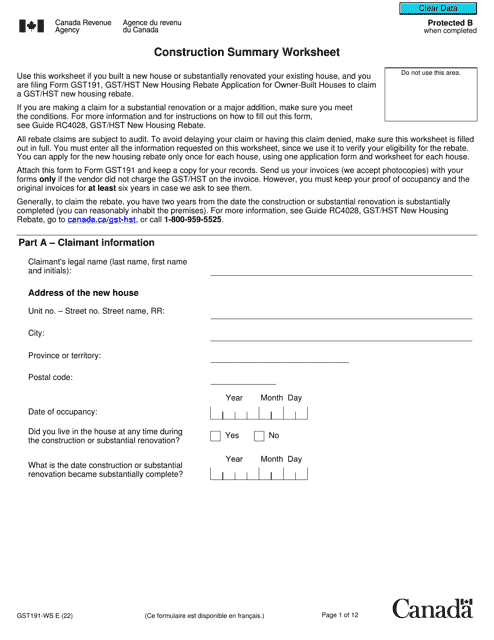

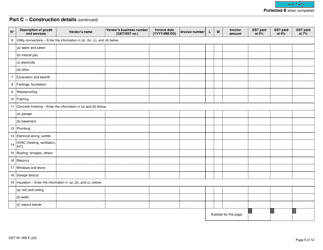

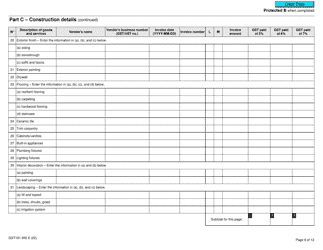

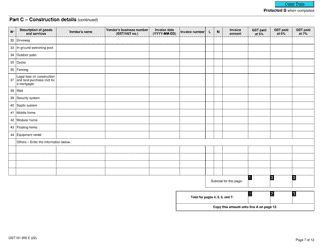

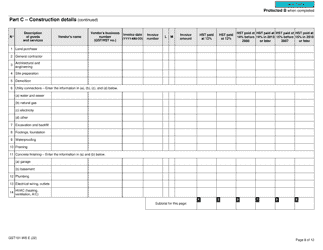

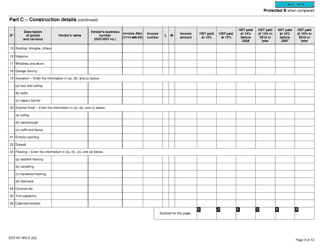

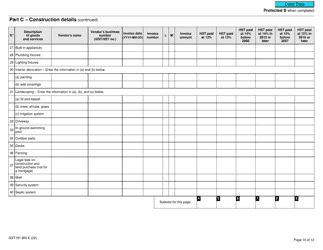

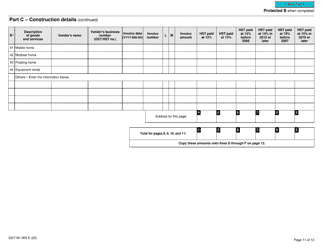

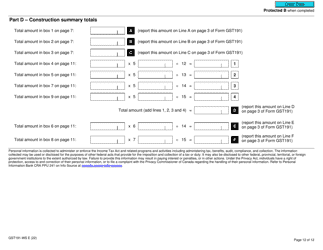

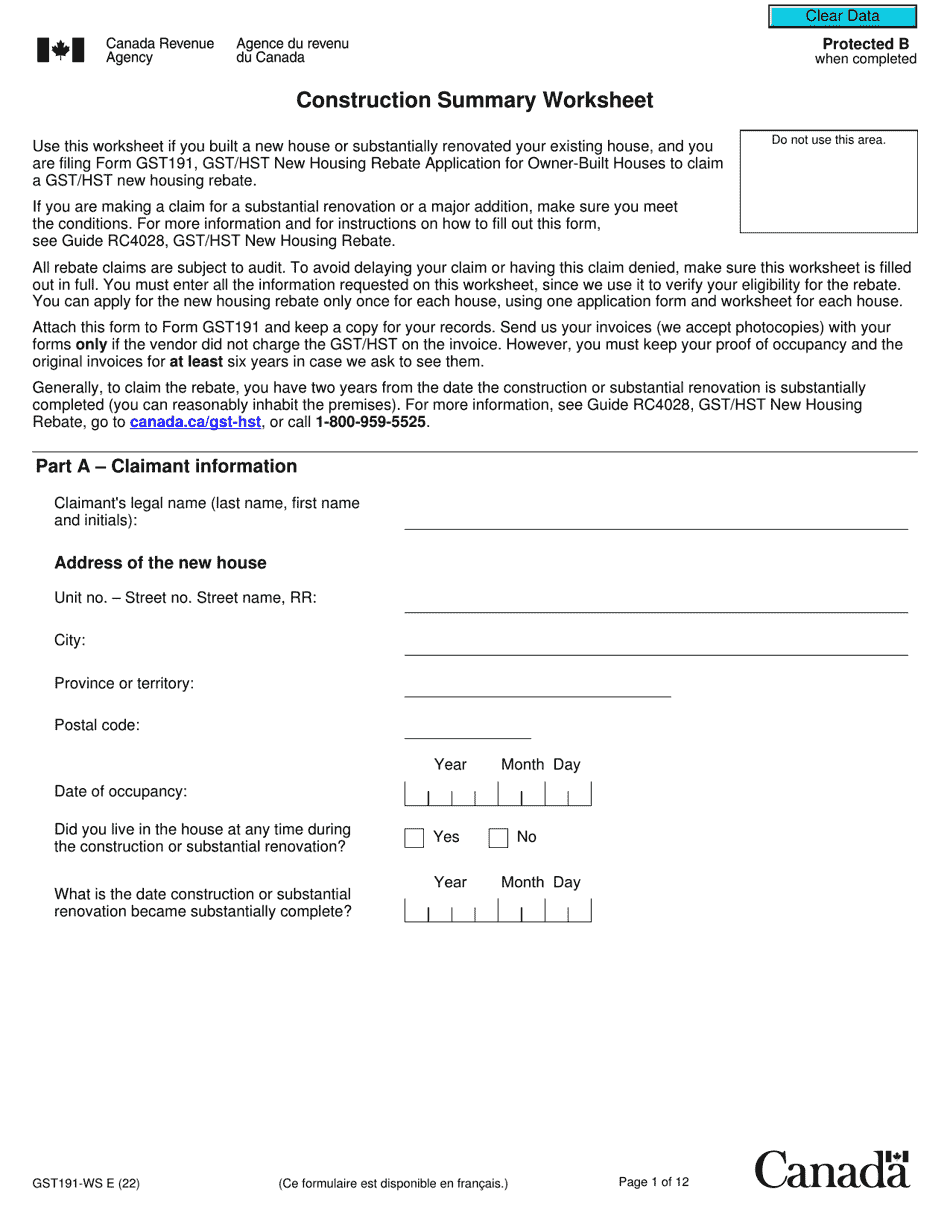

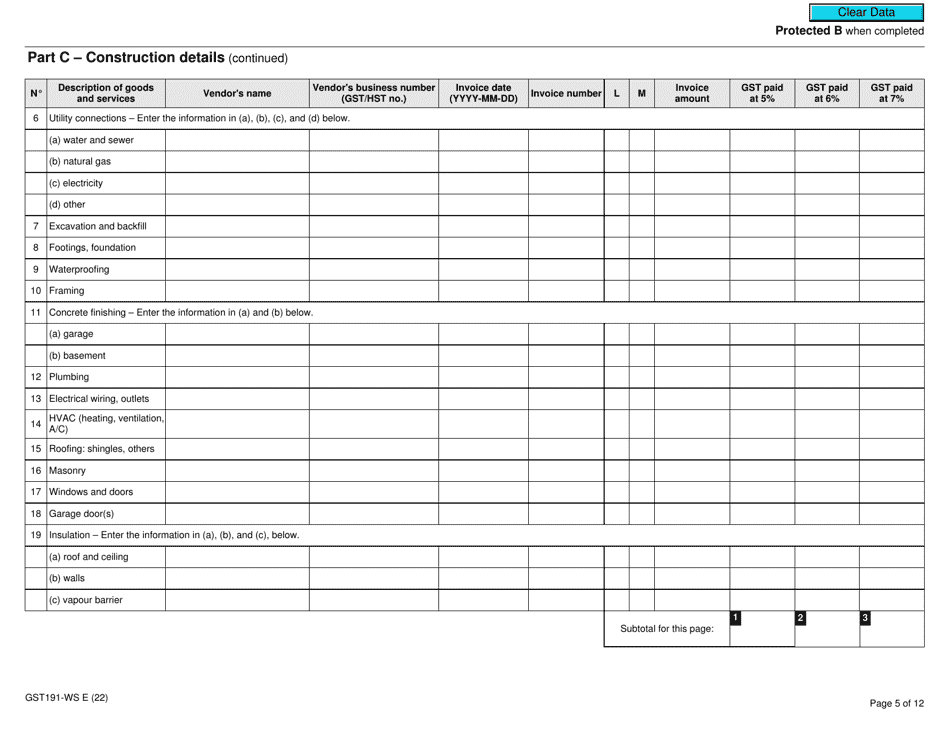

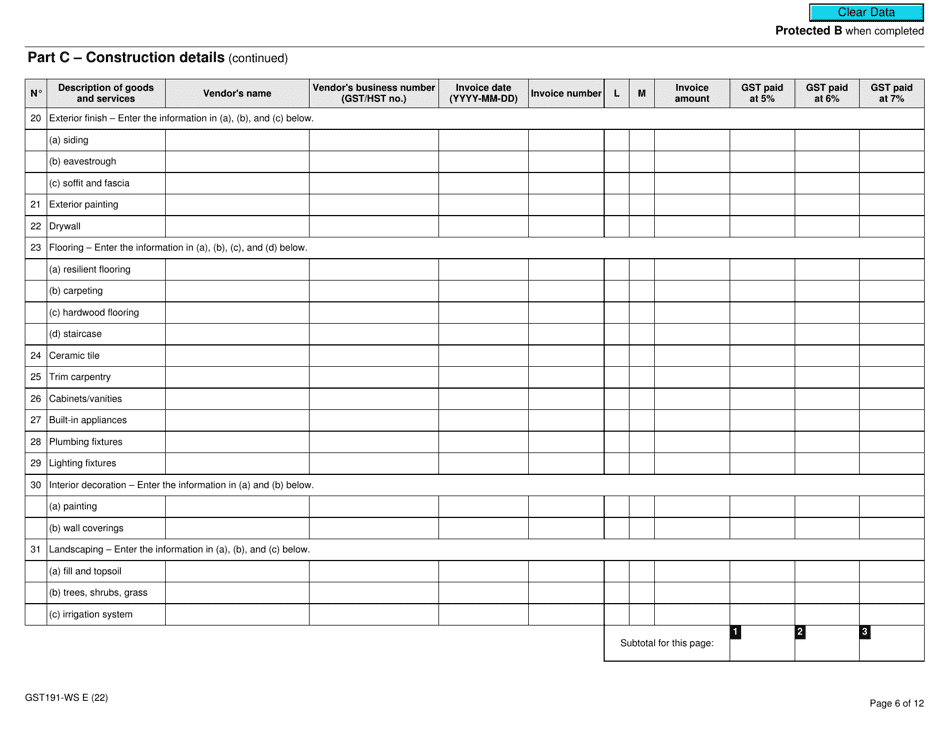

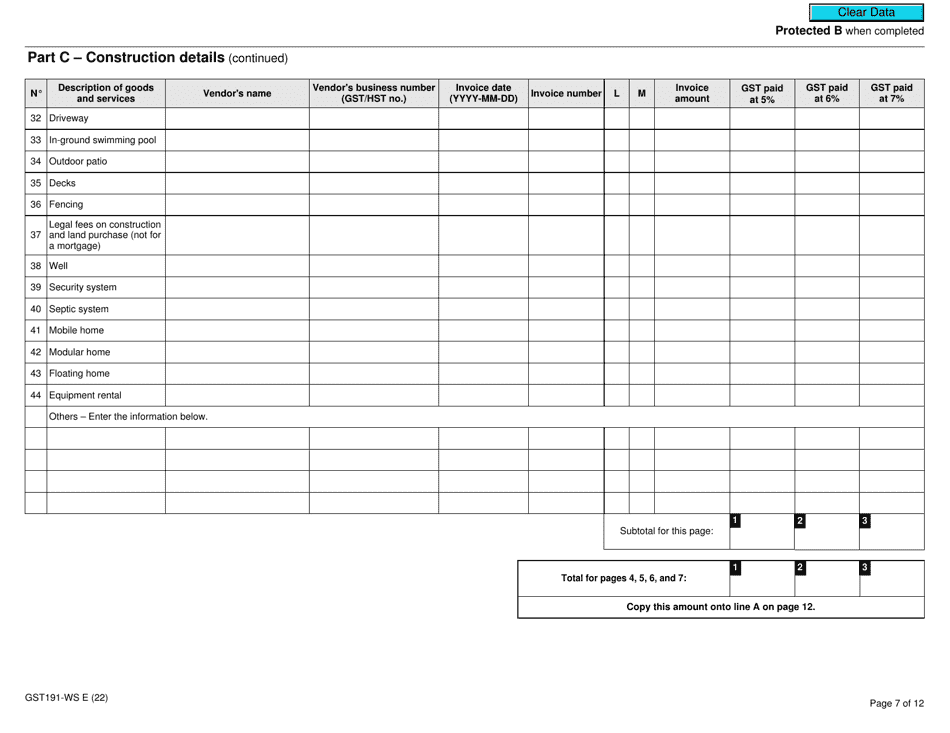

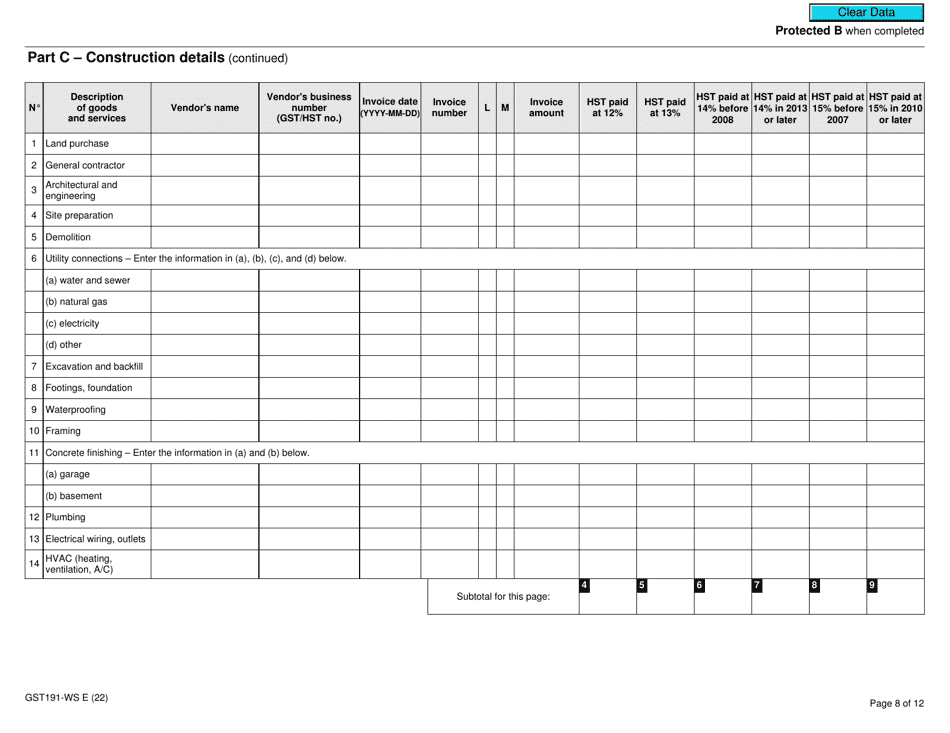

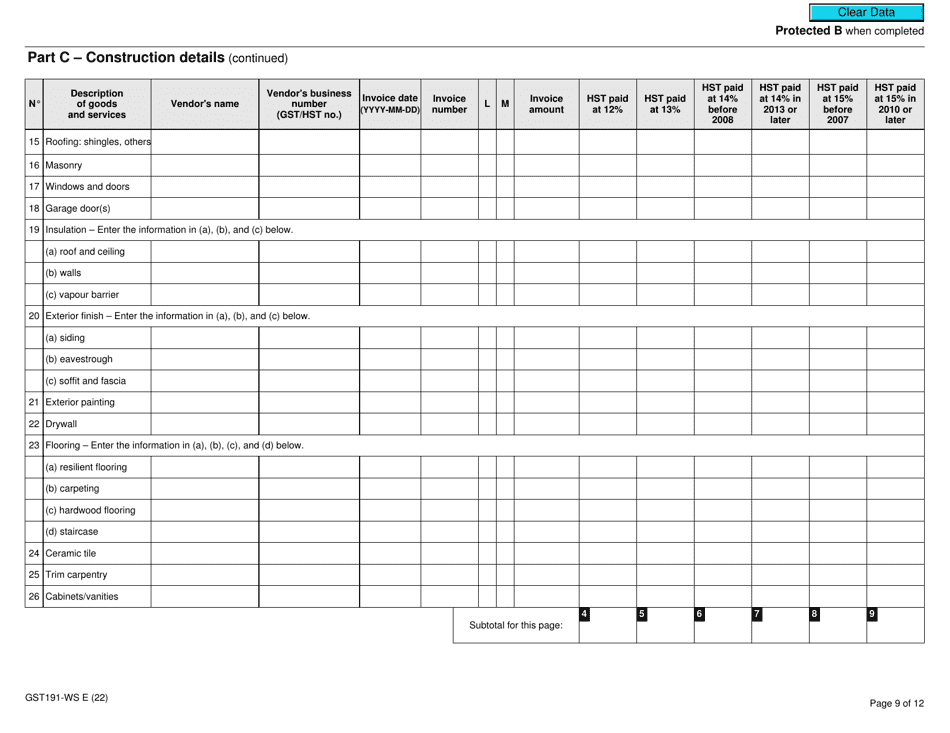

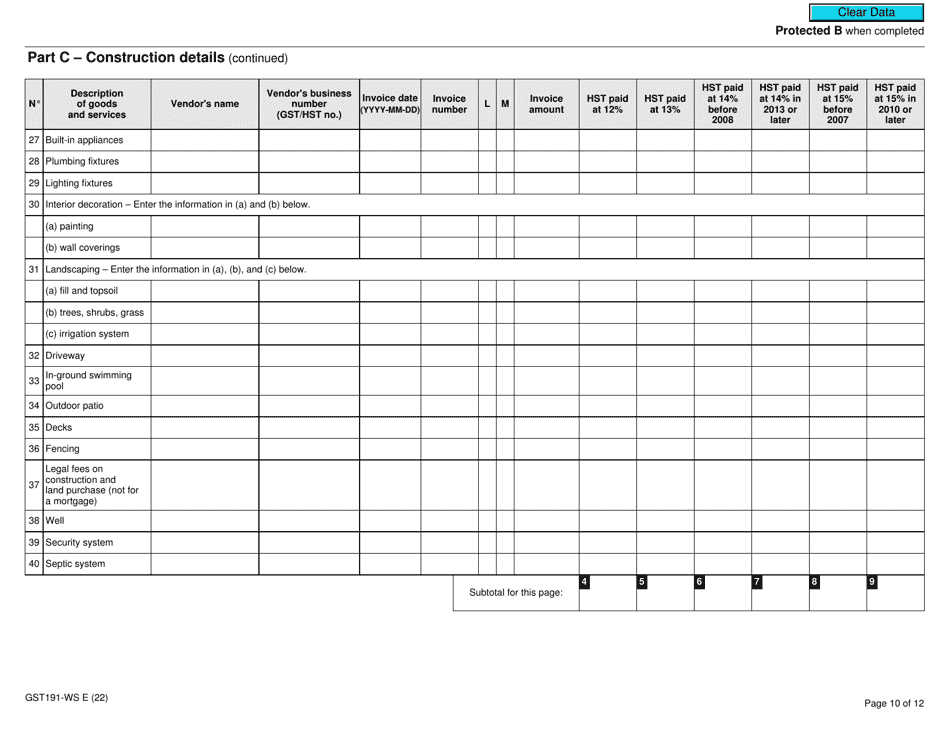

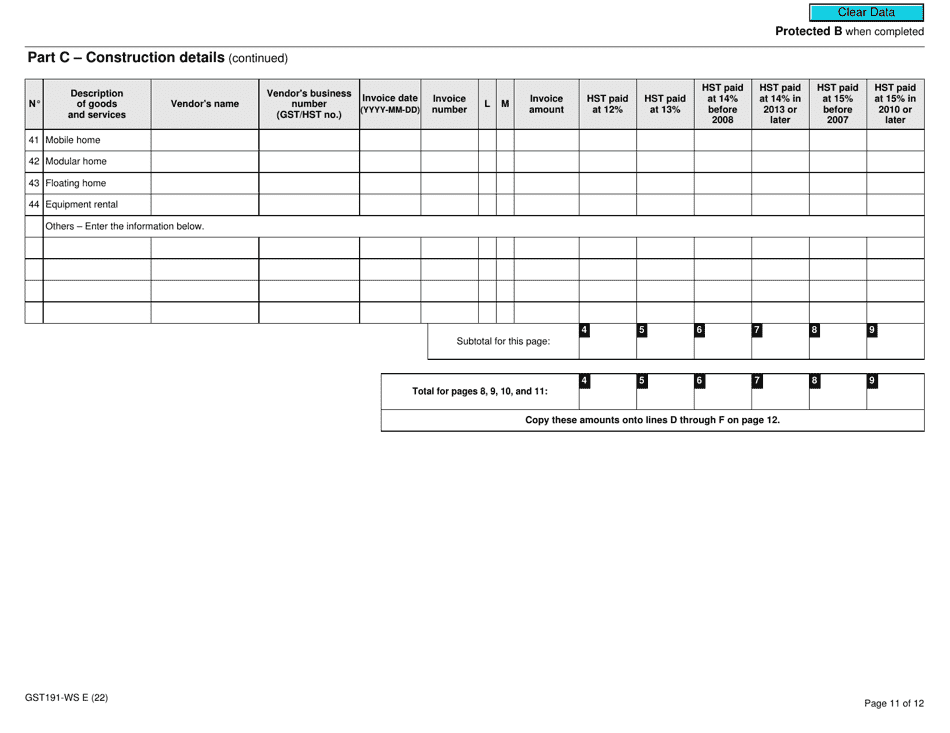

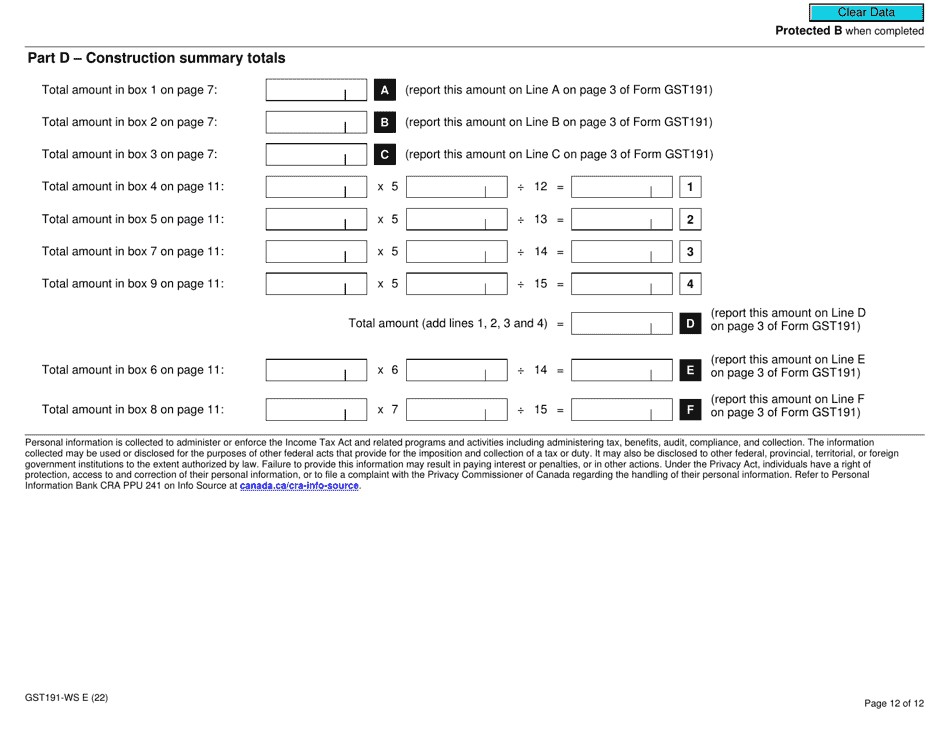

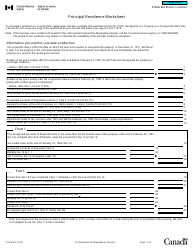

Form GST191-WS Construction Summary Worksheet - Canada

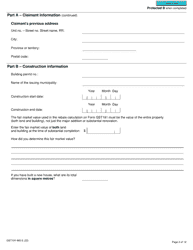

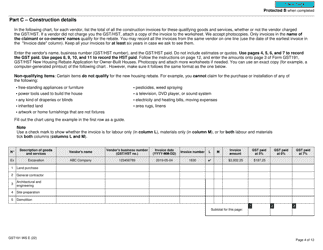

Form GST191-WS Construction Summary Worksheet is used in Canada for reporting the construction activities conducted during a specific reporting period for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes. It helps businesses in the construction industry report their taxable supplies and claim input tax credits.

The Form GST191-WS Construction Summary Worksheet in Canada is typically filed by construction contractors and subcontractors.

Form GST191-WS Construction Summary Worksheet - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST191-WS?

A: Form GST191-WS is a Construction Summary Worksheet used in Canada.

Q: What is the purpose of Form GST191-WS?

A: The purpose of Form GST191-WS is to summarize the construction expenditures for claiming input tax credits in Canada.

Q: Who needs to use Form GST191-WS?

A: Anyone involved in construction projects in Canada may need to use Form GST191-WS.

Q: What information is required on Form GST191-WS?

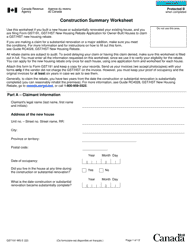

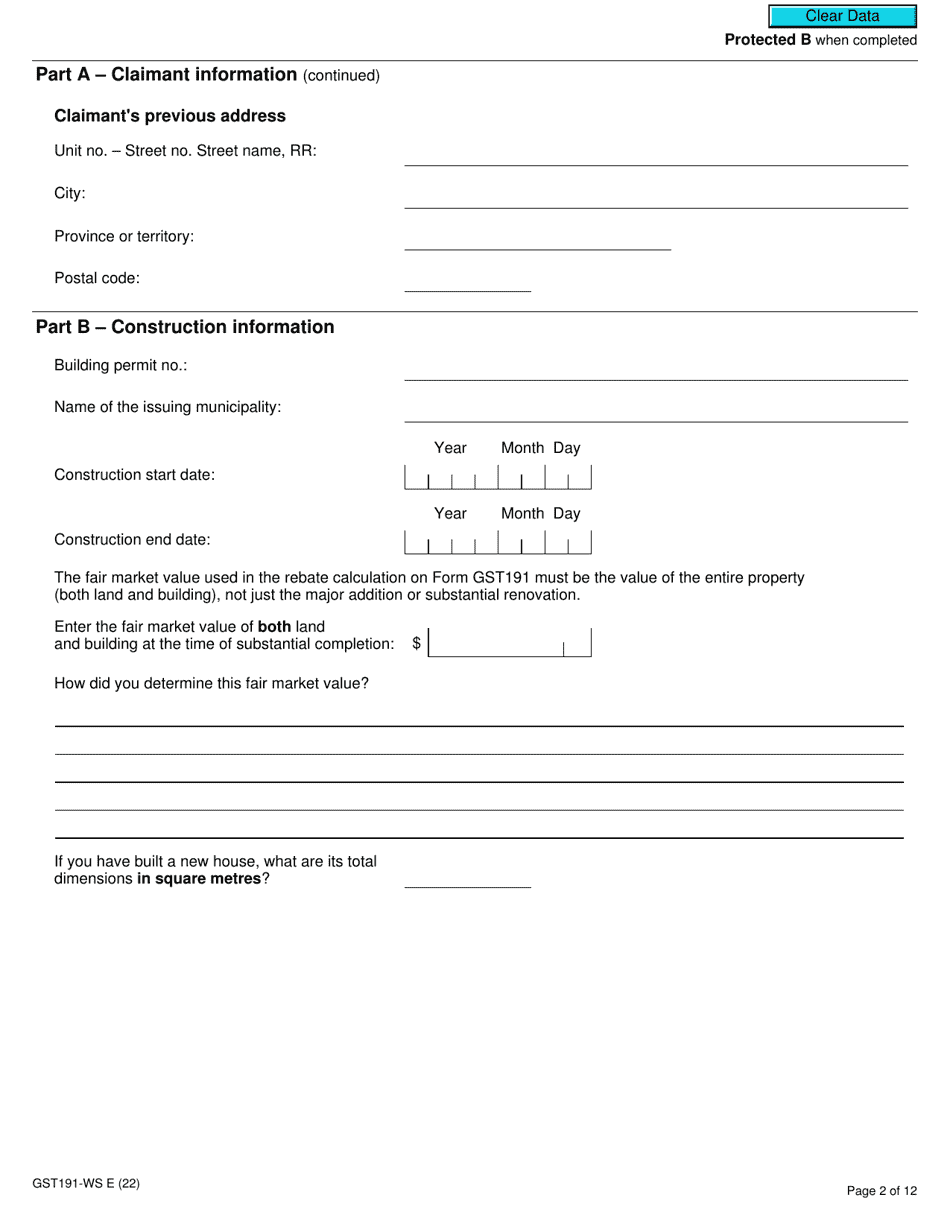

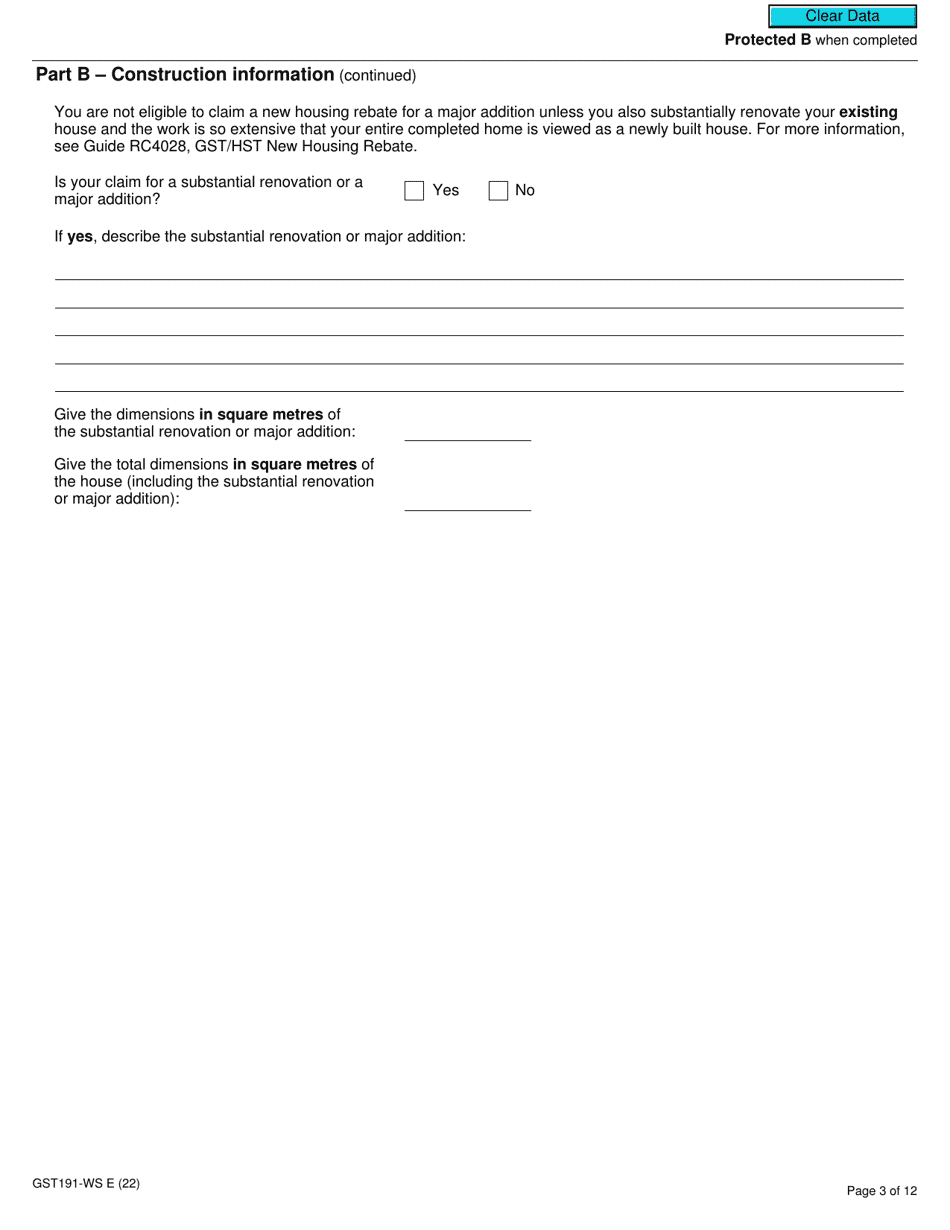

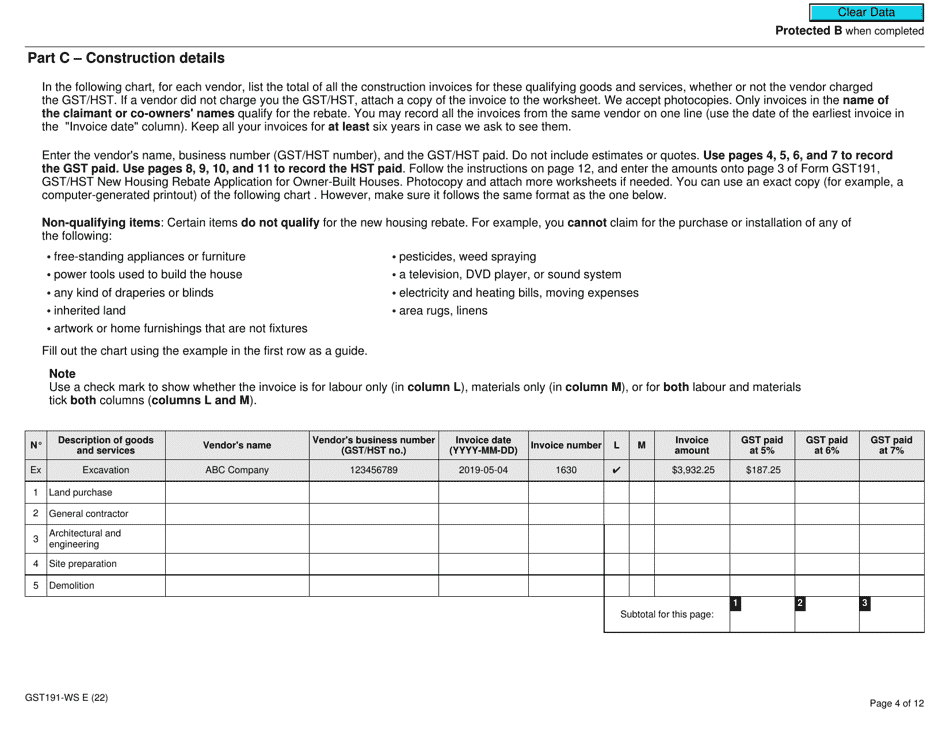

A: Form GST191-WS requires information such as project details, construction costs, and applicable taxes.

Q: When should Form GST191-WS be submitted?

A: Form GST191-WS should be submitted along with the GST/HST return for the reporting period in which the construction project is completed.

Q: Are there any penalties for not filing Form GST191-WS?

A: Yes, failure to file Form GST191-WS may result in penalties or interest charges imposed by the Canada Revenue Agency.

Q: Can I claim input tax credits without using Form GST191-WS?

A: No, Form GST191-WS is required to claim input tax credits for construction projects in Canada.

Q: Can I request an extension to file Form GST191-WS?

A: Yes, you can request an extension to file Form GST191-WS by contacting the Canada Revenue Agency.