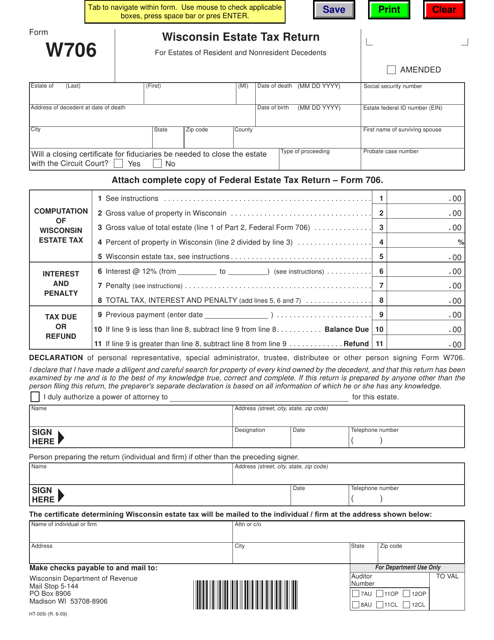

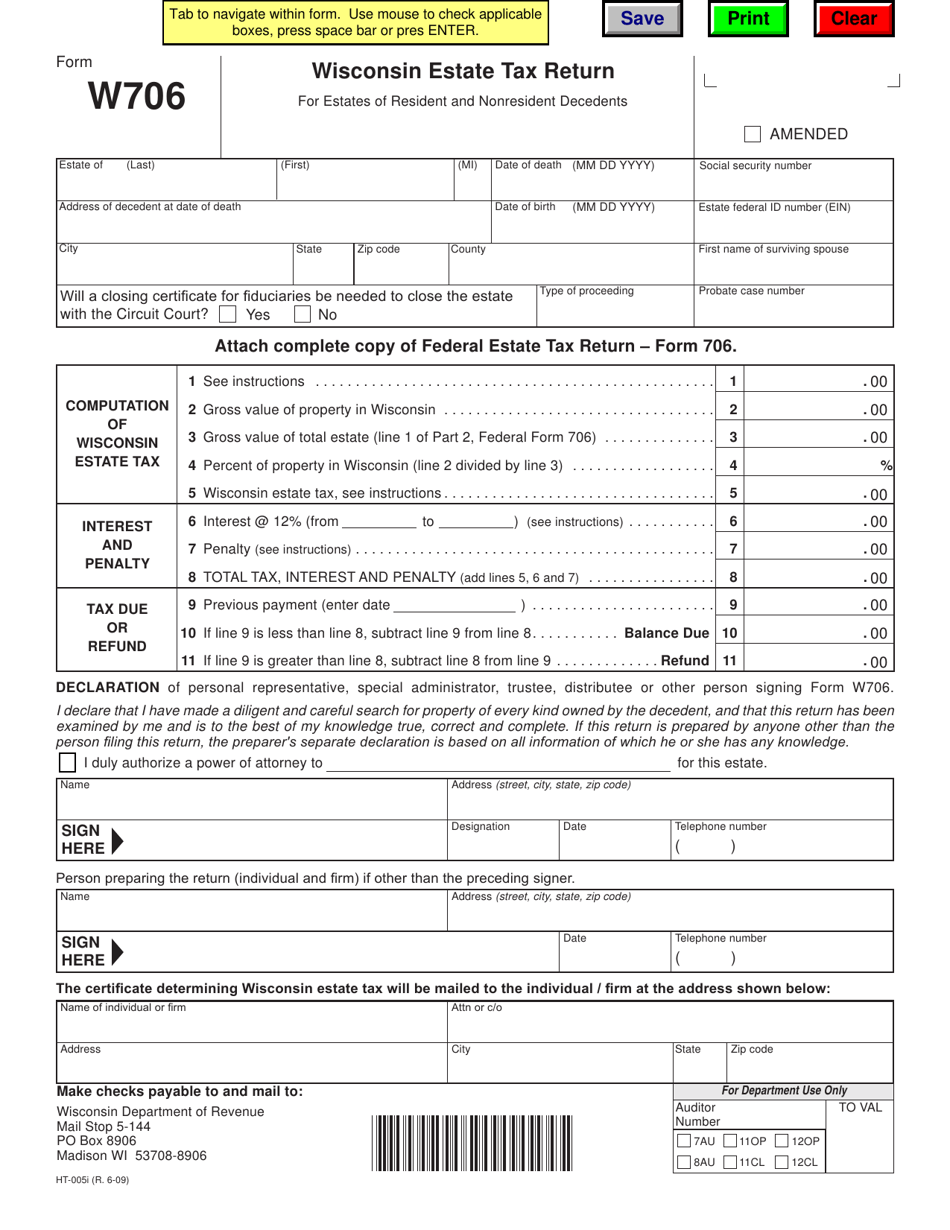

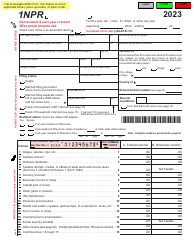

Form W706 (HT-005I) Wisconsin Estate Tax Return for Estates of Resident and Nonresident Decedents - Wisconsin

What Is Form W706 (HT-005I)?

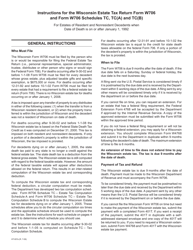

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form W706?

A: Form W706 is the Wisconsin Estate Tax Return for Estates of Resident and Nonresident Decedents.

Q: Who needs to file Form W706?

A: Form W706 needs to be filed by the estates of both resident and nonresident decedents in Wisconsin.

Q: What is the purpose of Form W706?

A: The purpose of Form W706 is to calculate and report any estate tax liability owed to the state of Wisconsin.

Q: Is Form W706 specific to Wisconsin?

A: Yes, Form W706 is specific to the state of Wisconsin.

Q: Are there any filing deadlines for Form W706?

A: Yes, Form W706 must be filed within nine months of the decedent's date of death.

Q: Are there any penalties for late filing of Form W706?

A: Yes, there may be penalties for late filing of Form W706, so it is important to file on time.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W706 (HT-005I) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.