This version of the form is not currently in use and is provided for reference only. Download this version of

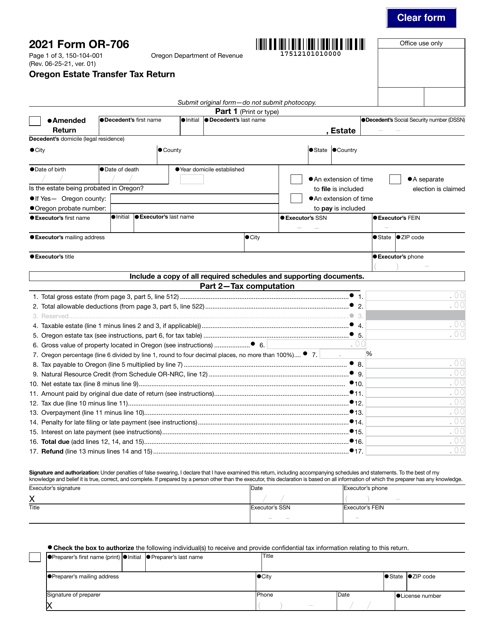

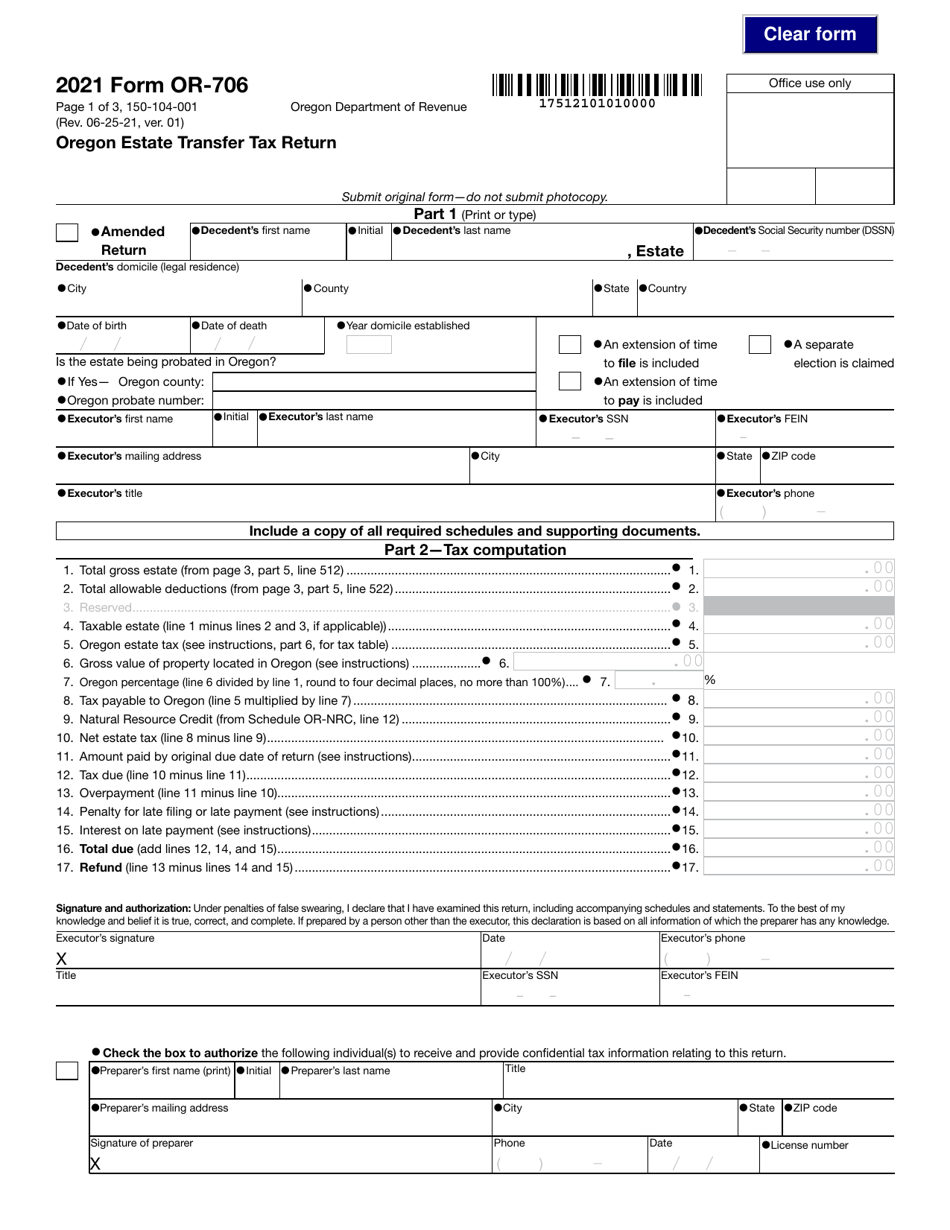

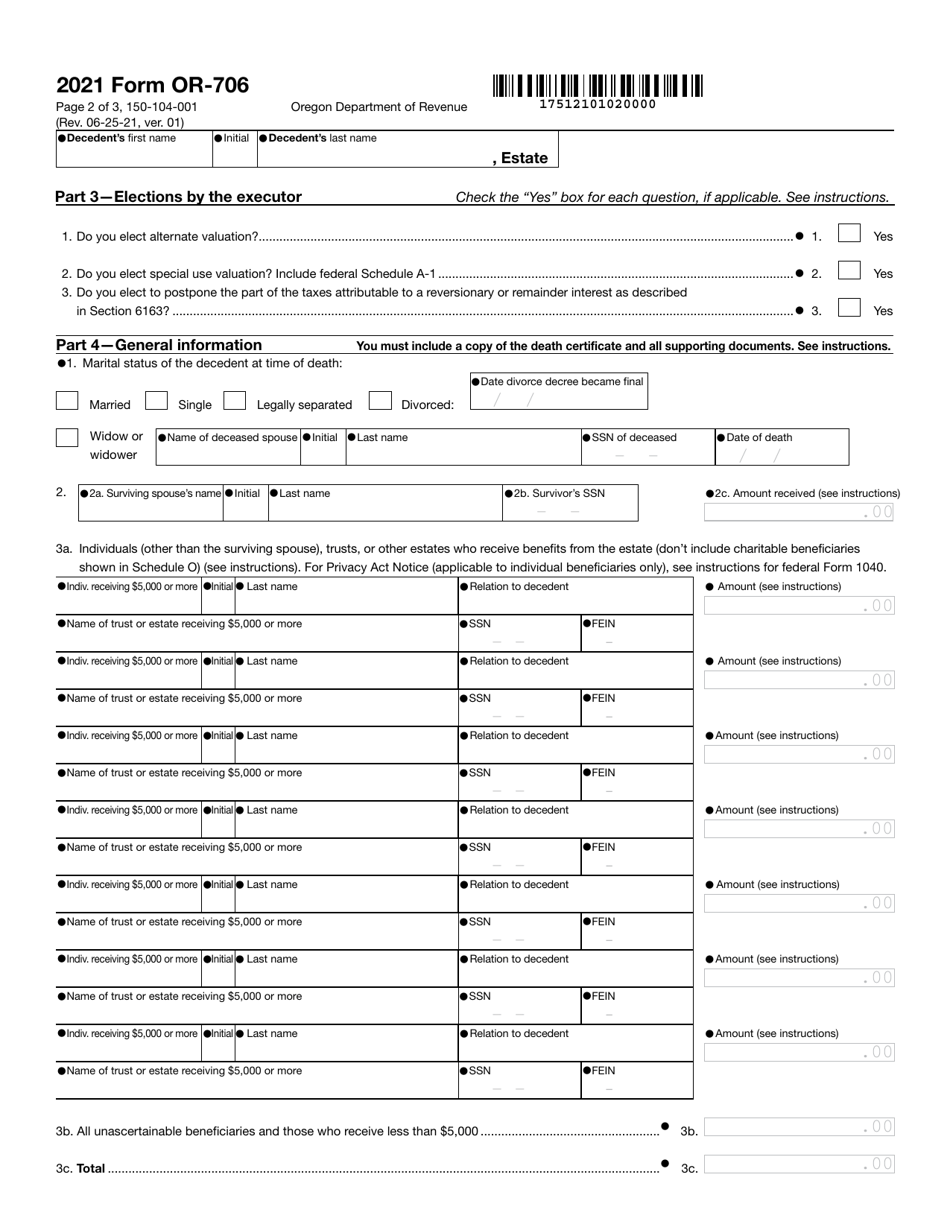

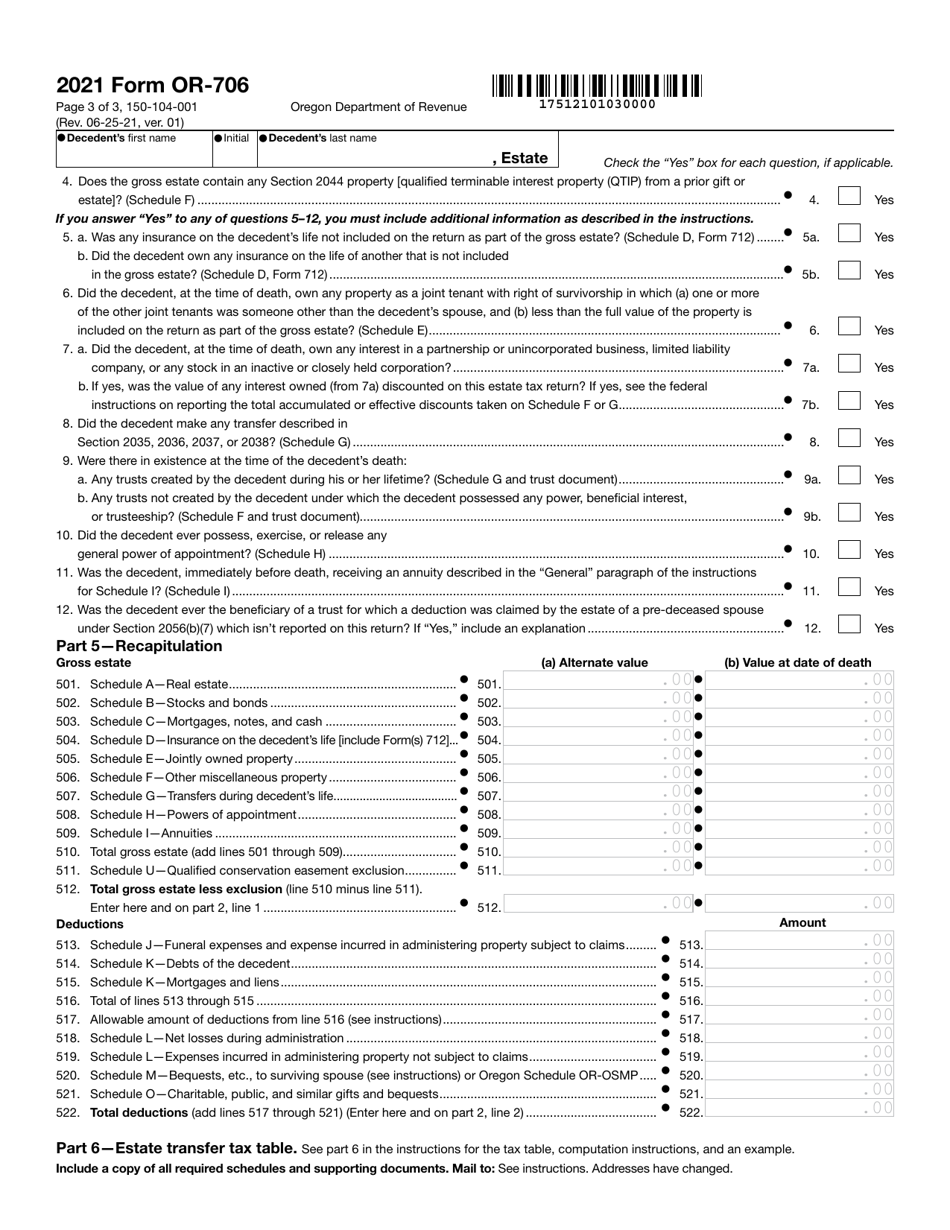

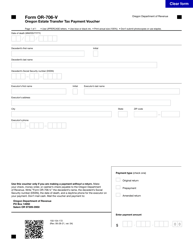

Form OR-706 (150-104-001)

for the current year.

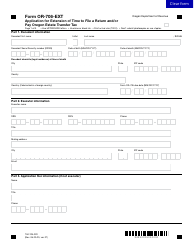

Form OR-706 (150-104-001) Oregon Estate Transfer Tax Return - Oregon

What Is Form OR-706 (150-104-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-706?

A: Form OR-706 is the Oregon Estate Transfer Tax Return.

Q: Who needs to file Form OR-706?

A: Form OR-706 needs to be filed by the personal representative of an estate when someone passes away and their estate is subject to Oregon estate transfer tax.

Q: What is the purpose of Form OR-706?

A: The purpose of Form OR-706 is to calculate and report any Oregon estate transfer tax owed by the estate.

Q: What information do I need to complete Form OR-706?

A: To complete Form OR-706, you will need information about the decedent's assets, deductions, and beneficiaries.

Q: When is Form OR-706 due?

A: Form OR-706 is due within nine months after the decedent's date of death.

Q: Are there any filing fees for Form OR-706?

A: Yes, there is a filing fee for Form OR-706. The fee amount depends on the value of the estate.

Q: Can I file Form OR-706 electronically?

A: No, at this time, you cannot file Form OR-706 electronically. It must be filed by mail.

Form Details:

- Released on June 25, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706 (150-104-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.