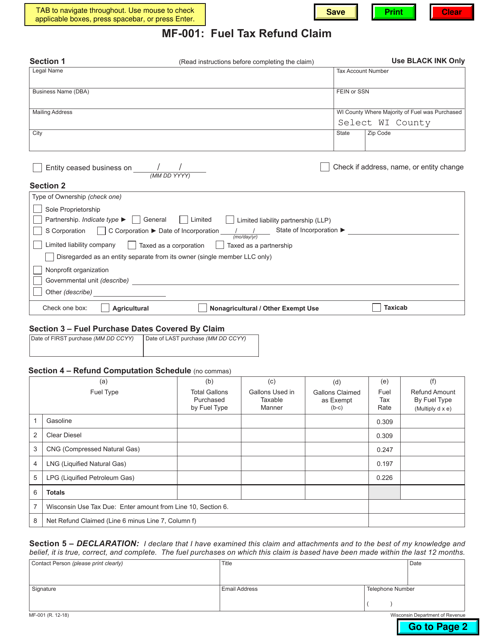

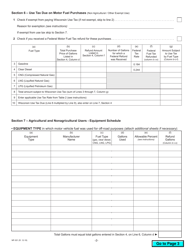

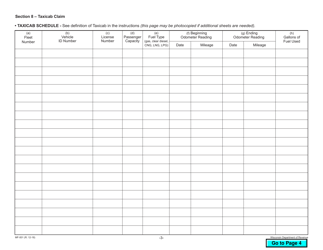

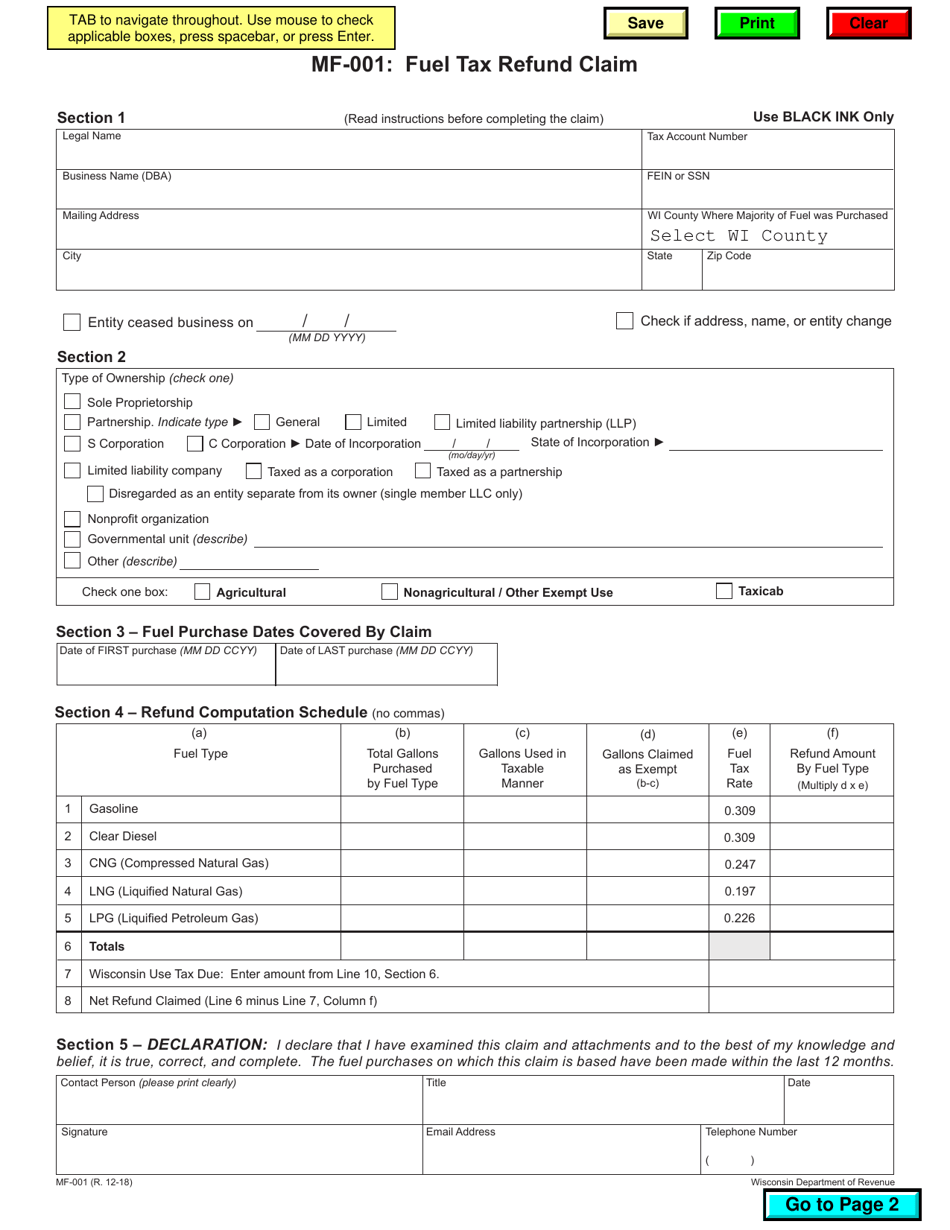

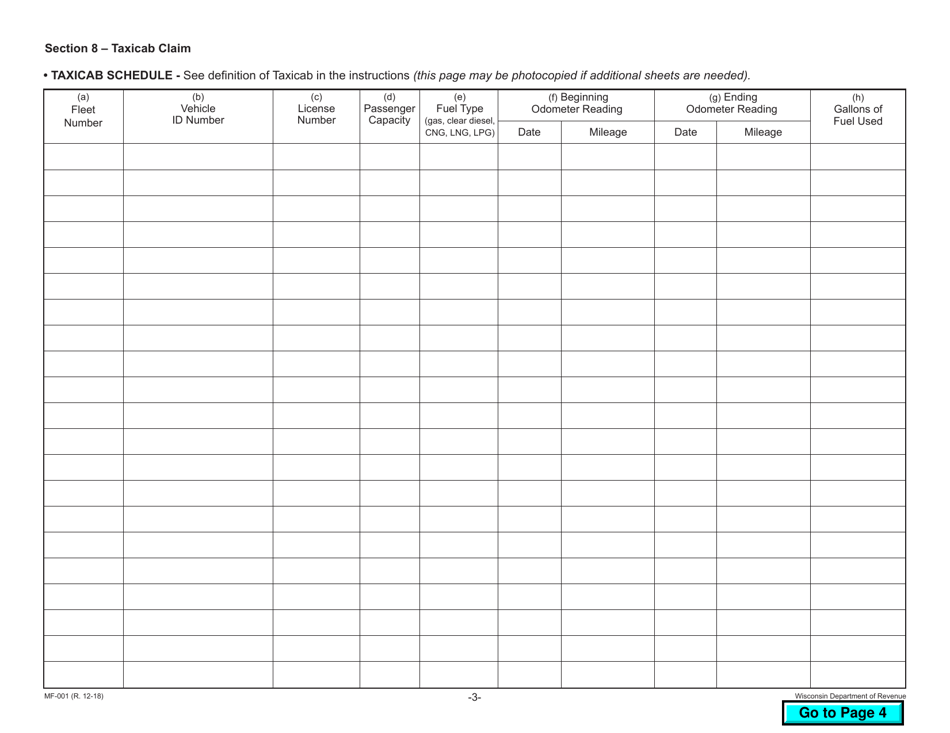

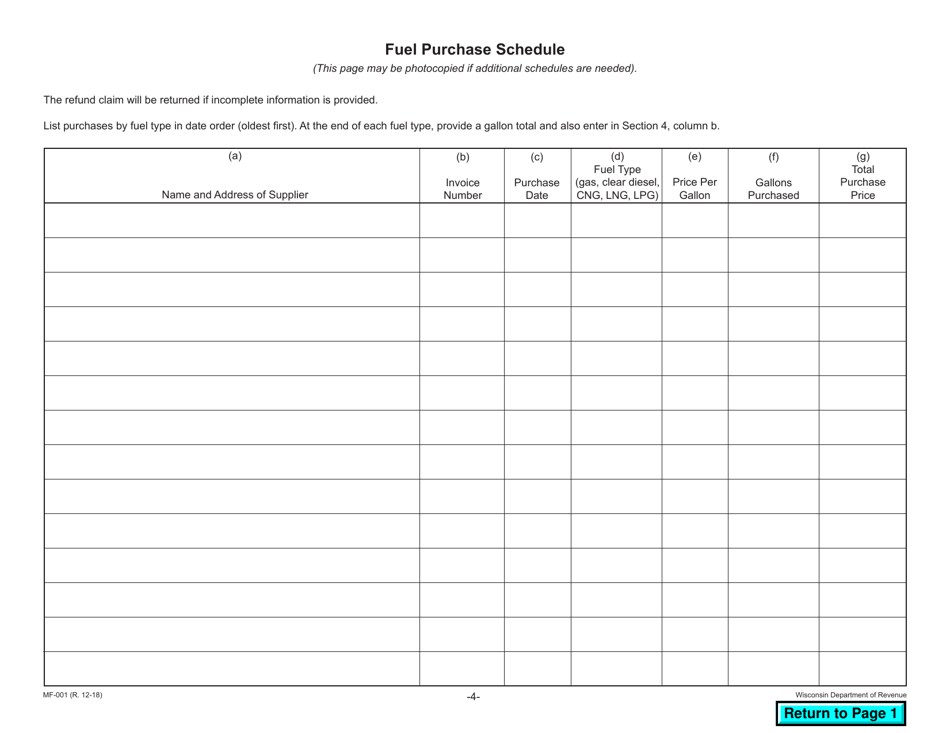

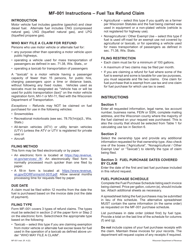

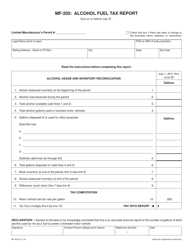

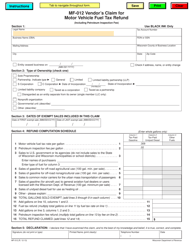

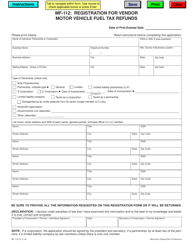

Form MF-001 Fuel Tax Refund Claim - Wisconsin

What Is Form MF-001?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MF-001?

A: Form MF-001 is a Fuel Tax Refund Claim form used in Wisconsin.

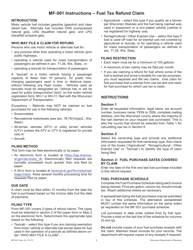

Q: Who can file Form MF-001?

A: Any individual, partnership, corporation, or other organization that has paid fuel tax in Wisconsin can file Form MF-001.

Q: What is the purpose of filing Form MF-001?

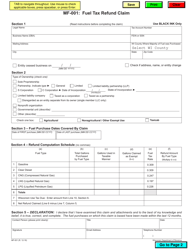

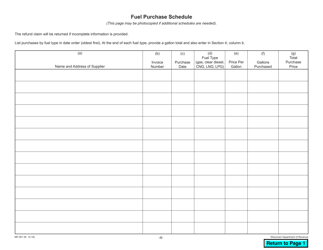

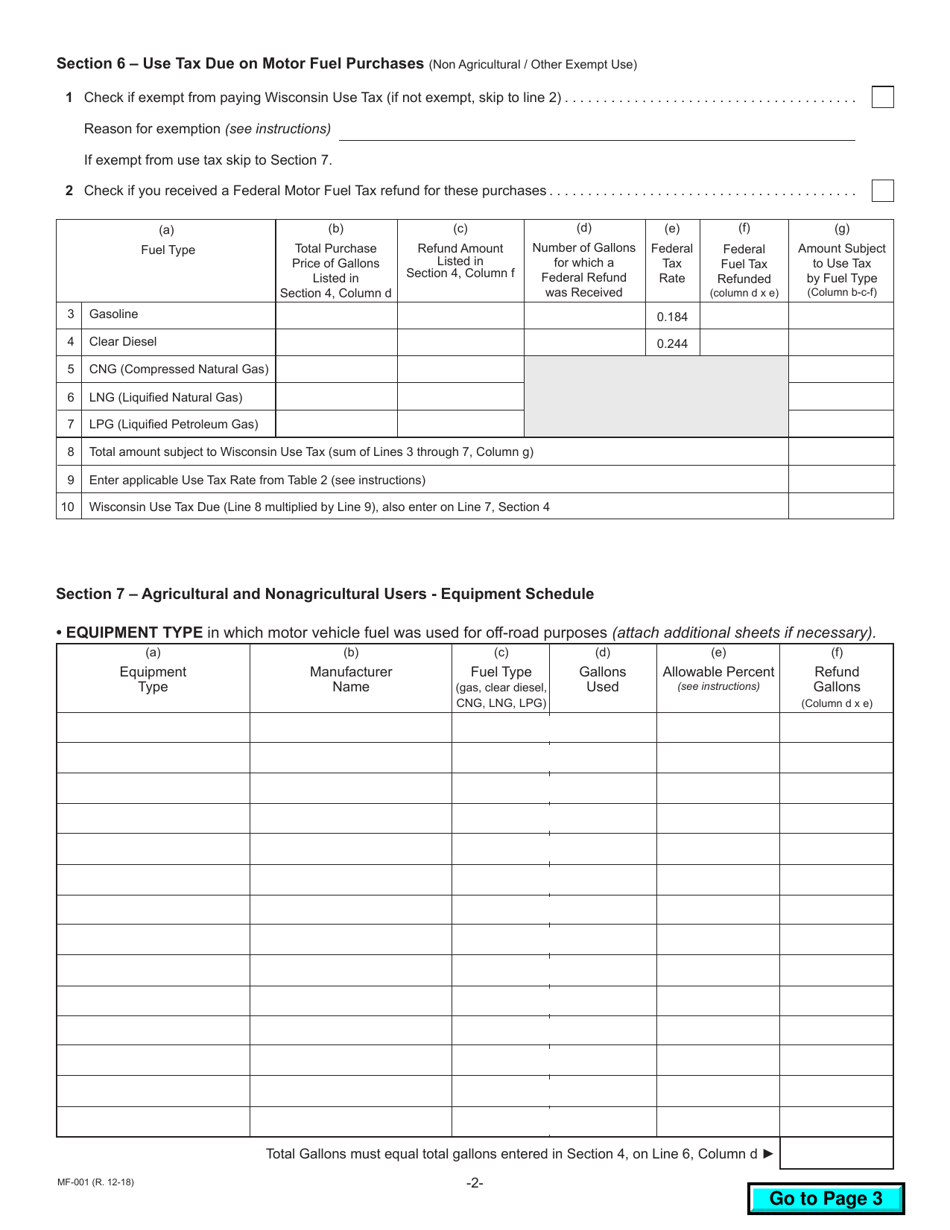

A: The purpose of filing Form MF-001 is to claim a refund for fuel tax paid in Wisconsin.

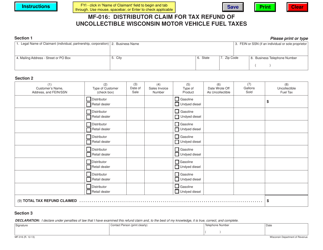

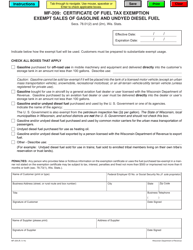

Q: What types of fuel are eligible for a refund?

A: Gasoline, diesel fuel, and alternative fuels such as biodiesel and ethanol are eligible for a refund.

Q: Are there any specific requirements to be eligible for a refund?

A: Yes, the fuel must have been purchased and used exclusively for off-highway use, such as in farm machinery, construction equipment, or boats.

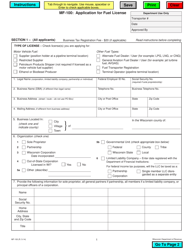

Q: Is there a deadline for filing Form MF-001?

A: Yes, the form must be filed within three years from the date of the original purchase of the fuel.

Q: Is there a limit to the amount of refund that can be claimed?

A: No, there is no limit on the amount of refund that can be claimed.

Q: How long does it take to process a refund claim?

A: It typically takes four to six weeks to process a refund claim, but processing times may vary.

Q: What should I do if my refund claim is denied?

A: If your refund claim is denied, you have the option to appeal the decision by contacting the Wisconsin Department of Revenue.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-001 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.