Instructions for Form W706 Schedule TC, TC(A), TC(B) - Wisconsin

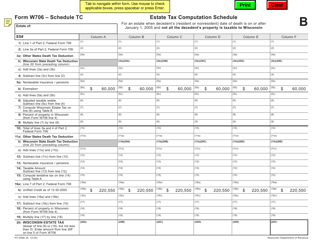

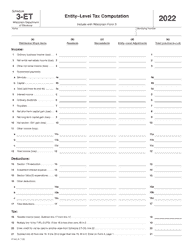

This document contains official instructions for Schedule TC , Schedule TC(A) , and Schedule TC(B) for Form W706 . . These documents are released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form W706 (HT-006) Schedule TC is available for download through this link.

FAQ

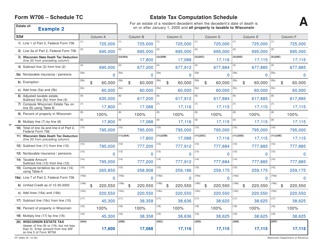

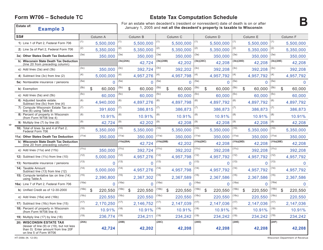

Q: What is Form W706 Schedule TC?

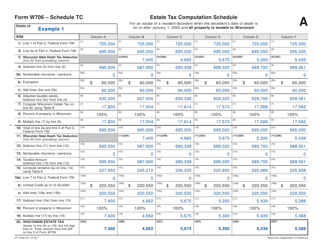

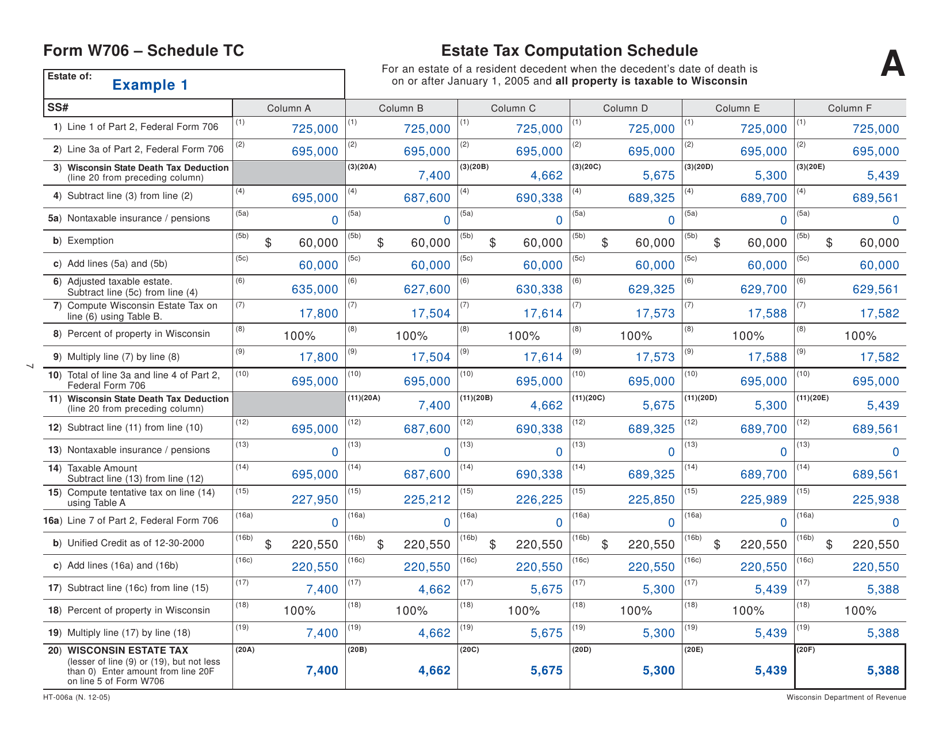

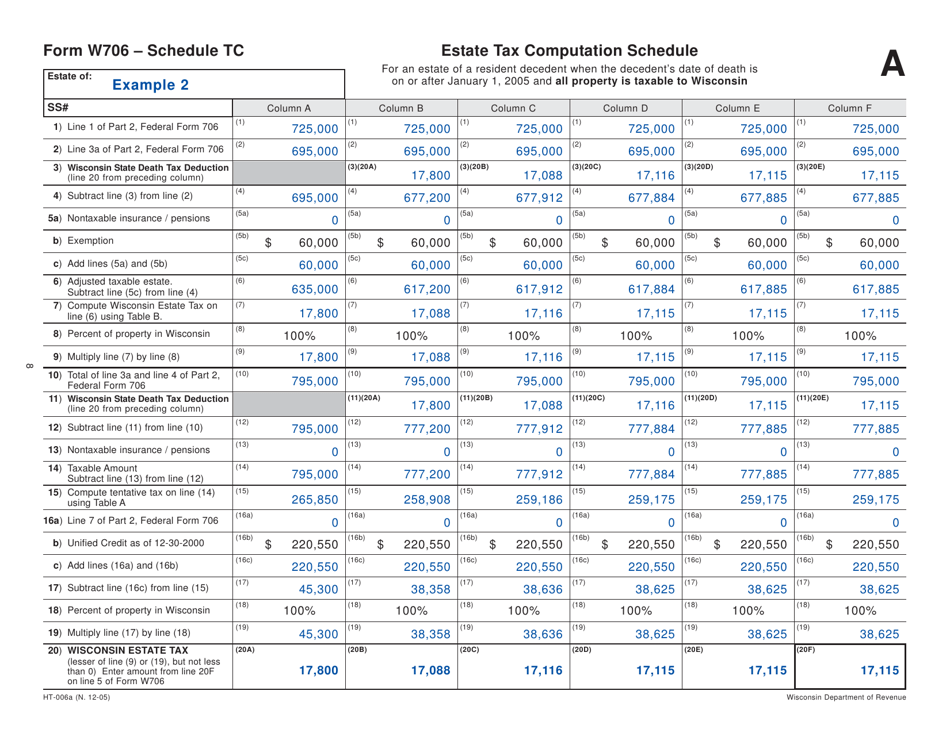

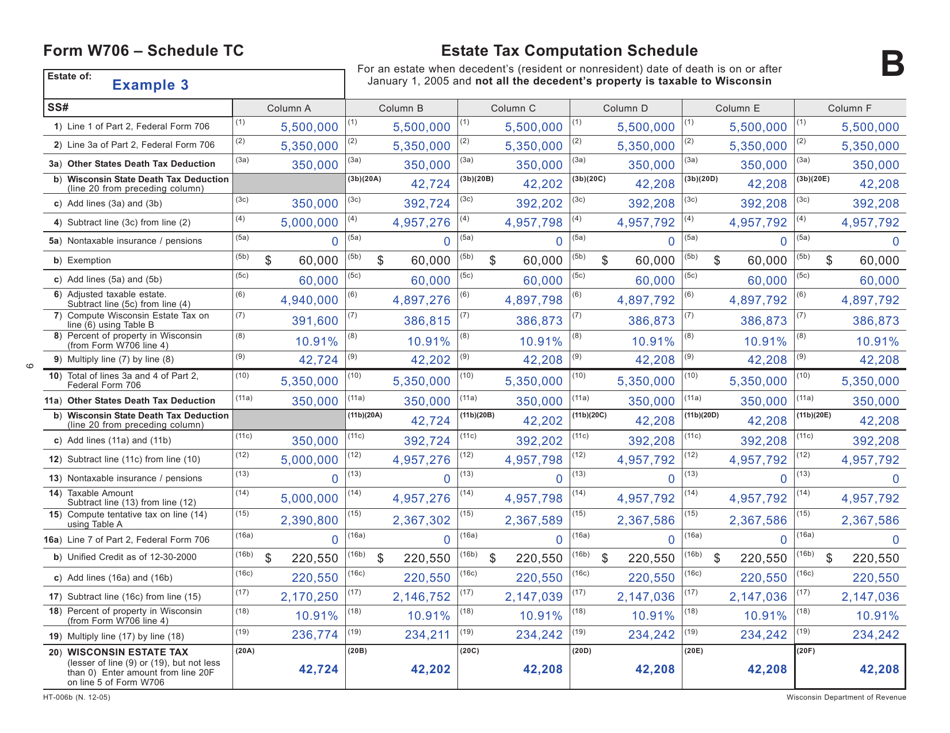

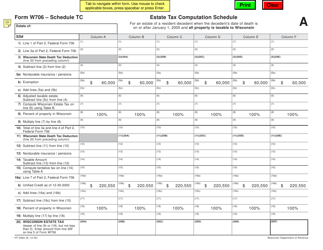

A: Form W706 Schedule TC is a schedule that is used in the state of Wisconsin to report information related to transfer of property and the calculation of the Wisconsin estate tax.

Q: What are TC, TC(A), and TC(B)?

A: TC, TC(A), and TC(B) are different versions of Form W706 Schedule TC. Each version is used based on the specific circumstances of the estate being reported.

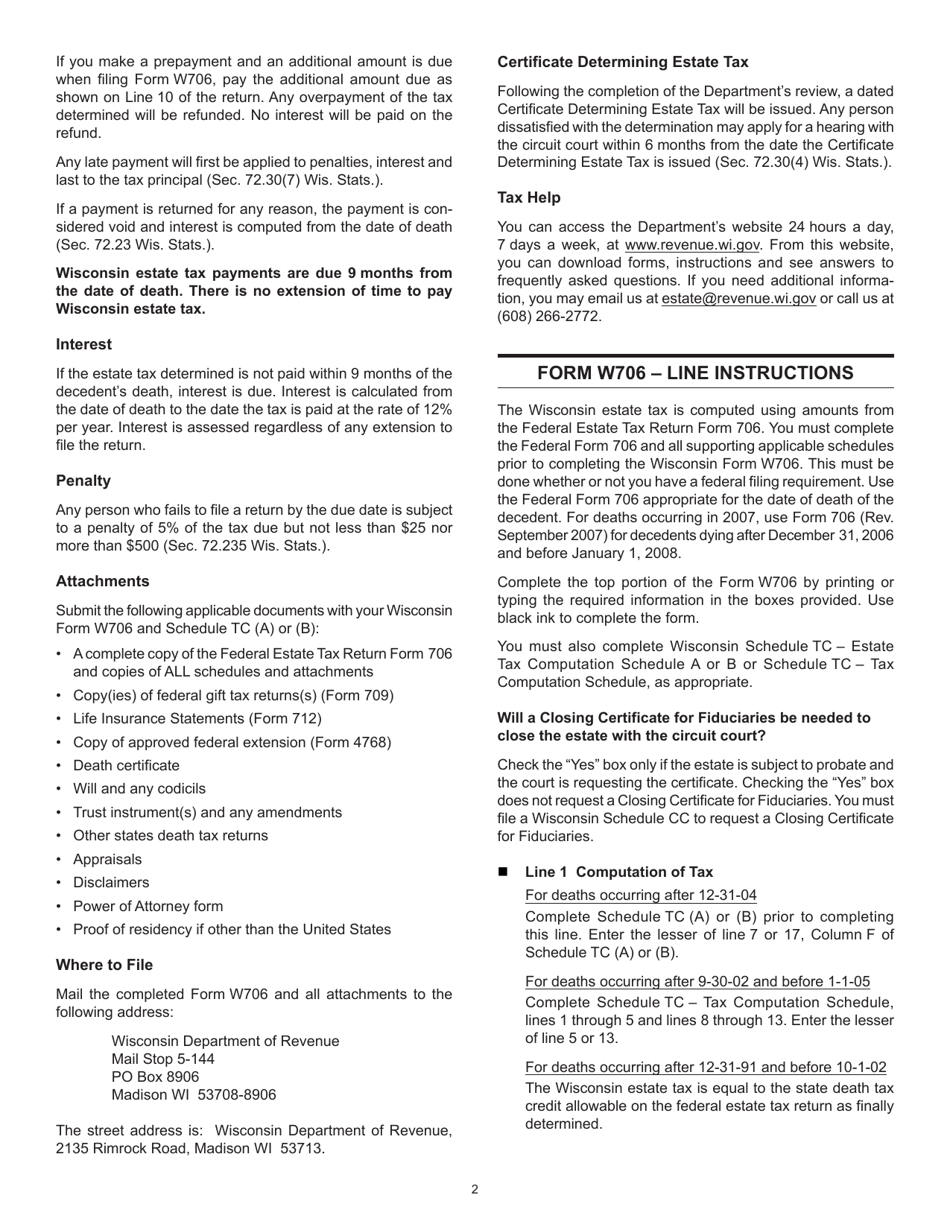

Q: Do I need to file Form W706 Schedule TC?

A: If you are filing Form W706 for the Wisconsin estate tax, you may also need to file Form W706 Schedule TC depending on the details of the estate.

Q: What information do I need to complete Form W706 Schedule TC?

A: To complete Form W706 Schedule TC, you will need information about the property being transferred, its value, and other details related to the estate.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.