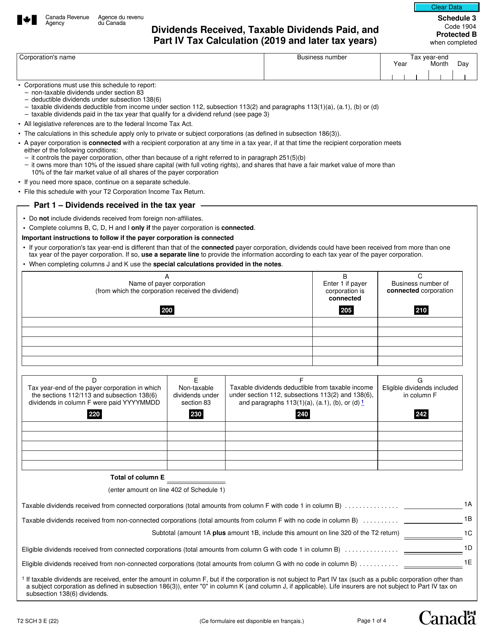

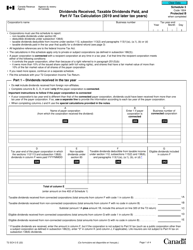

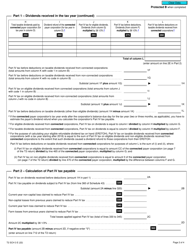

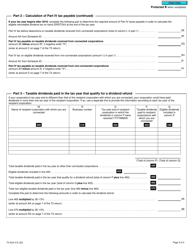

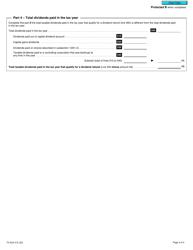

Form T2 Schedule 3 Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 3 Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation (2019 and Later Tax Years) is used by Canadian corporations to report dividends received, taxable dividends paid, and calculate Part IV tax for the specified tax years.

The corporation that has received or paid dividends and needs to calculate Part IV tax will file the Form T2 Schedule 3 Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation in Canada.

Form T2 Schedule 3 Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation (2019 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 3?

A: Form T2 Schedule 3 is a tax form used in Canada for reporting dividends received and taxable dividends paid.

Q: What is the purpose of Form T2 Schedule 3?

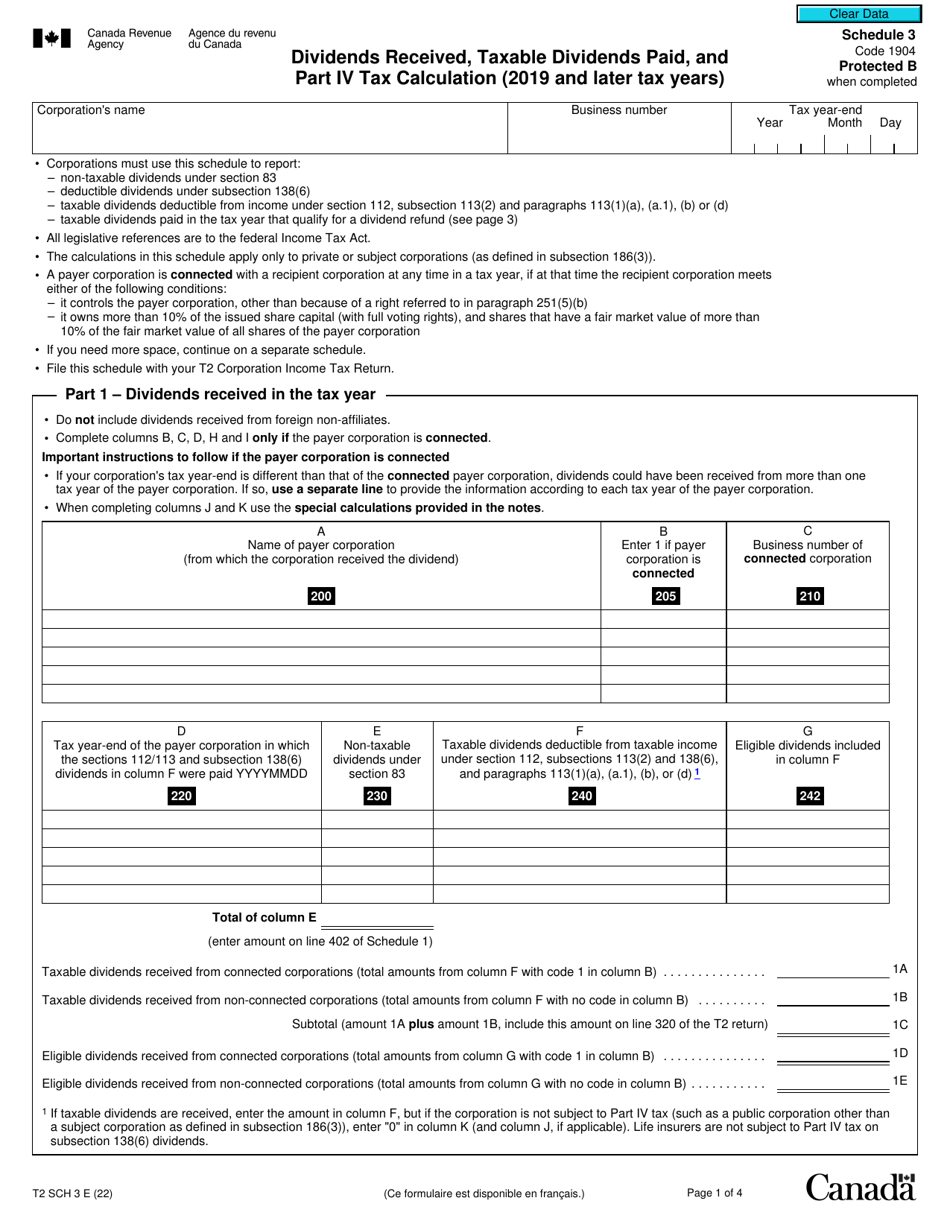

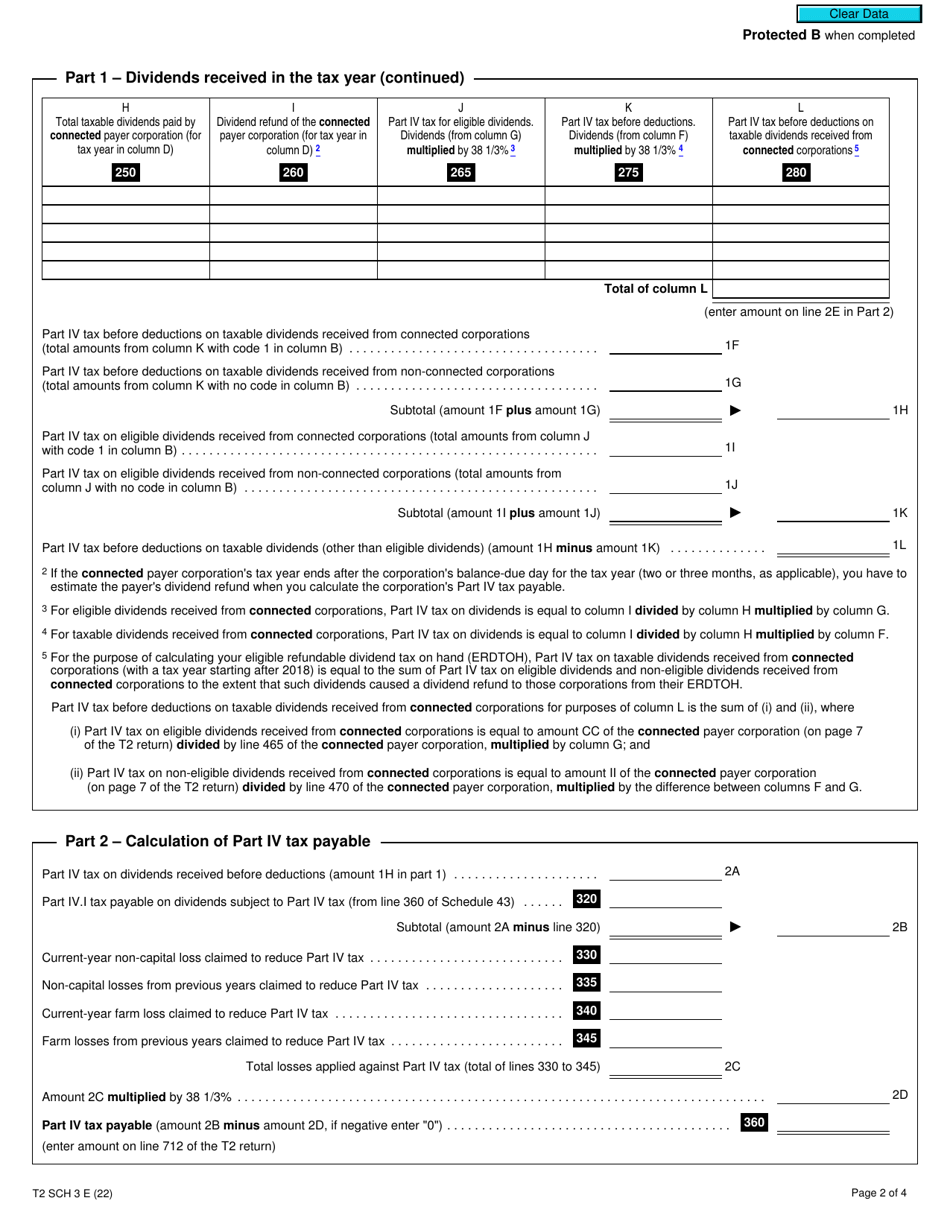

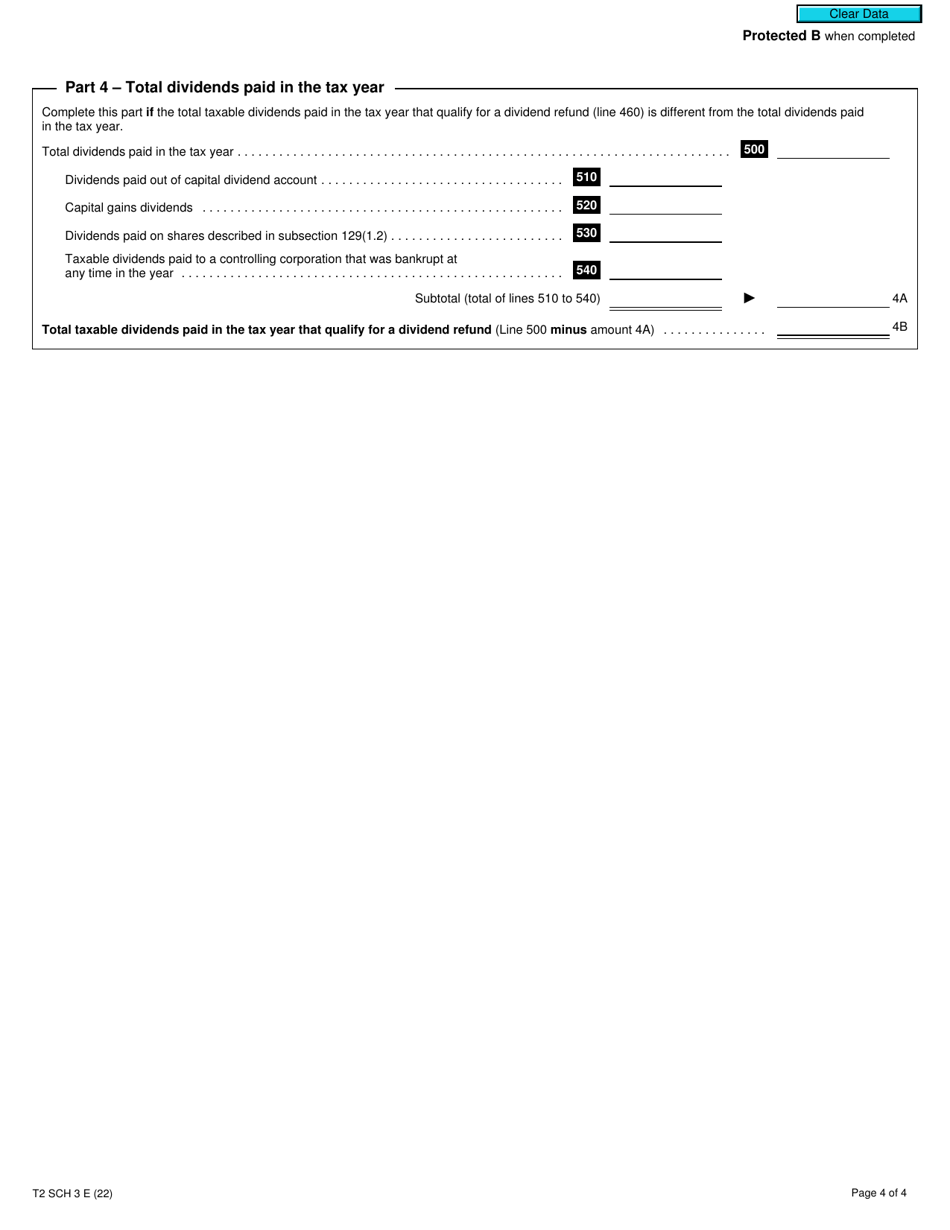

A: The purpose of Form T2 Schedule 3 is to calculate the Part IV tax on dividends received and taxable dividends paid.

Q: When should Form T2 Schedule 3 be filed?

A: Form T2 Schedule 3 should be filed with the Canadian tax return for the applicable tax year.

Q: What information is required on Form T2 Schedule 3?

A: Form T2 Schedule 3 requires information on the dividends received, taxable dividends paid, and other details relevant to the Part IV tax calculation.

Q: Can Form T2 Schedule 3 be filed for tax years before 2019?

A: No, Form T2 Schedule 3 is specifically for tax years 2019 and later.