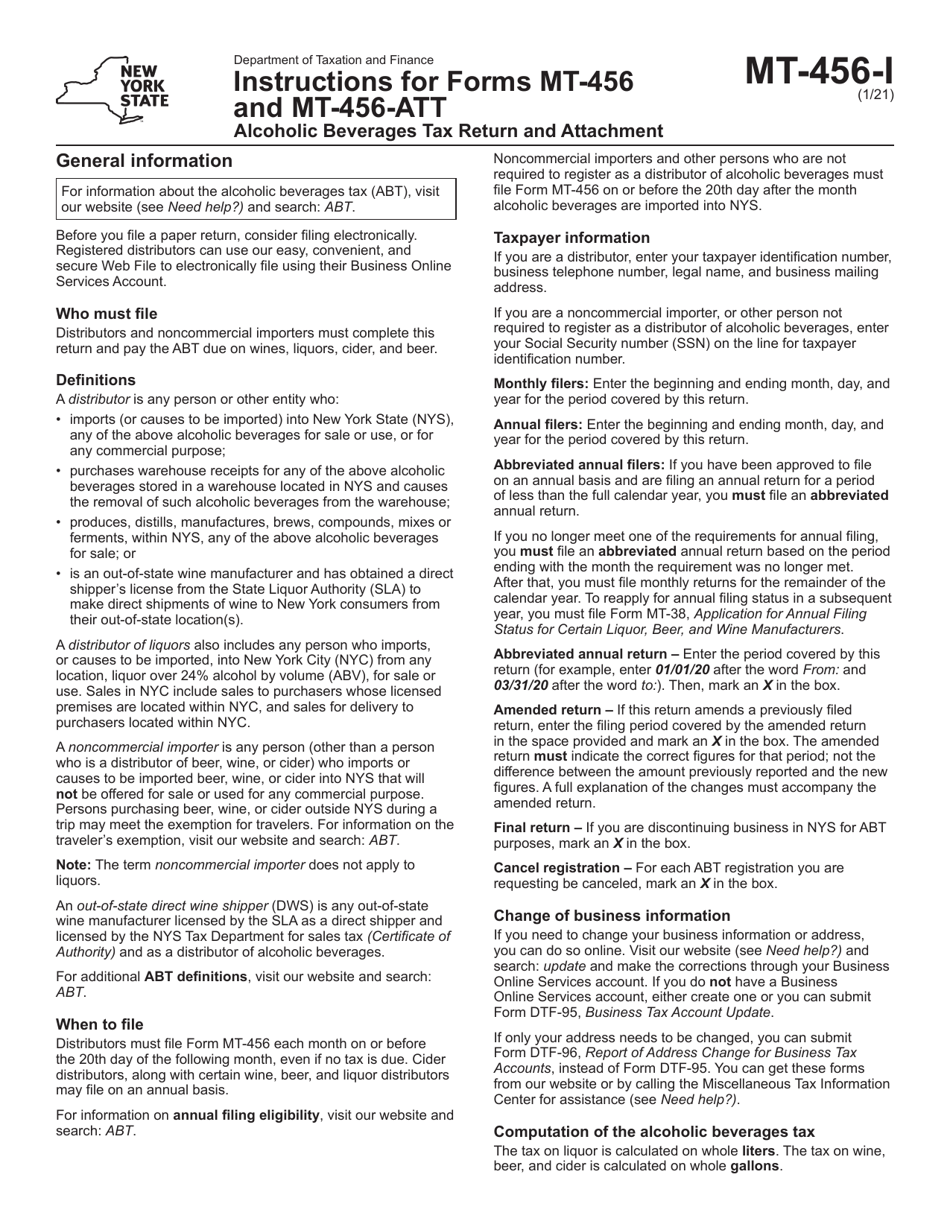

Instructions for Form MT-456, MT-456-ATT - New York

This document contains official instructions for Form MT-456 , and Form MT-456-ATT . Both forms are released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form MT-456-ATT is available for download through this link.

FAQ

Q: What is Form MT-456?

A: Form MT-456 is a form used for reporting tax on fuel used in motor vehicles in the state of New York.

Q: What is Form MT-456-ATT?

A: Form MT-456-ATT is an attachment to Form MT-456 and is used for providing additional information regarding fuel usage.

Q: Who needs to file Form MT-456?

A: Any person or entity that uses motor fuel in vehicles for highway use in New York and is liable for the highway use tax must file Form MT-456.

Q: What information is required on Form MT-456?

A: Form MT-456 requires information such as the amount of fuel used, the number of miles traveled, and any exemptions or credits claimed.

Q: When is Form MT-456 due?

A: Form MT-456 is generally due on a quarterly basis, with specific due dates depending on the fiscal year of the filer.

Q: Are there any penalties for not filing Form MT-456?

A: Yes, failure to file Form MT-456 or late filing can result in penalties and interest being assessed by the New York State Department of Taxation and Finance.

Q: Is there any assistance available for completing Form MT-456?

A: Yes, the New York State Department of Taxation and Finance provides instructions and guidance for completing Form MT-456.

Q: Can I claim a refund on fuel tax paid through Form MT-456?

A: Yes, eligible taxpayers can claim a refund on fuel tax paid by completing the appropriate sections of Form MT-456.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.