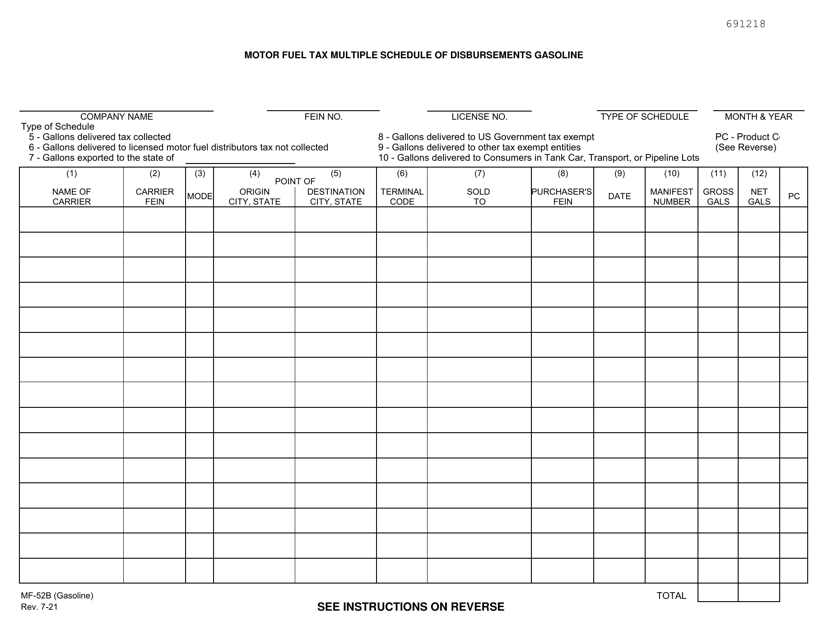

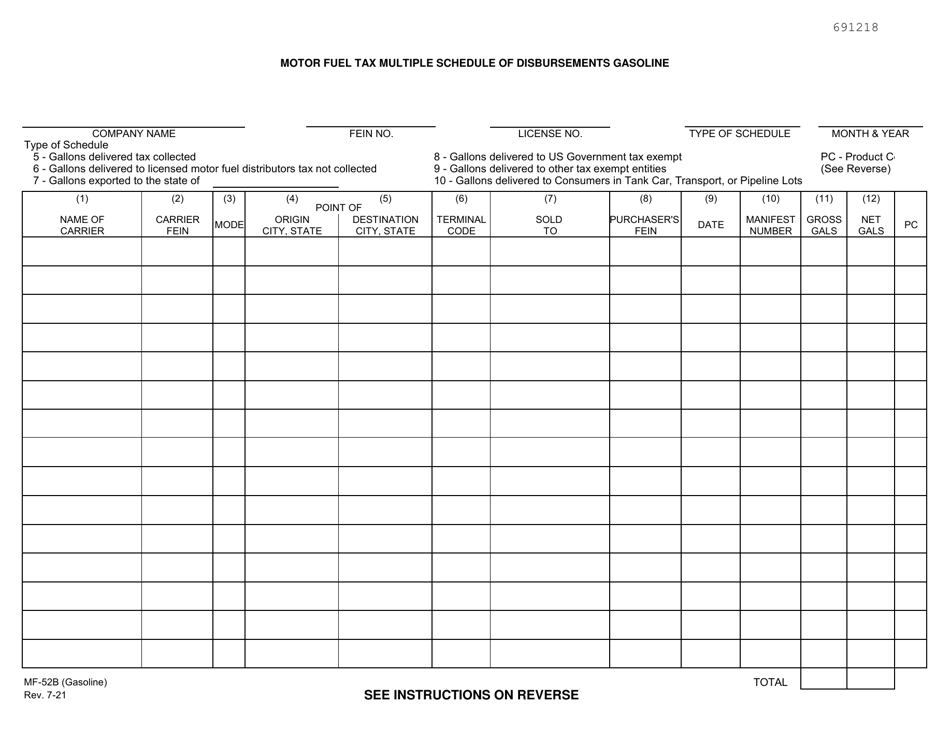

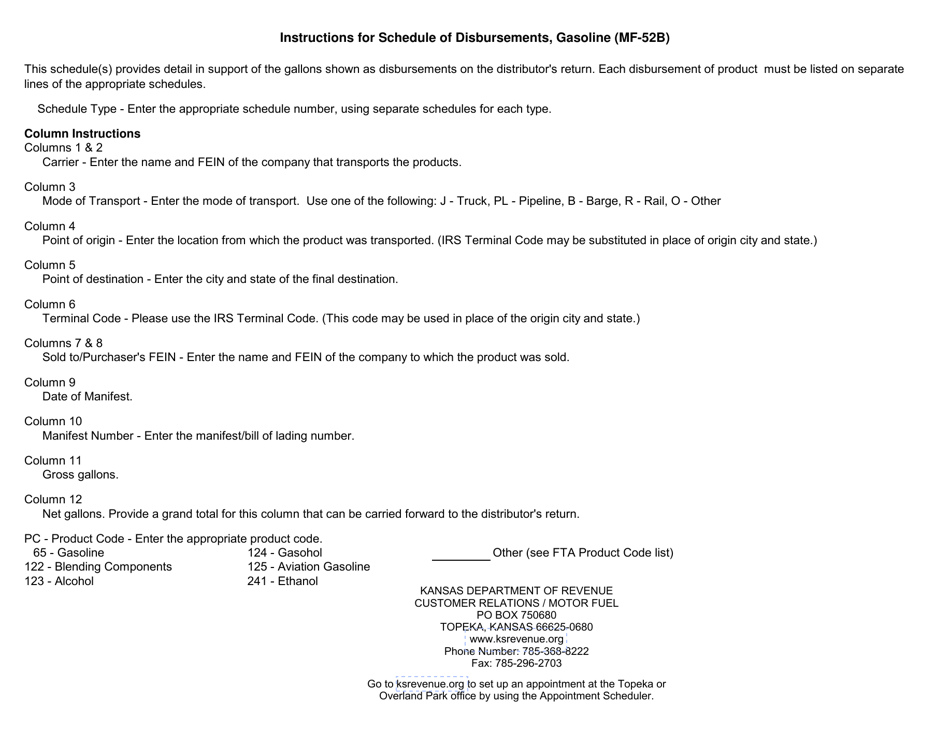

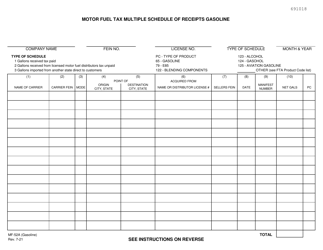

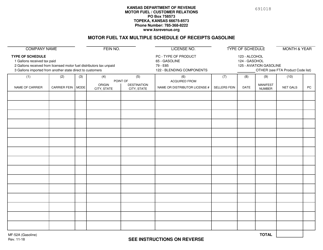

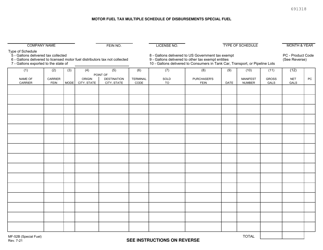

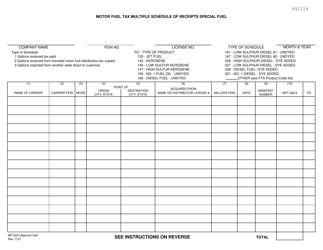

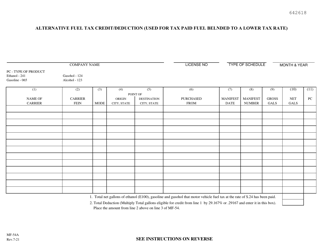

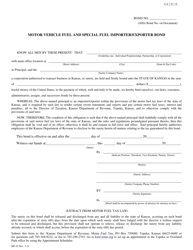

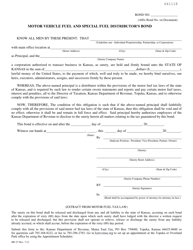

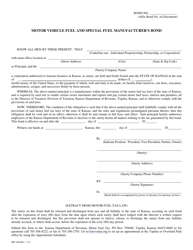

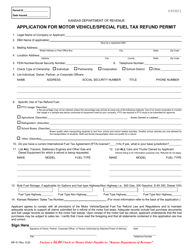

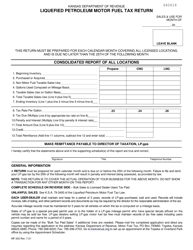

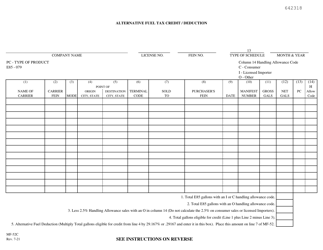

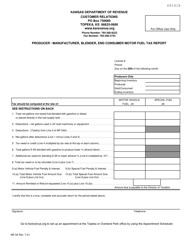

Form MF-52B (GASOLINE) Motor Fuel Tax Multiple Schedule of Disbursements Gasoline - Kansas

What Is Form MF-52B (GASOLINE)?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-52B?

A: Form MF-52B is a tax form related to motor fuel tax in Kansas.

Q: What does Form MF-52B cover?

A: Form MF-52B covers gasoline disbursements.

Q: What is the purpose of Form MF-52B?

A: The purpose of Form MF-52B is to report and document motor fuel tax disbursements for gasoline.

Q: Who needs to use Form MF-52B?

A: Businesses or individuals involved in the sale or distribution of gasoline in Kansas need to use Form MF-52B.

Q: How often do I need to file Form MF-52B?

A: Form MF-52B needs to be filed on a monthly basis.

Q: What information is required on Form MF-52B?

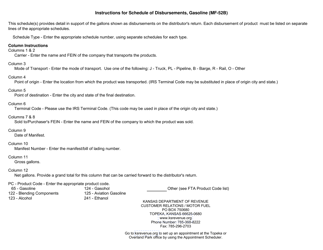

A: Form MF-52B requires you to provide information such as the number of gallons sold, the per gallon tax rate, and the total amount of tax due.

Q: Are there any penalties for late filing of Form MF-52B?

A: Yes, there are penalties for late filing of Form MF-52B, including potential interest charges on unpaid taxes.

Q: Can Form MF-52B be electronically filed?

A: Yes, you can electronically file Form MF-52B.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-52B (GASOLINE) by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.