This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4615

for the current year.

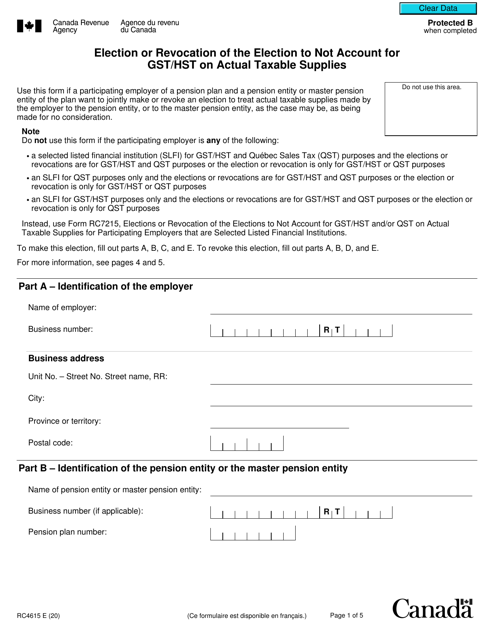

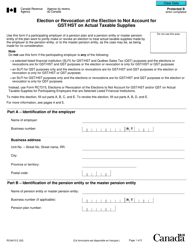

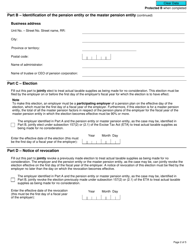

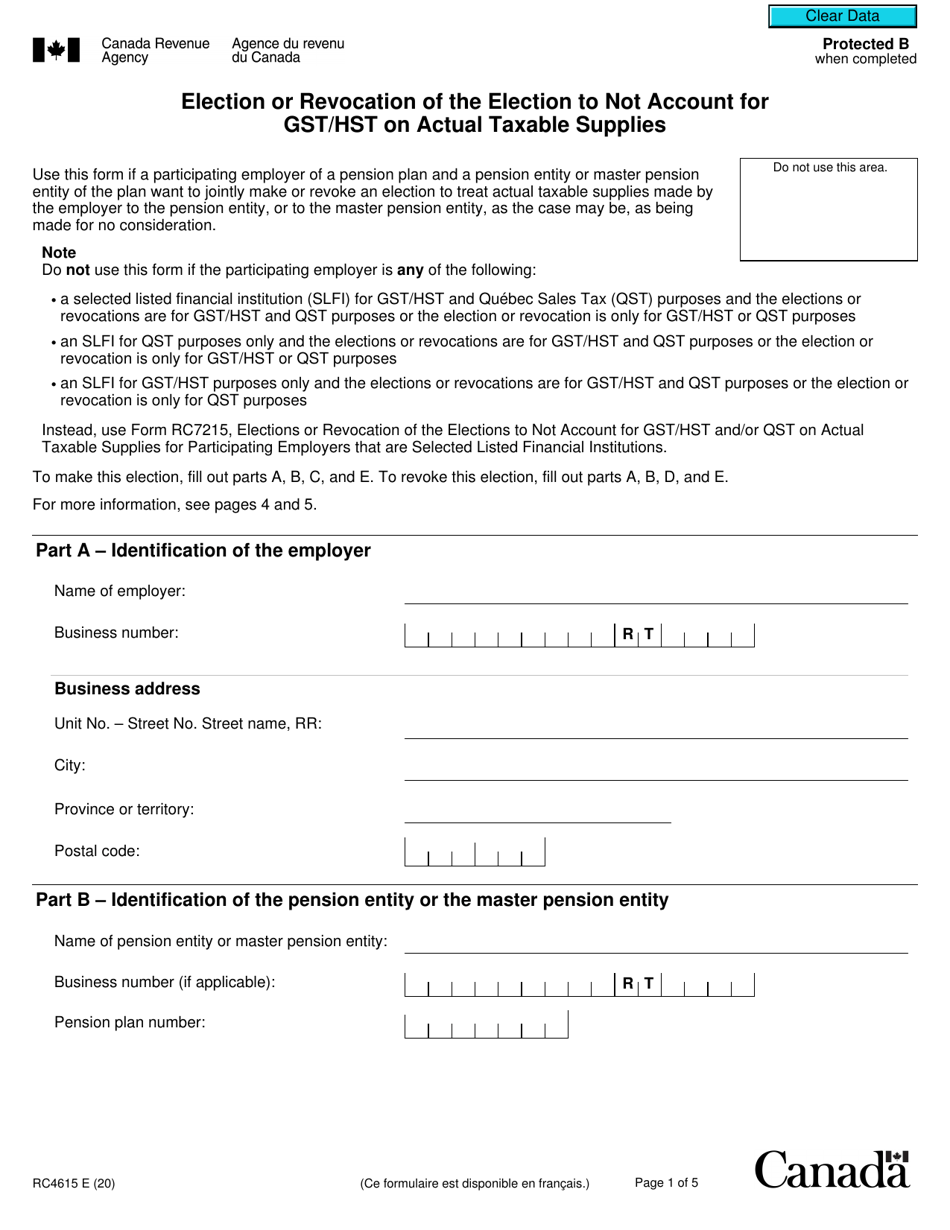

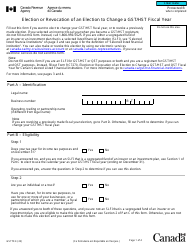

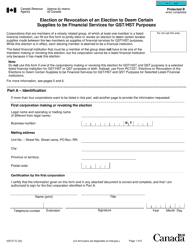

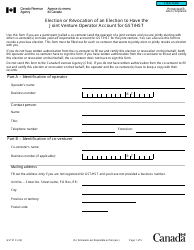

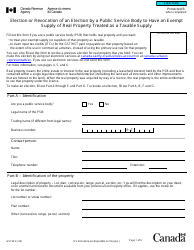

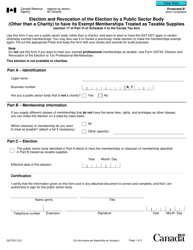

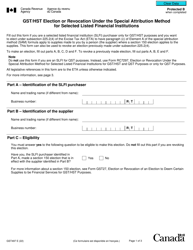

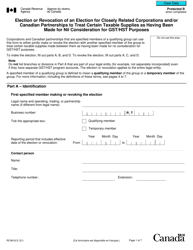

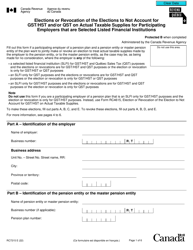

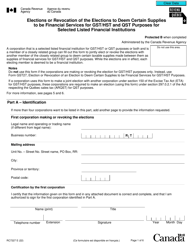

Form RC4615 Election or Revocation of the Election to Not Account for Gst / Hst on Actual Taxable Supplies - Canada

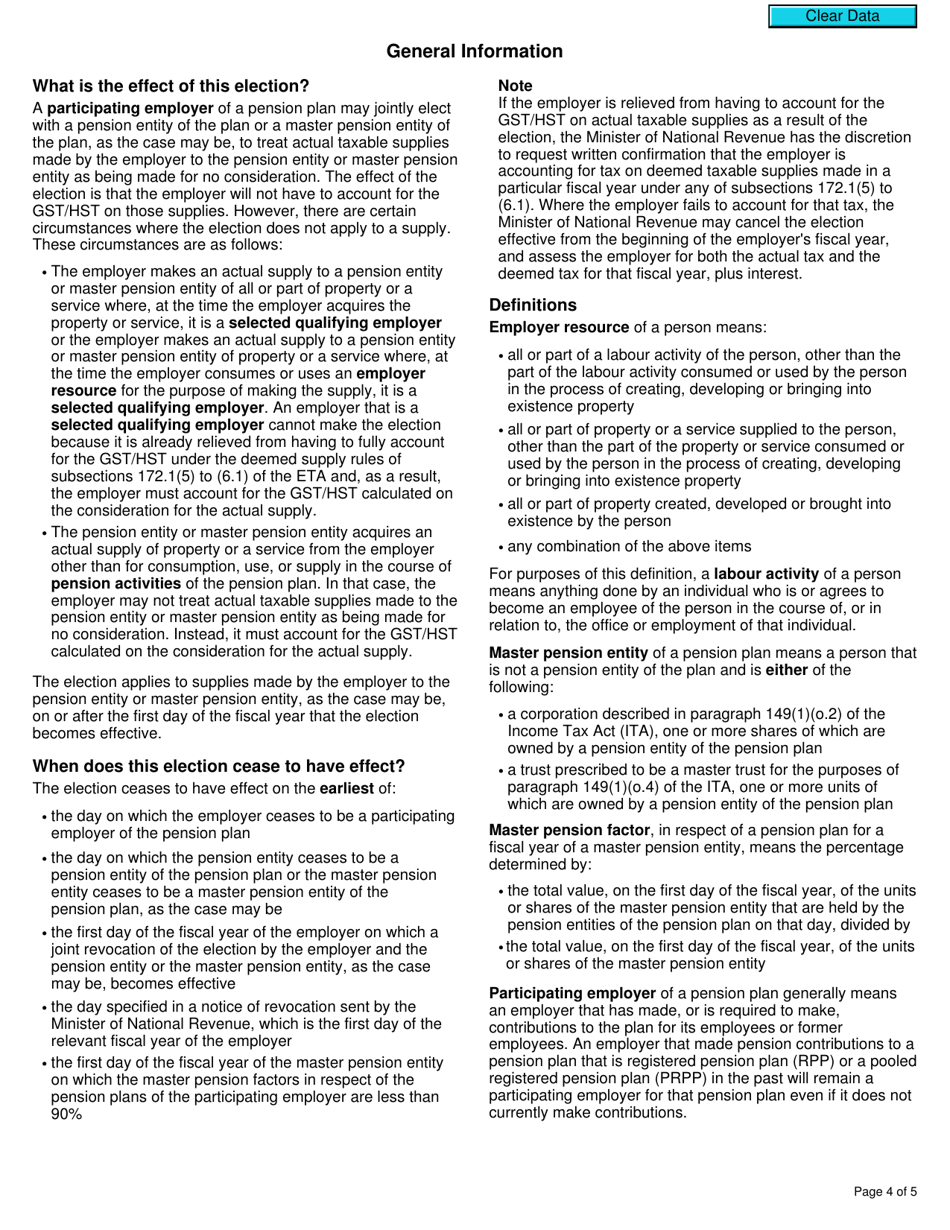

Form RC4615 Election or Revocation of the Election to Not Account for GST/HST on Actual Taxable Supplies in Canada is used by businesses to elect or revoke the election to not account for Goods and Services Tax (GST) or Harmonized Sales Tax (HST) on actual taxable supplies. It allows businesses to choose an alternative method of reporting and remitting GST/HST, based on their actual taxable supplies rather than their annual worldwide sales. It is a form used for tax purposes in Canada.

The form RC4615 Election or Revocation of the Election to Not Account for GST/HST on Actual Taxable Supplies in Canada is filed by businesses that want to elect or revoke the election to not account for GST/HST on their actual taxable supplies.

FAQ

Q: What is form RC4615?

A: Form RC4615 is the Election or Revocation of the Election to Not Account for GST/HST on Actual Taxable Supplies in Canada.

Q: What is GST/HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. They are taxes imposed on the supply of goods and services in Canada.

Q: Who needs to use form RC4615?

A: Businesses in Canada that want to elect or revoke the election to not account for GST/HST on their actual taxable supplies.

Q: What does it mean to not account for GST/HST on actual taxable supplies?

A: Not accounting for GST/HST on actual taxable supplies means that businesses do not have to charge GST/HST on certain goods and services they provide.

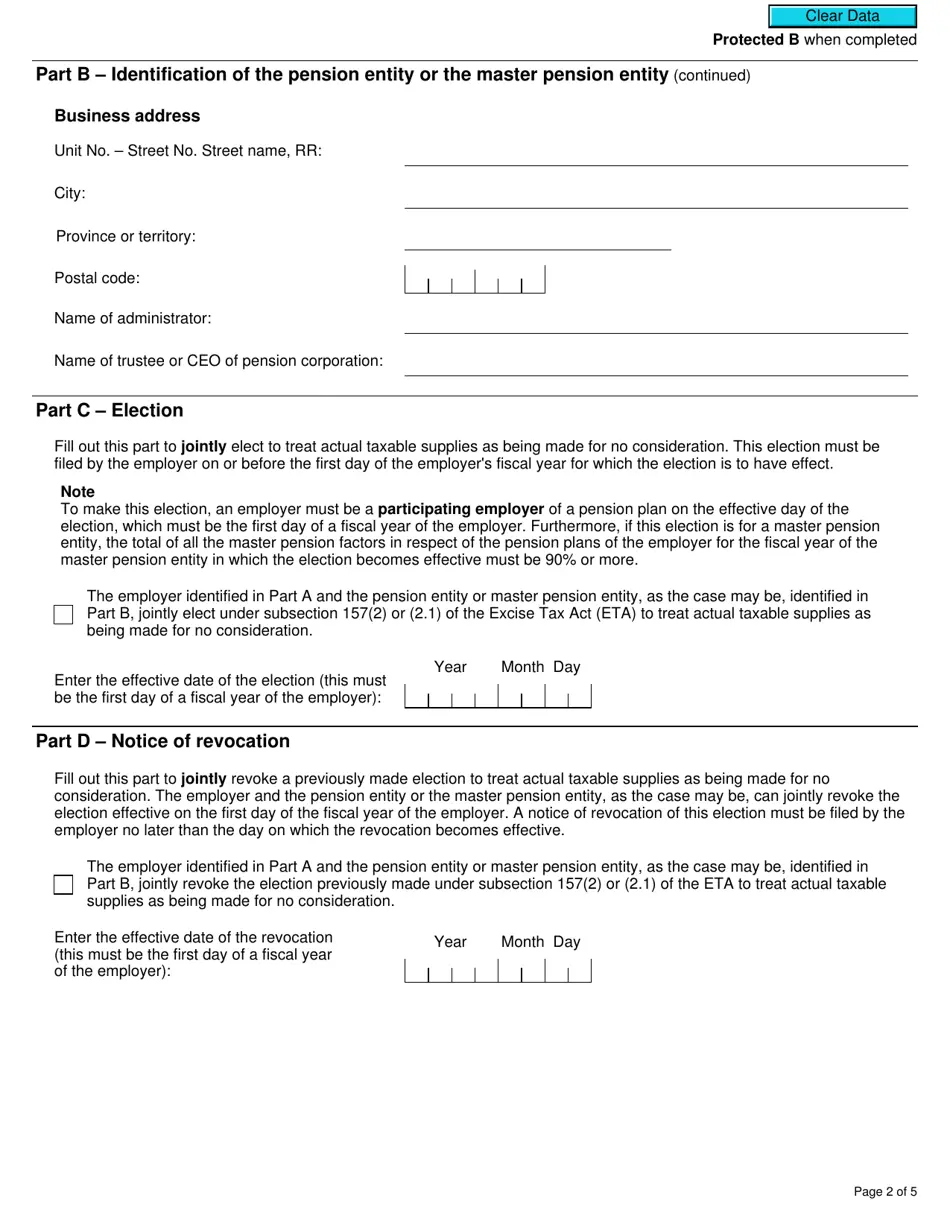

Q: How do I fill out form RC4615?

A: To fill out form RC4615, you need to provide your business information, indicate whether you are making an election or revoking an election, and provide the effective date of the election or revocation.

Q: Is there a deadline for submitting form RC4615?

A: There is no specific deadline for submitting form RC4615. However, it is recommended to submit it before the effective date of the election or revocation.

Q: What happens after submitting form RC4615?

A: After submitting form RC4615, the Canada Revenue Agency will process your election or revocation and inform you of the outcome.