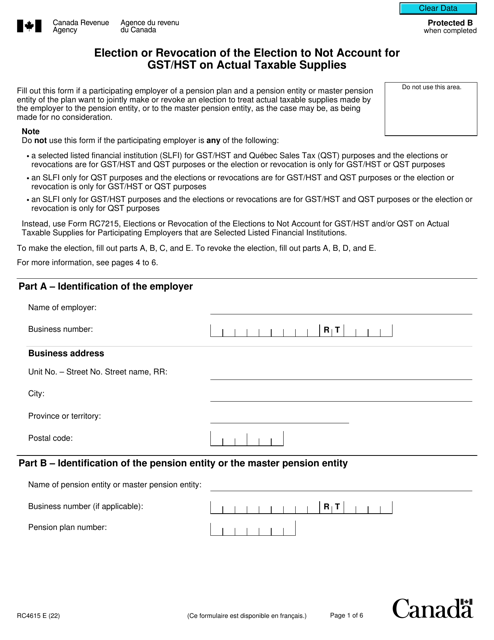

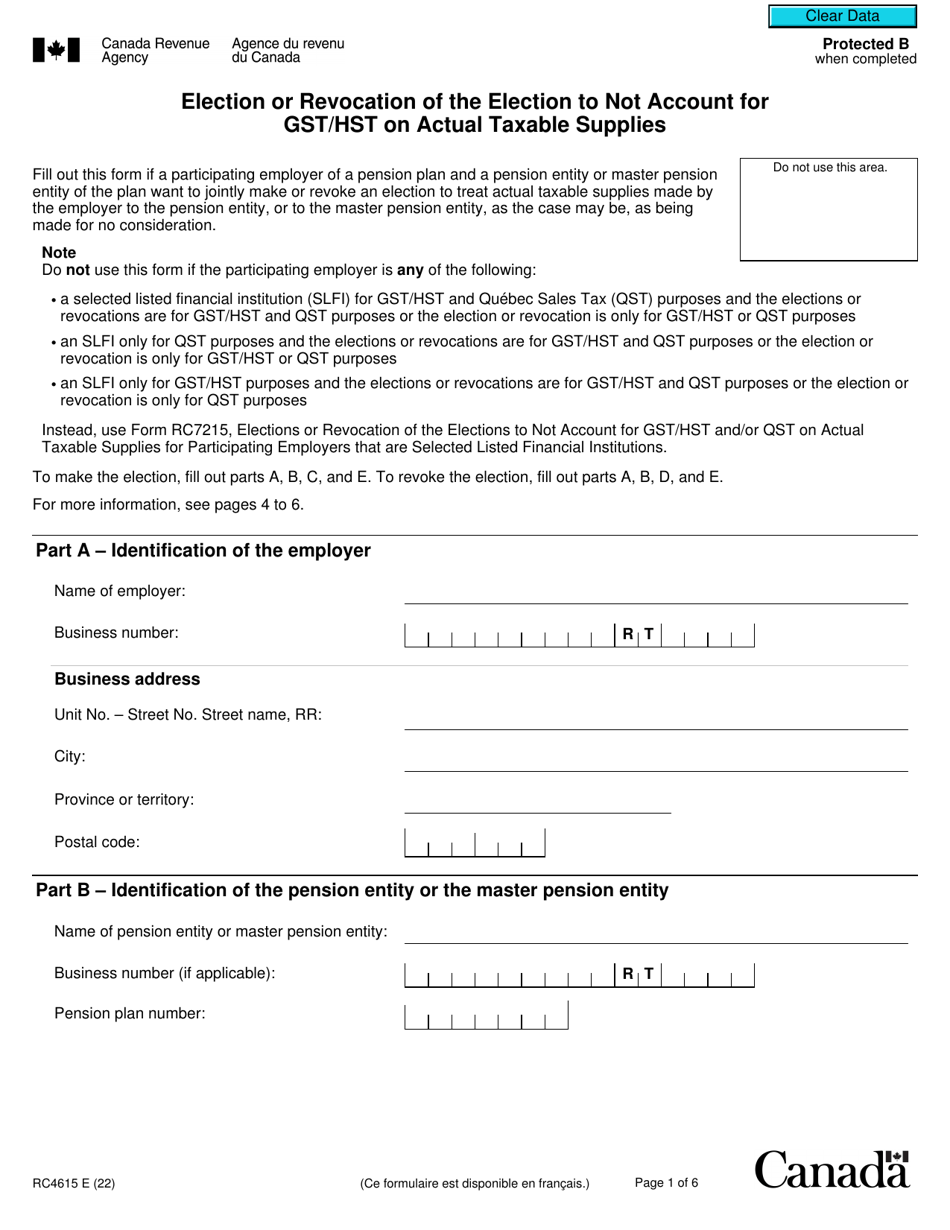

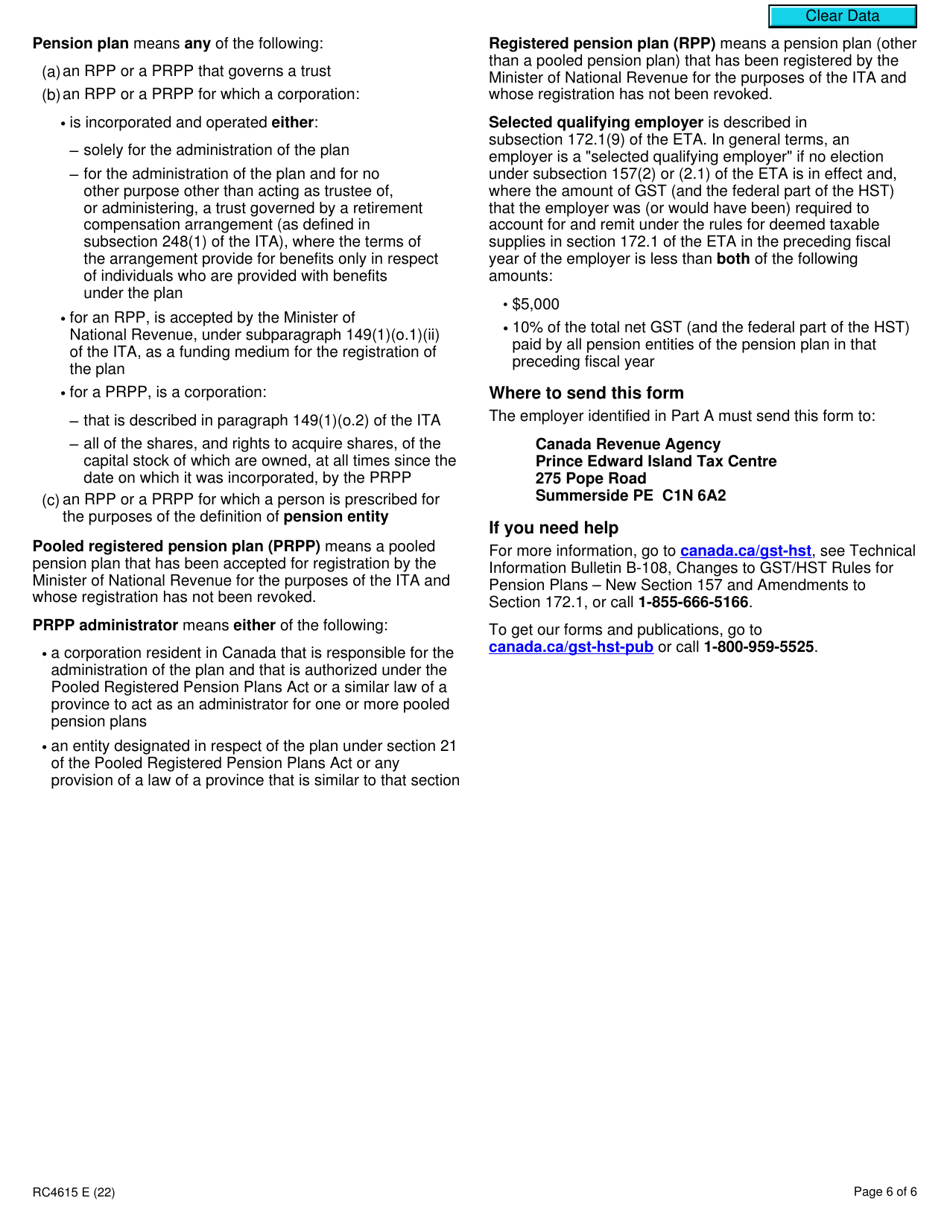

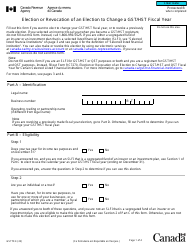

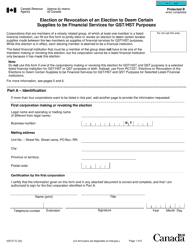

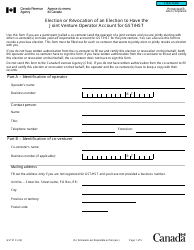

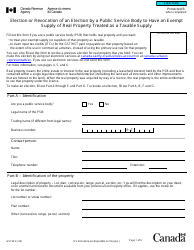

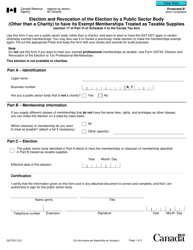

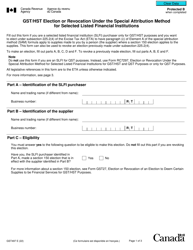

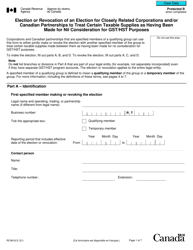

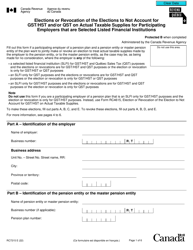

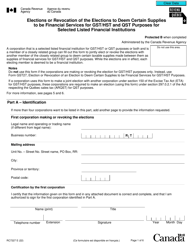

Form RC4615 Election or Revocation of the Election to Not Account for Gst / Hst on Actual Taxable Supplies - Canada

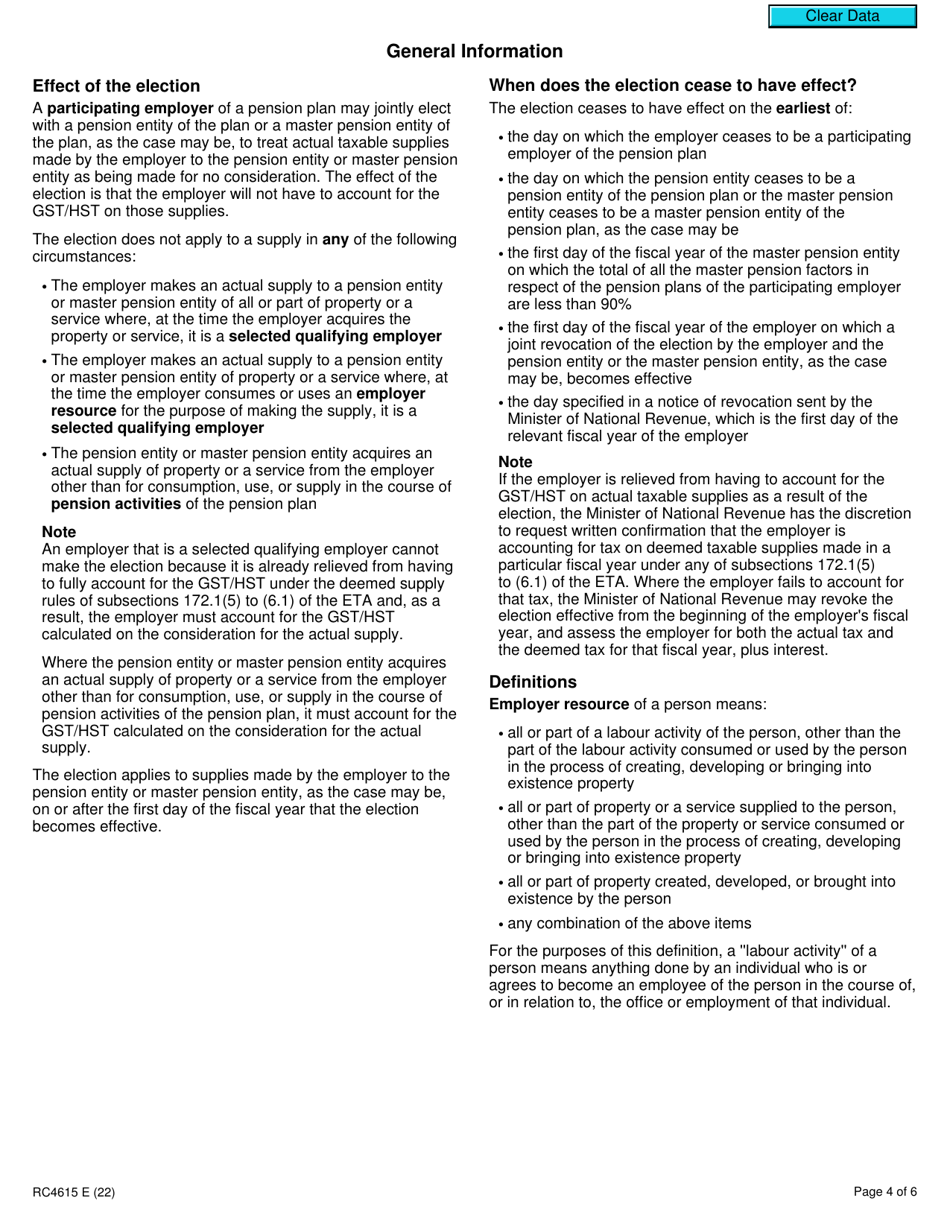

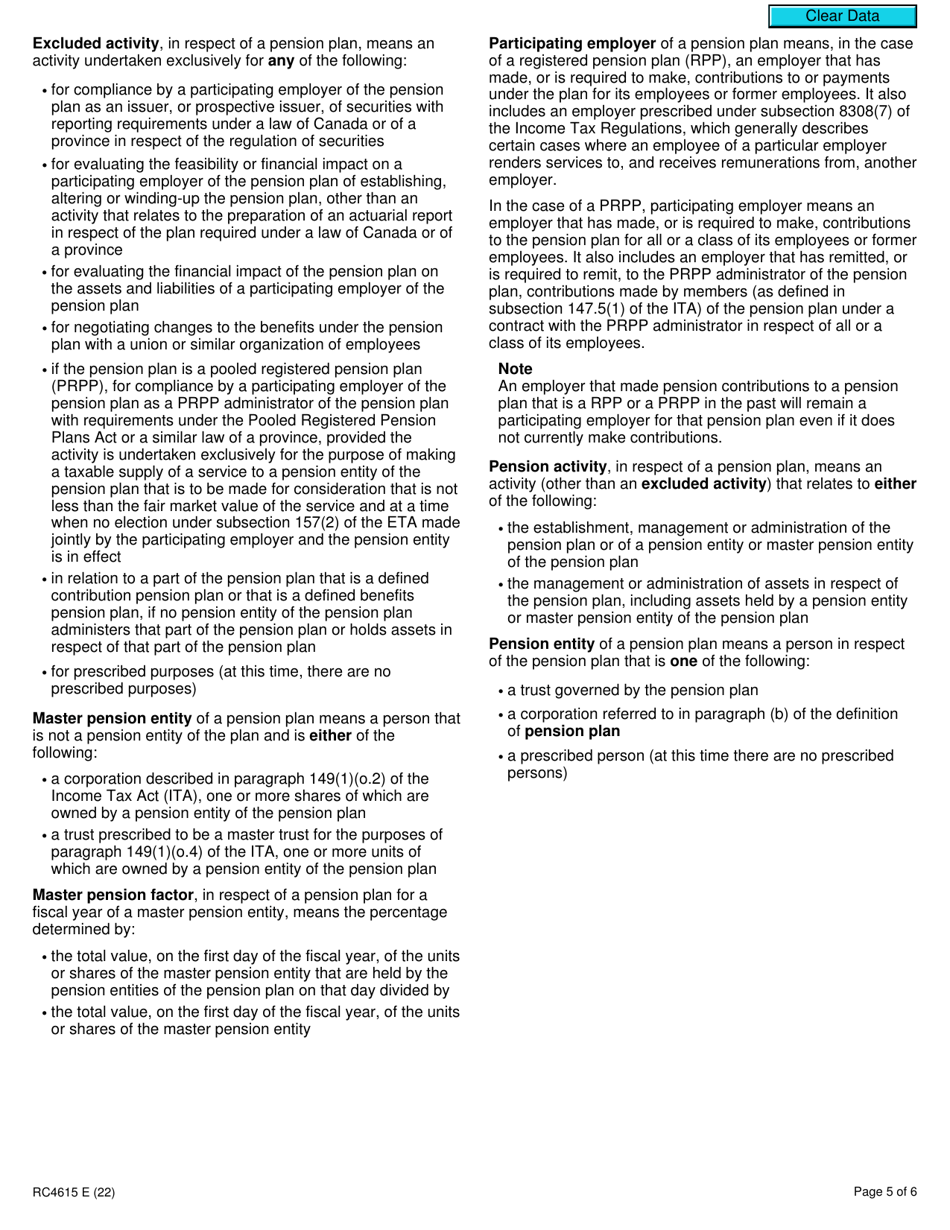

Form RC4615 is used by eligible small suppliers in Canada to make an election or revoke a previous election to not account for Goods and Services Tax (GST) or Harmonized Sales Tax (HST) on their actual taxable supplies. This election allows these suppliers to not charge GST/HST on their sales, but also means they cannot claim input tax credits for any GST/HST paid on their business purchases.

The form RC4615 "Election or Revocation of the Election to Not Account for GST/HST on Actual Taxable Supplies" in Canada is filed by businesses or individuals who want to elect or revoke the election to not account for GST/HST on their actual taxable supplies.

Form RC4615 Election or Revocation of the Election to Not Account for Gst/Hst on Actual Taxable Supplies - Canada - Frequently Asked Questions (FAQ)

Q: What is form RC4615?

A: Form RC4615 is used in Canada for the election or revocation of the election to not account for GST/HST on actual taxable supplies.

Q: What does GST and HST stand for?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. Both are types of consumption taxes in Canada.

Q: Who should use form RC4615?

A: Individuals or businesses in Canada who want to elect or revoke the election to not account for GST/HST on actual taxable supplies should use form RC4615.

Q: What is the purpose of the election to not account for GST/HST on actual taxable supplies?

A: The purpose of the election is to simplify the reporting and remitting of GST/HST for individuals or businesses who have few taxable supplies.

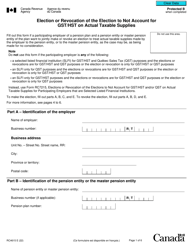

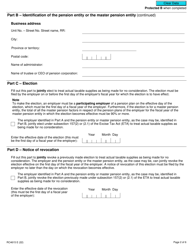

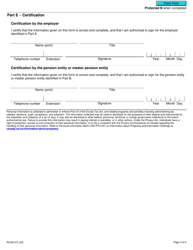

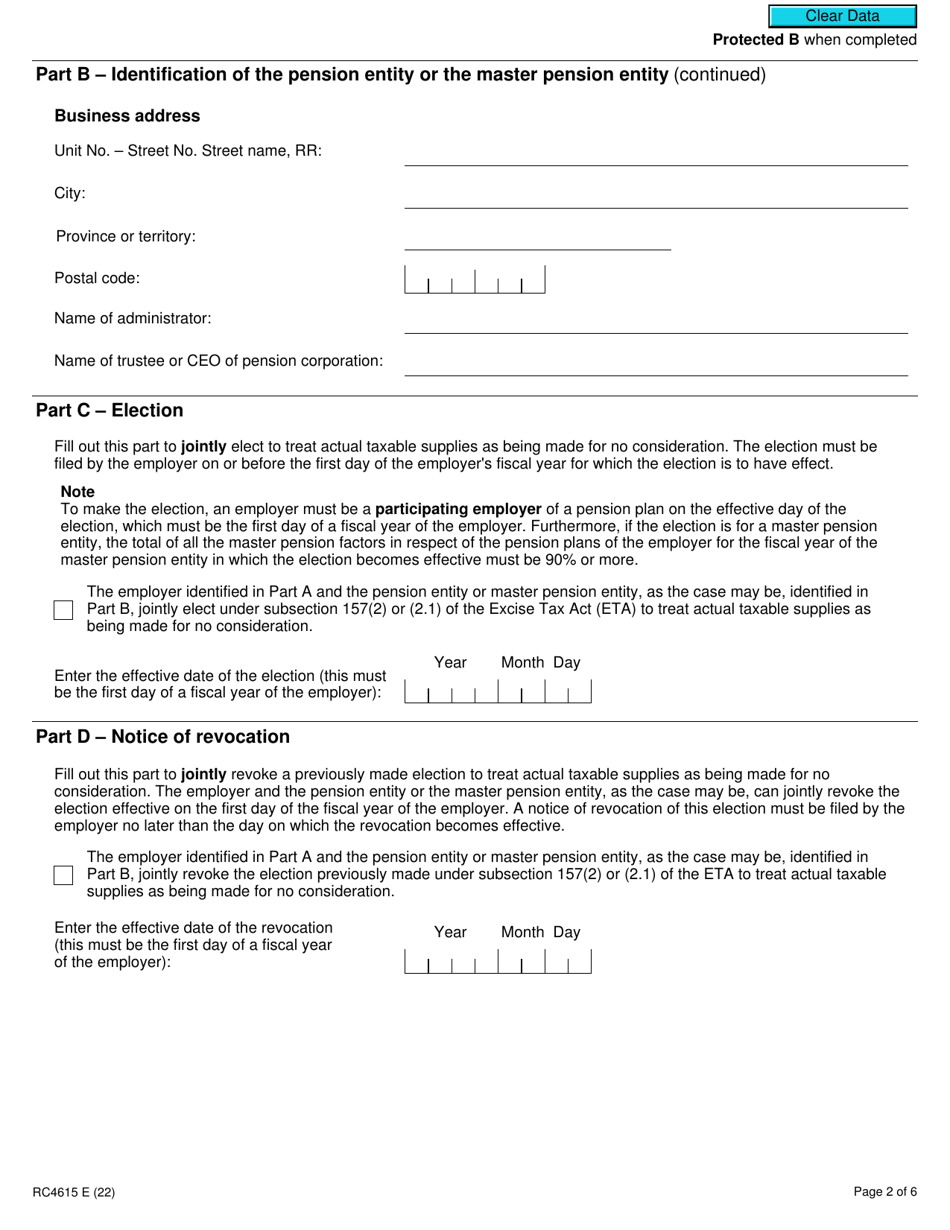

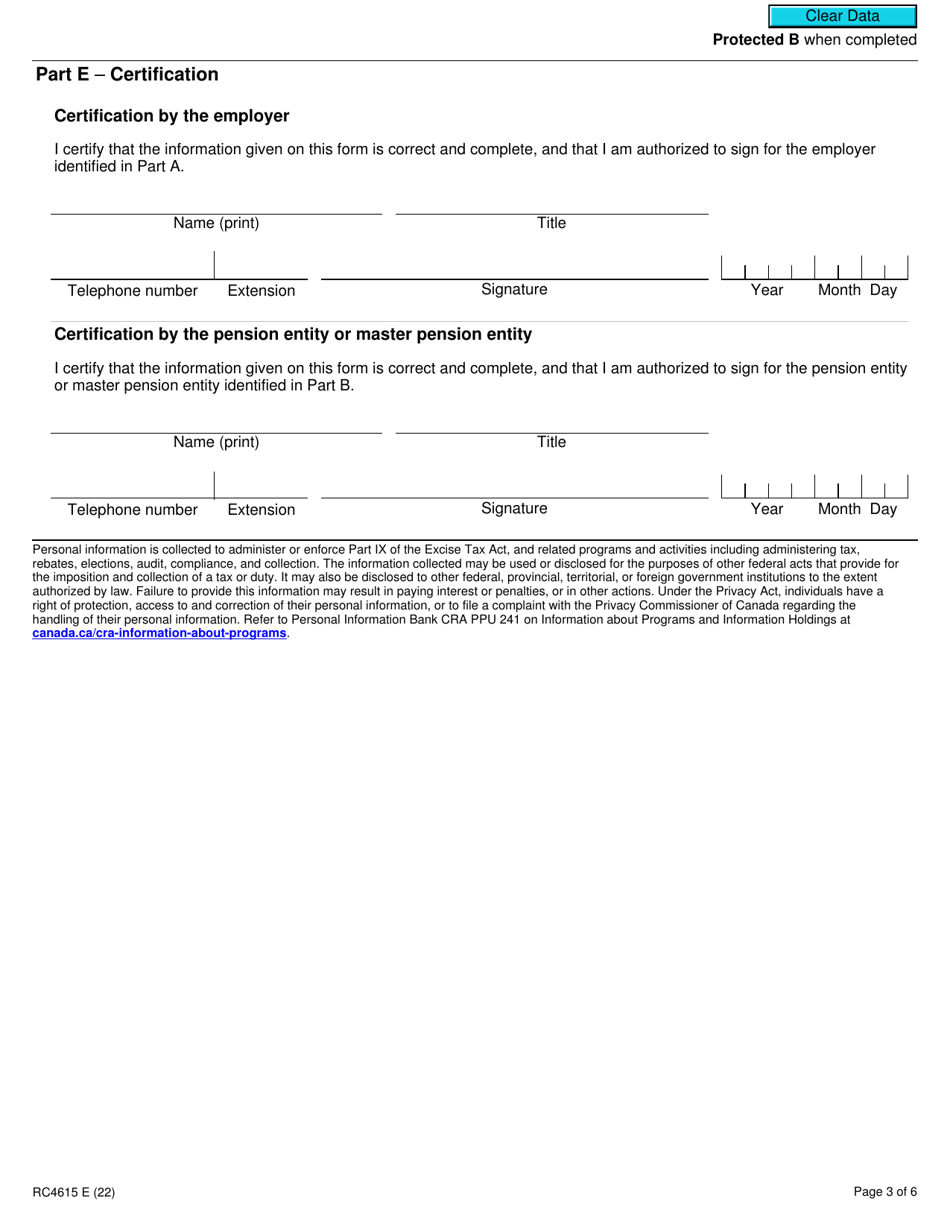

Q: What information is required to complete form RC4615?

A: To complete form RC4615, you will need to provide your name or business name, contact information, registration number, and details about the election or revocation of election.