This version of the form is not currently in use and is provided for reference only. Download this version of

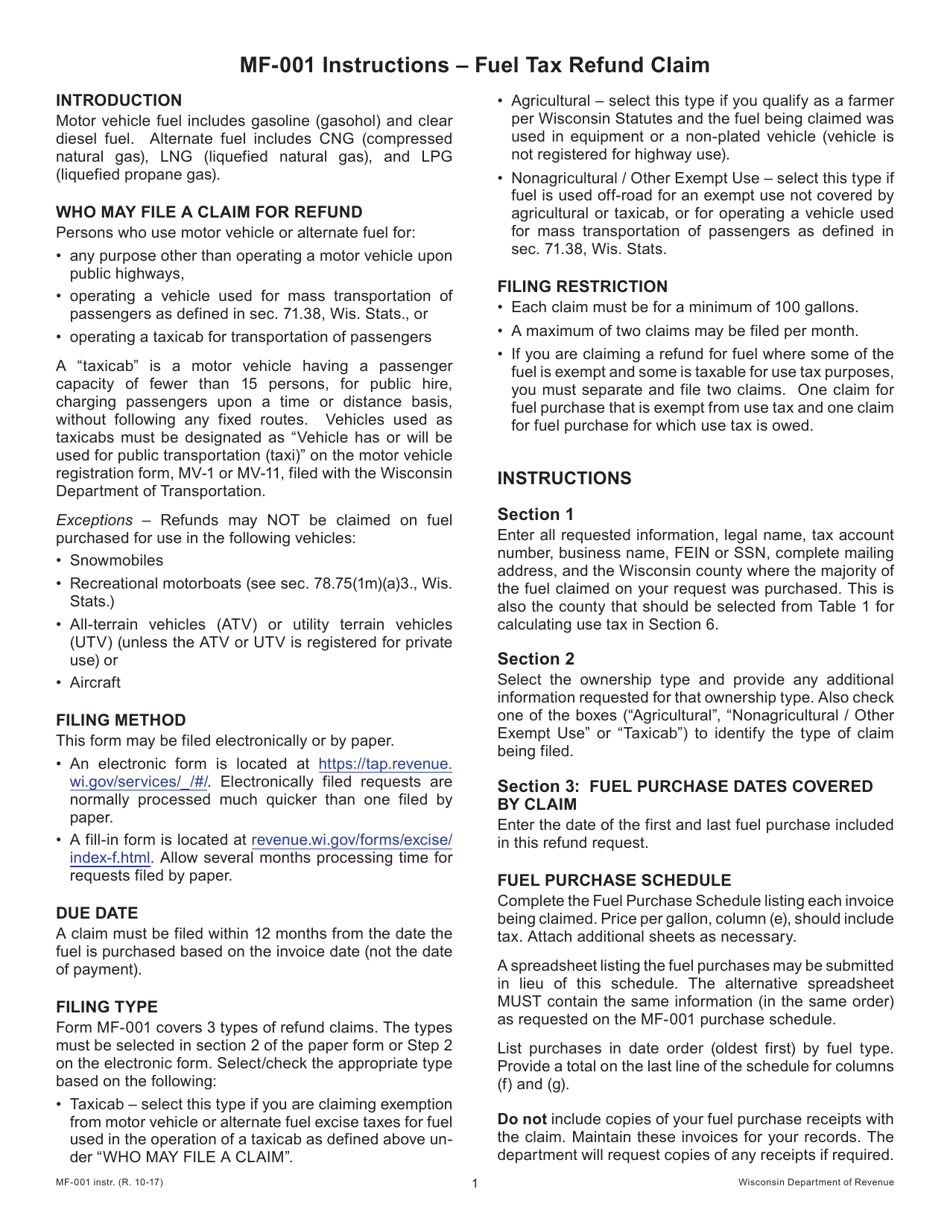

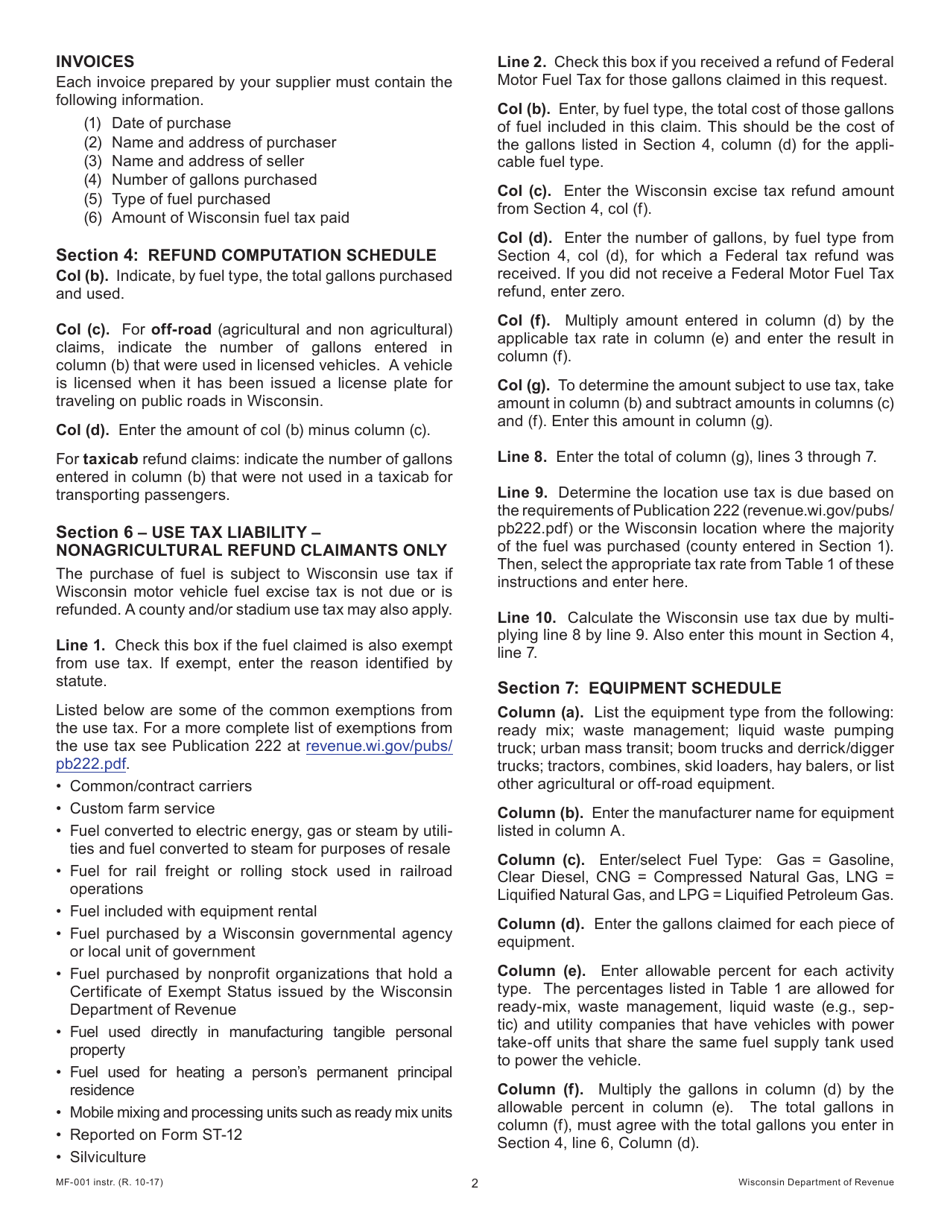

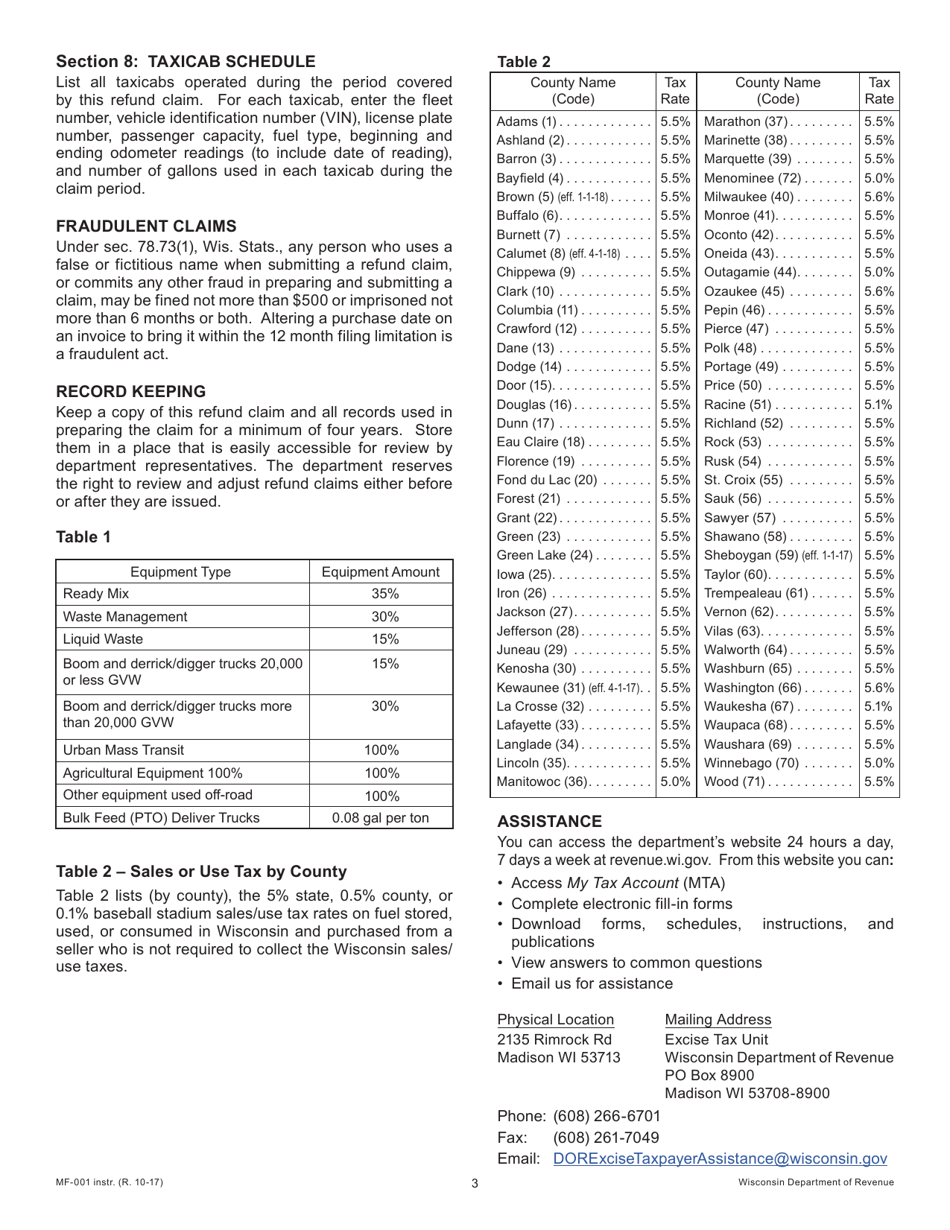

Instructions for Form MF-001

for the current year.

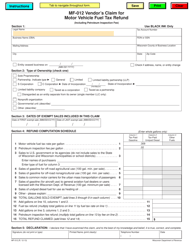

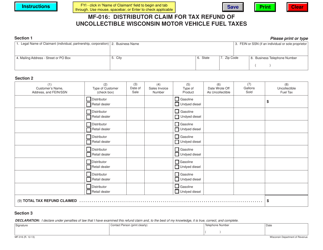

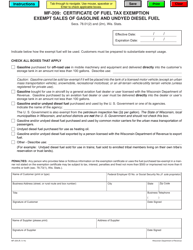

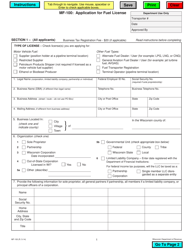

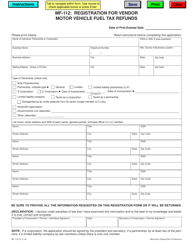

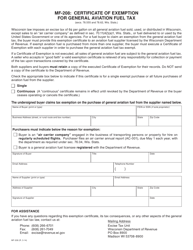

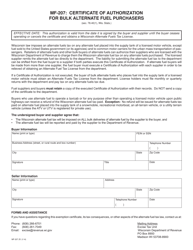

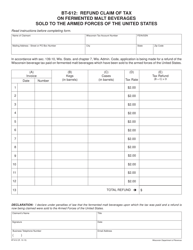

Instructions for Form MF-001 Fuel Tax Refund Claim - Wisconsin

This document contains official instructions for Form MF-001 , Fuel Tax Refund Claim - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form MF-001 is available for download through this link.

FAQ

Q: What is Form MF-001?

A: Form MF-001 is the Fuel Tax Refund Claim form for the state of Wisconsin.

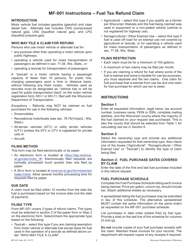

Q: Who is eligible to file Form MF-001?

A: Motor fuel dealers, bulk users, and ultimate purchasers who have paid fuel taxes in Wisconsin are eligible to file Form MF-001.

Q: What is the purpose of Form MF-001?

A: The purpose of Form MF-001 is to claim a refund of the fuel taxes paid in Wisconsin.

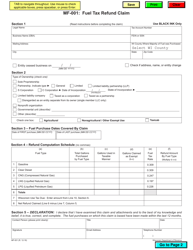

Q: How do I fill out Form MF-001?

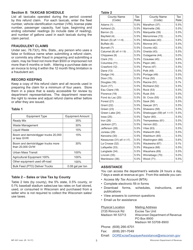

A: You must provide detailed information about the gallons of fuel purchased, the rate of tax paid, and the amount of refund claimed.

Q: Is there a deadline for filing Form MF-001?

A: Yes, Form MF-001 must be filed within 6 months from the date of the last purchase for which the refund is claimed.

Q: Are there any supporting documents required with Form MF-001?

A: Yes, you must attach copies of invoices, purchase orders, or other supporting documents to substantiate your refund claim.

Q: How long does it take to get a refund after filing Form MF-001?

A: It may take up to 90 days for the refund to be processed and issued after filing Form MF-001.

Q: Can I file Form MF-001 electronically?

A: As of now, Form MF-001 cannot be filed electronically. It must be filed by mail or in person.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.