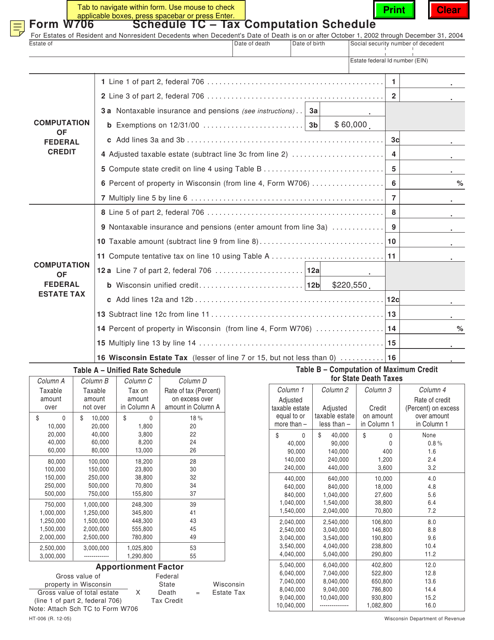

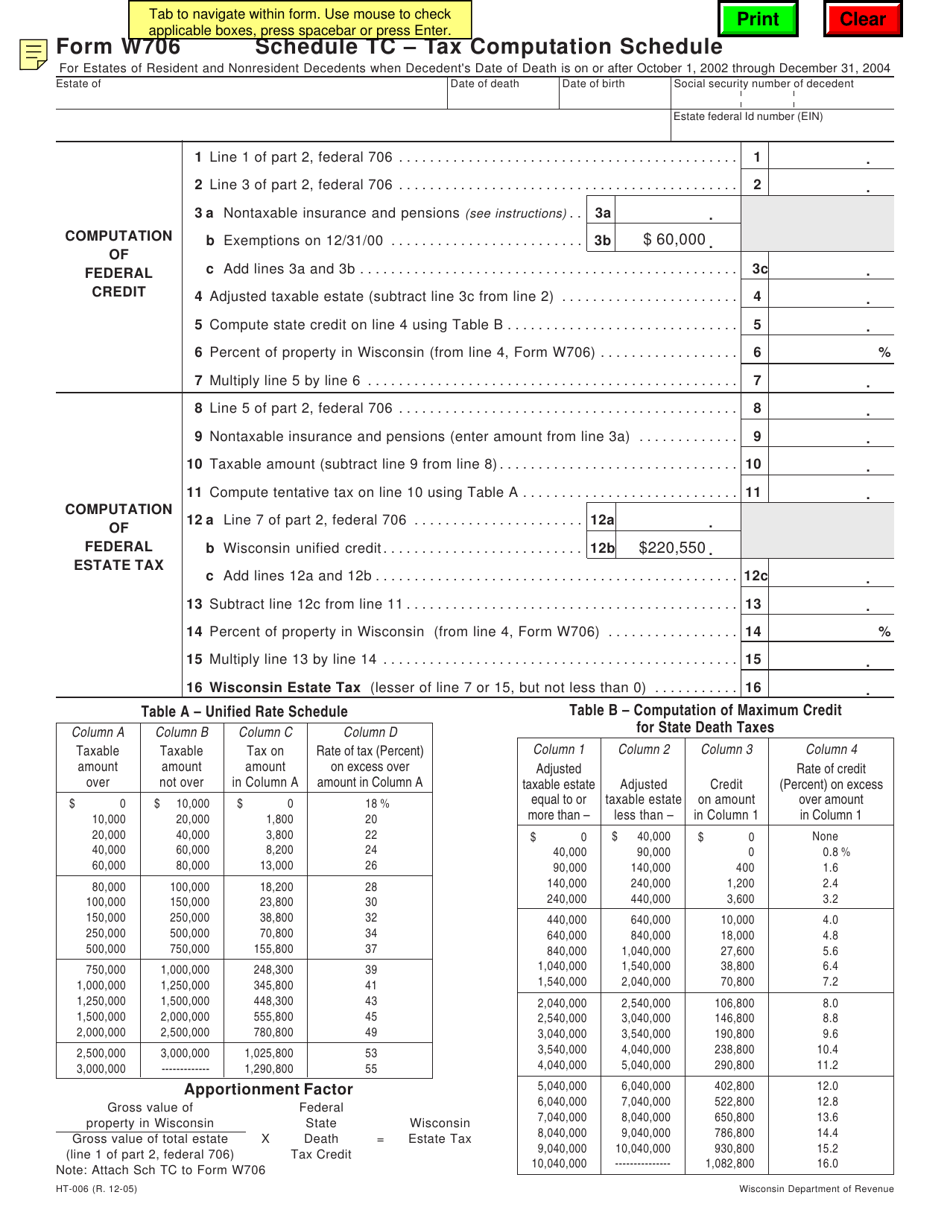

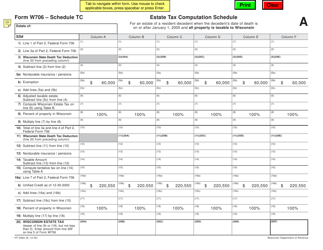

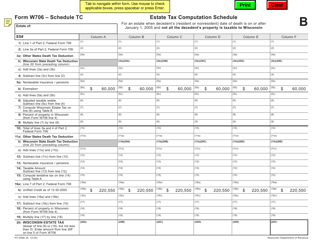

Form W706 (HT-006) Schedule TC Tax Computation Schedule for Deaths on or After October 1, 2002 Through December 31, 2004 - Wisconsin

What Is Form W706 (HT-006) Schedule TC?

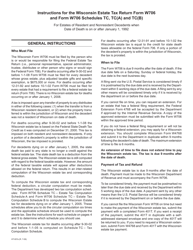

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin.The document is a supplement to Form W706, Wisconsin Estate Tax Return for Estates of Resident and Nonresident Decedents. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form W706 (HT-006)?

A: Form W706 (HT-006) is a schedule used for tax computation in Wisconsin for deaths that occurred between October 1, 2002, and December 31, 2004.

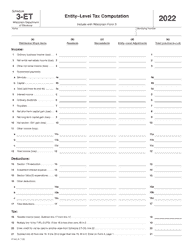

Q: What is the purpose of Schedule TC?

A: The purpose of Schedule TC is to calculate the applicable tax for estates in Wisconsin.

Q: Which time period does Schedule TC cover?

A: Schedule TC covers deaths that occurred between October 1, 2002, and December 31, 2004.

Q: Is Form W706 (HT-006) specific to Wisconsin?

A: Yes, Form W706 (HT-006) is specific to tax computation in Wisconsin.

Q: Who needs to fill out Schedule TC?

A: Schedule TC is to be filled out by the estates of individuals who passed away between October 1, 2002, and December 31, 2004, in Wisconsin.

Q: What is the significance of October 1, 2002, and December 31, 2004?

A: These dates mark the time period for which Schedule TC is applicable in Wisconsin.

Q: What information is required to complete Schedule TC?

A: To complete Schedule TC, you will need details about the estate's income, deductions, credits, and tax liability.

Q: Is Form W706 (HT-006) still applicable today?

A: No, Form W706 (HT-006) is specific to deaths that occurred between October 1, 2002, and December 31, 2004.

Form Details:

- Released on December 1, 2005;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W706 (HT-006) Schedule TC by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.