This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST191-WS

for the current year.

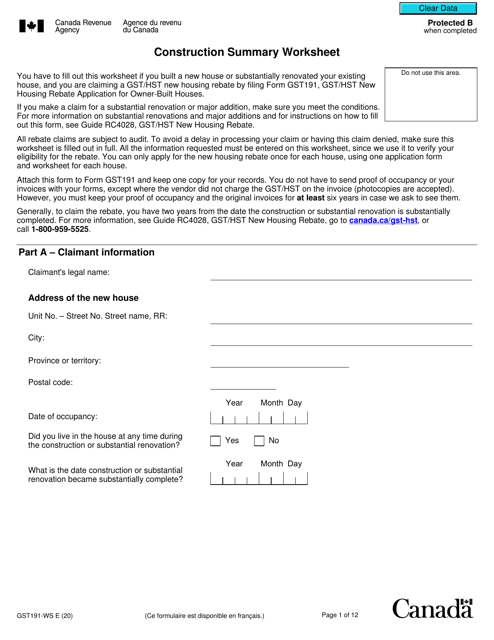

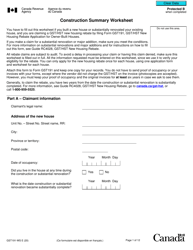

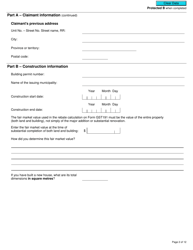

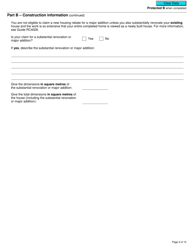

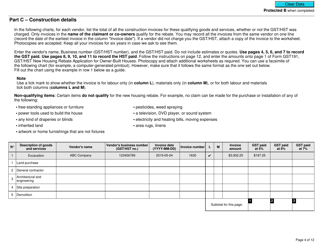

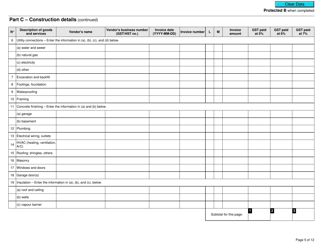

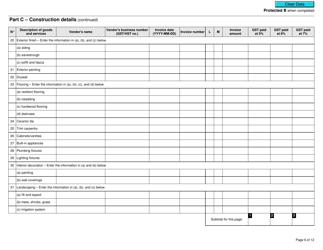

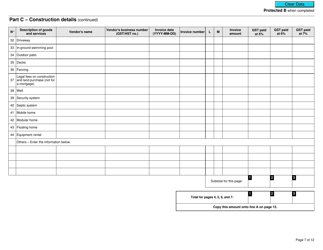

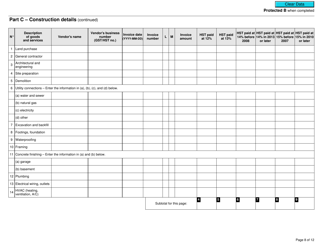

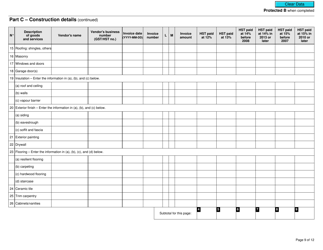

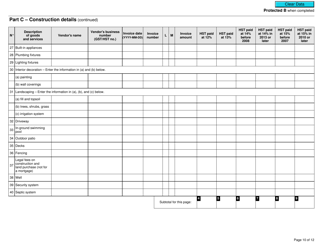

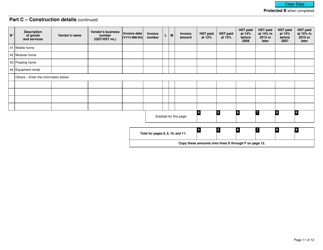

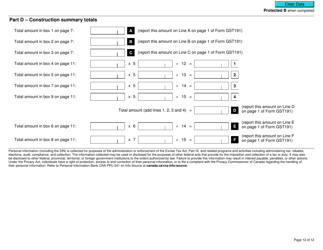

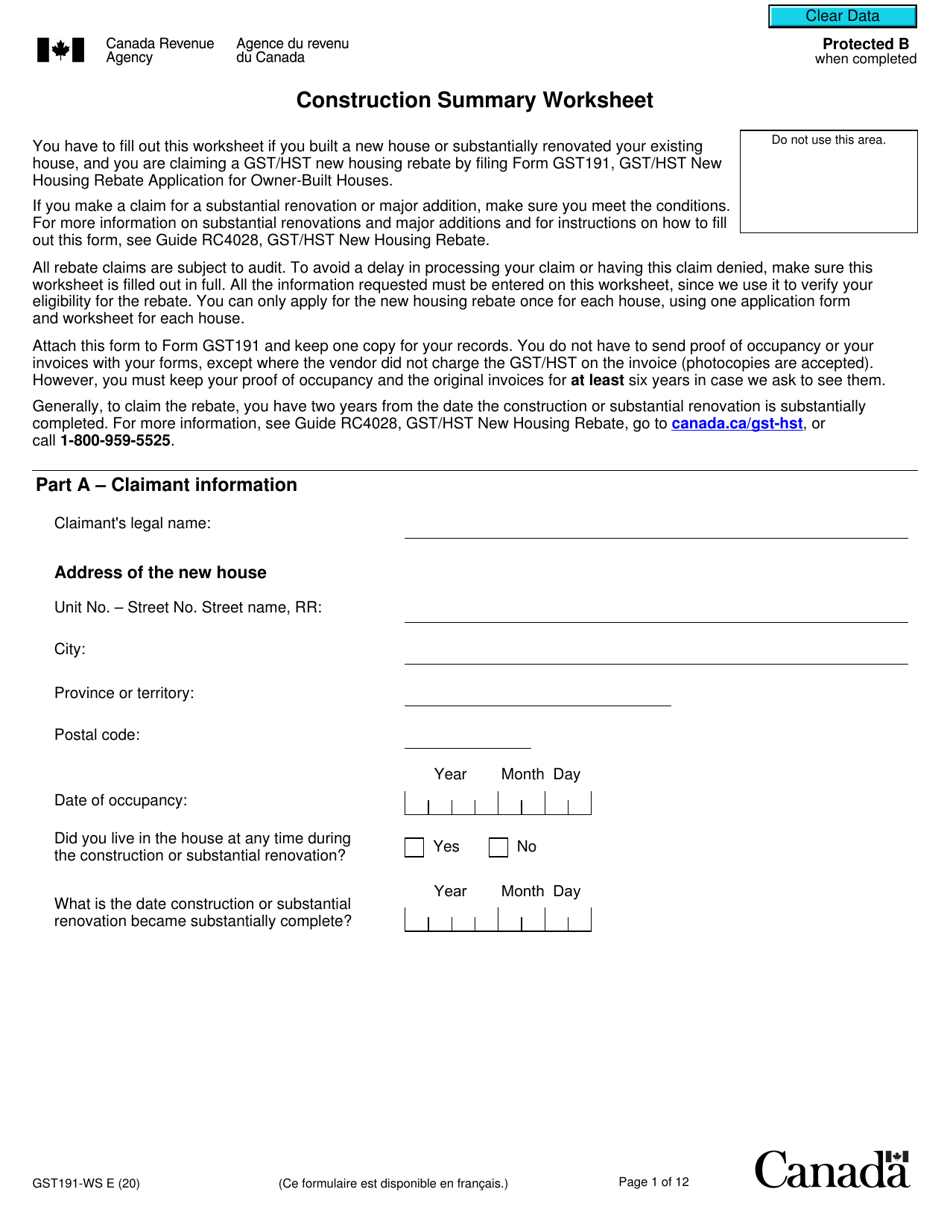

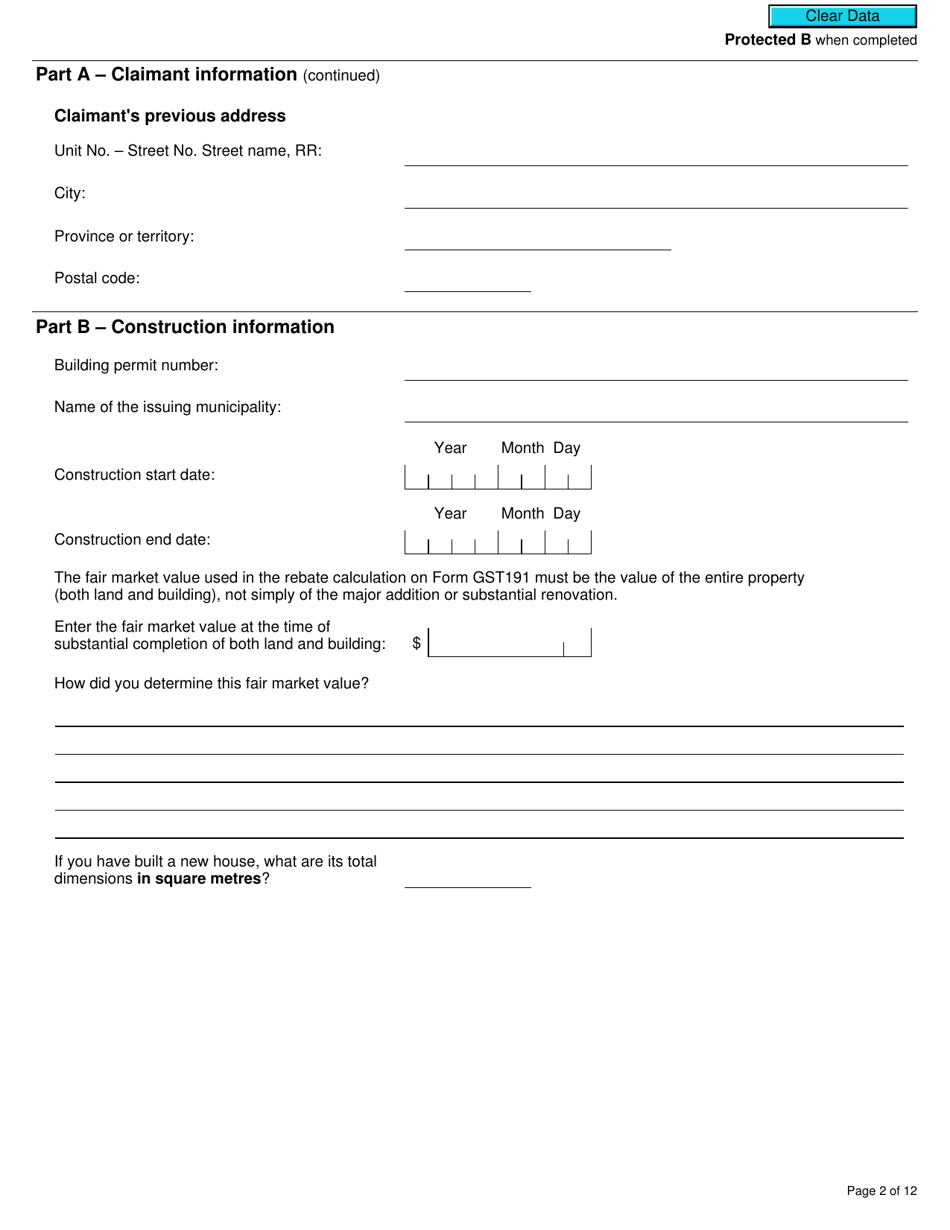

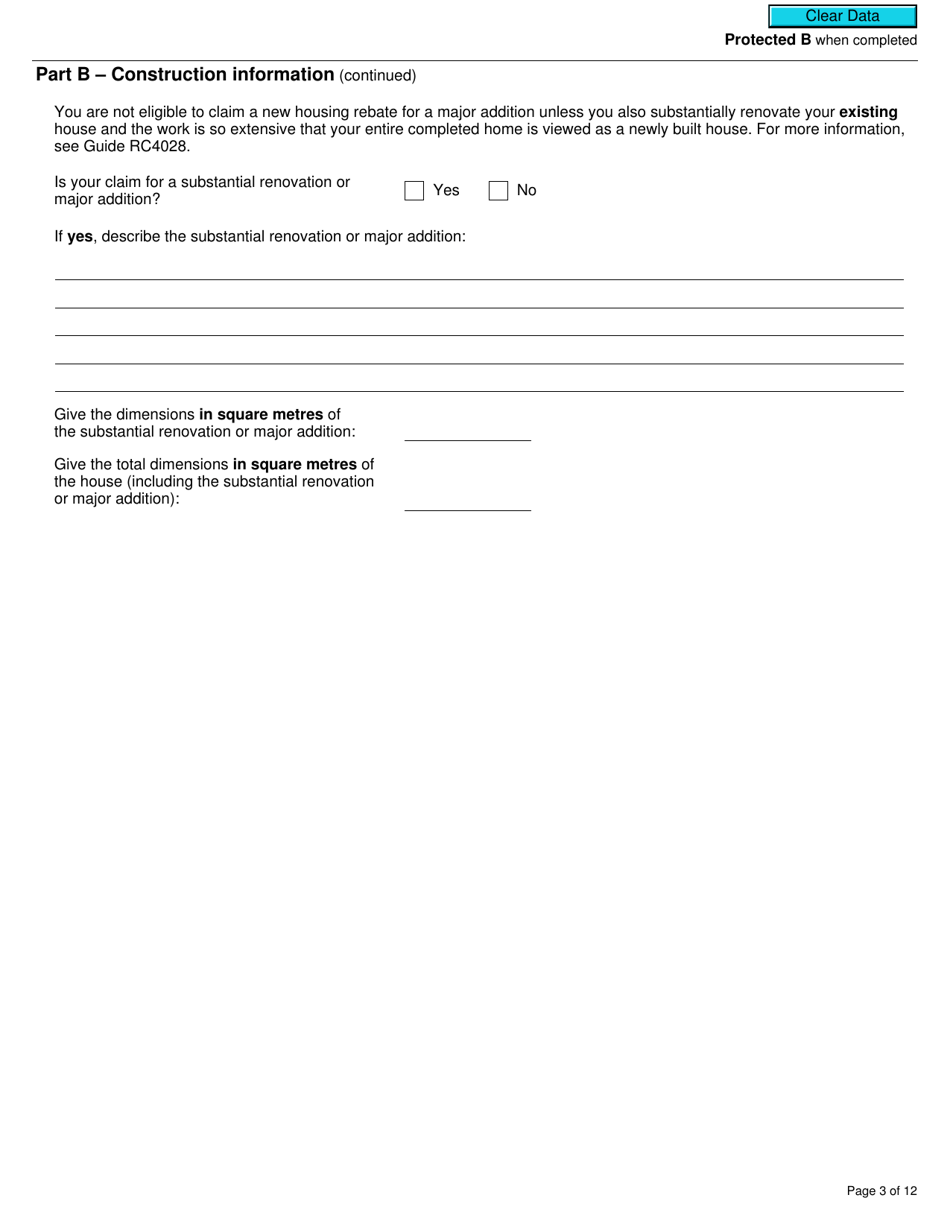

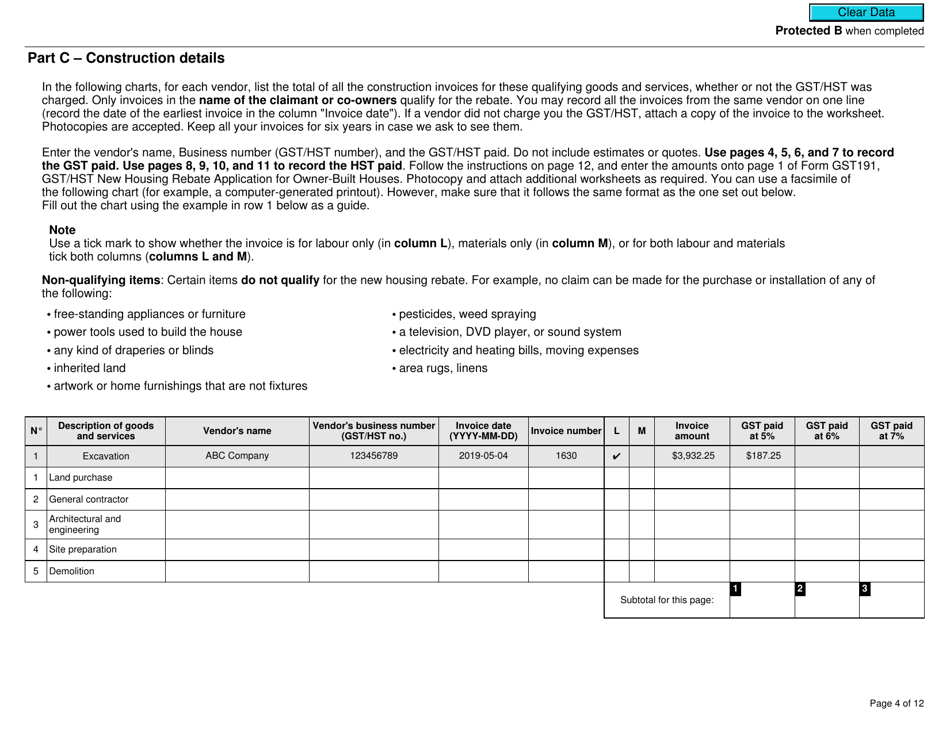

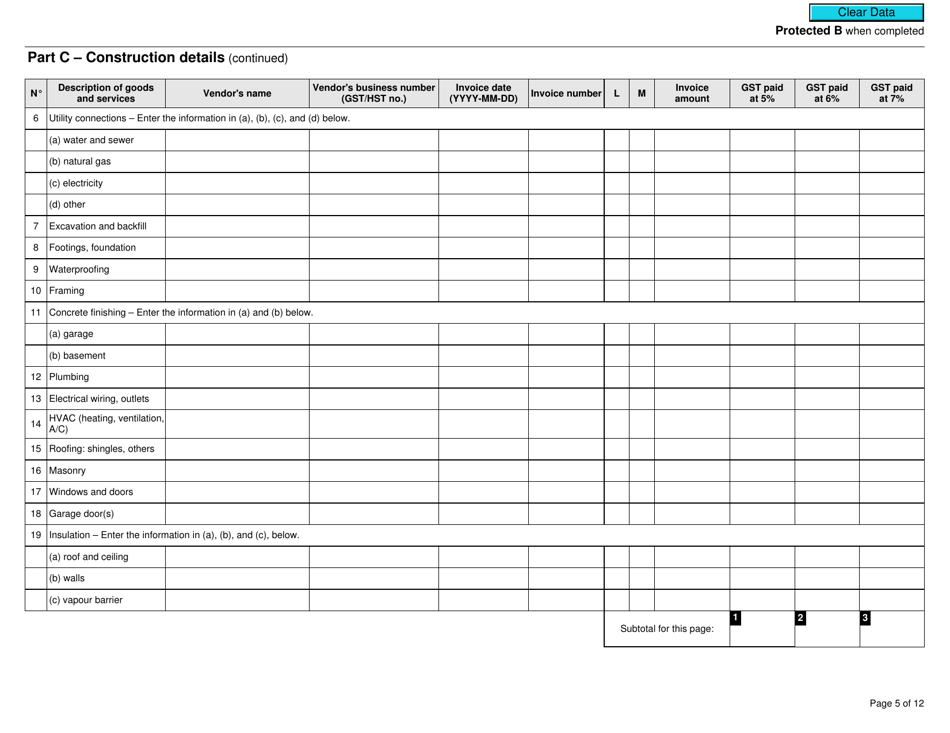

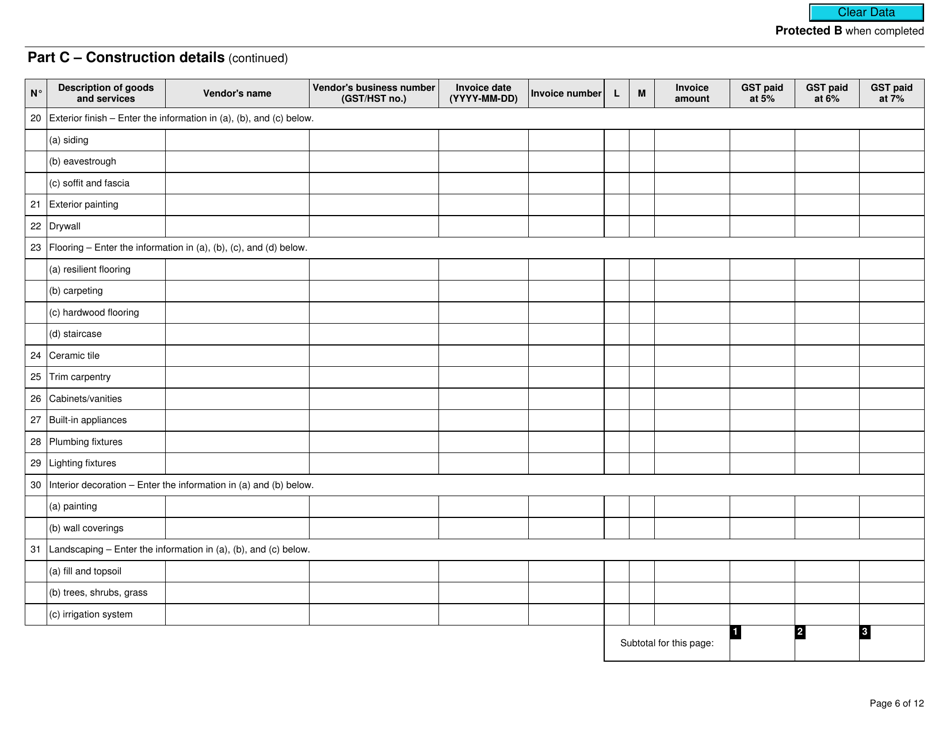

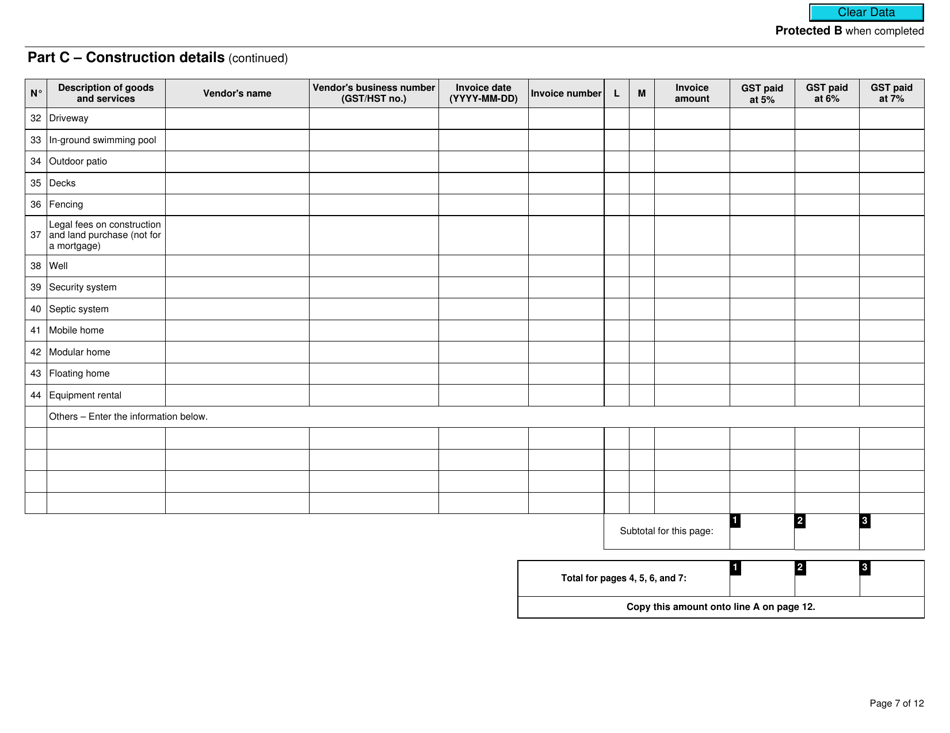

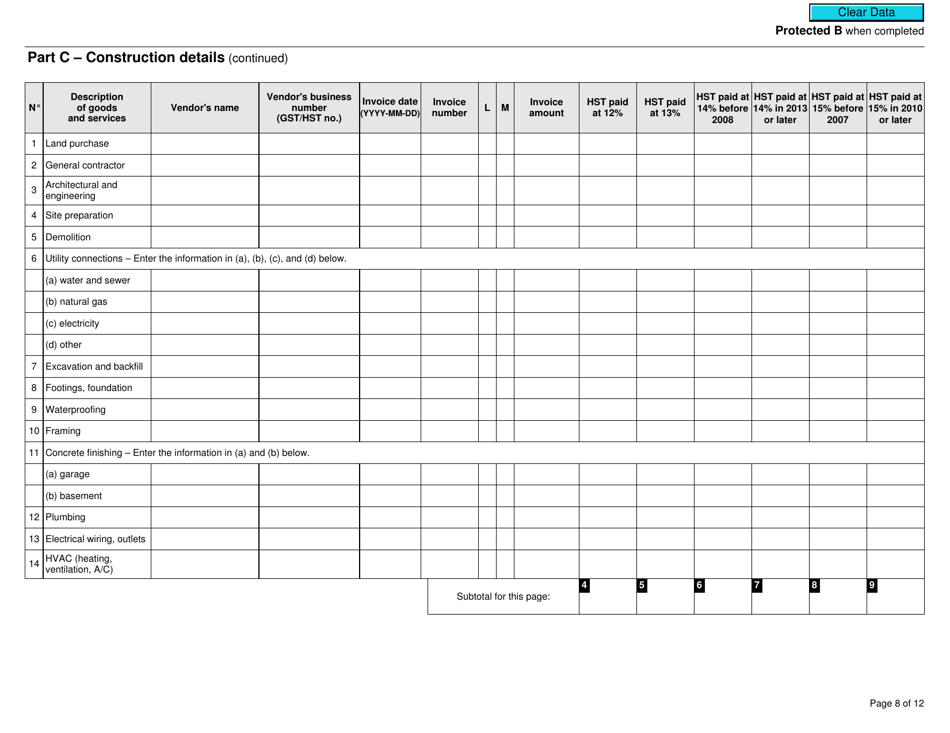

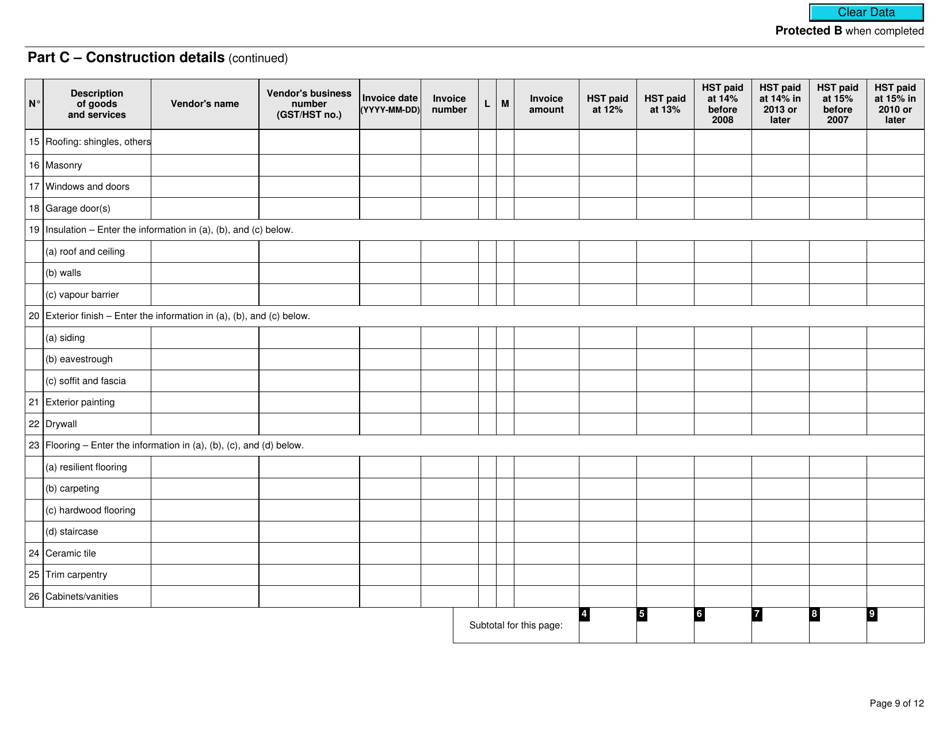

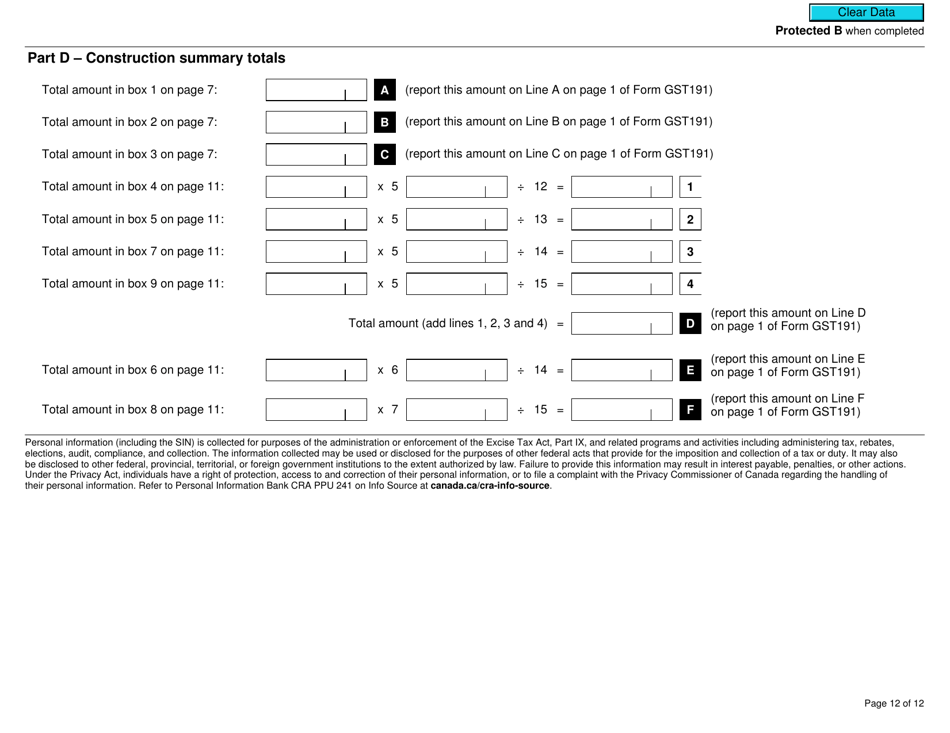

Form GST191-WS Construction Summary Worksheet - Canada

Form GST191-WS Construction Summary Worksheet - Canada is used to calculate the amount of goods and services tax (GST) or harmonized sales tax (HST) applicable to a construction project in Canada. It helps businesses involved in construction to determine their GST/HST obligations and report them to the Canada Revenue Agency.

The Form GST191-WS Construction Summary Worksheet in Canada is typically filed by the construction business or contractor.

FAQ

Q: What is Form GST191-WS?

A: Form GST191-WS is a Construction Summary Worksheet for Canada.

Q: What is the purpose of Form GST191-WS?

A: The purpose of Form GST191-WS is to provide a summary of construction activities for GST/HST purposes in Canada.

Q: Who should use Form GST191-WS?

A: Form GST191-WS should be used by anyone engaged in construction activities in Canada.

Q: What information is required in Form GST191-WS?

A: Form GST191-WS requires information such as the total consideration for construction activities, the amount of GST/HST charged and collected, and the GST/HST paid on inputs.

Q: Is Form GST191-WS mandatory?

A: Form GST191-WS is not mandatory, but it is recommended to keep accurate records of construction activities for tax purposes.

Q: Are there any penalties for not filing Form GST191-WS?

A: There are no specific penalties for not filing Form GST191-WS, but failure to keep accurate records of construction activities may result in penalties for non-compliance with GST/HST requirements in Canada.

Q: When should Form GST191-WS be filed?

A: Form GST191-WS should be filed with your GST/HST return, which is usually due on the last day of the month following the reporting period.

Q: Is Form GST191-WS applicable for all provinces and territories in Canada?

A: Yes, Form GST191-WS is applicable for all provinces and territories in Canada.