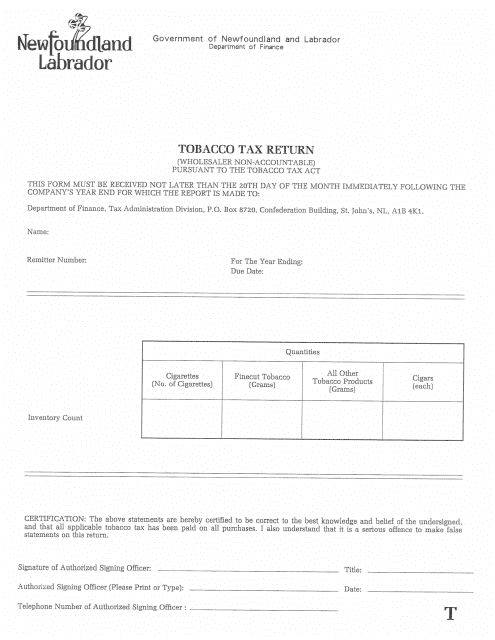

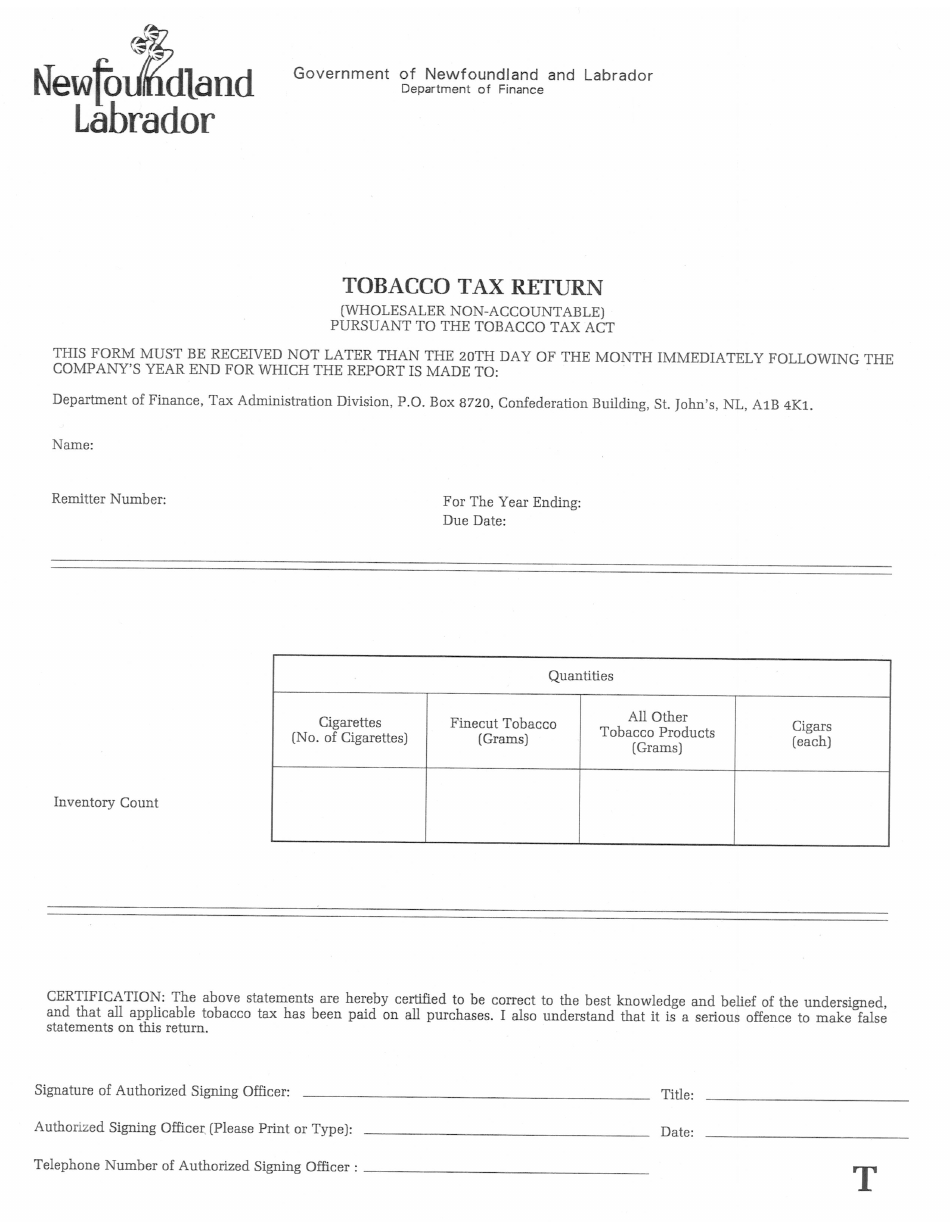

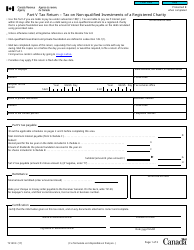

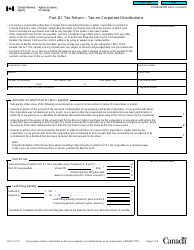

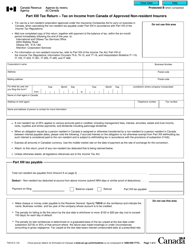

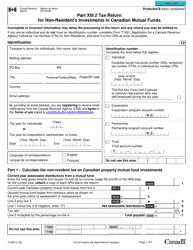

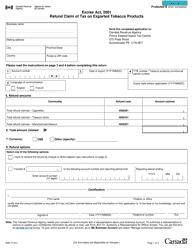

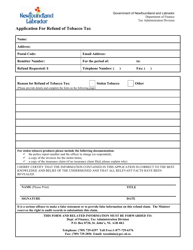

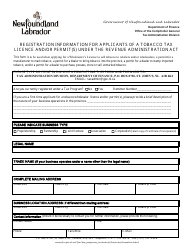

Form T Tobacco Tax Return (Wholesaler Non-accountable) - Newfoundland and Labrador, Canada

Form T Tobacco Tax Return (Wholesaler Non-accountable) in Newfoundland and Labrador, Canada is used by wholesaler businesses to report and remit taxes on tobacco products. It is specifically for wholesalers who are not accountable for the taxes collected from the sale of tobacco products.

The Form T Tobacco Tax Return (Wholesaler Non-accountable) in Newfoundland and Labrador, Canada is filed by wholesalers who are not accountable for the tobacco tax.

FAQ

Q: What is Form T?

A: Form T is the Tobacco Tax Return (Wholesaler Non-accountable) in Newfoundland and Labrador, Canada.

Q: Who needs to file Form T?

A: Wholesalers who are non-accountable for tobacco taxes in Newfoundland and Labrador, Canada need to file Form T.

Q: What is the purpose of Form T?

A: Form T is used to report and remit tobacco taxes for wholesalers who are non-accountable for tobacco taxes in Newfoundland and Labrador, Canada.

Q: How often do I need to file Form T?

A: Form T should be filed on a monthly basis, with the return and payment due by the 20th day of the following month.

Q: What information is required on Form T?

A: Form T requires information on the wholesaler's name, address, tobacco product category, volume of tobacco products sold, and the amount of tobacco tax due.

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment of tobacco taxes, including a late filing penalty and an interest charge on unpaid amounts.