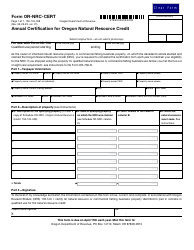

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-104-003 Schedule OR-NRC

for the current year.

Instructions for Form 150-104-003 Schedule OR-NRC Oregon Natural Resource Credit - Oregon

This document contains official instructions for Form 150-104-003 Schedule OR-NRC, Oregon Natural Resource Credit - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-104-003 Schedule OR-NRC is available for download through this link.

FAQ

Q: What is Form 150-104-003 Schedule OR-NRC?

A: Form 150-104-003 Schedule OR-NRC is a tax form in Oregon used to claim the Oregon Natural Resource Credit.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit in Oregon designed to encourage conservation and land stewardship.

Q: Who can claim the Oregon Natural Resource Credit?

A: Individuals and businesses who have made qualifying expenditures on eligible natural resource projects in Oregon can claim the credit.

Q: What types of projects qualify for the Oregon Natural Resource Credit?

A: Projects that enhance water quality, restore streams, promote wildlife habitat, conserve wetlands, or protect working forests may qualify for the credit.

Q: How much is the Oregon Natural Resource Credit?

A: The amount of the credit is equal to a percentage of the eligible expenditures made on the qualifying projects.

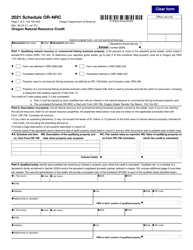

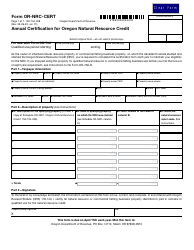

Q: How do I fill out Form 150-104-003 Schedule OR-NRC?

A: You will need to provide information about your eligible expenditures and the details of the qualifying projects on the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.