This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 3

for the current year.

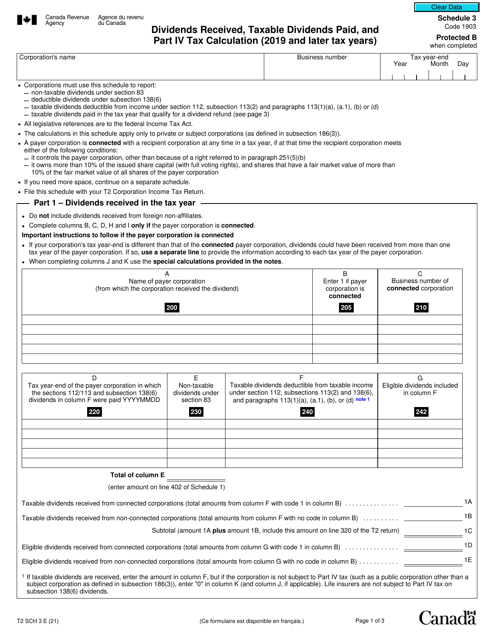

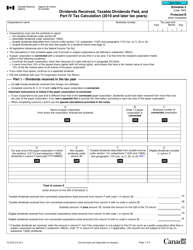

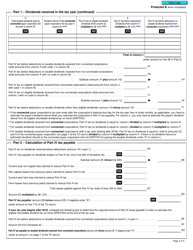

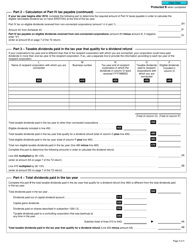

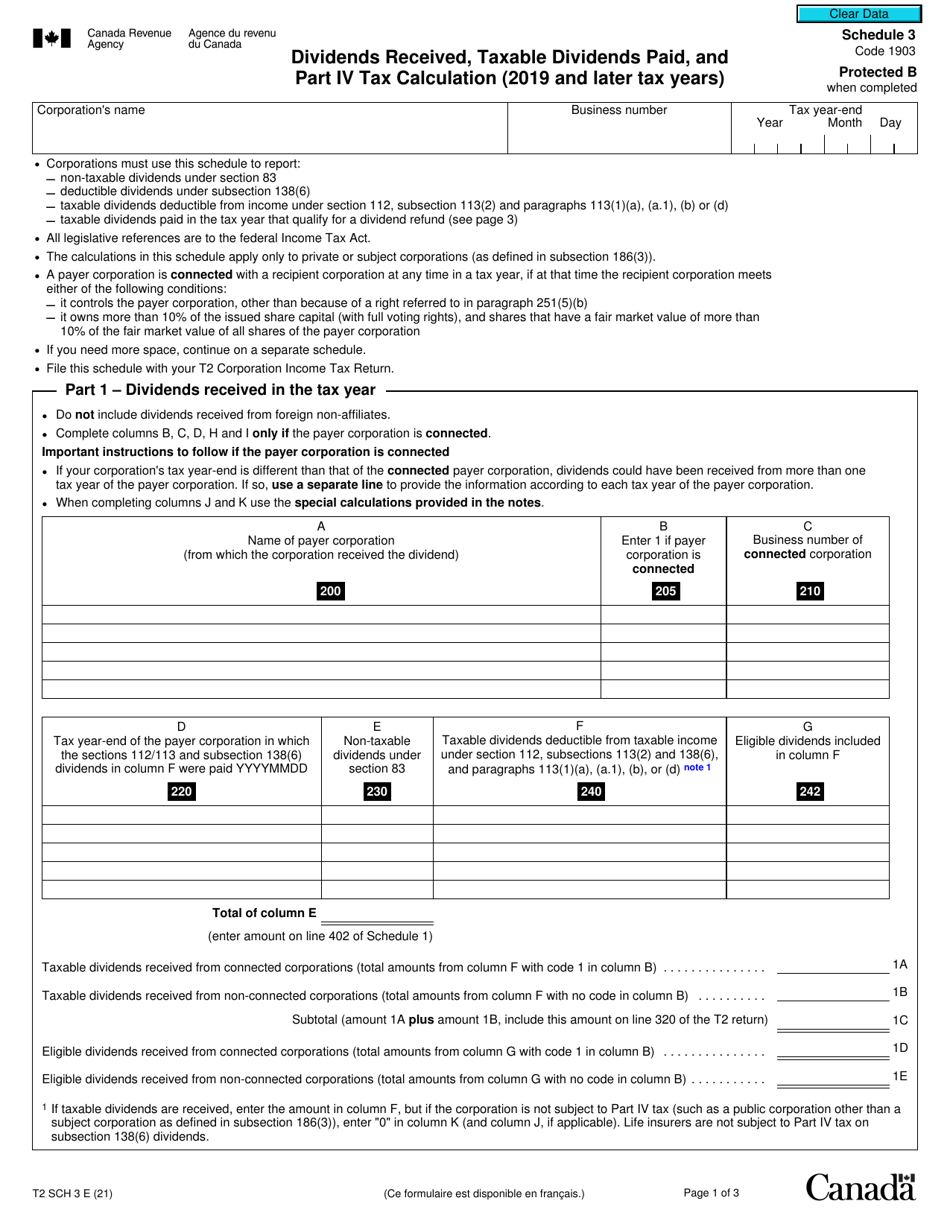

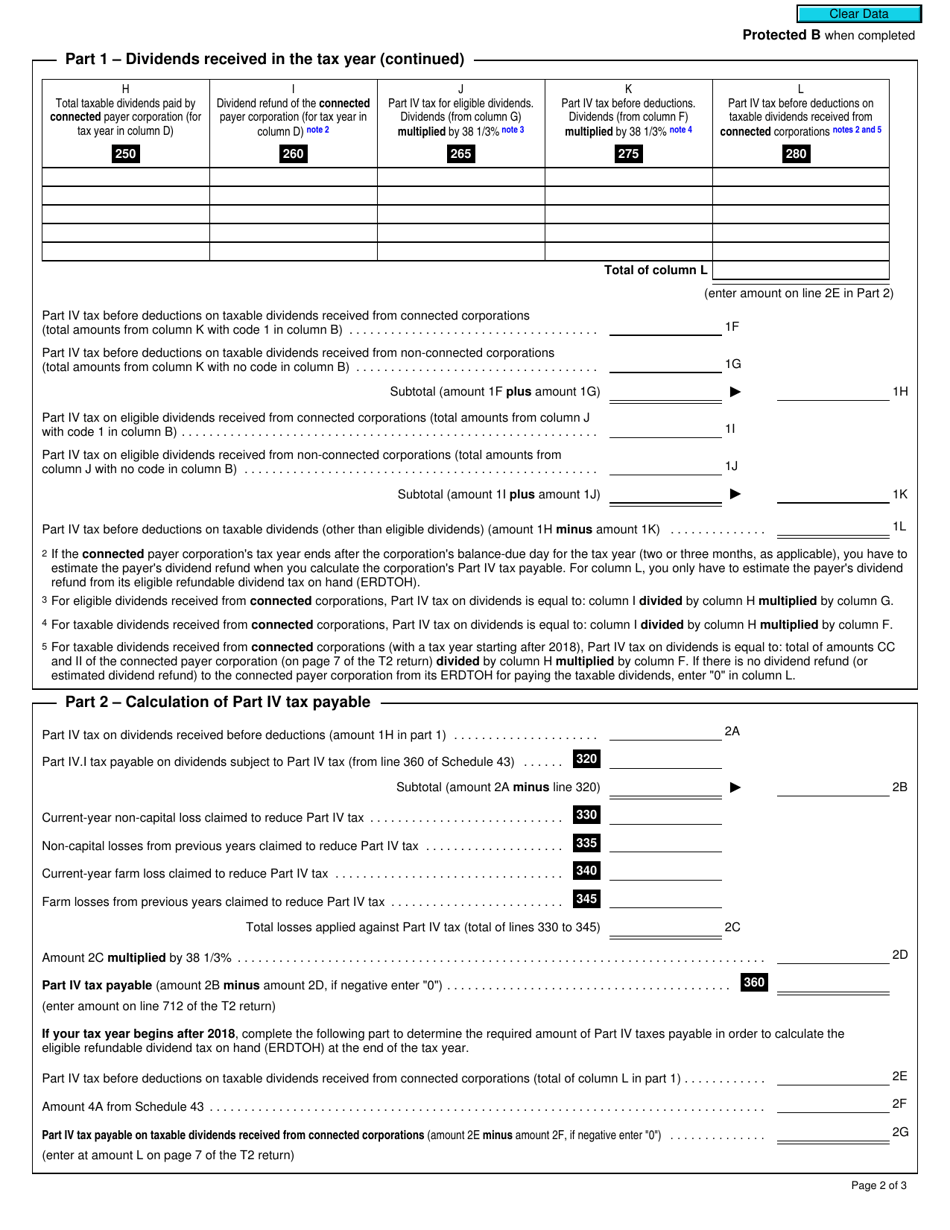

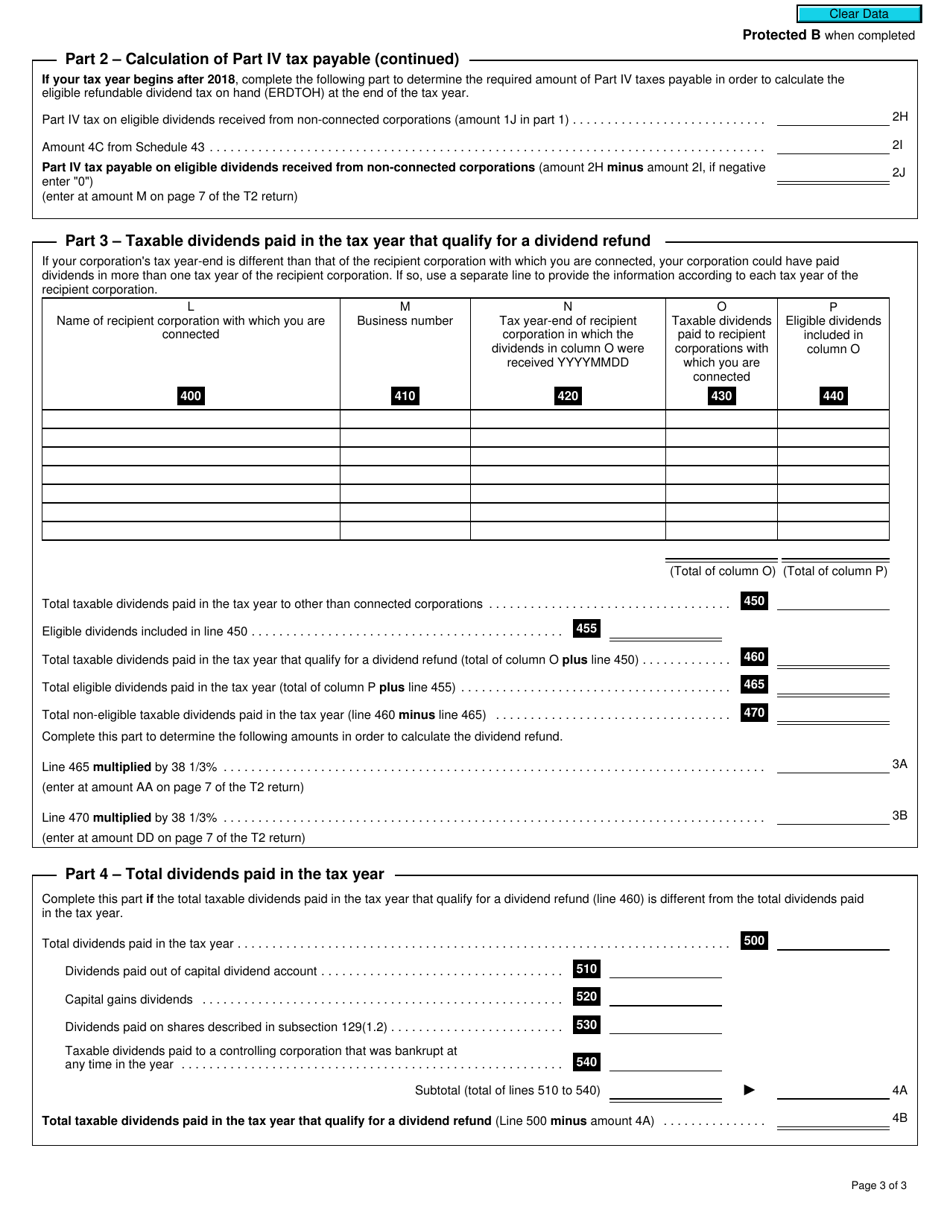

Form T2 Schedule 3 Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 3 is used in Canada to report and calculate dividends received, taxable dividends paid, and Part IV tax. It is used by corporations to determine their tax liability related to dividends.

The Form T2 Schedule 3 "Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation" is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 3?

A: Form T2 Schedule 3 is a tax form used in Canada for reporting dividends received, taxable dividends paid, and for calculating Part IV Tax.

Q: Who needs to file Form T2 Schedule 3?

A: Corporations in Canada need to file Form T2 Schedule 3 if they have received or paid dividends and need to calculate Part IV Tax.

Q: What information is reported on Form T2 Schedule 3?

A: Form T2 Schedule 3 is used to report the amounts of dividends received, taxable dividends paid, and to calculate Part IV Tax.

Q: Why is it important to file Form T2 Schedule 3?

A: Filing Form T2 Schedule 3 is important for accurate reporting of dividends received and paid, and for calculating the correct Part IV Tax amount.

Q: How do I fill out Form T2 Schedule 3?

A: You need to enter the required information on Form T2 Schedule 3, including the amounts of dividends received, taxable dividends paid, and calculate the Part IV Tax.

Q: Is there a deadline for filing Form T2 Schedule 3?

A: Yes, the deadline for filing Form T2 Schedule 3 is the same as the filing deadline for the corporation’s tax return, which is usually six months after the end of the corporation's fiscal year.

Q: Can I file Form T2 Schedule 3 electronically?

A: Yes, Form T2 Schedule 3 can be filed electronically using the Corporation Internet Filing service.

Q: What happens if I don't file Form T2 Schedule 3?

A: Failure to file Form T2 Schedule 3 or any required tax forms may result in penalties and interest charges from the Canada Revenue Agency.