This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 1350

for the current year.

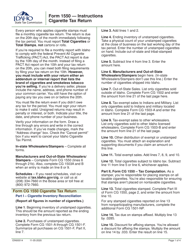

Instructions for Form 1350 Tobacco Tax Return - Idaho

This document contains official instructions for Form 1350 , Tobacco Tax Return - a form released and collected by the Idaho State Tax Commission.

FAQ

Q: What is Form 1350?

A: Form 1350 is the Tobacco Tax Return for Idaho.

Q: Who needs to file Form 1350?

A: Any individual or business engaged in the sale of tobacco products in Idaho needs to file Form 1350.

Q: When is Form 1350 due?

A: Form 1350 is due on the 20th day of the month following the reporting period.

Q: What information do I need to include on Form 1350?

A: You will need to provide information about the quantity and sales value of tobacco products sold, as well as any credit or exemptions claimed.

Q: Are there any penalties for late filing of Form 1350?

A: Yes, if you fail to file Form 1350 by the due date, you may be subject to penalties and interest charges.

Q: Is there an option for paper filing Form 1350?

A: Yes, you can also file Form 1350 by mail if you prefer.

Q: Are there any exemptions or credits available on Form 1350?

A: Yes, there are certain exemptions and credits available. You should refer to the instructions for Form 1350 for more information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Idaho State Tax Commission.