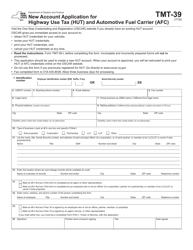

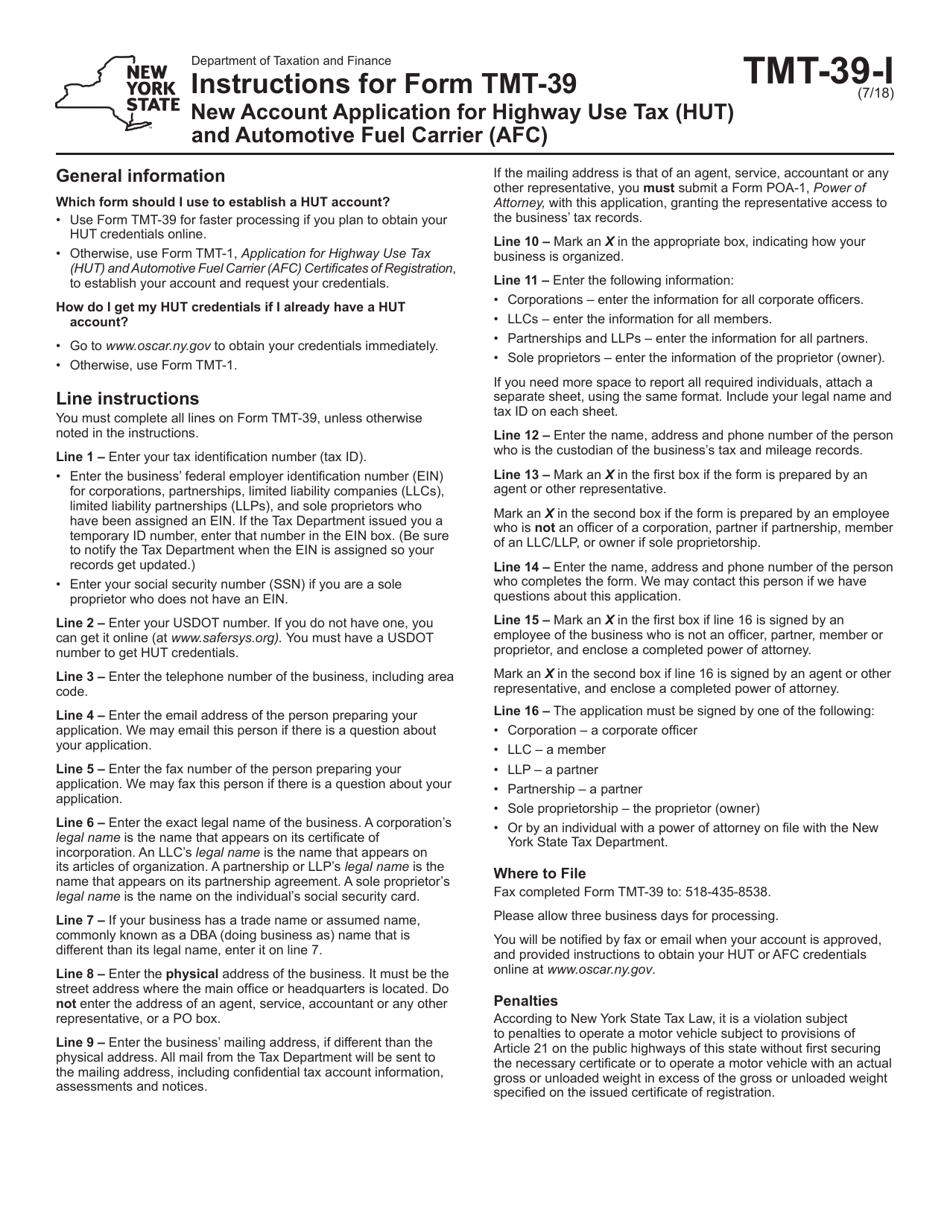

Instructions for Form TMT-39 New Account Application for Highway Use Tax (Hut) and Automotive Fuel Carrier (Afc) - New York

This document contains official instructions for Form TMT-39 , New Account Application for Highway Fuel Carrier (Afc) - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form TMT-39 is available for download through this link.

FAQ

Q: What is Form TMT-39?

A: Form TMT-39 is the New Account Application for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) in New York.

Q: What is Highway Use Tax (HUT)?

A: Highway Use Tax (HUT) is a tax on motor carriers' operation of certain motor vehicles on New York State public highways.

Q: What is Automotive Fuel Carrier (AFC)?

A: Automotive Fuel Carrier (AFC) is a tax on the sale of diesel motor fuel and special fuel to automotive carriers.

Q: Who needs to file Form TMT-39?

A: Motor carriers and automotive carriers operating in New York State need to file Form TMT-39.

Q: What information is required on Form TMT-39?

A: Form TMT-39 requires information such as carrier details, vehicle information, and fuel usage.

Q: When is Form TMT-39 due?

A: Form TMT-39 is due within 20 days after starting your operations in New York State.

Q: What are the penalties for late filing of Form TMT-39?

A: Penalties for late filing of Form TMT-39 include monetary penalties and suspension of operating privileges.

Q: Is there a fee to file Form TMT-39?

A: No, there is no fee to file Form TMT-39.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.