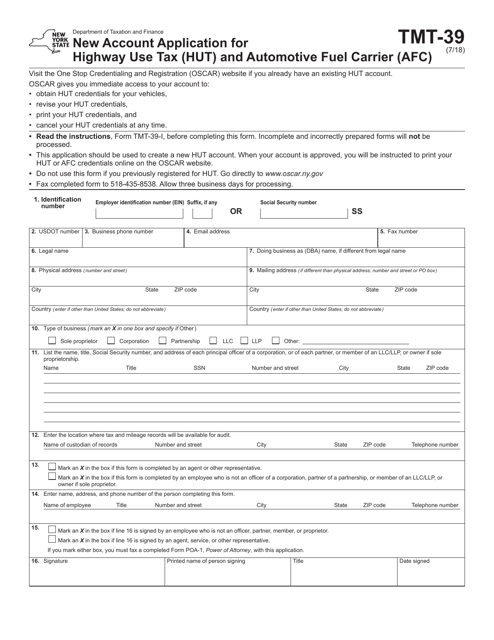

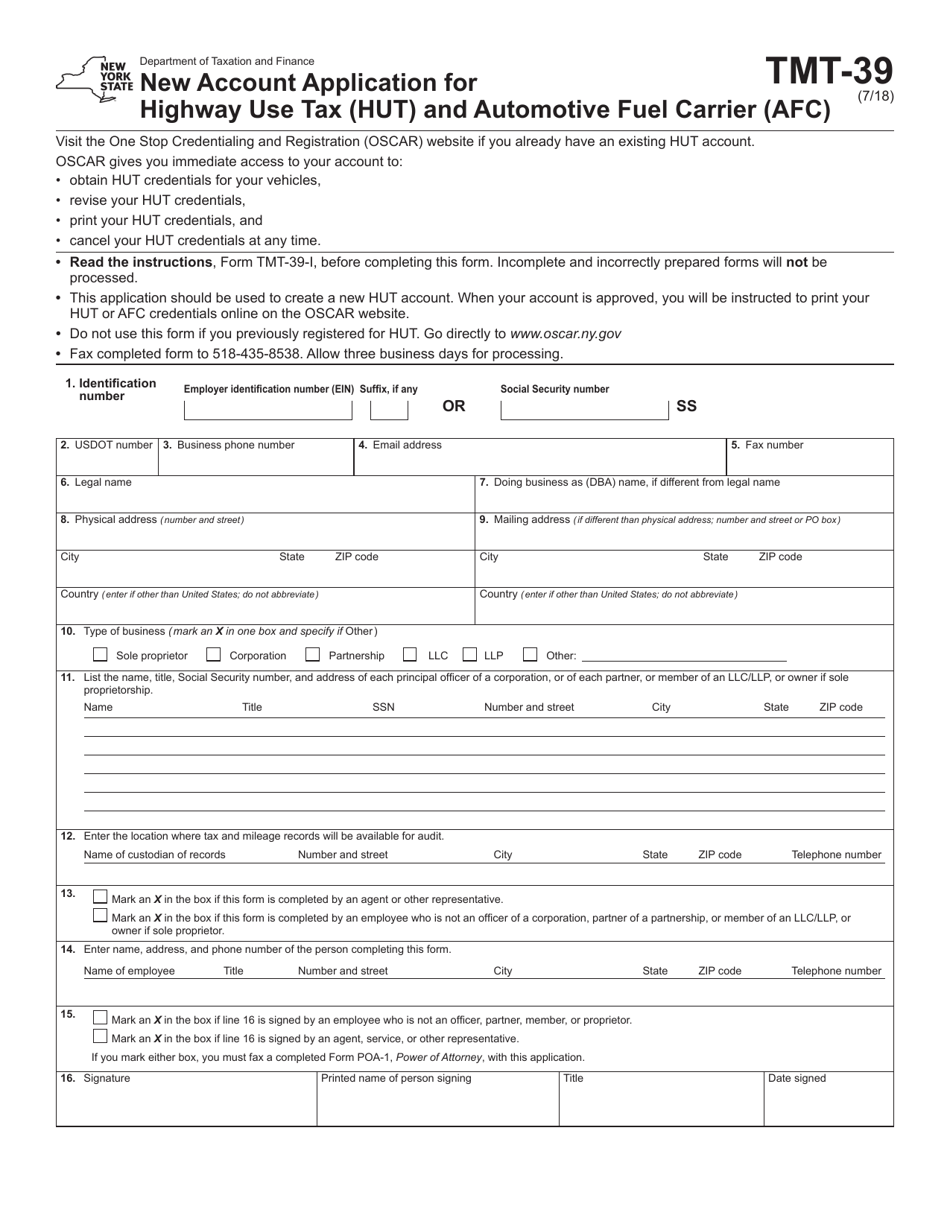

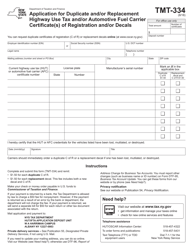

Form TMT-39 New Account Application for Highway Use Tax (Hut) and Automotive Fuel Carrier (Afc) - New York

What Is Form TMT-39?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TMT-39?

A: Form TMT-39 is the New Account Application for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) in New York.

Q: What is Highway Use Tax (HUT)?

A: Highway Use Tax (HUT) is a tax imposed on motor carriers operating certain motor vehicles on New York State public highways.

Q: What is Automotive Fuel Carrier (AFC)?

A: Automotive Fuel Carrier (AFC) is a registration program for vehicles that transport automotive fuel in bulk within New York State.

Q: Who needs to file Form TMT-39?

A: Motor carriers operating in New York State who are subject to Highway Use Tax (HUT) and/or Automotive Fuel Carrier (AFC) registration requirements need to file Form TMT-39.

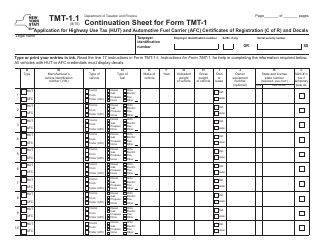

Q: What information is required on Form TMT-39?

A: Form TMT-39 requires information such as the motor carrier's business details, vehicle information, and tax registration details.

Q: Are there any fees associated with filing Form TMT-39?

A: Yes, there are fees associated with filing Form TMT-39. The specific fees depend on the type of registration being applied for.

Q: What is the purpose of filing Form TMT-39?

A: The purpose of filing Form TMT-39 is to register for Highway Use Tax (HUT) and/or Automotive Fuel Carrier (AFC) in New York State.

Q: Are there any deadlines for filing Form TMT-39?

A: Yes, there are specific deadlines for filing Form TMT-39. Motor carriers are required to file the form within certain timeframes after starting operations or acquiring a new vehicle.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TMT-39 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.