This version of the form is not currently in use and is provided for reference only. Download this version of

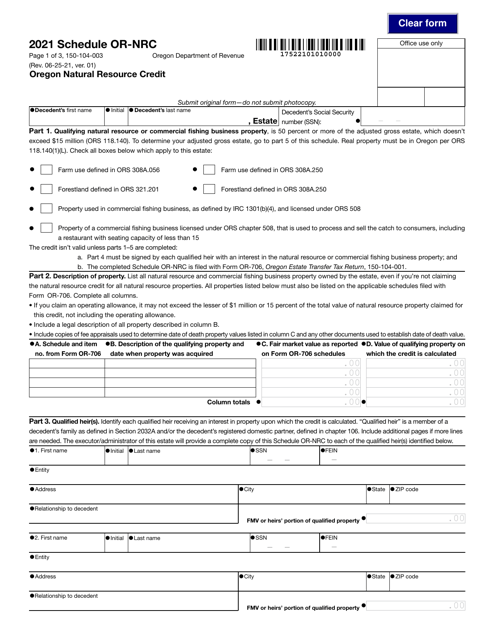

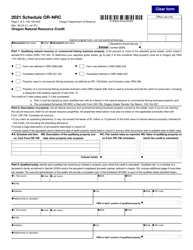

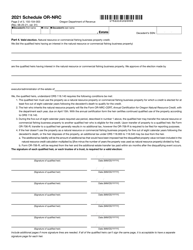

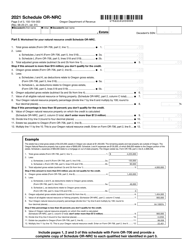

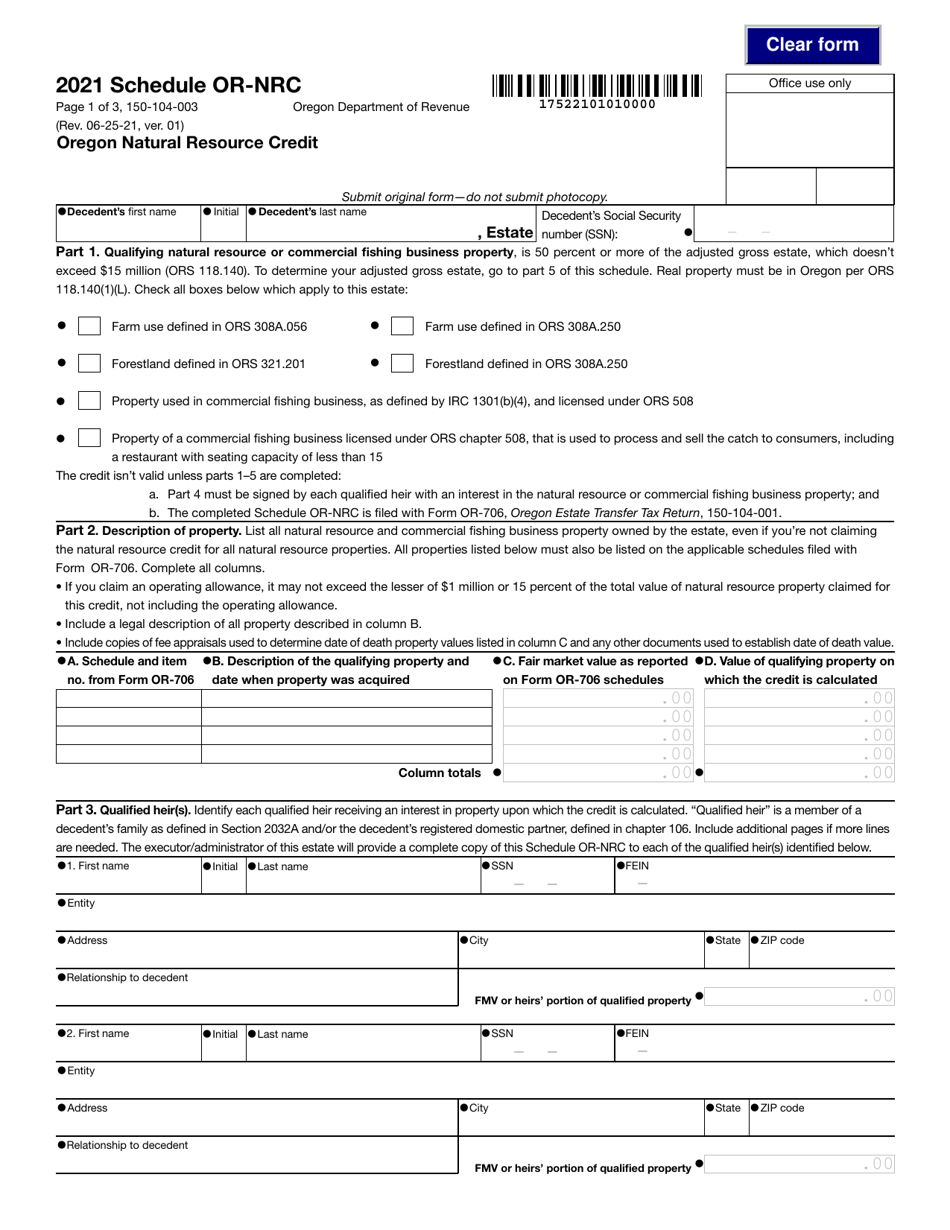

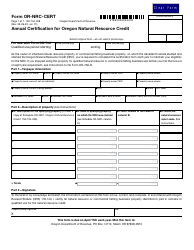

Form 150-104-003 Schedule OR-NRC

for the current year.

Form 150-104-003 Schedule OR-NRC Oregon Natural Resource Credit - Oregon

What Is Form 150-104-003 Schedule OR-NRC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-104-003?

A: Form 150-104-003 is the schedule for claiming the Oregon Natural Resource Credit in the state of Oregon.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit available to individuals and businesses in Oregon who have made qualified investments in natural resource property.

Q: Who is eligible to claim the Oregon Natural Resource Credit?

A: Individuals and businesses in Oregon who have made qualified investments in natural resource property are eligible to claim the Oregon Natural Resource Credit.

Q: What is natural resource property?

A: Natural resource property refers to land or water resources that are used for commercial purposes such as farming, fishing, mining, or timber operations.

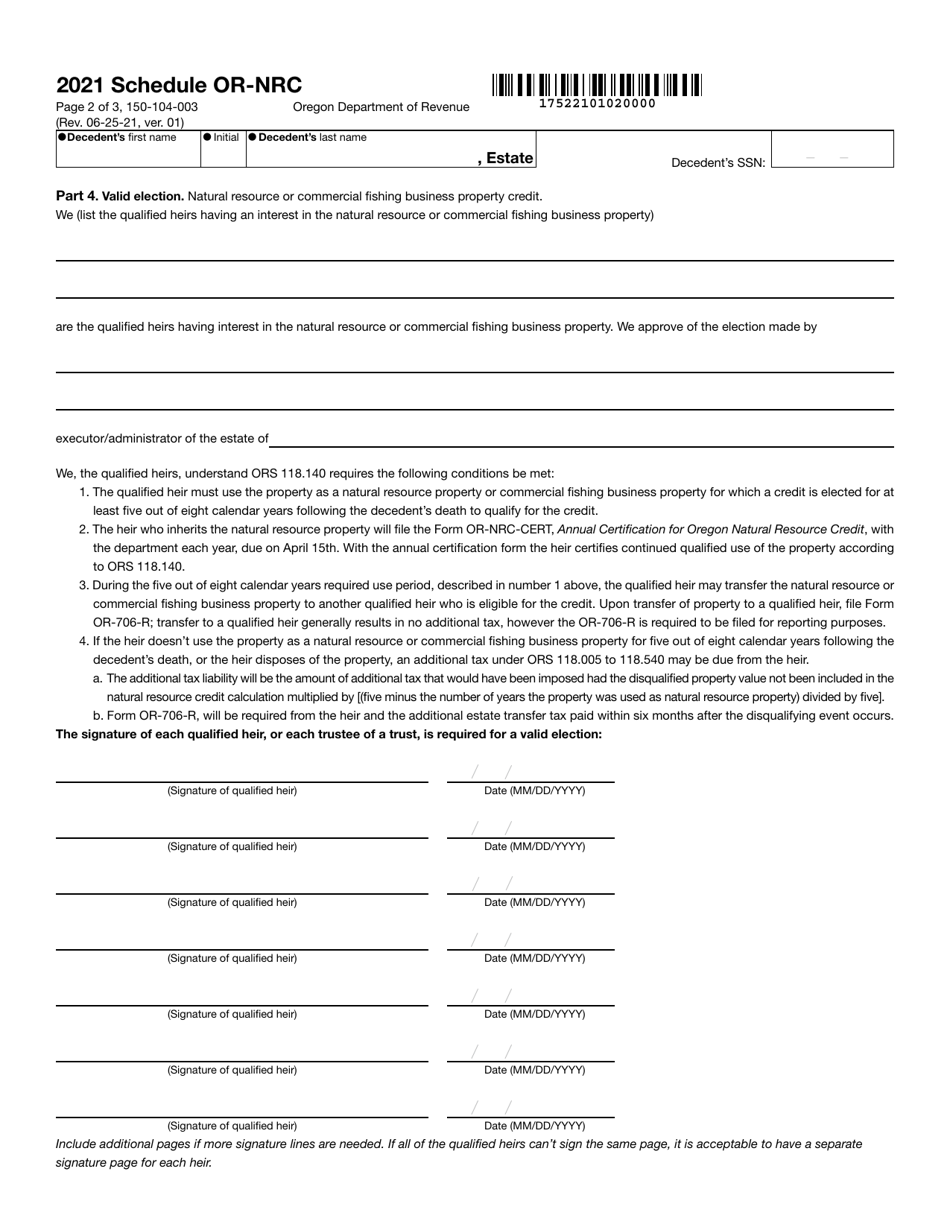

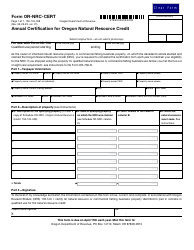

Q: How do I claim the Oregon Natural Resource Credit?

A: To claim the Oregon Natural Resource Credit, you need to complete Form 150-104-003 and attach it to your Oregon tax return.

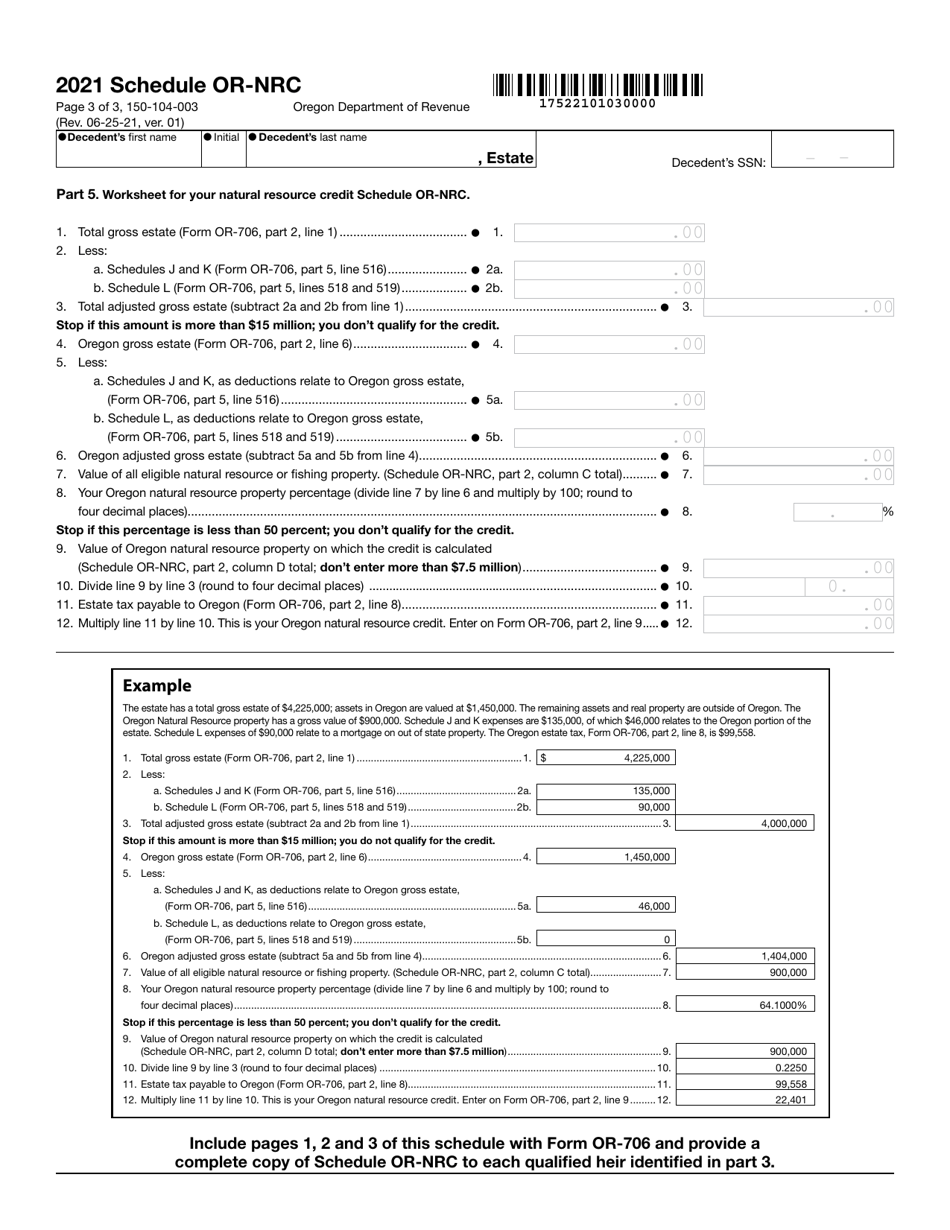

Q: What information do I need to complete Form 150-104-003?

A: To complete Form 150-104-003, you will need information about your qualified investments in natural resource property, including the amount invested and the tax year of the investment.

Q: Is there a deadline for claiming the Oregon Natural Resource Credit?

A: Yes, the deadline for claiming the Oregon Natural Resource Credit is the same as the deadline for filing your Oregon tax return.

Q: How much is the Oregon Natural Resource Credit?

A: The amount of the Oregon Natural Resource Credit depends on the qualified investments you have made in natural resource property. The credit is generally a percentage of the investment amount.

Q: Can the Oregon Natural Resource Credit be carried forward or transferred?

A: Yes, unused Oregon Natural Resource Credit can be carried forward for up to five years or transferred to another individual or business.

Form Details:

- Released on June 25, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-104-003 Schedule OR-NRC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.