This version of the form is not currently in use and is provided for reference only. Download this version of

Form HR-T (IC-134)

for the current year.

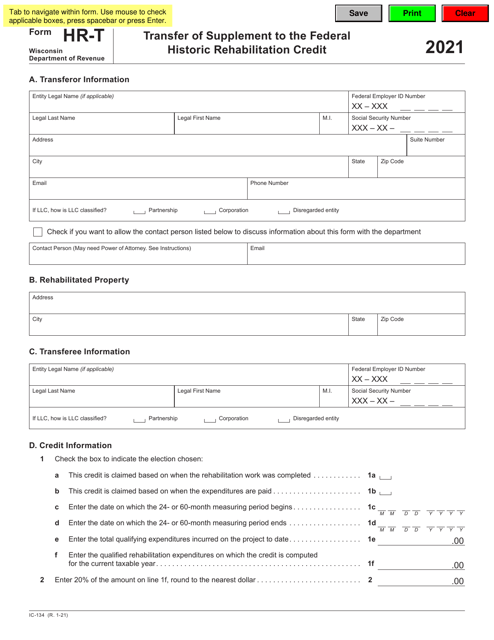

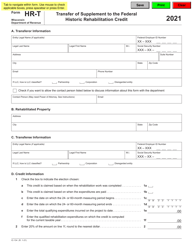

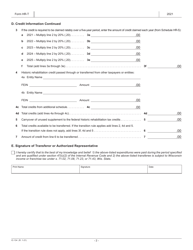

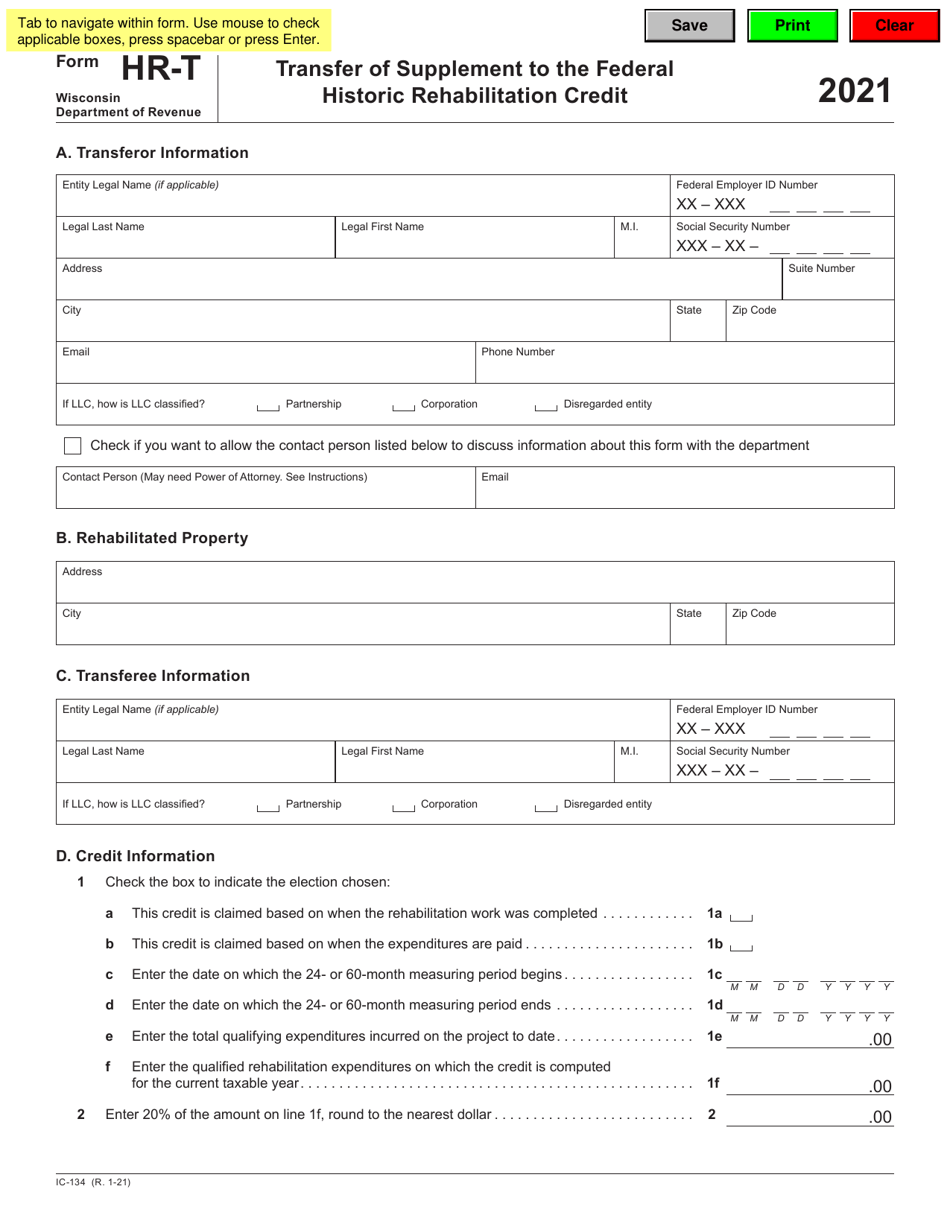

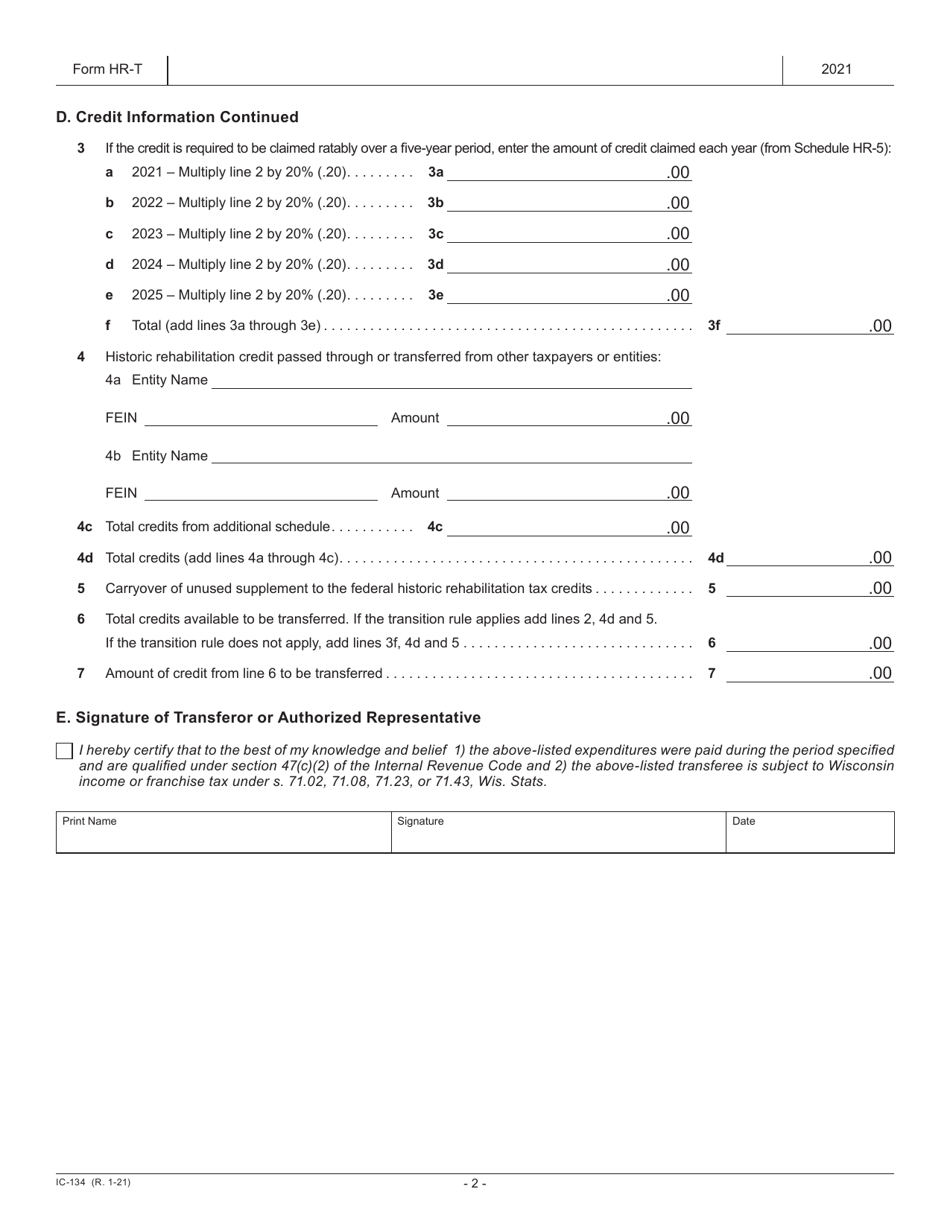

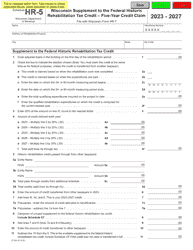

Form HR-T (IC-134) Transfer of Supplement to the Federal Historic Rehabilitation Credit - Wisconsin

What Is Form HR-T (IC-134)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form HR-T (IC-134)?

A: Form HR-T (IC-134) is a Transfer of Supplement to the Federal Historic Rehabilitation Credit specifically for projects in Wisconsin.

Q: What is the purpose of Form HR-T?

A: The purpose of Form HR-T is to transfer the supplemental state historic credit generated by a rehabilitation project in Wisconsin.

Q: What does the Form HR-T (IC-134) transfer?

A: Form HR-T transfers the supplemental state historic credit to a new owner or partner.

Q: Who is eligible to file Form HR-T?

A: Any owner or partner of a rehabilitation project in Wisconsin that has generated a supplemental state historic credit can file Form HR-T.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HR-T (IC-134) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.