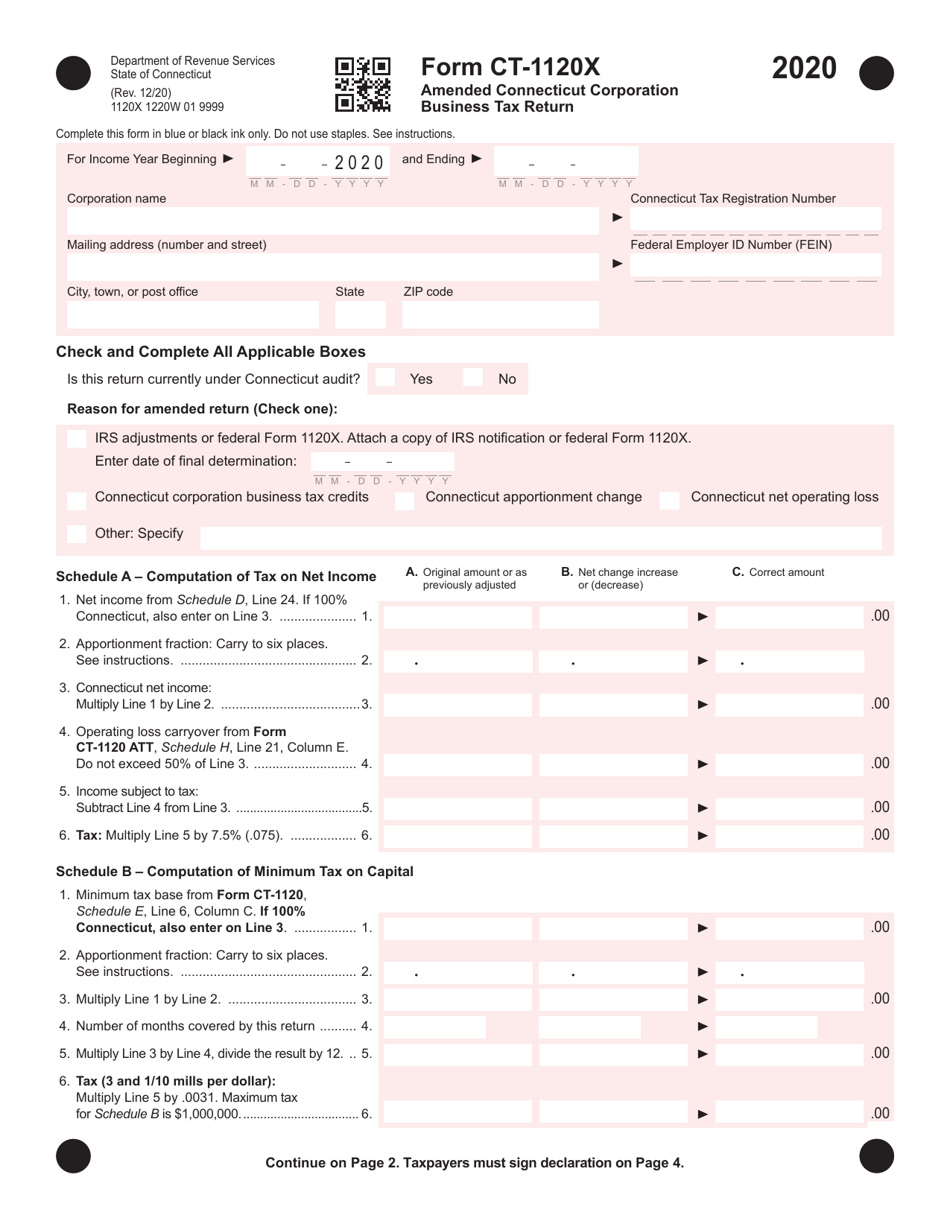

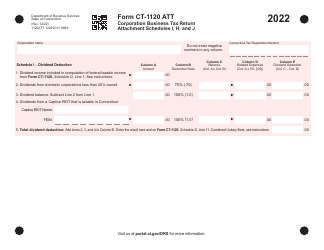

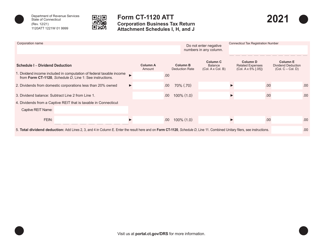

Form CT-1120X Amended Connecticut Corporation Business Tax Return - Connecticut

What Is Form CT-1120X?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1120X?

A: Form CT-1120X is the Amended Connecticut Corporation Business Tax Return.

Q: Who needs to file Form CT-1120X?

A: Any corporation that needs to amend their previous Connecticut Corporation Business Tax Return.

Q: When should I file Form CT-1120X?

A: You should file Form CT-1120X as soon as you discover an error or omission in your previous tax return.

Q: What information do I need to complete Form CT-1120X?

A: You will need your original tax return information and any additional information required to correct the error or omission.

Q: Are there any penalties for filing Form CT-1120X?

A: Penalties may apply if the amended return results in an increase in tax liability. It is important to file the amended return as soon as possible to avoid penalties.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120X by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.