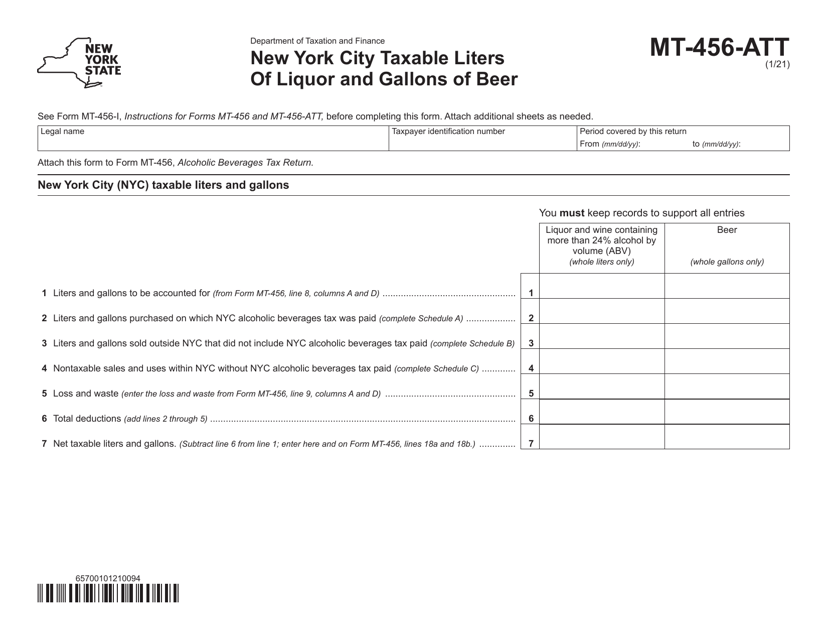

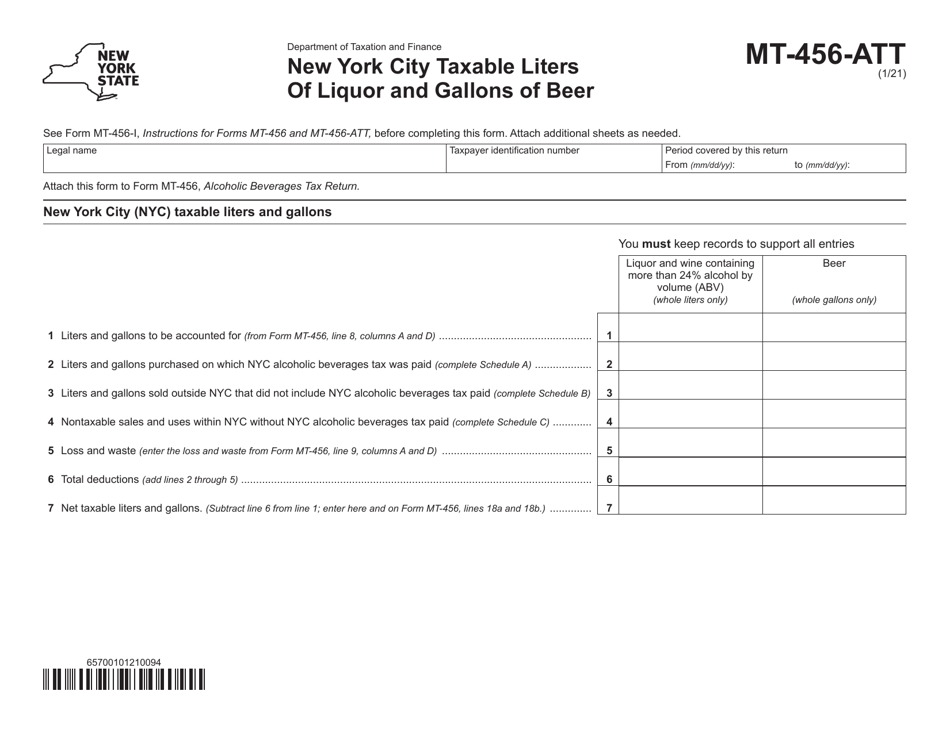

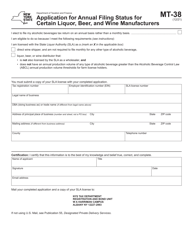

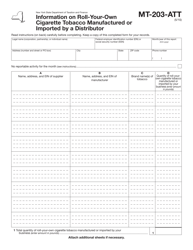

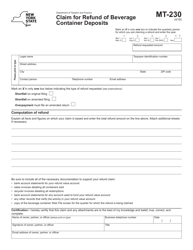

Form MT-456-ATT New York City Taxable Liters of Liquor and Gallons of Beer - New York

What Is Form MT-456-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MT-456-ATT?

A: Form MT-456-ATT is a tax form used in New York City to report the taxable liters of liquor and gallons of beer.

Q: Who needs to file Form MT-456-ATT?

A: Businesses in New York City that sell liquor and beer need to file Form MT-456-ATT to report their taxable sales.

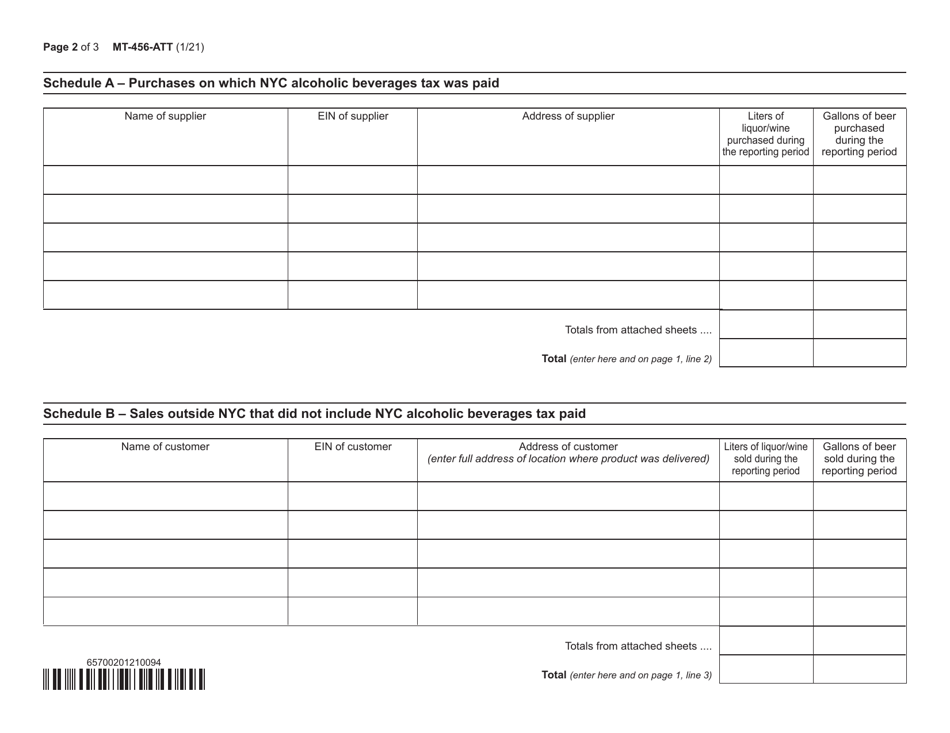

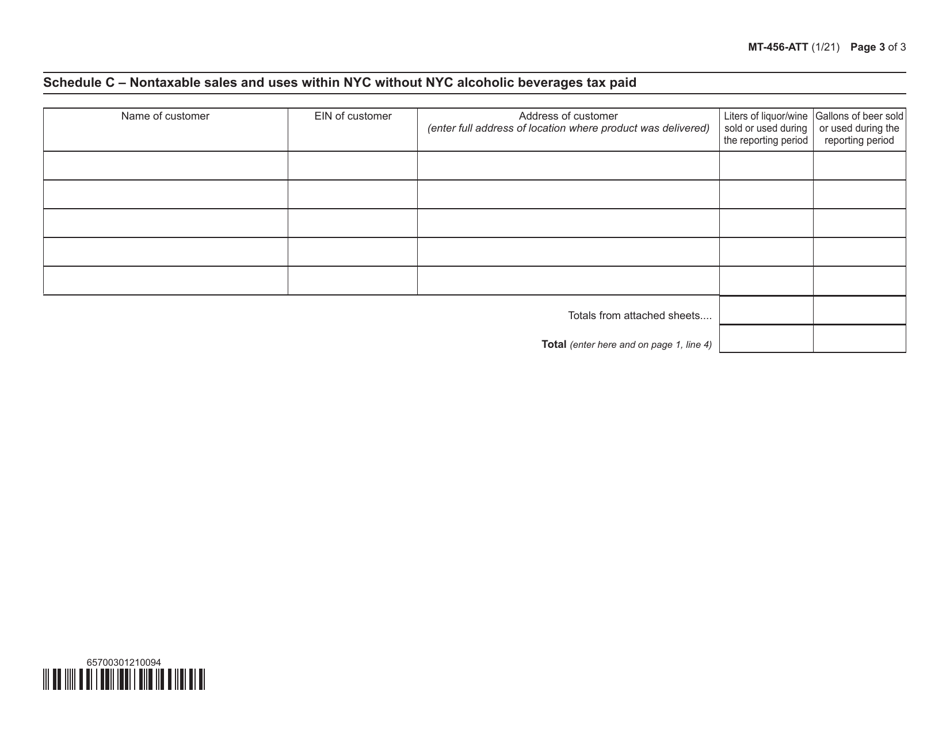

Q: What information is required on Form MT-456-ATT?

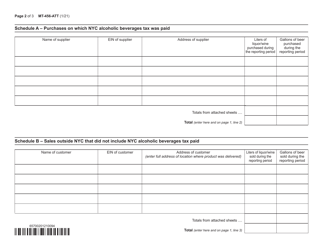

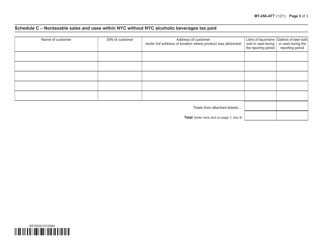

A: Form MT-456-ATT requires businesses to provide details about their liquor and beer sales, including the number of taxable liters of liquor and gallons of beer sold.

Q: When is Form MT-456-ATT due?

A: Form MT-456-ATT is due on a quarterly basis, with the specific due dates indicated on the form.

Q: Are there any penalties for not filing Form MT-456-ATT?

A: Yes, failure to file Form MT-456-ATT or filing it late may result in penalties and interest charges.

Q: Can I e-file Form MT-456-ATT?

A: As of now, Form MT-456-ATT cannot be e-filed. It must be filed in paper format.

Q: Is Form MT-456-ATT used in other cities besides New York?

A: No, Form MT-456-ATT is specific to New York City and is not used in other cities or states.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MT-456-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.