This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form OR-706, 150-104-001

for the current year.

Instructions for Form OR-706, 150-104-001 Oregon Estate Transfer Tax Return - Oregon

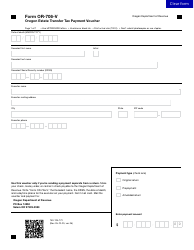

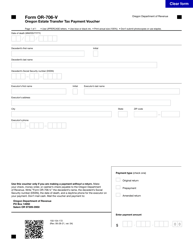

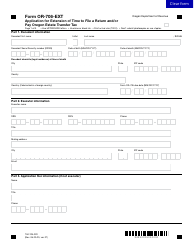

This document contains official instructions for Form OR-706 , and Form 150-104-001 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-706 (150-104-001) is available for download through this link.

FAQ

Q: What is Form OR-706?

A: Form OR-706 is the Oregon Estate Transfer Tax Return.

Q: Who needs to file Form OR-706?

A: Anyone who is the personal representative of a decedent's estate and is required to file a federal Form 706 needs to file Form OR-706 in Oregon.

Q: What is the purpose of Form OR-706?

A: Form OR-706 is used to report and pay the Oregon estate transfer tax.

Q: When is Form OR-706 due?

A: Form OR-706 is due nine months after the date of the decedent's death.

Q: What information is required on Form OR-706?

A: Form OR-706 requires information about the decedent, the estate's assets and liabilities, and the calculation of the estate transfer tax.

Q: Are there any exemptions or deductions on Form OR-706?

A: Yes, there are certain exemptions and deductions available on Form OR-706, such as the unlimited marital deduction and charitable deductions.

Q: What happens if I don't file Form OR-706 on time?

A: If Form OR-706 is not filed on time, penalties and interest may be assessed.

Q: Can I e-file Form OR-706?

A: No, currently Form OR-706 cannot be e-filed and must be filed by mail.

Instruction Details:

- This 10-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.